|

市场调查报告书

商品编码

1708133

搔痒症治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pruritus Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

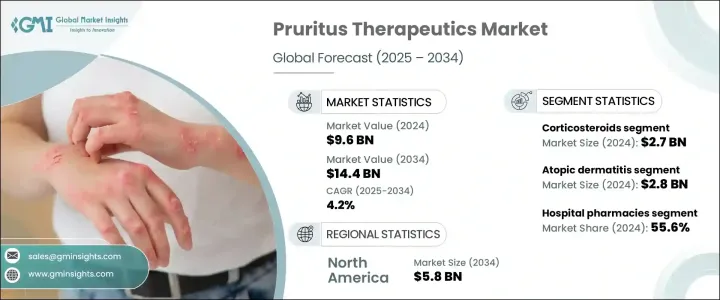

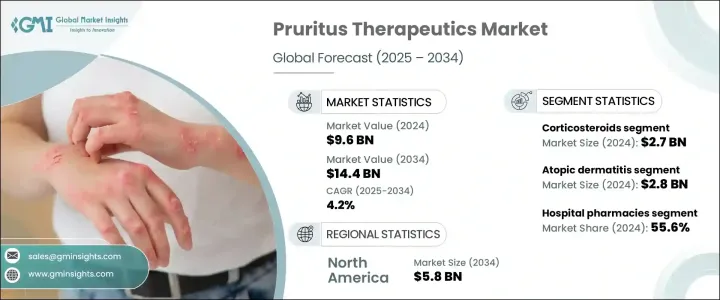

2024 年全球搔痒症治疗市场规模达到 96 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.2%。受异位性皮肤炎、牛皮癣和慢性肾臟病等疾病的推动,慢性搔痒症发病率不断上升,继续推动市场扩张。由于搔痒症仍然是一种常见但往往难以治疗的症状,对先进治疗方案的需求正在加速成长。全球皮肤病和全身疾病的负担日益加重,迫使製药公司不断创新并扩大其治疗组合。老年人口的不断增长,对慢性搔痒症极为敏感,进一步扩大了市场需求。此外,对可用治疗方法的认识提高,加上医疗服务机会的改善,预计将在未来十年推动持续成长。

医学研究的进步正在改变搔痒症治疗的格局,生物製剂和JAK抑制剂等新型药物带来了有希望的成果。这些创新疗法正在透过解决根本原因而不是仅仅缓解症状来重塑市场。製药公司正积极投资研发,以推出能够长期缓解病情且副作用最小的针对性疗法。精准医疗的兴起和搔痒相关疾病临床试验的扩大为产业参与者创造了新的机会。随着对以患者为中心的护理的日益重视,公司正致力于开发更有效、更安全和个人化的治疗方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 96亿美元 |

| 预测值 | 144亿美元 |

| 复合年增长率 | 4.2% |

由于异位性皮肤炎盛行率高且迫切需要标靶治疗,2024 年该领域将占全球市场份额的 35.7%。与异位性皮肤炎相关的慢性搔痒严重影响生活质量,促使患者和医疗保健提供者寻求更有效的解决方案。新型药物的开发,包括非类固醇类治疗和生物疗法,对于扩大治疗选择起到了重要作用。同时,胆汁淤积性搔痒症通常与肝病有关,这进一步加剧了对有效治疗方法的需求。搔痒症市场不断发展,新的治疗适应症和先进药物取得管道的扩大推动了大幅成长。

皮质类固醇仍然是搔痒症治疗的主要产品类别,占了相当大的市场。 2024 年皮质类固醇市场价值为 40 亿美元,巩固了其作为各种搔痒症治疗基石的地位。皮质类固醇因其功效而广受认可,常用于治疗皮肤炎和荨麻疹等疾病。它们有多种剂型,包括外用药膏、口服药物和注射剂,确保能够满足不同患者的需求。它们的价格低廉且易于获得,进一步加强了它们的广泛使用,特别是在需要具有成本效益的治疗选择的地区。

2024 年,美国搔痒症治疗市场价值为 36 亿美元,由于慢性搔痒症盛行率高且医疗保健体系完善,美国仍占据主导地位。强大的研发计划,加上稳定的创新治疗方法,继续推动市场成长。生物製剂、JAK 抑制剂和标靶疗法的扩展正在改善治疗效果,而个人化医疗的兴起正在重塑患者护理。随着人们越来越关註解决搔痒症的根本原因,美国市场预计将继续处于治疗进步的前沿,在未来几年推动创新和可及性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 皮肤病盛行率上升

