|

市场调查报告书

商品编码

1708174

活动记录器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Actigraphy Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球活动记录设备市场规模达到 23 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.4%。随着对非侵入性即时健康监测解决方案的需求不断增长,活动记录设备正成为医疗保健提供者和消费者的必备工具。人们越来越意识到睡眠健康的重要性,加上失眠、睡眠呼吸中止症和不安腿症候群等睡眠相关疾病的发病率不断上升,推动了这些设备的广泛采用。

市场也见证了技术进步的激增,包括提供即时个人化健康洞察的人工智慧分析和基于云端的平台。这些创新使得活动记录设备更加精确、用户友好,并与其他数位健康生态系统整合。此外,远端病人监控和远距医疗的日益增长的趋势正在加速临床环境中对活动记录设备的需求,而个人健康爱好者也在采用这些设备来追踪他们的日常活动和睡眠模式。随着人们日益重视预防性医疗保健和个人化健康,活动记录设备市场将在整个预测期内保持持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 42亿美元 |

| 复合年增长率 | 6.4% |

活动记录器市场分为穿戴式装置和手持设备,其中穿戴式装置在 2024 年将产生 18 亿美元的市场规模。消费者更喜欢穿戴式活动记录仪,因为它们能够持续监测睡眠模式和身体活动,而不会中断日常生活。配备先进睡眠追踪功能的智慧手錶和健身带的流行推动了这一领域的快速成长。公司正在大力投资,透过整合人工智慧、机器学习演算法和云端连接来改善这些穿戴式装置的设计、准确性和功能,以提供个人化的健康建议和可行的见解。这些增强功能不仅为使用者增加了价值,而且还促进了更好的睡眠卫生和主动的健康管理。

活动记录器的通路包括线上平台和实体零售店。 2024 年,线上市场创造了 14 亿美元的销售额,引领市场。电子商务的扩张和人们对便利的在家购物的偏好日益增长,极大地促进了线上销售。直接面向消费者的品牌正在利用数位行销策略并提供线上独家优惠来占领更大的市场份额。基于订阅的睡眠和活动追踪服务也越来越受欢迎,促进了线上销售管道的强劲成长。

受睡眠障碍日益普遍、医疗保健基础设施先进以及消费者对睡眠健康意识不断增强的推动,美国活动记录设备市场规模到 2024 年将达到 8.327 亿美元。先进的人工智慧睡眠追踪技术使这些设备更容易获得,而远端病人监控以及更广泛的睡眠诊断保险覆盖范围正在加速它们在该国临床和个人健康领域的应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 睡眠障碍和昼夜节律紊乱的盛行率不断上升

