|

市场调查报告书

商品编码

1708185

淋巴瘤治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Lymphoma Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

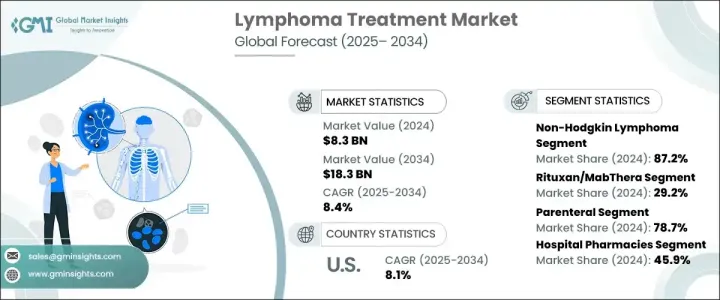

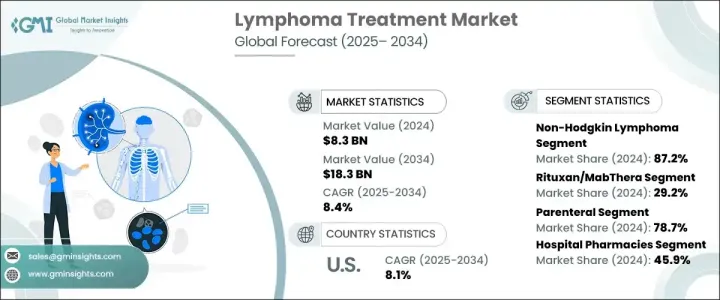

2024 年全球淋巴瘤治疗市场规模达 83 亿美元,预估 2025 年至 2034 年复合年增长率为 8.4%。淋巴瘤是一种影响淋巴系统的癌症,由淋巴球(一种白血球)的异常增生所引起。它主要表现在淋巴结中,也可能影响其他组织。淋巴瘤主要有两种类型:非何杰金氏淋巴瘤和霍奇金淋巴瘤,以霍奇金淋巴瘤中 Reed-Sternberg 细胞的存在为特征。症状通常包括淋巴结肿大、发烧、疲劳和食慾不振。霍奇金淋巴瘤的负担仍然很高,尤其是在年轻族群中,而一些地区医疗基础设施不足导致存活率较低。这种差异强调了改进治疗方法的必要性,特别是在低收入地区。

非何杰金氏淋巴瘤 (NHL) 因其盛行率较高且亚型多样而占据市场主导地位,导致全球患者数量较大。发病率的上升继续推动市场的成长。利妥昔单抗等单株抗体疗法的使用彻底改变了淋巴瘤的治疗。利妥昔单抗针对 B 淋巴细胞上的 CD20 分子,已被证明可有效治疗 NHL 和结节性淋巴细胞为主的霍奇金淋巴瘤 (NLPHL)。该疗法提高了反应率,延长了缓解时间,提高了存活率,巩固了其作为淋巴瘤治疗基石的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 83亿美元 |

| 预测值 | 183亿美元 |

| 复合年增长率 | 8.4% |

2024 年,肠外给药占了 78.7% 的市场份额,凸显了其主导地位。这种方法是将药物直接注射到血液中,确保药物快速吸收,使其成为需要立即干预的恶性淋巴瘤的理想选择。肠外途径可实现精确给药和控制输送,这对于免疫疗法、CAR-T 细胞疗法和高剂量化疗等先进疗法至关重要。由于严重症状或肠道问题而无法耐受口服药物的患者可以从这种方法中受益。此外,对于口服治疗效果不佳的復发性或难治性淋巴瘤病例,肠外给药仍是首选方法。

2024 年,医院药局占据最大的市场份额,为 45.9%,这得益于化疗、免疫疗法和 CAR T 细胞疗法等医院管理疗法的广泛使用。这些专门的治疗需要精心的准备和监测,最好在医院环境中进行。医院药房仍然是这些定製药物和高成本生物製剂的主要来源。接受专科肿瘤治疗的医院入院人数不断增长,进一步巩固了该领域的巨大市场份额。

在英国,淋巴瘤治疗市场预计将在 2025 年至 2034 年间持续成长。该地区淋巴瘤患病率的不断上升推动了对创新治疗方案的需求。精准医疗、免疫疗法和 CAR T 细胞疗法的进步正在满足这一需求。此外,生命科学产业策略和英国脱欧推动的权力下放等措施正在加强英国创新和生产国内治疗方法的能力,从而促进该地区的整体市场成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 淋巴瘤盛行率不断上升