- 标靶治疗和生物製剂的进展

- 提高认知度和诊断率

- 老年人口不断增加

- 产业陷阱与挑战

- 生物製剂和标靶治疗成本高昂

- 副作用和安全问题

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 皮质类固醇

- 抗组织胺药

- 抗刺激剂

- 免疫抑制剂

- 钙调神经磷酸酶抑制剂

- 其他产品

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 异位性皮肤炎

- 过敏性接触性皮肤炎

- 牛皮癣

- 荨麻疹

- 其他应用

第七章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AbbVie

- Amgen

- Astellas Pharma

- Arcutis Biotherapeutics

- Bristol-Myers Squibb

- Cara Therapeutics

- Eli Lilly And Company

- GSK

- Galderma

- Johnson & Johnson

- Kyowa Kirin

- Novartis AG

- Pfizer

- Sanofi

- Teva Pharmaceutical Industries

The Global Pruritus Therapeutics Market reached USD 9.6 billion in 2024 and is projected to grow at a CAGR of 4.2% between 2025 and 2034. The rising incidence of chronic itching disorders, driven by conditions such as atopic dermatitis, psoriasis, and chronic kidney disease, continues to fuel market expansion. As pruritus remains a common yet often challenging symptom to treat, the demand for advanced therapeutic solutions is accelerating. The increasing burden of dermatologic and systemic conditions worldwide is compelling pharmaceutical companies to innovate and expand their treatment portfolios. The growing geriatric population, a demographic highly susceptible to chronic pruritus, further amplifies market demand. Additionally, heightened awareness regarding available treatments, coupled with improved access to healthcare services, is expected to drive sustained growth over the next decade.

Advancements in medical research are transforming the pruritus therapeutics landscape, with new drug classes such as biologics and JAK inhibitors offering promising results. These innovative treatments are reshaping the market by addressing underlying causes rather than just alleviating symptoms. Pharmaceutical firms are actively investing in research and development to introduce targeted therapies that provide long-term relief with minimal side effects. The rise of precision medicine and the expansion of clinical trials for pruritus-related conditions are creating new opportunities for industry players. With a growing emphasis on patient-centric care, companies are focusing on developing more effective, safer, and personalized treatment options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $14.4 Billion |

| CAGR | 4.2% |

The atopic dermatitis segment accounted for 35.7% of the global market share in 2024, driven by its high prevalence and the urgent need for targeted therapies. Chronic itching associated with atopic dermatitis significantly impacts quality of life, pushing patients and healthcare providers to seek more effective solutions. The development of novel medications, including non-steroidal treatments and biologic therapies, has been instrumental in expanding treatment options. Meanwhile, cholestatic pruritus, often linked to liver diseases, has further intensified the demand for effective therapeutics. The pruritus market continues to evolve, with new treatment indications and expanded access to advanced medications driving substantial growth.

Corticosteroids remain the leading product category in pruritus therapeutics, accounting for a significant market share. The corticosteroids segment was valued at USD 4 billion in 2024, cementing its role as a cornerstone treatment for various pruritic conditions. Widely recognized for their efficacy, corticosteroids are commonly used for conditions such as dermatitis and urticaria. Their availability in multiple formulations-including topical creams, oral medications, and injectables-ensures their adaptability for different patient needs. Their affordability and accessibility further reinforce their widespread use, particularly in regions where cost-effective treatment options are essential.

The U.S. Pruritus Therapeutics Market was valued at USD 3.6 billion in 2024, maintaining its dominance due to a high prevalence of chronic pruritus conditions and a well-established healthcare system. Strong research and development initiatives, coupled with a steady pipeline of innovative treatments, continue to propel market growth. The expansion of biologics, JAK inhibitors, and targeted therapies is enhancing treatment outcomes, while the rise of personalized medicine is reshaping patient care. With a growing focus on addressing the root causes of pruritus, the U.S. market is expected to remain at the forefront of therapeutic advancements, driving innovation and accessibility in the years to come.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of dermatological diseases

- 3.2.1.2 Advancements in targeted therapies and biologics

- 3.2.1.3 Increasing awareness and diagnosis rates

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biologic and targeted therapies

- 3.2.2.2 Side effects and safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroids

- 5.3 Antihistamines

- 5.4 Counterirritants

- 5.5 Immunosuppressant

- 5.6 Calcineurin inhibitors

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Atopic dermatitis

- 6.3 Allergic contact dermatitis

- 6.4 Psoriasis

- 6.5 Urticaria

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Amgen

- 9.3 Astellas Pharma

- 9.4 Arcutis Biotherapeutics

- 9.5 Bristol-Myers Squibb

- 9.6 Cara Therapeutics

- 9.7 Eli Lilly And Company

- 9.8 GSK

- 9.9 Galderma

- 9.10 Johnson & Johnson

- 9.11 Kyowa Kirin

- 9.12 Novartis AG

- 9.13 Pfizer

- 9.14 Sanofi

- 9.15 Teva Pharmaceutical Industries