|

市场调查报告书

商品编码

1708151

赛车运动市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Motorsport Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

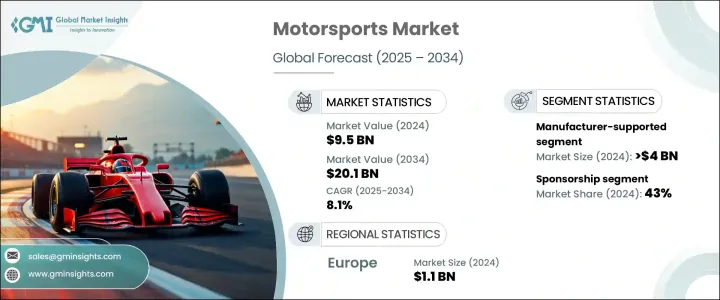

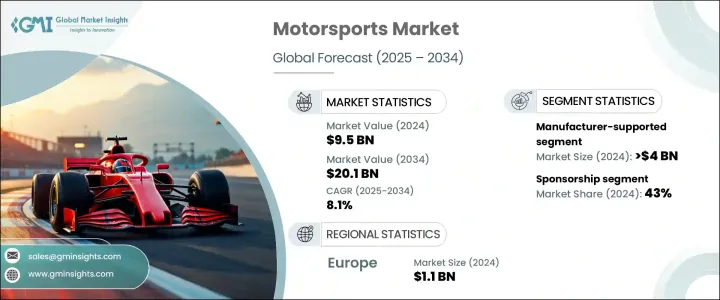

2024 年全球赛车运动市场规模达到 95 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 8.1%。随着行业的快速发展,技术进步、永续发展计划和不断变化的观众偏好正在塑造赛车运动的未来。由于人们越来越重视永续性以及电动和混合动力赛车系列的采用,市场正在经历显着的转变。主要汽车製造商和赛车组织正在大力投资绿色技术,包括电动传动系统、替代燃料和再生材料。这种转变受到日益增加的监管压力、不断增强的环保意识以及日益增长的环保创新需求的推动。随着永续性成为优先事项,球队和赞助商正在调整策略,以吸引新一代具有环保意识的球迷和利益相关者。

赛车运动产业的全球观众人数也在激增,数位平台、转播权、门票销售和商品销售的收入来源也在扩大。赞助部分仍然是财务成长的重要支柱,公司利用赛车运动的广泛影响力来提高知名度。 2024 年,赞助占该产业总收入的 43%,凸显了品牌合作的利润丰厚性质。数位化互动持续扩大品牌曝光度,数百万粉丝收看顶级赛事,从而提高赞助价值和观众参与度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 95亿美元 |

| 预测值 | 201亿美元 |

| 复合年增长率 | 8.1% |

赛车运动市场内的所有权结构包括私人车队、企业支持的实体和製造商支援的车队。 2024年,製造商支援部门创造了40亿美元的收入,巩固了其在产业中的主导地位。製造商利用赛车运动作为创新中心,在极端赛车条件下测试空气动力学、混合动力系统和轻质材料的突破性进步。这些发展不仅提高了赛车性能,也影响了商用汽车技术的发展,弥合了高性能赛车工程与主流汽车进步之间的差距。

2024 年,德国赛车运动市场创造 11 亿美元,巩固了其全球赛车运动中心的地位。德国拥有知名汽车巨头和世界级赛道,持续吸引大量投资、人才和赞助。该国在推动尖端赛车技术、举办着名赛车赛事和促进行业创新方面发挥关键作用。凭藉在汽车工程和赛车运动方面的卓越成就,德国仍然是推动全球赛车运动市场未来发展的关键参与者。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 服务提供者

- 技术提供者

- 最终用途

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动和混合动力赛车技术的进步

- 增加全球观众和数位参与度

- 汽车製造商和赞助商的投资不断增加

- 拓展赛车旅游与车迷体验

- 产业陷阱与挑战

- 团队和基础设施成本高昂

- 更严格的环境法规和永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依赛事系列,2021 - 2034