- 治疗方案的进步

- 新型标靶疗法的核准率不断提高

- 产业陷阱与挑战

- 治疗费用高

- 延迟诊断

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 霍奇金淋巴瘤

- 非何杰金氏淋巴瘤

第六章:市场估计与预测:依药物类型,2021 年至 2034 年

- 主要趋势

- 利妥昔单抗/美罗华

- 来那度胺

- 依鲁替尼

- 阿德塞特里斯

- 可瑞达

- 奥狄沃

- 其他药物类型

第七章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 肠外

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- AstraZeneca

- Bayer

- Biogen

- BioGene

- Bristol-Myers Squibb

- Celgene

- Eli Lilly and Company

- F. Hoffmann-La Roche

- Gilead Sciences

- Incyte

- Johnson & Johnson

- Juno Therapeutics

- Merck

- Novartis

- Seattle Genetics

- Takeda Pharmaceutical

The Global Lymphoma Treatment Market reached USD 8.3 billion in 2024 and is projected to exhibit a CAGR of 8.4% from 2025 to 2034. Lymphoma, a type of cancer affecting the lymphatic system, arises from abnormal proliferation of lymphocytes, a form of white blood cell. It primarily manifests in lymph nodes and can also affect other tissues. There are two primary types non-Hodgkin lymphoma and Hodgkin lymphoma-distinguished by the presence of Reed-Sternberg cells in Hodgkin lymphoma. Symptoms often include lymphadenopathy, fever, fatigue, and appetite loss. The burden of Hodgkin lymphoma remains high, especially among young populations, while inadequate healthcare infrastructure in some regions contributes to lower survival rates. This disparity emphasizes the need for improved treatment approaches, particularly in low-income regions.

Non-Hodgkin lymphoma (NHL) dominates the market due to its higher prevalence and multiple subtypes, resulting in a larger patient population worldwide. Increasing incidence rates continue to propel the market's growth. The use of monoclonal antibody therapies, such as Rituximab, has revolutionized lymphoma treatment. Rituximab targets the CD20 molecule on B lymphocytes and has proven effective in managing both NHL and nodular lymphocyte predominant Hodgkin lymphoma (NLPHL). The therapy enhances response rates, prolongs remission duration, and boosts survival rates, reinforcing its position as a cornerstone in lymphoma treatment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $18.3 Billion |

| CAGR | 8.4% |

Parenteral administration accounted for 78.7% of the market share in 2024, underscoring its dominance. This method, which involves injecting medication directly into the bloodstream, ensures rapid drug absorption, making it ideal for aggressive lymphomas requiring immediate intervention. Parenteral routes allow for precise dosing and controlled delivery, which is critical for advanced therapies such as immunotherapy, CAR T-cell therapy, and high-dose chemotherapy. Patients who are unable to tolerate oral medications due to severe symptoms or bowel issues benefit from this approach. Furthermore, parenteral administration remains the preferred method for relapsed or refractory lymphoma cases that do not respond well to oral treatments.

Hospital pharmacies held the largest market share at 45.9% in 2024, driven by the widespread use of hospital-administered therapies such as chemotherapy, immunotherapy, and CAR T-cell therapies. These specialized treatments require careful preparation and monitoring, which is best handled within a hospital setting. Hospital pharmacies remain the primary source for these tailored medications and high-cost biologics. The growing volume of hospital admissions for specialized oncology care further reinforces the segment's substantial market share.

In the United Kingdom, the lymphoma treatment market is expected to witness consistent growth between 2025 and 2034. The increasing prevalence of lymphoma in the region is driving demand for innovative treatment solutions. Advancements in precision medicine, immunotherapy, and CAR T-cell therapies are meeting this demand. Additionally, initiatives such as the Life Sciences Industrial Strategy and Brexit-driven devolution efforts are strengthening the UK's capacity to innovate and produce domestic treatments, boosting the region's overall market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of lymphoma

- 3.2.1.2 Advancements in treatment options

- 3.2.1.3 Growing approval of novel targeted therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Delayed diagnosis

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hodgkin lymphoma

- 5.3 Non-Hodgkin lymphoma

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Rituxan/MabThera

- 6.3 Revlimid

- 6.4 Imbruvica

- 6.5 Adcetris

- 6.6 Keytruda

- 6.7 Opdivo

- 6.8 Other drug types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Bayer

- 10.3 Biogen

- 10.4 BioGene

- 10.5 Bristol-Myers Squibb

- 10.6 Celgene

- 10.7 Eli Lilly and Company

- 10.8 F. Hoffmann-La Roche

- 10.9 Gilead Sciences

- 10.10 Incyte

- 10.11 Johnson & Johnson

- 10.12 Juno Therapeutics

- 10.13 Merck

- 10.14 Novartis

- 10.15 Seattle Genetics

- 10.16 Takeda Pharmaceutical