|

市场调查报告书

商品编码

1708203

生物标记市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biomarkers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

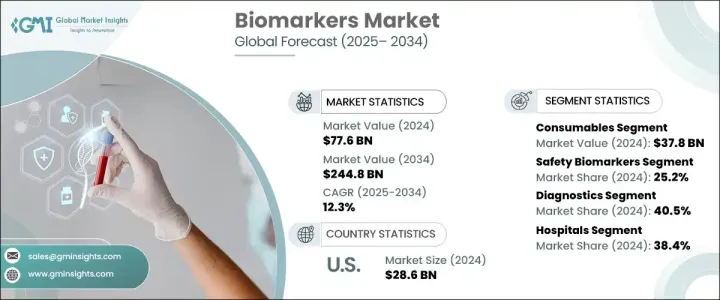

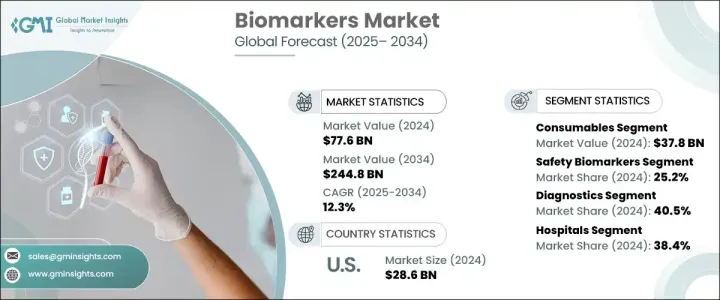

2024 年全球生物标记市场价值为 776 亿美元,预计将从 2025 年的 859 亿美元成长到 2034 年的 2,448 亿美元,复合年增长率为 12.3%。生物标记包括血液、组织和体液中的蛋白质、基因和其他分子,在识别生物过程和疾病状况方面发挥着至关重要的作用。它们在早期疾病检测、监测治疗反应和开发个人化疗法方面的应用继续推动市场成长。个人化医疗的进步正在改变生物标记的检测和治疗方法,液体活检等创新技术可以实现非侵入性识别和即时监测治疗反应。这些进步扩大了生物标记的临床应用,使其成为改善患者预后和加速药物发现的不可或缺的工具。

耗材部分包括试剂、检测试剂盒和微孔板,2024 年创收 378 亿美元,预计预测期内复合年增长率为 12.1%。在严格的品质控制标准下生产的耗材可确保生物标记研究(特别是在临床诊断和药物发现)的结果一致且可重复。它们与质谱、次世代定序 (NGS) 和液相层析等先进平台的兼容性提高了生物标记发现和分析的准确性和效率,从而推动了该领域的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 776亿美元 |

| 预测值 | 2448亿美元 |

| 复合年增长率 | 12.3% |

安全生物标记领域在 2024 年占据了 25.2% 的市场份额,预计到 2034 年将达到 632 亿美元。安全生物标记在早期检测药物或治疗的潜在副作用、预防严重併发症以及最大限度地降低与后期临床试验失败相关的成本方面发挥关键作用。这些生物标记有助于识别多个器官系统的毒性,从而可以持续监测器官功能并提高药物开发的整体安全性。

诊断领域在 2024 年占据了 40.5% 的市场份额,这得益于生物标记在早期识别疾病并透过及时干预改善预后的能力。非侵入性和微创生物标记检测方法,包括血液、尿液和唾液测试,可提高患者的依从性,同时减少与传统诊断方法相关的不适。下一代定序 (NGS) 和质谱等诊断技术的创新进一步提高了生物标记检测的敏感度和准确性,扩大了其临床实用性并促进了市场成长。

癌症领域仍是生物标记的主要应用领域,到 2024 年其市占率将达到 38.5%。生物标记能够早期发现各种癌症,提高成功治疗的可能性,并区分良性和恶性肿瘤。它们还促进治疗后监测,以识别潜在的癌症復发,确保及时介入并有助于改善患者的治疗效果。

医院在 2024 年占据了 38.4% 的市场份额,由于其能够管理大量慢性病患者并为先进的诊断程序提供高技能人员,因此继续引领生物标记市场。对液体活检和伴随诊断等非侵入性生物标记测试的需求不断增长,进一步加强了医院在生物标记领域的作用。

2024 年,北美的生物标记市场规模为 314 亿美元,预计到 2034 年将达到 975 亿美元,其中美国将以 286 亿美元的规模位居榜首。心血管疾病、神经系统疾病和癌症等慢性疾病的发生率不断上升,推动了美国生物标记市场的成长。这些疾病负担的加重促使製药公司、医院和研究机构投资开发先进的诊断解决方案和创新疗法,从而确保了生物标记市场的持续扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率上升

