|

市场调查报告书

商品编码

1708147

汽车载货地板市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Load Floor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

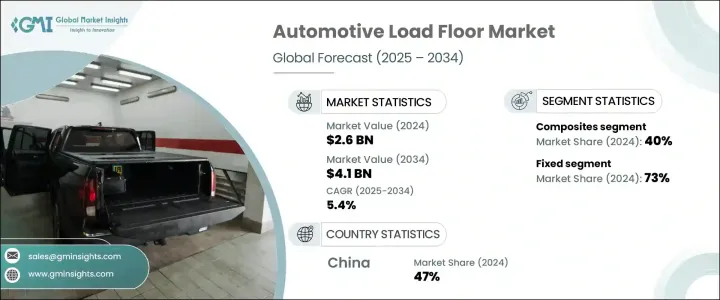

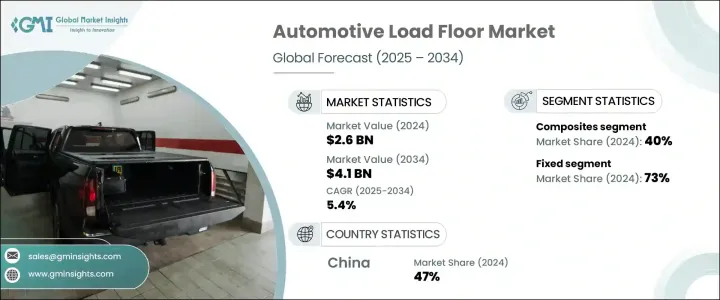

2024 年全球汽车载货地板市场规模达 26 亿美元,预计 2025-2034 年期间复合年增长率为 5.4%。这种扩张是由对电动和自动驾驶汽车(EV 和 AV)不断增长的需求所推动的,这些汽车需要先进的设计和增强的功能。由于电动车的电池组通常位于地板下方,汽车製造商越来越关注超轻但耐用的货物地板。因此,人们正在采用复合材料和热塑性塑胶等先进材料来提高空间效率、优化货物容量并保持结构完整性。

随着对燃油经济性和可持续性的日益重视,製造商正在优先考虑轻质材料以减少碳足迹。将非增强聚合物复合材料、热塑性塑胶和蜂窝结构整合到载货地板中,在降低车辆整体重量且不牺牲耐用性方面发挥着至关重要的作用。随着汽车製造商致力于严格的排放法规和提高燃油效率,这一趋势正在增强。随着消费者意识的增强和针对环保汽车零件的监管要求的加强,向永续解决方案的转变进一步加速。高檔和豪华汽车产量的不断增长也推动了对高性能材料的需求,轻质而坚固的载货地板解决方案对于增强功能性和舒适性至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 5.4% |

市场按材料类型细分,包括硬质纤维板、蜂巢聚丙烯、波纹聚丙烯和复合材料。复合材料凭藉其轻质、高强度和防潮性能,将在 2024 年占据 40% 的市场份额。碳纤维增强塑胶 (CFRP) 和玻璃纤维复合材料越来越受到人们的关注,因为它们可以提供卓越的结构支撑,同时有效减轻车辆重量。这些材料对提高燃油效率和降低碳排放做出了巨大贡献,使其成为努力实现永续发展目标的汽车製造商的首选。

载货地板依其操作特性分为固定式和滑动式。 2024年,固定载重地板占据73%的市场份额,预计将持续保持强劲成长。固定负载地板具有出色的结构稳定性、耐用性和成本效益,是乘用车和商用车的标准选择。这些地板可确保最佳的负载分布和增强的安全性,因此比滑动地板更受欢迎。

2024 年,中国汽车载重地板市场规模达到 5.2 亿美元,得益于中国电动车产业的快速发展,中国汽车载重地板市场将领先全球市场。政府鼓励使用复合材料和环保材料的激励措施进一步增强了对轻量、高性能载重地板解决方案日益增长的需求。支持政策、技术进步和国内汽车製造商的扩张相结合,巩固了中国作为汽车载重地板行业主要参与者的地位。随着全球市场朝着更大的永续性和创新性发展,中国预计将在塑造汽车载货地板解决方案的未来格局方面继续发挥关键作用。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 一级供应商

- 原始设备製造商 (OEM)

