|

市场调查报告书

商品编码

1708180

细菌和病毒样本采集市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bacterial and Viral Specimen Collection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

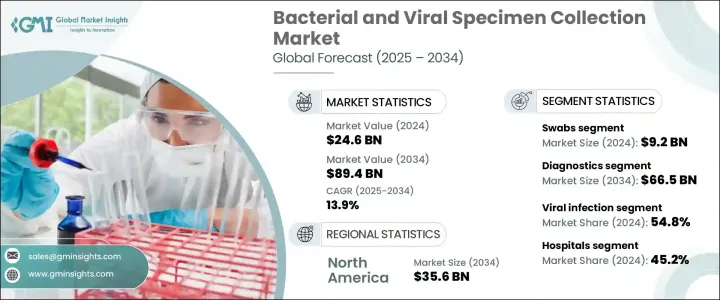

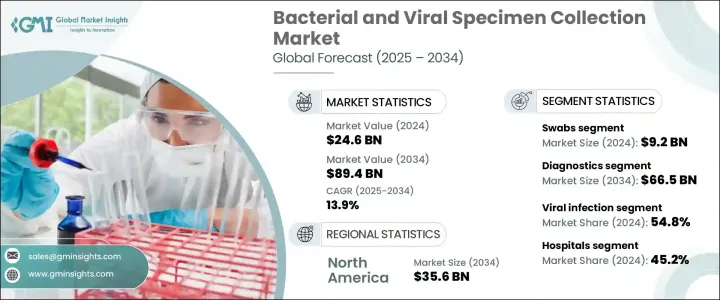

2024 年全球细菌和病毒样本采集市场规模达 246 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 13.9%。样本采集是诊断细菌和病毒感染的关键步骤,涉及从患者或环境来源采集体液、组织和拭子等生物材料。随着全球传染病的流行不断升级,对有效、及时的诊断方法的需求正在迅速增长。全球各地的医疗保健系统对准确的标本采集流程的需求日益增长,以促进早期诊断、更好的治疗结果和有效的疾病管理。

医疗诊断技术的进步,加上人们对早期疾病检测的认识不断提高,正在推动市场成长。此外,政府对医疗基础设施和诊断创新的投资不断增加,加上新兴传染病(包括潜在的大流行病)的持续威胁,进一步加速了对先进标本采集工具的需求。随着对预防性医疗保健和早期检测的日益重视,医院、诊断实验室和研究机构正在采用高效的标本采集试剂盒来提高诊断准确性和临床结果。新型病原体的不断出现以及全球对更好地预防传染病爆发的努力也在推动市场走向新的高度,从而加强了对先进标本采集技术的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 246亿美元 |

| 预测值 | 894亿美元 |

| 复合年增长率 | 13.9% |

市场按产品类型细分,包括拭子、细菌运输介质、采血试剂盒和其他相关产品。其中,拭子在2024年创造了92亿美元的收入,成为领先的产品领域。拭子由于其简单、方便和非侵入性而仍然受到高度青睐,在临床和非临床环境中使用时只需极少的培训。它们能够从鼻腔和喉咙等敏感区域采集样本,同时减少患者的不适,使其成为大规模测试和诊断的理想选择。随着医疗保健提供者寻求更用户友好和高效的诊断解决方案,预计拭子在整个预测期内将保持强劲的需求。

从应用角度来看,细菌和病毒标本采集市场主要分为诊断和研究。诊断领域在 2024 年占了 75.2% 的市场份额,预计到 2034 年将达到 665 亿美元。对先进诊断工具进行准确病原体识别的日益依赖,对于确保适当的治疗计划和降低误诊风险起着至关重要的作用。随着诊断技术的不断创新,该领域在解决日益加重的传染病负担方面仍然发挥关键作用,并将在未来几年实现持续成长。

从地区来看,北美细菌和病毒标本采集市场在 2024 年创造了 100 亿美元的产值,这得益于美国传染病病例的增加以及对尖端标本采集试剂盒开发的大力支持。虽然该地区实行严格的监管框架,但医疗保健解决方案的持续进步和强大的研发计划正在推动整个北美市场的扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 传染病发生率上升

- 对准确诊断的需求日益增长

- 诊断技术的进步

- 预防保健意识不断提高

- 产业陷阱与挑战

- 污染风险高

- 缺乏标准化协议

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 拭子

- 鼻拭子

- 咽拭子

- 其他拭子

- 细菌运输培养基

- 血液采集套件

- 其他产品

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 诊断

- 研究

第七章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 细菌感染

- 结核

- 肺炎

- 霍乱

- 沙门氏菌

- 性传染感染(STI)

- 其他细菌感染

- 病毒感染

- 流感

- 新冠肺炎

- 爱滋病

- B型肝炎

- 登革热

- 寨卡病毒

- 其他病毒感染

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 家庭检测

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Becton, Dickinson And Company