- 提高对睡眠健康和心理健康的认识

- 穿戴式科技与人工智慧分析的进步

- 产业陷阱与挑战

- 穿戴式健康监测设备的资料隐私和安全问题

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术格局

- 波特的分析

- PESTEL分析

- 价值链分析

- 定价分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 穿戴式体动记录仪

- 手持式体动记录仪

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 睡眠障碍监测

- 昼夜节律紊乱监测

- 失眠和不安腿综合症的诊断

- 其他应用

第七章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 实体店面

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- ActiGraph

- Advanced Brain Monitoring

- Apple

- CamNtech

- Cidelec

- Cleveland Medical Devices

- Fitbit

- Garmin

- neurocare

- Nox Medical

- Philips Healthcare

- ResMed

- Samsung

- SOMNOmedics

- Withings

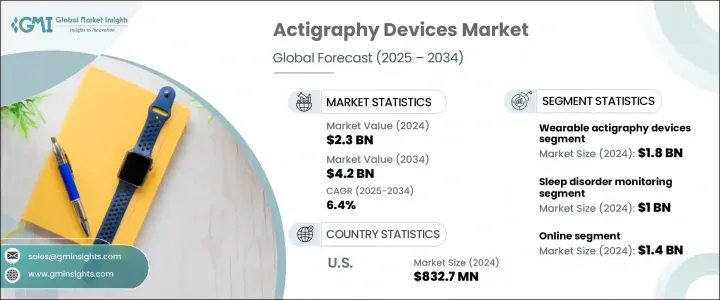

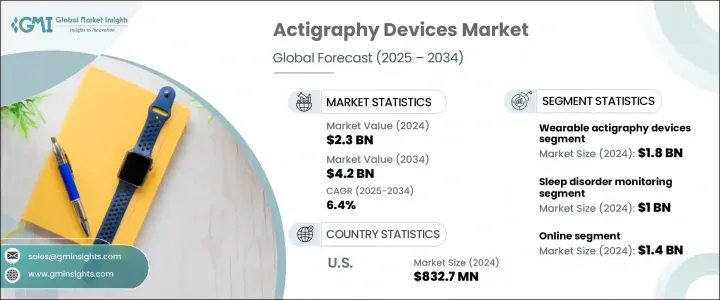

The Global Actigraphy Devices Market reached USD 2.3 billion in 2024 and is projected to grow at a CAGR of 6.4% between 2025 and 2034. As the demand for non-invasive, real-time health monitoring solutions continues to rise, actigraphy devices are becoming essential tools for healthcare providers and consumers alike. Growing awareness of the importance of sleep health, coupled with the increasing incidence of sleep-related disorders such as insomnia, sleep apnea, and restless leg syndrome, is fueling the widespread adoption of these devices.

The market is also witnessing a surge in technological advancements, including AI-powered analytics and cloud-based platforms that deliver real-time, personalized health insights. These innovations are making actigraphy devices more precise, user-friendly, and integrated with other digital health ecosystems. Moreover, the growing trend of remote patient monitoring and telehealth is accelerating the demand for actigraphy devices in clinical settings, while personal health enthusiasts are also embracing these devices to track their daily activity and sleep patterns. With the increasing shift toward preventive healthcare and personalized wellness, the actigraphy devices market is set to see consistent and sustained growth throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 6.4% |

The actigraphy devices market is segmented into wearable and handheld devices, with wearable devices generating USD 1.8 billion in 2024. Consumers prefer wearable actigraphy devices due to their ability to continuously monitor sleep patterns and physical activity without interrupting daily routines. The popularity of smartwatches and fitness bands equipped with advanced sleep-tracking features has driven this segment's rapid growth. Companies are heavily investing in improving the design, accuracy, and functionality of these wearables by integrating artificial intelligence, machine learning algorithms, and cloud connectivity to offer personalized health recommendations and actionable insights. These enhancements not only add value for users but also promote better sleep hygiene and proactive health management.

Distribution channels for actigraphy devices include both online platforms and brick-and-mortar retail outlets. The online segment led the market by generating USD 1.4 billion in 2024. The expansion of e-commerce and the rising preference for convenient, at-home purchases have significantly boosted online sales. Direct-to-consumer brands are leveraging digital marketing strategies and offering online-exclusive deals to capture a larger share of the market. Subscription-based services for sleep and activity tracking are also gaining traction, adding to the robust growth of online sales channels.

The U.S. Actigraphy Devices Market reached USD 832.7 million in 2024, driven by the increasing prevalence of sleep disorders, cutting-edge healthcare infrastructure, and heightened consumer awareness of sleep wellness. Advanced AI-driven sleep-tracking technologies are making these devices more accessible, while remote patient monitoring, along with broader insurance coverage for sleep diagnostics, is accelerating their adoption across clinical and personal health segments in the country.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of sleep disorders and circadian rhythm disorders

- 3.2.1.2 Increasing awareness about sleep health and mental well-being

- 3.2.1.3 Advancements in wearable technology and AI-driven analytics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns with wearable health monitoring devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technological landscape

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Value chain analysis

- 3.9 Pricing analysis

- 3.10 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable actigraphy devices

- 5.3 Handheld actigraphy devices

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Sleep disorders monitoring

- 6.3 Circadian rhythm disorder monitoring

- 6.4 Insomnia and restless leg syndrome diagnosis

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online

- 7.3 Brick and mortar

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ActiGraph

- 9.2 Advanced Brain Monitoring

- 9.3 Apple

- 9.4 CamNtech

- 9.5 Cidelec

- 9.6 Cleveland Medical Devices

- 9.7 Fitbit

- 9.8 Garmin

- 9.9 neurocare

- 9.10 Nox Medical

- 9.11 Philips Healthcare

- 9.12 ResMed

- 9.13 Samsung

- 9.14 SOMNOmedics

- 9.15 Withings