|

市场调查报告书

商品编码

1708150

颅骨植入物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cranial Implant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

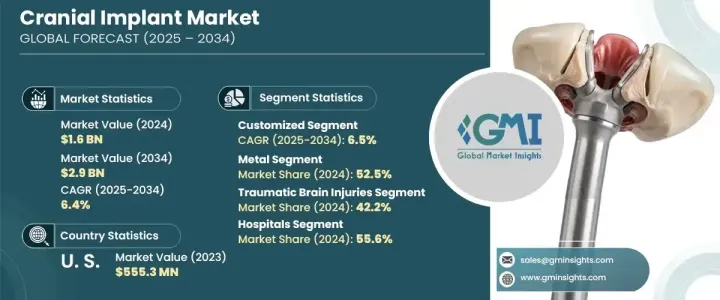

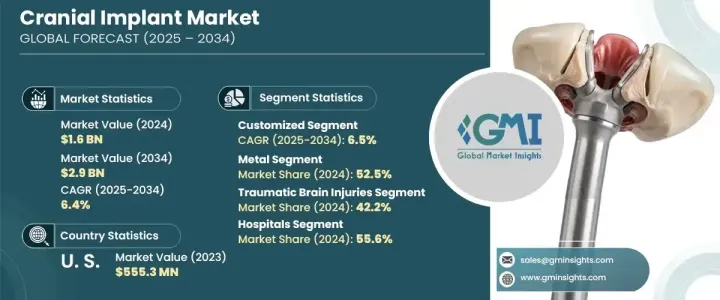

2024 年全球颅脑植入物市场价值为 16 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.4%。受神经系统疾病、创伤性脑损伤盛行率上升以及先进外科技术的日益普及的推动,该市场正在稳步增长。在全球范围内,越来越多的患者因中风、癫痫、阿兹海默症和先天性颅骨畸形等疾病而需要进行颅骨重建。随着全球人口老化和事故相关头部损伤的增加,对高品质颅脑植入物的需求预计将激增。 3D 列印和生物材料的不断进步正在彻底改变这个行业,使植入物更加精确、耐用和生物相容性。此外,已开发市场的有利监管政策正在加速产品审批,使企业能够更有效地推出创新解决方案。新兴经济体医疗保健投资的增加和神经和创伤护理可近性的提高也促进了市场扩张。

市场分为客製化产品和非客製化产品。 2024 年,客製化颅骨植入物产值达 10 亿美元,并将实现显着成长,预计未来十年的复合年增长率为 6.5%。这些植入物因其能够提供精确的贴合度、增强重建效果和功能性能而越来越受欢迎。利用 CT 扫描和 MRI 等先进的影像技术,医疗专业人员可以创建与个人颅骨结构无缝对齐的患者专用植入物。这种个人化的方法显着改善了术后恢復和美学效果,推动了整个医疗保健行业对客製化解决方案的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 29亿美元 |

| 复合年增长率 | 6.4% |

颅骨植入物主要由金属、聚合物或陶瓷材料製成。 2024 年,金属产业占据市场主导地位,占有 52.5% 的份额,创造了 8.309 亿美元的收入。钛及其合金由于其出色的强度、生物相容性和长期耐用性仍然是首选。金属植入物为大脑提供了卓越的保护,使其成为从创伤或复杂的颅骨手术中恢復的患者的理想选择。与聚合物植入物相比,金属植入物的寿命更长、失败率更低,因此在医疗程序中广泛使用。

2024 年北美颅脑植入物市场规模为 6.406 亿美元,预计到 2034 年将达到 12 亿美元。这一增长主要得益于创伤性脑损伤 (TBI) 发病率的上升以及该地区先进的医疗保健基础设施。尤其是美国,受益于鼓励尖端医疗技术开发和商业化的支持性监管环境。人工智慧辅助成像、3D 列印和生物工程材料的采用正在重塑颅骨植入物的格局,从而实现更有效率、更个性化的治疗方案。这些技术进步,加上强劲的医疗保健支出和对神经外科解决方案的高度认识,使北美成为全球市场成长的主要贡献者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 创伤性脑损伤(TBI)病例不断增加

- 神经系统疾病和颅骨畸形的盛行率不断上升

- 3D列印和客製化植入技术的进步

- 生物相容性和智慧材料的采用日益增多

- 产业陷阱与挑战

- 颅骨植入物和外科手术费用高昂

- 严格的监管批准和合规要求

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 客製化

- 非客製化

第六章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 金属

- 聚合物

- 聚醚醚酮(PEEK)

- 聚甲基丙烯酸甲酯(PMMA)

- 其他聚合物

- 陶瓷製品

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 创伤性脑损伤

- 肿瘤切除病例

- 神经外科重建手术

- 其他应用

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 神经外科中心

- 学术研究机构

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 3D Systems

- Acumed LLC

- Anatomics Pty Ltd

- B. Braun SE

- Brainlab

- evonos GmbH & Co. KG

- Integra LifeSciences

- Johnson & Johnson

- Kelyniam Global Inc.