- 售后市场供应商

- 利润率分析

- 价格趋势

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 轻质材料需求不断成长

- 电动车和自动驾驶汽车的扩张

- 消费者对货物管理解决方案的需求不断增加

- 严格的燃油效率和排放法规

- 製造技术的进步

- 产业陷阱与挑战

- 汽车产量波动

- 材料成本波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 硬质纤维板

- 凹槽聚丙烯

- 蜂窝状聚丙烯

- 复合材料

第六章:市场估计与预测:按运营,2021 - 2034 年

- 主要趋势

- 固定的

- 滑动

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- ABC Technologies

- Applied Component Technology

- Arlington Industries

- ASG Group

- Autoneum

- CIE Automotive

- Covestro

- DS Smith

- Gemini Group

- Grudem

- Huntsman

- IDEAL Automotive

- KRAIBURG TPE

- Nagase America

- Recticel

- SA Automotive

- Sonoco Products

- Tricel Honeycomb

- UFP Technologies

- Woodbridge

The Global Automotive Load Floor Market reached USD 2.6 billion in 2024 and is projected to grow at a CAGR of 5.4% during 2025-2034. This expansion is fueled by the rising demand for electric and autonomous vehicles (EVs and AVs), which require advanced designs and enhanced functionality. Automakers are increasingly focusing on ultra-lightweight yet durable load floors, as battery packs in electric vehicles are typically positioned beneath the floor. As a result, advanced materials like composites and thermoplastics are being adopted to improve space efficiency, optimize cargo capacity, and maintain structural integrity.

With a growing emphasis on fuel economy and sustainability, manufacturers are prioritizing lightweight materials to reduce carbon footprints. The integration of non-reinforced polymer composites, thermoplastics, and honeycomb structures into load floors plays a crucial role in lowering overall vehicle weight without sacrificing durability. This trend is gaining momentum as automakers work toward stringent emissions regulations and improved fuel efficiency. The shift toward sustainable solutions is further accelerated by increasing consumer awareness and regulatory mandates focusing on eco-friendly automotive components. The demand for high-performance materials is also driven by the rising production of premium and luxury vehicles, where lightweight yet robust load floor solutions are essential for enhanced functionality and comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 billion |

| Forecast Value | $4.1 billion |

| CAGR | 5.4% |

The market is segmented by material type, including hardboard, honeycomb polypropylene, fluted polypropylene, and composites. Composites dominated the market in 2024 with a 40% share, driven by their lightweight, high-strength, and moisture-resistant properties. Carbon fiber reinforced plastic (CFRP) and glass fiber composite materials are gaining traction as they offer superior structural support while effectively reducing vehicle weight. These materials contribute significantly to fuel efficiency and lower carbon emissions, making them a preferred choice among automakers striving to meet sustainability goals.

Load floors are classified into fixed and sliding systems based on their operational characteristics. In 2024, fixed load floors accounted for 73% of the market share and are expected to continue experiencing robust growth. Fixed-load floors provide exceptional structural stability, durability, and cost-efficiency, making them the standard choice for passenger and commercial vehicles. These floors ensure optimal load distribution and enhanced security, making them more favorable than sliding alternatives.

China Automotive Load Floor Market generated USD 520 million in 2024, leading the global market due to the country's rapidly growing electric vehicle sector. Increasing demand for lightweight, high-performance load floor solutions is further reinforced by government incentives promoting the use of composites and environmentally friendly materials. The combination of supportive policies, technological advancements, and the expansion of domestic automakers strengthens China's position as a key player in the automotive load floor industry. As the global market moves toward greater sustainability and innovation, China's role is expected to remain pivotal in shaping the future landscape of automotive load floor solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Tier 1 suppliers

- 3.2.4 Original Equipment Manufacturers (OEMs)

- 3.2.5 Aftermarket suppliers

- 3.3 Profit margin analysis

- 3.4 Price trends

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for lightweight materials

- 3.9.1.2 Expansion of electric and autonomous vehicles

- 3.9.1.3 Increasing consumer demand for cargo management solutions

- 3.9.1.4 Stringent fuel efficiency and emission regulations

- 3.9.1.5 Advancements in manufacturing technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Fluctuations in automotive production

- 3.9.2.2 Material cost volatility

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardboard

- 5.3 Fluted polypropylene

- 5.4 Honeycomb polypropylene

- 5.5 Composites

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fixed

- 6.3 Sliding

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicle (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ABC Technologies

- 10.2 Applied Component Technology

- 10.3 Arlington Industries

- 10.4 ASG Group

- 10.5 Autoneum

- 10.6 CIE Automotive

- 10.7 Covestro

- 10.8 DS Smith

- 10.9 Gemini Group

- 10.10 Grudem

- 10.11 Huntsman

- 10.12 IDEAL Automotive

- 10.13 KRAIBURG TPE

- 10.14 Nagase America

- 10.15 Recticel

- 10.16 SA Automotive

- 10.17 Sonoco Products

- 10.18 Tricel Honeycomb

- 10.19 UFP Technologies

- 10.20 Woodbridge