|

市场调查报告书

商品编码

1708140

再製造汽车零件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Remanufactured Automotive Parts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

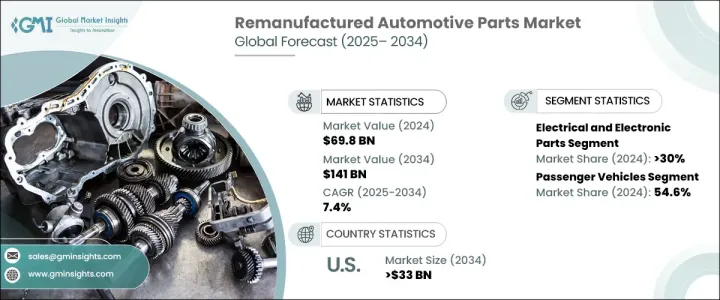

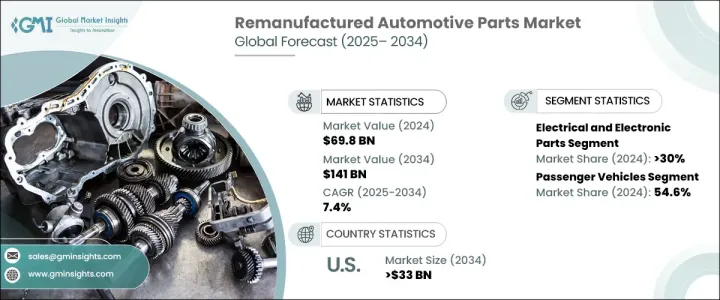

2024 年全球再製汽车零件市场规模达到 698 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.4%。由于技术进步、环境效益和成本效益等因素的共同作用,对再製造汽车零件的需求正在激增。随着永续性问题和循环经济原则的日益受到重视,再製造零件正成为新零件的首选替代品。这些组件经过严格的翻新过程,确保它们达到或超过原始设备製造商 (OEM) 标准,同时减少材料浪费和能源消耗。因此,汽车製造商和消费者都认识到再製造汽车零件的优势,从而推动了市场大幅扩张。

自动化、数位化和材料科学创新的快速融合彻底改变了再製造过程,并提高了产品品质和可靠性。借助现代技术,再製造商可以有效地将旧零件恢復到接近新的状态,确保最佳性能和使用寿命。电动车 (EV) 和混合动力车的日益普及进一步增强了这一趋势,因为它们依赖更多的复杂零件。此外,政府对排放和永续发展措施的严格监管正在推动汽车製造商投资再製造解决方案,从而促进市场成长。随着越来越多的车主寻求经济高效且环保的新零件替代品,高品质再生零件以具有竞争力的价格不断增加,这影响着消费者的购买决策。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 698亿美元 |

| 预测值 | 1410亿美元 |

| 复合年增长率 | 7.4% |

再製造汽车零件市场分为几个主要零件类别,包括电气和电子零件、引擎、变速箱、车轮和煞车。 2024年,电气和电子零件领域占最大的市场份额,占30%。对感测器、电动传动系统和资讯娱乐系统等先进车辆技术的日益依赖,增加了对再製造电气和电子元件的需求。这些零件提供了一种可持续的方法来延长车辆系统的使用寿命,同时降低维修和更换成本。再製造电子产品的整合不仅提高了车辆效率,而且还显着减少了电子垃圾,进一步推动了市场的发展。

按车辆类型划分,再製造汽车零件市场包括乘用车和商用车。 2024 年,乘用车市场占据主导地位,占有 54.6% 的份额。这种成长很大程度上得益于延长汽车零件使用寿命和减少汽车生产碳足迹的努力。再生起动机、交流发电机和高压电池的日益普及与产业向循环经济的转型相一致,在循环经济中,重复使用和翻新零件可最大限度地减少对环境的影响并节约宝贵的资源。随着汽车製造商优先考虑永续生产和维修解决方案,乘用车领域对再製造零件的需求预计将加速成长。

2024 年,北美占据再製汽车零件市场的 35% 份额,其中美国将成为主要贡献者。预测显示,随着人们越来越关注永续性、成本效益以及OEM支持的再製造计划,美国市场规模到 2034 年将达到 330 亿美元。主要汽车製造商正在扩大其再製造计划,提供各种各样的再製造零件以满足不断增长的需求。凭藉严格的环境政策、强大的售后市场行业以及不断增强的消费者意识,北美仍然是推动全球再製造汽车零件市场扩张的关键地区。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 汽车製造商

- 第三方再製造商

- 逆向物流供应商

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 成本明细

- 价格趋势

- 监管格局

- 衝击力

- 成长动力

- 改善再製流程

- 更严格的环境政策

- 越来越重视减少浪费

- 透过使用再製造零件来节省更多成本

- 产业陷阱与挑战

- 消费者的负面看法

- 供应链复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依组件,2021 年至 2034 年

- 主要趋势

- 电气和电子零件

- 引擎

- 传染

- 车轮和煞车

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:依供应量,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Andre Niermann

