|

市场调查报告书

商品编码

1708167

资料中心火灾侦测与灭火市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Data Center Fire Detection and Suppression Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

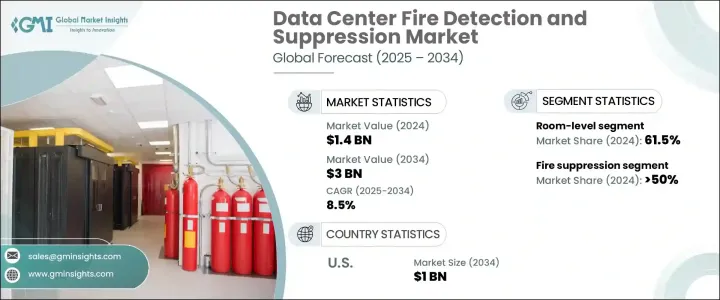

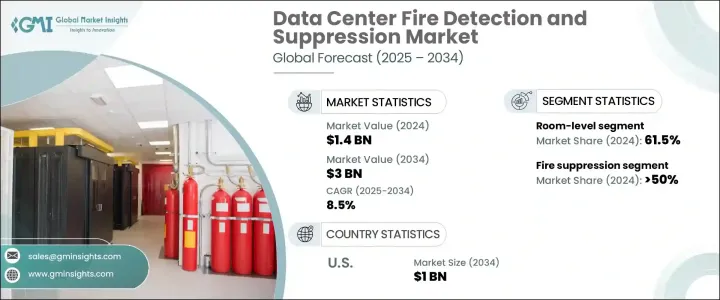

2024 年全球资料中心火灾侦测抑制市场规模达到 14 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 8.5%。对先进消防安全解决方案的需求不断增长,很大程度上受到全球资料中心数量激增的推动,而这得益于云端运算、边缘运算、人工智慧技术和高效能运算 (HPC) 的日益普及。随着企业不断扩大资料基础设施规模,以支援大量资料流和低延迟服务,确保全面的消防安全已成为重中之重。

现代资料中心,尤其是超大规模和主机託管设施,容纳了价值数百万美元的关键任务 IT 资产,因此它们容易受到电气故障、过热或设备故障引起的火灾危险。由于停机成本每分钟高达数十万美元,对可靠、智慧的火灾侦测和灭火系统的需求从未如此强烈。此外,严格的消防安全法规和日益增强的敏感资料和设备保护意识正在促使营运商整合基于人工智慧和物联网的消防解决方案,以提供即时监控和更快的回应时间。对业务连续性、营运弹性以及对日益增长的网路物理风险的防范的日益重视,进一步推动了市场向前发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 30亿美元 |

| 复合年增长率 | 8.5% |

市场分为火灾侦测和灭火系统,其中 2024 年,灭火系统占据了 50% 的市场份额,凸显了其在保护高价值资产免受火灾损害方面的关键作用。火灾侦测系统对于早期火灾风险识别和有效的事件反应至关重要。这些系统包括人工智慧烟雾侦测器、多感测器侦测单元和吸气式烟雾侦测 (ASD) 系统,旨在提供更快、更准确的侦测能力。 ASD+ 等尖端技术利用双波长讯号处理,增强其区分烟雾和灰尘的能力,从而减少误报并确保及时发出真正的威胁警报。

根据部署情况,市场分为房间级和建筑级解决方案,其中房间级系统在 2024 年将占据 61.5% 的份额。资料中心营运商越来越青睐房间级防火,因为它可以提供局部化和有针对性的抑制,保护单一资料大厅、伺服器机房和高密度机架空间,而不会危及整个设施。这种方法涉及使用预作用喷水灭火系统、先进的气体抑制系统以及人工智慧整合检测设备,旨在在密闭区域内快速响应。鑑于超大规模、主机託管和企业资料中心的快速崛起,房间级防火被视为防止火灾发生时造成大面积停电和设备损失的关键。

预计到 2034 年,北美资料中心火灾侦测和抑制市场将产生 10 亿美元的产值,并在全球保持主导地位。该地区的市场实力源于复杂资料中心基础设施的不断扩大以及对实施最先进的消防安全技术的日益重视。在美国,云端服务、人工智慧工作负载和资料流量的持续成长,正在加剧对具有无与伦比的可靠性并符合严格安全标准的下一代火灾侦测和抑制系统的需求。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原物料供应商

