|

市场调查报告书

商品编码

1708143

汽车皮带张紧轮市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Belt Tensioner Pulleys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

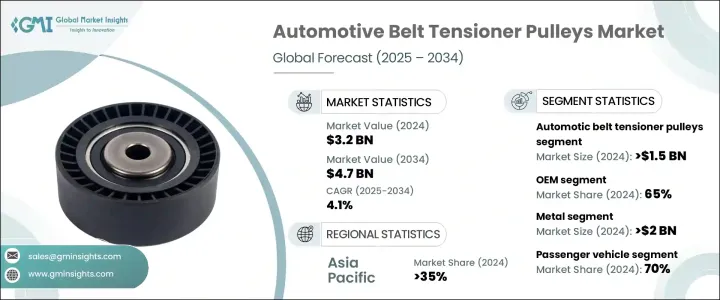

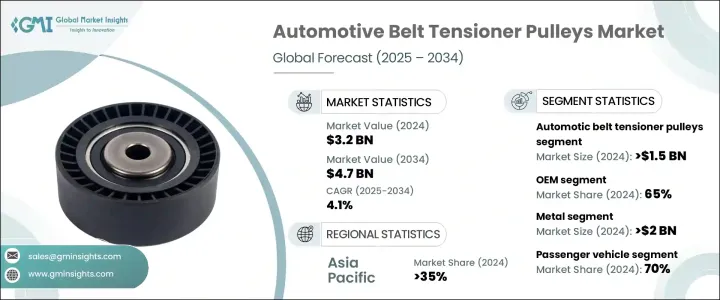

2024 年全球汽车皮带张紧轮市场价值为 32 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.1%。受全球乘用车和商用车产量不断增长的推动,该市场正在稳步增长。汽车皮带张紧轮在维持适当的皮带张力、减少磨损和优化引擎效率方面发挥关键作用。随着汽车製造商专注于高性能、省油和耐用的发动机,对这些部件的需求持续上升。

汽车产业的快速扩张,尤其是在新兴经济体,进一步推动了市场的成长。旨在减少排放和提高燃油效率的严格监管标准促使汽车製造商整合先进的张紧解决方案。皮带传动系统的创新,包括轻质和高耐用性材料,正在提高皮带张紧轮的性能。此外,电动和混合动力车的日益普及正在重塑市场动态,为针对先进动力系统量身定制的专用张紧解决方案创造了机会。随着向永续移动性和模组化引擎设计的转变,製造商正专注于开发皮带张紧轮,以确保在不同操作条件下保持一致的性能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 47亿美元 |

| 复合年增长率 | 4.1% |

市场分为两大主要产品类别:自动和手动皮带张紧轮。自动皮带张紧轮部分在 2024 年的估值为 15 亿美元,占据了相当大的市场。这些自调整皮带轮在各种车型中都受到青睐,因为它们无需人工干预即可保持最佳皮带张力,从而提高引擎的寿命和效率。现代车辆对低维护、高精度零件的需求不断增长,推动了这一领域的扩张。

汽车皮带张紧轮市场也按最终用途应用分类,包括原始设备製造商(OEM)和售后市场销售。 2024年, OEM领域占据65%的市场份额,预计将稳定成长。汽车製造商正在整合客製化设计的皮带张紧轮,以提高引擎性能、满足燃油效率法规并增强耐用性。电动和混合动力车对下一代引擎设计和模组化皮带传动系统的推动正在加速OEM领域对先进张紧轮的采用。

2024 年,中国汽车皮带张紧轮市场规模达到 3.325 亿美元,巩固了其作为主要区域参与者的地位。中国是全球最大的汽车製造国之一,其汽车产量不断增长以及消费者对节油汽车的需求不断增加,推动了对先进皮带张紧轮系统的需求。在物流成长和车队管理计画的推动下,商用车队的扩张进一步推动了对这些零件的需求。随着汽车产业的不断发展,皮带张紧轮对于确保各种车辆类别的无缝引擎性能仍然不可或缺。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 零件供应商

