|

市场调查报告书

商品编码

1708196

卡车货箱衬垫市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Truck Bedliners Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

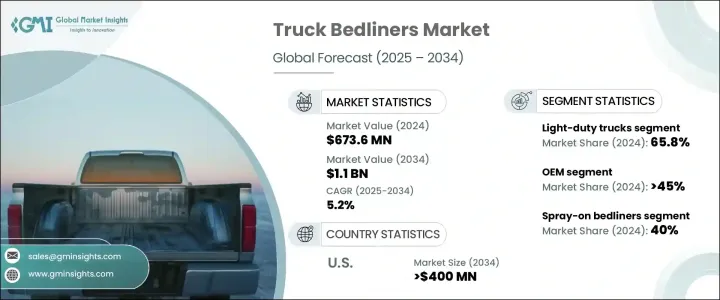

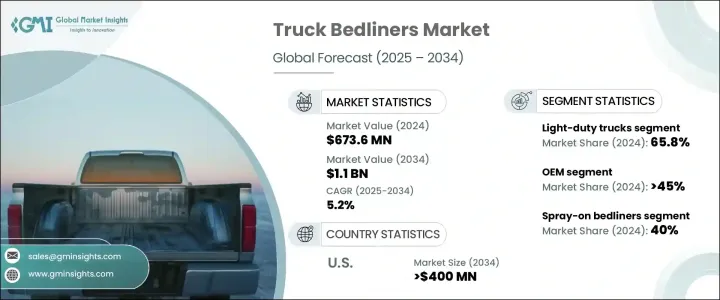

2024 年全球卡车货箱衬垫市场价值为 6.736 亿美元,预计 2025 年至 2034 年期间复合年增长率为 5.2%,这得益于皮卡车在各个地区日益普及的推动。消费者和企业越来越依赖皮卡车用于个人和商业用途,从而推动了北美、欧洲和新兴市场的卡车销售。保护卡车车厢免受损坏已成为车主的首要任务,从而对有效且持久的保护解决方案的需求也随之增加。货箱衬垫发挥着至关重要的作用,它可以防止刮痕、生锈和腐蚀,确保卡车货箱具有更高的耐用性。

随着车辆客製化趋势的持续发展,卡车车主正在积极寻求个人化的货箱衬垫解决方案,不仅可以增强保护性,还可以提高美观度。人们越来越倾向于延长汽车的使用寿命,加上人们越来越意识到保护涂层的好处,进一步推动了市场的成长。电子商务平台和线上汽车配件商店使这些产品更容易获得,有助于提高消费者的接受度。此外,货箱衬垫技术的进步(例如环保和快速固化解决方案)正在吸引具有环保意识的消费者,从而扩大市场。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.736亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 5.2% |

市场按不同类型的货箱衬垫进行分类,其中喷涂货箱衬垫在 2024 年占据 40% 的主导份额。喷涂货箱衬垫提供无缝保护和长期耐用性,直接黏合到卡车车厢上,消除了积水和腐蚀等问题。这些衬垫具有出色的抵抗化学品洩漏和恶劣环境条件的能力,使其成为个人和商业应用的理想选择。消费者更喜欢喷涂式货箱衬垫,因为它能够延长车辆的使用寿命,同时提供光滑、客製化的外观。这些衬垫的耐用性和美观性使其成为注重功能性和外观的卡车车主的首选。

卡车货箱衬垫主要用于轻型卡车和重型卡车,其中轻型卡车在 2024 年占据 65.8% 的市场份额。轻型卡车广泛用于日常交通、小型企业营运和城市物流,使其成为货箱衬垫采用的重要驱动力。许多个人和企业依靠这些卡车进行货物运输,而货箱衬垫在保护卡车货箱免受重载和频繁使用造成的损坏方面发挥着至关重要的作用。轻型卡车车主通常优先考虑经济实惠、耐用性和易于维护,因此货箱衬垫是售后市场必不可少的附加产品。

2024 年,北美卡车货箱衬垫市场占有 45% 的份额,这得益于领先卡车製造商的强大影响力、售后市场销售额的成长以及货箱衬垫技术的持续创新。随着越来越多的消费者投资购买皮卡车用于个人和商业用途,对高品质货箱衬垫的需求预计将保持强劲。该地区蓬勃发展的汽车产业,加上消费者对车辆保护解决方案意识的不断增强,正在巩固市场稳定的成长轨迹。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原物料供应商