- BBB Industries

- BorgWarner

- Bosch

- Cardone

- Carwood

- Caterpillar

- Denso

- Detroit Diesel

- Eaton

- Jasper Engines & Transmissions

- Lucas Electrical

- Marelli

- Maval

- Motorcar Parts of America

- NAPA

- Stellantis

- Teamec

- Valeo

- ZF

The Global Remanufactured Automotive Parts Market reached USD 69.8 billion in 2024 and is projected to grow at a CAGR of 7.4% between 2025 and 2034. The demand for remanufactured automotive parts is surging due to a combination of technological advancements, environmental benefits, and cost-efficiency. As sustainability concerns and circular economy principles gain momentum, remanufactured components are emerging as a preferred alternative to new parts. These components undergo rigorous refurbishment processes, ensuring they meet or exceed original equipment manufacturer (OEM) standards while reducing material waste and energy consumption. As a result, automakers and consumers alike are recognizing the advantages of remanufactured automotive parts, driving substantial market expansion.

The rapid integration of automation, digitalization, and material science innovations has revolutionized the remanufacturing process, enhancing product quality and reliability. With modern technology, remanufacturers can efficiently restore used parts to near-new condition, ensuring optimal performance and longevity. This trend is further bolstered by the rising adoption of electric vehicles (EVs) and hybrid models, which rely on a greater number of sophisticated components. Additionally, stringent government regulations on emissions and sustainability initiatives are pushing automakers to invest in remanufacturing solutions, reinforcing market growth. The increasing availability of high-quality remanufactured parts at competitive prices is influencing consumer purchasing decisions as more vehicle owners seek cost-effective and environmentally friendly alternatives to new components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.8 Billion |

| Forecast Value | $141 Billion |

| CAGR | 7.4% |

The remanufactured automotive parts market is segmented into key component categories, including electrical and electronic parts, engines, transmissions, wheels, and brakes. In 2024, the electrical and electronic parts segment held the largest market share, accounting for 30%. The growing reliance on advanced vehicle technologies, such as sensors, electric drivetrains, and infotainment systems, has amplified the demand for remanufactured electrical and electronic components. These components offer a sustainable way to extend the lifespan of vehicle systems while lowering repair and replacement costs. The integration of remanufactured electronics not only enhances vehicle efficiency but also significantly reduces electronic waste, further driving the market forward.

By vehicle type, the remanufactured automotive parts market includes passenger and commercial vehicles. The passenger vehicle segment dominated the market in 2024, securing a 54.6% share. This growth is largely driven by efforts to extend the longevity of automotive components and reduce the carbon footprint of vehicle production. The increasing adoption of remanufactured starters, alternators, and high-voltage batteries aligns with the industry's transition toward a circular economy, where reusing and refurbishing parts minimizes environmental impact and conserves valuable resources. With automakers prioritizing sustainable production and repair solutions, the demand for remanufactured parts in the passenger vehicle sector is expected to accelerate.

North America held a significant 35% share of the remanufactured automotive parts market in 2024, with the U.S. emerging as the dominant contributor. Projections indicate that the U.S. market will reach USD 33 billion by 2034, fueled by an increasing focus on sustainability, cost-effectiveness, and OEM-backed remanufacturing programs. Major automotive manufacturers are expanding their remanufacturing initiatives, offering a diverse range of remanufactured components to cater to rising demand. With stringent environmental policies, a strong aftermarket industry, and growing consumer awareness, North America remains a key region driving the global expansion of the remanufactured automotive parts market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automakers

- 3.1.2 Third-party remanufacturers

- 3.1.3 Reverse logistics providers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown

- 3.8 Price trend

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Improving remanufacturing processes

- 3.10.1.2 Stricter environmental policies

- 3.10.1.3 Growing emphasis on reducing waste

- 3.10.1.4 Increasing cost savings by using remanufactured parts

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Negative consumer perception

- 3.10.2.2 Supply chain complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 – 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electrical and electronic parts

- 5.3 Engine

- 5.4 Transmission

- 5.5 Wheels and brakes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Supply, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Andre Niermann

- 9.2 BBB Industries

- 9.3 BorgWarner

- 9.4 Bosch

- 9.5 Cardone

- 9.6 Carwood

- 9.7 Caterpillar

- 9.8 Denso

- 9.9 Detroit Diesel

- 9.10 Eaton

- 9.11 Jasper Engines & Transmissions

- 9.12 Lucas Electrical

- 9.13 Marelli

- 9.14 Maval

- 9.15 Motorcar Parts of America

- 9.16 NAPA

- 9.17 Stellantis

- 9.18 Teamec

- 9.19 Valeo

- 9.20 ZF