- 服务提供者

- 经销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 成本分析

- 价格趋势

- 材料性能比较分析

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 汽车产量和售后市场需求不断增加

- 皮带传动系统的进步

- 电动和混合动力汽车的需求不断增长

- 严格的排放和燃油效率法规

- 产业陷阱与挑战

- 耐用性和性能限制

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 自动皮带张紧轮

- 手动皮带张紧轮

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 金属

- 塑胶

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 引擎正时系统

- 交流发电机系统

- 动力转向系统

- 空调系统

- 水泵系统

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- ACDelco

- Bando Chemical Industries

- BorgWarner

- Cloyes Gear & Products

- Continental

- Dayco Products

- Fenner

- Gates

- Goodyear Belts

- Hutchinson

- INA Tensioner

- JTEKT

- Litens Automotive

- Mitsuboshi Belting

- NSK Automation

- NTN

- Pricol Limited

- Schaeffler

- SKF Group

- Tsubakimoto Chain

The Global Automotive Belt Tensioner Pulleys Market was valued at USD 3.2 billion in 2024 and is projected to grow at a CAGR of 4.1% between 2025 and 2034. This market is witnessing steady growth, driven by the increasing production of passenger and commercial vehicles worldwide. Automotive belt tensioner pulleys play a critical role in maintaining proper belt tension, reducing wear and tear, and optimizing engine efficiency. As vehicle manufacturers focus on high-performing, fuel-efficient, and durable engines, the demand for these components continues to rise.

The rapid expansion of the automotive industry, particularly in emerging economies, is further propelling market growth. Stringent regulatory standards aimed at reducing emissions and improving fuel efficiency have prompted automakers to integrate advanced tensioning solutions. Innovations in belt drive systems, including lightweight and high-durability materials, are enhancing the performance of belt tensioner pulleys. Additionally, the rising adoption of electric and hybrid vehicles is reshaping market dynamics, creating opportunities for specialized tensioning solutions tailored for advanced powertrain systems. With a shift towards sustainable mobility and modular engine designs, manufacturers are focusing on developing belt tensioner pulleys that ensure consistent performance under varying operating conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.1% |

The market is segmented into two primary product categories: automatic and manual belt tensioner pulleys. The automatic belt tensioner pulleys segment garnered a valuation of USD 1.5 billion in 2024, holding a significant market share. These self-adjusting pulleys are preferred across vehicle models as they maintain optimal belt tension without manual intervention, enhancing engine longevity and efficiency. The increasing demand for low-maintenance, high-precision components in modern vehicles is fueling the expansion of this segment.

The automotive belt tensioner pulleys market is also categorized by end-use applications, including original equipment manufacturers (OEM) and aftermarket sales. In 2024, the OEM segment accounted for 65% of the market share and is expected to grow steadily. Automakers are integrating custom-engineered belt tensioner pulleys to improve engine performance, meet fuel efficiency regulations, and enhance durability. The push for next-generation engine designs and modular belt drive systems in electric and hybrid vehicles is accelerating the adoption of advanced tensioner pulleys in the OEM sector.

China automotive belt tensioner pulleys market generated USD 332.5 million in 2024, cementing its position as a key regional player. With the country being one of the largest automotive manufacturers globally, rising vehicle production and increasing consumer demand for fuel-efficient automobiles are boosting the need for advanced belt tensioner pulley systems. The expansion of commercial vehicle fleets, driven by logistics growth and fleet management programs, is further driving demand for these components. As the automotive industry continues evolving, belt tensioner pulleys remain indispensable in ensuring seamless engine performance across various vehicle categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Component suppliers

- 3.2.3 Service providers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Cost analysis

- 3.7 Price trend

- 3.8 Comparative analysis of material performance

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing vehicle production and aftermarket demand

- 3.11.1.2 Advancements in belt drive systems

- 3.11.1.3 Growing demand for electric and hybrid vehicles

- 3.11.1.4 Stringent emission and fuel efficiency regulations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Durability and performance limitations

- 3.11.2.2 Fluctuations in raw material prices

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Automatic belt tensioner pulleys

- 5.3 Manual belt tensioner pulleys

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicle

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Metal

- 7.3 Plastic

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Engine timing system

- 8.3 Alternator system

- 8.4 Power steering system

- 8.5 Air conditioning system

- 8.6 Water pump system

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ACDelco

- 11.2 Bando Chemical Industries

- 11.3 BorgWarner

- 11.4 Cloyes Gear & Products

- 11.5 Continental

- 11.6 Dayco Products

- 11.7 Fenner

- 11.8 Gates

- 11.9 Goodyear Belts

- 11.10 Hutchinson

- 11.11 INA Tensioner

- 11.12 JTEKT

- 11.13 Litens Automotive

- 11.14 Mitsuboshi Belting

- 11.15 NSK Automation

- 11.16 NTN

- 11.17 Pricol Limited

- 11.18 Schaeffler

- 11.19 SKF Group

- 11.20 Tsubakimoto Chain