- BIOMÉRIEUX

- COPAN Italia

- DiaSorinGroup

- Hardy Diagnostics

- HiMedia Laboratories

- Longhorn Vaccines and Diagnostics

- Medical Wire & Equipment

- Puritan Medical Products

- Pretium Packaging

- Quidel Corporation

- Thermo Fisher Scientific

- Trinity Biotech

- Vircell SL

- Wuxi Nest Biotechnology

The Global Bacterial and Viral Specimen Collection Market generated USD 24.6 billion in 2024 and is projected to grow at a CAGR of 13.9% between 2025 and 2034. Specimen collection is a crucial step in diagnosing bacterial and viral infections, involving the collection of biological materials such as fluids, tissues, and swabs from patients or environmental sources. As the prevalence of infectious diseases continues to escalate worldwide, the demand for effective and timely diagnostic methods is growing rapidly. Healthcare systems across the globe are witnessing an increased need for accurate specimen collection processes to facilitate early diagnosis, better treatment outcomes, and effective disease management.

Technological advancements in healthcare diagnostics, coupled with the growing awareness regarding early disease detection, are fueling market growth. Moreover, rising government investments in healthcare infrastructure and diagnostic innovations, along with the persistent threat of emerging infectious diseases, including potential pandemics, are further accelerating the demand for advanced specimen collection tools. With an increasing focus on preventive healthcare and early detection, hospitals, diagnostic labs, and research institutions are adopting highly efficient specimen collection kits to improve diagnostic accuracy and clinical outcomes. The continuous emergence of novel pathogens and the global push for better preparedness against infectious outbreaks are also driving the market to new heights, reinforcing the need for advanced specimen collection techniques.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.6 Billion |

| Forecast Value | $89.4 Billion |

| CAGR | 13.9% |

The market is segmented by product types, including swabs, bacterial transport media, blood collection kits, and other related products. Among these, swabs generated USD 9.2 billion in revenue in 2024, emerging as the leading product segment. Swabs remain highly preferred due to their simplicity, convenience, and non-invasive nature, requiring minimal training for use in both clinical and non-clinical environments. Their ability to collect samples from sensitive areas like the nasal cavity and throat with reduced patient discomfort makes them an ideal choice for large-scale testing and diagnostics. As healthcare providers seek more user-friendly and efficient diagnostic solutions, swabs are anticipated to maintain robust demand throughout the forecast period.

From an application perspective, the bacterial and viral specimen collection market is primarily classified into diagnostics and research. The diagnostics segment accounted for a dominant 75.2% market share in 2024 and is projected to reach USD 66.5 billion by 2034. The growing reliance on advanced diagnostic tools for accurate pathogen identification plays a vital role in ensuring appropriate treatment plans and reducing risks of misdiagnosis. With continuous innovations in diagnostic technologies, this segment remains pivotal in addressing the rising burden of infectious diseases and is set to witness sustained growth in the coming years.

Regionally, the North America bacterial and viral specimen collection market generated USD 10 billion in 2024, driven by an increasing number of infectious disease cases in the U.S. and robust support for the development of cutting-edge specimen collection kits. While the region operates under a stringent regulatory framework, consistent advancements in healthcare solutions and strong R&D initiatives are fueling market expansion across North America.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of infectious diseases

- 3.2.1.2 Growing need for accurate diagnostics

- 3.2.1.3 Advancements in diagnostic technologies

- 3.2.1.4 Rising awareness of preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk of contamination

- 3.2.2.2 Lack of standardized protocols

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Swabs

- 5.2.1 Nasal swabs

- 5.2.2 Throat swabs

- 5.2.3 Other swabs

- 5.3 Bacterial transport media

- 5.4 Blood collection kits

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostics

- 6.3 Research

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacterial infection

- 7.2.1 Tuberculosis

- 7.2.2 Pneumonia

- 7.2.3 Cholera

- 7.2.4 Salmonella

- 7.2.5 Sexually transmitted infections (STIs)

- 7.2.6 Other bacterial infections

- 7.3 Viral infection

- 7.3.1 Influenza

- 7.3.2 COVID-19

- 7.3.3 HIV

- 7.3.4 Hepatitis B

- 7.3.5 Dengue

- 7.3.6 Zika virus

- 7.3.7 Other viral infections

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic laboratories

- 8.4 Home testing

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Becton, Dickinson And Company

- 10.2 BIOMÉRIEUX

- 10.3 COPAN Italia

- 10.4 DiaSorinGroup

- 10.5 Hardy Diagnostics

- 10.6 HiMedia Laboratories

- 10.7 Longhorn Vaccines and Diagnostics

- 10.8 Medical Wire & Equipment

- 10.9 Puritan Medical Products

- 10.10 Pretium Packaging

- 10.11 Quidel Corporation

- 10.12 Thermo Fisher Scientific

- 10.13 Trinity Biotech

- 10.14 Vircell S.L.

- 10.15 Wuxi Nest Biotechnology