- 主要趋势

- 单一品牌系列赛

- 保时捷超级杯

- 法拉利挑战赛

- 兰博基尼 Super Trofeo

- 房车赛

- 世界房车锦标赛

- BTCC(英国房车锦标赛)

- DTM(德国房车大师赛)

- 赛车

- NASCAR(全国运动汽车竞赛协会)

- ARCA Menards系列

- GT赛车

- GT系列世界挑战赛(Blacpain GT系列赛)

- 超级GT

- 洲际GT挑战赛

- 耐力赛

- 世界耐力锦标赛(WEC)

- IMSA WeatherTech跑车锦标赛

- 24H系列

- 拉力赛和越野赛

- 世界拉力锦标赛(WRC)

- 欧洲拉力锦标赛(ERC)

- 达卡拉力赛

- SCORE国际越野赛车

- 极端E

- NHRA直线加速赛系列赛

- 方程式赛车

- 一级方程式

- 二级方程式

- 电动方程式

- 印地赛车

- 摩托车赛车

- 摩托车大奖赛

- WorldSBK(世界超级摩托车锦标赛)

- FIM EWC(国际摩托车耐力世界锦标赛)

- 超级摩托车越野锦标赛(MX)

- 英国超级摩托车(BSB)

- 摩托车越野赛世界锦标赛(MXGP)

- MotoAmerica超级摩托车锦标赛

第六章:市场估计与预测:依收入来源,2021 年至 2034 年

- 主要趋势

- 广播

- 门票销售

- 赞助

- 商品推销

第七章:市场估计与预测:依所有权划分,2021 - 2034 年

- 主要趋势

- 私营

- 製造商支持

- 企业及赞助商

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Ferrari

- Red Bull Racing

- Mercedes-Benz Grand Prix

- Formula One Group

- Team Penske

- Hendrick Motorsports

- Chip Ganassi Racing

- McLaren Racing

- Aston Martin Aramco Cognizant F1 Team

- Williams Racing

- Alpine F1 Team

- Scuderia AlphaTauri

- Haas F1 Team

- Joe Gibbs Racing

- Richard Childress Racing

- Stewart-Haas Racing

- Toyota Gazoo Racing

- Andretti Autosport

- Rahal Letterman Lanigan Racing

- Arrow McLaren SP

The Global Motorsport Market reached USD 9.5 billion in 2024 and is projected to grow at a CAGR of 8.1% between 2025 and 2034. With the industry rapidly evolving, advancements in technology, sustainability initiatives, and shifting audience preferences are shaping the future of motorsport. The market is experiencing a notable transition, driven by the increasing emphasis on sustainability and the adoption of electric and hybrid racing series. Major automotive manufacturers and racing organizations are investing heavily in green technologies, including electric drivetrains, alternative fuels, and renewable materials. This shift is fueled by mounting regulatory pressures, rising environmental awareness, and the growing demand for eco-friendly innovations. As sustainability becomes a priority, teams and sponsors are aligning their strategies to appeal to a new generation of environmentally conscious fans and stakeholders.

The motorsport industry is also witnessing a surge in global viewership, expanding revenue streams across digital platforms, broadcasting rights, ticket sales, and merchandising. The sponsorship segment remains a critical pillar of financial growth, with companies leveraging motorsport's extensive reach to gain visibility. In 2024, sponsorships accounted for 43% of the industry's total revenue, underscoring the lucrative nature of brand partnerships. Digital engagement continues to amplify brand exposure, with millions of fans tuning in to premier events, driving higher sponsorship values and audience engagement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $20.1 Billion |

| CAGR | 8.1% |

Ownership structures within the motorsport market include privately owned teams, corporate-backed entities, and manufacturer-supported teams. In 2024, the manufacturer-supported segment generated USD 4 billion, solidifying its position as a dominant force in the industry. Manufacturers utilize motorsport as an innovation hub, testing groundbreaking advancements in aerodynamics, hybrid powertrains, and lightweight materials under extreme racing conditions. These developments are not only enhancing racing performance but also influencing the evolution of commercial automotive technology, bridging the gap between high-performance motorsport engineering and mainstream vehicle advancements.