- 製造和涂料供应商

- 设备和技术提供商

- OEM和售后市场分销商

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 价格趋势

- 成本細項分析

- 监管格局

- 衝击力

- 成长动力

- 皮卡车销量不断成长

- 售后配件需求不断成长

- 不断进步的技术

- 商业船队的扩张

- 产业陷阱与挑战

- 优质床垫的成本很高

- 环境法规

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 嵌入式床垫

- 喷涂式货箱衬垫

- 床垫

- 床垫

第六章:市场估计与预测:依资料,2021 年至 2034 年

- 主要趋势

- 聚氨酯

- 聚脲

- 橡皮

- 其他的

第七章:市场估计与预测:依车型,2021 年至 2034 年

- 主要趋势

- 轻型

- 重负

第八章:市场估计与预测:依销售管道,2021 年至 2034 年

- 主要趋势

- OEM

- 售后市场

- 网路零售

- 经销商

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 汽车

- 军事与国防

- 活力

- 建造

- 农业

- 零售与电子商务

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Als Liner

- ArmorThane

- BedRug

- Bullet Liner

- Bullhide Liner

- DualLiner

- Durabak

- Herculiner

- LINE-X

- Maxliner

- Metso

- Penda

- Rhino Linings

- Scorpion Coatings

- Speedliner

- Toff Liner

- Truck Hero

- Ultimate Linings

- U-POL Raptor

- Vortex Sprayliners

The Global Truck Bedliners Market generated USD 673.6 million in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034, driven by the rising popularity of pickup trucks across various regions. Consumers and businesses are increasingly relying on pickup trucks for both personal and commercial use, boosting truck sales in North America, Europe, and emerging markets. Protecting truck beds from damage has become a priority for owners, leading to higher demand for effective and long-lasting protective solutions. Bedliners play a crucial role by providing resistance against scratches, rust, and corrosion, ensuring enhanced durability for truck beds.

As vehicle customization trends continue to gain momentum, truck owners are actively seeking personalized bedliner solutions that not only enhance protection but also improve aesthetics. The growing inclination toward enhancing vehicle longevity, coupled with an increasing awareness of the benefits of protective coatings, is further driving market growth. E-commerce platforms and online auto accessory stores are making these products more accessible, contributing to higher consumer adoption. Additionally, advancements in bedliner technology, such as eco-friendly and quick-curing solutions, are expanding the market by appealing to environmentally conscious consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $673.6 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 5.2% |

The market is categorized by different types of bedliners, with the spray-on bedliners segment holding a dominant 40% share in 2024. Spray-on bedliners provide seamless protection and long-term durability, bonding directly to the truck bed and eliminating issues such as water accumulation and corrosion. These liners offer superior resistance against chemical spills and harsh environmental conditions, making them ideal for both personal and commercial applications. Consumers prefer spray-on bedliners due to their ability to enhance vehicle longevity while offering a sleek, customized finish. The durability and aesthetic appeal of these liners have made them a preferred choice among truck owners who prioritize both functionality and appearance.

Truck bedliners are primarily used in light-duty and heavy-duty trucks, with light-duty trucks accounting for 65.8% of the market share in 2024. Light-duty trucks are extensively used for everyday transportation, small business operations, and urban logistics, making them a significant driver of bedliner adoption. Many individuals and businesses rely on these trucks for cargo transportation, and bedliners play a critical role in protecting truck beds from damage caused by heavy loads and frequent use. Light-duty truck owners often prioritize affordability, durability, and ease of maintenance, making bedliners an essential aftermarket addition.

North America truck bedliners market held a 45% share in 2024, driven by the strong presence of leading truck manufacturers, increasing aftermarket sales, and continuous innovations in bedliner technology. As more consumers invest in pickup trucks for personal and business use, the demand for high-quality bedliners is expected to remain strong. The region's thriving automotive industry, coupled with growing consumer awareness of vehicle protection solutions, is reinforcing the market's steady growth trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Manufacturing & coating suppliers

- 3.1.3 Equipment & technology providers

- 3.1.4 OEM & aftermarket distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Price trend

- 3.8 Cost breakdown analysis

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing pickup truck sales

- 3.10.1.2 Rising demand for aftermarket accessories

- 3.10.1.3 Rising technological advancements

- 3.10.1.4 Expansion of commercial fleets

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High cost of premium bed liners

- 3.10.2.2 Environmental regulations

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034 (USD Billion, Units)

- 5.1 Key trends

- 5.2 Drop-in bedliners

- 5.3 Spray-on bedliners

- 5.4 Bed mats

- 5.5 Bed rugs

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034 (USD Billion, Units)

- 6.1 Key trends

- 6.2 Polyurethane

- 6.3 Polyurea

- 6.4 Rubber

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 – 2034 (USD Billion, Units)

- 7.1 Key trends

- 7.2 Light-duty

- 7.3 Heavy-duty

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 – 2034 (USD Billion, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

- 8.4 Online retail

- 8.5 Dealerships

Chapter 9 Market Estimates & Forecast, By End Use, 2021 – 2034 (USD Billion, Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Military & defense

- 9.4 Energy

- 9.5 Construction

- 9.6 Agriculture

- 9.7 Retail & e-commerce

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Als Liner

- 11.2 ArmorThane

- 11.3 BedRug

- 11.4 Bullet Liner

- 11.5 Bullhide Liner

- 11.6 DualLiner

- 11.7 Durabak

- 11.8 Herculiner

- 11.9 LINE-X

- 11.10 Maxliner

- 11.11 Metso

- 11.12 Penda

- 11.13 Rhino Linings

- 11.14 Scorpion Coatings

- 11.15 Speedliner

- 11.16 Toff Liner

- 11.17 Truck Hero

- 11.18 Ultimate Linings

- 11.19 U-POL Raptor

- 11.20 Vortex Sprayliners