- 基因组学和蛋白质组学技术的进展

- 个人化医疗需求不断成长

- 增加研发活动

- 产业陷阱与挑战

- 生物标誌物开发和测试成本高昂

- 缺乏标准化

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品和服务,2021 年至 2034 年

- 主要趋势

- 耗材

- 软体

- 服务

第六章:市场估计与预测:依生物标记类型,2021 年至 2034 年

- 主要趋势

- 安全生物标记

- 疗效生物标记

- 预测性生物标记

- 替代生物标记

- 药效学生物标誌物

- 预后生物标记

- 验证生物标记

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 诊断

- 药物发现与开发

- 个人化医疗

- 疾病风险评估

- 其他应用

第八章:市场估计与预测:依疾病类型,2021 年至 2034 年

- 主要趋势

- 癌症

- 心血管疾病

- 神经系统疾病

- 免疫疾病

- 其他疾病类型

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 学术和研究机构

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott Laboratories

- Agilent Technologies

- Bio-Rad Laboratories

- Becton, Dickinson and Company

- Eurofins Scientific

- Epigenomics

- F. Hoffmann-La Roche

- GE Healthcare

- Illumina

- Johnson & Johnson

- Merck KGaA

- PerkinElmer

- QIAGEN

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Biomarkers Market was valued at USD 77.6 billion in 2024 and is projected to grow from USD 85.9 billion in 2025 to USD 244.8 billion by 2034 at a CAGR of 12.3%. Biomarkers, which include proteins, genes, and other molecules found in blood, tissues, and body fluids, play a crucial role in identifying biological processes and disease conditions. Their use in early disease detection, monitoring treatment response, and developing personalized therapies continues to drive market growth. Advances in personalized medicine are transforming biomarker detection and treatment approaches, with innovations such as liquid biopsies enabling non-invasive identification and real-time monitoring of treatment responses. These advancements have expanded the clinical applications of biomarkers, making them indispensable tools in improving patient outcomes and accelerating drug discovery.

The consumables segment, which includes reagents, assay kits, and microplates, generated USD 37.8 billion in 2024 and is projected to grow at a CAGR of 12.1% during the forecast period. Consumables manufactured under stringent quality control standards ensure consistent and reproducible results across biomarker studies, particularly in clinical diagnostics and drug discovery. Their compatibility with advanced platforms such as mass spectrometry, next-generation sequencing (NGS), and liquid chromatography enhances the accuracy and efficiency of biomarker discovery and analysis, driving demand in this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.6 Billion |

| Forecast Value | $244.8 Billion |

| CAGR | 12.3% |

The safety biomarkers segment captured a 25.2% market share in 2024 and is expected to reach USD 63.2 billion by 2034. Safety biomarkers play a critical role in detecting potential adverse effects of drugs or treatments at an early stage, preventing severe complications, and minimizing costs associated with late-stage clinical trial failures. These biomarkers facilitate the identification of toxicity across multiple organ systems, allowing continuous monitoring of organ function and improving overall safety in drug development.

The diagnostics segment held a 40.5% market share in 2024, driven by the ability of biomarkers to identify diseases at an early stage and improve prognosis through timely intervention. Non-invasive and minimally invasive biomarker detection methods, including blood, urine, and saliva tests, enhance patient compliance while reducing discomfort associated with traditional diagnostic methods. Innovations in diagnostic technologies, such as NGS and mass spectrometry, further improve the sensitivity and accuracy of biomarker detection, expanding their clinical utility and boosting market growth.

The cancer segment, with a 38.5% market share in 2024, remains a dominant application of biomarkers. Biomarkers enable the early detection of various cancers, improving the likelihood of successful treatment and distinguishing between benign and malignant tumors. They also facilitate post-treatment surveillance to identify potential cancer recurrence, ensuring timely intervention and contributing to better patient outcomes.

Hospitals, which accounted for a 38.4% market share in 2024, continue to lead the biomarkers market due to their ability to manage a large volume of chronic disease patients and provide highly skilled personnel for advanced diagnostic procedures. The growing demand for non-invasive biomarker tests, such as liquid biopsy and companion diagnostics, has further strengthened the role of hospitals in the biomarker landscape.

North America generated USD 31.4 billion in 2024 and is expected to reach USD 97.5 billion by 2034, with the U.S. dominating the region at USD 28.6 billion in 2024. The rising prevalence of chronic diseases, including cardiovascular diseases, neurological disorders, and cancer, drives market growth in the U.S. The increasing burden of these diseases has prompted pharmaceutical companies, hospitals, and research institutions to invest in the development of advanced diagnostic solutions and innovative therapies, ensuring the continued expansion of the biomarkers market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Advancements in genomic and proteomic technologies

- 3.2.1.3 Rising demand for personalized medicine

- 3.2.1.4 Increasing research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of biomarker development and testing

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product and Services, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Biomarker Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Safety biomarkers

- 6.3 Efficacy biomarkers

- 6.4 Predictive biomarkers

- 6.5 Surrogate biomarkers

- 6.6 Pharmacodynamic biomarkers

- 6.7 Prognostics biomarkers

- 6.8 Validation biomarkers

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Drug discovery and development

- 7.4 Personalized medicine

- 7.5 Disease risk assessment

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cancer

- 8.3 Cardiovascular diseases

- 8.4 Neurological diseases

- 8.5 Immunological diseases

- 8.6 Other diseases types

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Academic and research institutions

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 Agilent Technologies

- 11.3 Bio-Rad Laboratories

- 11.4 Becton, Dickinson and Company

- 11.5 Eurofins Scientific

- 11.6 Epigenomics

- 11.7 F. Hoffmann-La Roche

- 11.8 GE Healthcare

- 11.9 Illumina

- 11.10 Johnson & Johnson

- 11.11 Merck KGaA

- 11.12 PerkinElmer

- 11.13 QIAGEN

- 11.14 Siemens Healthineers

- 11.15 Thermo Fisher Scientific