Germany motorsport market generated USD 1.1 billion in 2024, cementing its status as a global motorsport hub. Home to renowned automotive giants and world-class racing circuits, Germany continues to attract significant investment, talent, and sponsorships. The country plays a pivotal role in the advancement of cutting-edge motorsport technologies, hosting prestigious racing events and fostering innovation within the industry. With a strong legacy in automotive engineering and motorsport excellence, Germany remains a key player in driving the future of the global motorsport market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturer

- 3.2.2 Service provider

- 3.2.3 Technology provider

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Advancements in electric and hybrid racing technology

- 3.7.1.2 Increasing global viewership and digital engagement

- 3.7.1.3 Growing investments from automakers and sponsors

- 3.7.1.4 Expansion of motorsports tourism and fan experiences

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs for teams and infrastructure

- 3.7.2.2 Stricter environmental regulations and sustainability concerns

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Racing Series, 2021 - 2034 ($Mn & Number of Visitor)

- 5.1 Key trends

- 5.2 One-Make Series

- 5.2.1 Porsche Supercup

- 5.2.2 Ferrari Challenge

- 5.2.3 Lamborghini Super Trofeo

- 5.3 Touring Car Racing

- 5.3.1 World Touring Car Championship

- 5.3.2 BTCC (British Touring Car Championship)

- 5.3.3 DTM (Deutsche Tourenwagen Masters)

- 5.4 Stock Car Racing

- 5.4.1 NASCAR (National Association for Stock Car Auto Racing)

- 5.4.2 ARCA Menards Series

- 5.5 GT Racing

- 5.5.1 GT Series World Challenge (Blacpain GT Series)

- 5.5.2 Super GT

- 5.5.3 Intercontinental GT Challenge

- 5.6 Endurance Racing

- 5.6.1 World Endurance Championship (WEC)

- 5.6.2 IMSA WeatherTech SportsCar Championship

- 5.6.3 24H Series

- 5.7 Rally and Off-Road Racing

- 5.7.1 World Rally Championship (WRC)

- 5.7.2 European Rally Championship (ERC)

- 5.7.3 Dakar Rally

- 5.7.4 SCORE International Off-Road Racing

- 5.7.5 Extreme E

- 5.7.6 NHRA Drag Racing Series

- 5.8 Formula Racing

- 5.8.1 Formula 1

- 5.8.2 Formula 2

- 5.8.3 Formula E

- 5.8.4 IndyCar

- 5.9 Motorbike Racing

- 5.9.1 MotoGP

- 5.9.2 WorldSBK (World Superbike Championship)

- 5.9.3 FIM EWC (Fédération Internationale de Motocyclisme Endurance World Championship)

- 5.9.4 SuperMotoCross Championship (MX)

- 5.9.5 British SuperBikes (BSB)

- 5.9.6 MotoCross World Championship (MXGP)

- 5.9.7 MotoAmerica Superbike Championship

Chapter 6 Market Estimates & Forecast, By Revenue Source, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Broadcasting

- 6.3 Ticket sales

- 6.4 Sponsorship

- 6.5 Merchandising

Chapter 7 Market Estimates & Forecast, By Ownership, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Privately-owned

- 7.3 Manufacturer-supported

- 7.4 Corporate & sponsored

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Ferrari

- 9.2 Red Bull Racing

- 9.3 Mercedes-Benz Grand Prix

- 9.4 Formula One Group

- 9.5 Team Penske

- 9.6 Hendrick Motorsports

- 9.7 Chip Ganassi Racing

- 9.8 McLaren Racing

- 9.9 Aston Martin Aramco Cognizant F1 Team

- 9.10 Williams Racing

- 9.11 Alpine F1 Team

- 9.12 Scuderia AlphaTauri

- 9.13 Haas F1 Team

- 9.14 Joe Gibbs Racing

- 9.15 Richard Childress Racing

- 9.16 Stewart-Haas Racing

- 9.17 Toyota Gazoo Racing

- 9.18 Andretti Autosport

- 9.19 Rahal Letterman Lanigan Racing

- 9.20 Arrow McLaren SP