- 製造商

- 系统整合商

- 安装和维护提供者

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 案例研究

- 监管格局

- 衝击力

- 成长动力

- 资料中心扩张

- 消防安全法规日益严格

- 人工智慧和智慧检测的普及率不断提高

- 越来越多地转向永续灭火

- 产业陷阱与挑战

- 实施成本高

- 与现有基础设施集成

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按系统,2021 - 2034 年

- 主要趋势

- 火灾侦测

- 抽烟

- 热

- 火焰

- 气体

- 灭火

- 清洁剂

- 水性

- 气基

- 泡沫基

第六章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 房间级

- 大楼楼层

第七章:市场估计与预测:按资料中心,2021 - 2034 年

- 主要趋势

- 超大规模

- 主机託管

- 企业

- 边缘

- 政府和军队

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- 3S

- Ambetronics Engineers

- Cannon Fire Protection

- Chemours

- Control Fire Systems

- Eaton

- Fike

- FireFlex Systems

- Hiller Companies

- Honeywell

- Impact Fire Services

- Johnson Controls

- Minimax

- ORR Protection

- Robert Bosch

- SEM-SAFE

- SEVO Systems

- Siemens

- Victaulic

- WAGNER Group

The Global Data Center Fire Detection and Suppression Market reached USD 1.4 billion in 2024 and is expected to witness a robust CAGR of 8.5% from 2025 to 2034. The rising demand for advanced fire safety solutions is largely fueled by the exponential growth of data centers worldwide, driven by the increasing adoption of cloud computing, edge computing, AI-powered technologies, and high-performance computing (HPC). As companies continue to scale up their data infrastructure to support massive data flows and low-latency services, ensuring comprehensive fire safety has become a top priority.

Modern data centers, especially hyperscale and colocation facilities, house mission-critical IT assets worth millions of dollars, making them vulnerable to fire hazards caused by electrical faults, overheating, or equipment failures. With downtime costs running into hundreds of thousands of dollars per minute, the need for reliable and intelligent fire detection and suppression systems has never been greater. Additionally, stringent fire safety regulations and rising awareness about safeguarding sensitive data and equipment are pushing operators to integrate AI-based and IoT-enabled fire protection solutions, which offer real-time monitoring and faster response times. Increasing emphasis on business continuity, operational resilience, and protection against growing cyber-physical risks is further propelling the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3 Billion |

| CAGR | 8.5% |

The market is categorized into fire detection and fire suppression systems, where in 2024, the fire suppression segment captured a 50% market share, highlighting its critical role in safeguarding high-value assets from fire-related damages. Fire detection systems are indispensable for early-stage fire risk identification and efficient incident response. These systems comprise AI-powered smoke detectors, multi-sensor detection units, and aspirating smoke detection (ASD) systems, all designed to offer faster and more accurate detection capabilities. Cutting-edge technologies like ASD+ leverage dual-wavelength signal processing, enhancing their ability to differentiate between smoke and dust, thereby reducing false alarms and ensuring timely alerts for genuine threats.

Based on deployment, the market is split between room-level and building-level solutions, with room-level systems commanding a 61.5% share in 2024. Data center operators increasingly prefer room-level fire protection because it provides localized and targeted suppression, protecting individual data halls, server rooms, and high-density rack spaces without compromising entire facilities. This approach involves the use of pre-action sprinklers, advanced gas-based suppression systems, and AI-integrated detection devices designed to respond swiftly within confined zones. Given the rapid rise of hyperscale, colocation, and enterprise data centers, room-level fire protection is seen as essential to prevent widespread outages and equipment loss in the event of a fire.

North America Data Center Fire Detection and Suppression Market is projected to generate USD 1 billion by 2034, retaining its dominant position globally. The region's market strength stems from the expanding footprint of complex data center infrastructure and a growing emphasis on implementing state-of-the-art fire safety technologies. In the U.S., continuous growth in cloud services, AI workloads, and data traffic is escalating the demand for next-gen fire detection and suppression systems that offer unmatched reliability and compliance with stringent safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Manufacturers

- 3.1.3 System integrators

- 3.1.4 Installation and maintenance providers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising data center expansion

- 3.9.1.2 Increasing stringency of fire safety regulations

- 3.9.1.3 Growing adoption of AI & smart detection

- 3.9.1.4 Increasing shift to sustainable fire suppression

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High implementation cost

- 3.9.2.2 Integration with existing infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Fire detection

- 5.2.1 Smoke

- 5.2.2 Heat

- 5.2.3 Flame

- 5.2.4 Gas

- 5.3 Fire suppression

- 5.3.1 Clean agent

- 5.3.2 Water-based

- 5.3.3 Gas- based

- 5.3.4 Foam- based

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Room level

- 6.3 Building level

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Hyperscale

- 7.3 Colocation

- 7.4 Enterprise

- 7.5 Edge

- 7.6 Government & military

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 3S

- 9.2 Ambetronics Engineers

- 9.3 Cannon Fire Protection

- 9.4 Chemours

- 9.5 Control Fire Systems

- 9.6 Eaton

- 9.7 Fike

- 9.8 FireFlex Systems

- 9.9 Hiller Companies

- 9.10 Honeywell

- 9.11 Impact Fire Services

- 9.12 Johnson Controls

- 9.13 Minimax

- 9.14 ORR Protection

- 9.15 Robert Bosch

- 9.16 SEM-SAFE

- 9.17 SEVO Systems

- 9.18 Siemens

- 9.19 Victaulic

- 9.20 WAGNER Group