|

市场调查报告书

商品编码

1708163

汽车碰撞测试假人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Crash Test Dummies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

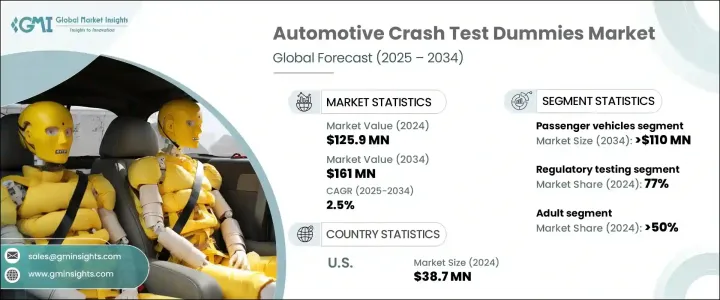

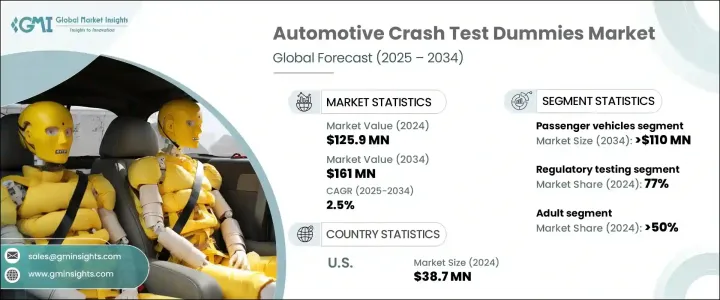

2024 年全球汽车碰撞测试假人市场规模达到 1.259 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 2.5%。随着车辆安全成为汽车製造商、监管机构和消费者的首要任务,市场规模将持续扩大。随着道路安全事故的增加以及对减少死亡和重伤的关注度不断提高,对高度先进和精确的碰撞测试假人的需求正在激增。这些假人对于模拟现实世界的事故场景至关重要,可帮助製造商设计符合严格安全标准的车辆。随着政府和安全组织推动更好地保护驾驶员和乘客,汽车製造商正在大力投资碰撞测试,以确保合规性并增强消费者信任。

公众对安全评级和碰撞测试性能的认识不断提高也影响着购买决策,促使製造商依靠复杂的碰撞测试假人来获得更高的安全分数。此外,假人技术的进步,包括增强的传感器整合和提高的生物保真度,使其成为现代车辆开发中不可或缺的一部分。随着汽车产业向电动车和自动驾驶汽车转型,新的碰撞场景不断出现,对能够评估独特碰撞条件的先进假人产生了额外的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.259亿美元 |

| 预测值 | 1.61亿美元 |

| 复合年增长率 | 2.5% |

市场根据车辆类型分为乘用车和商用车,其中乘用车在 2024 年将占 65% 的份额。受高产量和监管机构为满足不断发展的安全标准而施加的越来越大的压力的推动,预计到 2034 年,这一细分市场将产生 1.1 亿美元的收入。乘用车在这一领域的主导地位源于需要在各种碰撞情况下保护广泛的乘员,包括成人、儿童甚至宠物。随着全球安全基准变得越来越严格,汽车製造商被迫进行广泛的碰撞测试以确保合规,从而使乘用车处于碰撞测试假人利用率的最前线。

根据应用,汽车碰撞测试假人市场分为监管测试和研发,其中监管测试在 2024 年占据 77% 的份额。全球监管机构都要求在任何车辆进入市场之前进行全面的碰撞测试,这推动了对碰撞测试假人的持续需求。美国国家公路交通安全管理局 (NHTSA) 和欧洲新车评估计画 (Euro NCAP) 等机构执行严格的测试标准,迫使製造商持续更新撞击测试协议。随着安全法规变得越来越复杂和全面,对于努力满足这些准则的汽车製造商来说,可靠、准确的碰撞测试假人的需求仍然至关重要。

2024 年,美国汽车碰撞测试假人市场创造了 3,870 万美元的收入,这得益于专注于增强车辆安全技术的强大研发活动。美国拥有多家领先的撞击测试假人製造商,巩固了在全球市场的领导地位。凭藉着主要汽车品牌、尖端测试中心和积极主动的监管环境,美国仍然是碰撞测试假人领域创新和供应的重要中心。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 技术提供者

- 保险提供者

- 经销商

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 严格的车辆安全法规

- 消费者对更安全车辆的意识和需求不断提高

- 感测器技术与生物仿真假人的进步

- 自动驾驶汽车和电动车的成长需要新的碰撞测试

- 产业陷阱与挑战

- 先进碰撞测试假人成本高昂

- 复製不同人体类型和碰撞场景的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依虚拟变数类型,2021 - 2034