- KLS Martin

- Medartis AG

- Medtronic

- Matrix Surgical USA

- Renishaw plc.

- Stryker Corporation

- Zimmer Biomet

The Global Cranial Implant Market was valued at USD 1.6 billion in 2024 and is projected to grow at a CAGR of 6.4% between 2025 and 2034. The market is experiencing steady growth, driven by the rising prevalence of neurological disorders, traumatic brain injuries, and the increasing adoption of advanced surgical techniques. A growing number of patients worldwide require cranial reconstruction due to conditions such as strokes, epilepsy, Alzheimer's disease, and congenital skull deformities. With an aging global population and an uptick in accident-related head injuries, demand for high-quality cranial implants is expected to surge. Continuous advancements in 3D printing and biomaterials are revolutionizing the industry, making implants more precise, durable, and biocompatible. Furthermore, favorable regulatory policies in developed markets are accelerating product approvals, allowing companies to introduce innovative solutions more efficiently. Increasing healthcare investments and improved accessibility to neuro and trauma care in emerging economies also contribute to market expansion.

The market is divided into customized and non-customized products. In 2024, customized cranial implants generated USD 1 billion and are set for notable growth, with a projected CAGR of 6.5% over the next decade. These implants are gaining popularity due to their ability to provide a precise fit, enhancing both reconstructive outcomes and functional performance. Using advanced imaging techniques such as CT scans and MRIs, medical professionals can create patient-specific implants that align seamlessly with an individual's skull structure. This personalized approach significantly improves post-surgical recovery and aesthetic results, fueling the demand for customized solutions across the healthcare sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 6.4% |

Cranial implants are primarily made from metal, polymer, or ceramic materials. The metal segment dominated the market in 2024, holding a 52.5% share and generating USD 830.9 million in revenue. Titanium and its alloys remain the preferred choice due to their exceptional strength, biocompatibility, and long-term durability. Metal implants offer superior protection to the brain, making them ideal for patients recovering from traumatic injuries or complex skull surgeries. Compared to polymer-based implants, metal options provide enhanced longevity and lower failure rates, driving their widespread adoption in medical procedures.

North America Cranial Implant Market generated USD 640.6 million in 2024 and is projected to reach USD 1.2 billion by 2034. This growth is largely driven by the increasing incidence of traumatic brain injuries (TBI) and the region's advanced healthcare infrastructure. The United States, in particular, benefits from a supportive regulatory environment that encourages the development and commercialization of cutting-edge medical technologies. The adoption of AI-assisted imaging, 3D printing, and bioengineered materials is reshaping the landscape of cranial implants, enabling more efficient and customized treatment options. These technological advancements, combined with strong healthcare spending and high awareness of neurosurgical solutions, position North America as a key contributor to global market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing cases of traumatic brain injuries (TBI)

- 3.2.1.2 Growing prevalence of neurological disorders and skull deformities

- 3.2.1.3 Advancements in 3D printing and custom implant technologies

- 3.2.1.4 Increasing adoption of biocompatible and smart materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cranial implants and surgical procedures

- 3.2.2.2 Stringent regulatory approvals and compliance requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Customized

- 5.3 Non-customized

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Metal

- 6.3 Polymer

- 6.3.1 Polyetheretherketone (PEEK)

- 6.3.2 Polymethylmethacrylate (PMMA)

- 6.3.3 Other polymers

- 6.4 Ceramic

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Traumatic brain injuries

- 7.3 Tumor resection cases

- 7.4 Neurosurgical reconstructive procedures

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Neurosurgery centers

- 8.4 Academic and research institute

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3D Systems

- 10.2 Acumed LLC

- 10.3 Anatomics Pty Ltd

- 10.4 B. Braun SE

- 10.5 Brainlab

- 10.6 evonos GmbH & Co. KG

- 10.7 Integra LifeSciences

- 10.8 Johnson & Johnson

- 10.9 Kelyniam Global Inc.

- 10.10 KLS Martin

- 10.11 Medartis AG

- 10.12 Medtronic

- 10.13 Matrix Surgical USA

- 10.14 Renishaw plc.

- 10.15 Stryker Corporation

- 10.16 Zimmer Biomet