- 主要趋势

- 成年男性

- 孩子

- 婴儿

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 监管测试

- 研究与开发

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- 4activeSystems GmbH

- Autoliv

- Calspan Corporation

- Cellbond

- Continental AG

- CTS Corporation

- Denton ATD

- Diversified Technical Systems

- FTSS

- GRAS Sound & Vibration

- HORIBA MIRA

- Humanetics Innovative Solutions

- JASTI

- Kistler Group

- MGA Research Corporation

- Robert Bosch

- Siemens Digital Industries

- TASS International

- Transportation Research Center

- ZF Friedrichshafen

The Global Automotive Crash Test Dummies Market reached USD 125.9 million in 2024 and is projected to grow at a CAGR of 2.5% between 2025 and 2034. The market continues to expand as vehicle safety becomes a top priority for automakers, regulatory authorities, and consumers alike. With road safety incidents on the rise and increasing focus on reducing fatalities and serious injuries, the demand for highly advanced and accurate crash test dummies is surging. These dummies are pivotal in simulating real-world accident scenarios, helping manufacturers design vehicles that meet stringent safety standards. As governments and safety organizations push for better protection for drivers and passengers, automakers are investing heavily in crash testing to ensure compliance and boost consumer trust.

Growing public awareness around safety ratings and crash test performance is also influencing purchasing decisions, prompting manufacturers to rely on sophisticated crash test dummies to achieve higher safety scores. Furthermore, advancements in dummy technology, including enhanced sensor integration and improved biofidelity, are making them indispensable for modern vehicle development. As the automotive industry transitions towards electric and autonomous vehicles, new crash scenarios are emerging, creating additional demand for advanced dummies capable of evaluating unique impact conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.9 Million |

| Forecast Value | $161 Million |

| CAGR | 2.5% |

The market is segmented based on vehicle type into passenger and commercial vehicles, with passenger vehicles accounting for a 65% share in 2024. This segment is expected to generate USD 110 million by 2034, driven by high production volumes and the increasing pressure from regulatory bodies to meet evolving safety standards. The dominance of passenger vehicles in this space stems from the need to protect a wide range of occupants, including adults, children, and even pets, in various crash scenarios. As global safety benchmarks become more stringent, automakers are compelled to perform extensive crash testing to ensure compliance, keeping passenger vehicles at the forefront of crash test dummy utilization.

Based on application, the automotive crash test dummies market is divided into regulatory testing and research & development, with regulatory testing capturing a 77% share in 2024. Regulatory bodies across the globe require comprehensive crash tests before any vehicle can be introduced to the market, fueling ongoing demand for crash test dummies. Authorities such as the National Highway Traffic Safety Administration (NHTSA) and the European New Car Assessment Programme (Euro NCAP) enforce strict testing standards, pushing manufacturers to continuously update crash testing protocols. As safety regulations become increasingly complex and comprehensive, the need for reliable and accurate crash test dummies remains critical for automakers striving to meet these guidelines.

The U.S. Automotive Crash Test Dummies Market generated USD 38.7 million in 2024, supported by robust research and development activities focused on enhancing vehicle safety technologies. The U.S. is home to several leading crash test dummy manufacturers, reinforcing its leadership position in the global market. With the presence of major automotive brands, cutting-edge testing centers, and a proactive regulatory environment, the U.S. remains a key hub for innovation and supply in the crash test dummies space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Technology providers

- 3.1.1.2 Insurance providers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Stringent vehicle safety regulations

- 3.5.1.2 Rising consumer awareness and demand for safer vehicles

- 3.5.1.3 Advancements in sensor technology and biofidelic dummies

- 3.5.1.4 Growth of autonomous and electric vehicles requiring new crash testing

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High cost of advanced crash test dummies

- 3.5.2.2 Complexity in replicating diverse human body types and crash scenarios

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Dummy Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Adult male

- 5.3 Child

- 5.4 Infant

Chapter 6 Market Estimates & Forecast, By vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Regulatory testing

- 7.3 Research & development

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 4activeSystems GmbH

- 9.2 Autoliv

- 9.3 Calspan Corporation

- 9.4 Cellbond

- 9.5 Continental AG

- 9.6 CTS Corporation

- 9.7 Denton ATD

- 9.8 Diversified Technical Systems

- 9.9 FTSS

- 9.10 G.R.A.S. Sound & Vibration

- 9.11 HORIBA MIRA

- 9.12 Humanetics Innovative Solutions

- 9.13 JASTI

- 9.14 Kistler Group

- 9.15 MGA Research Corporation

- 9.16 Robert Bosch

- 9.17 Siemens Digital Industries

- 9.18 TASS International

- 9.19 Transportation Research Center

- 9.20 ZF Friedrichshafen