|

市场调查报告书

商品编码

1708208

肱骨外上髁炎治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Lateral Epicondylitis Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

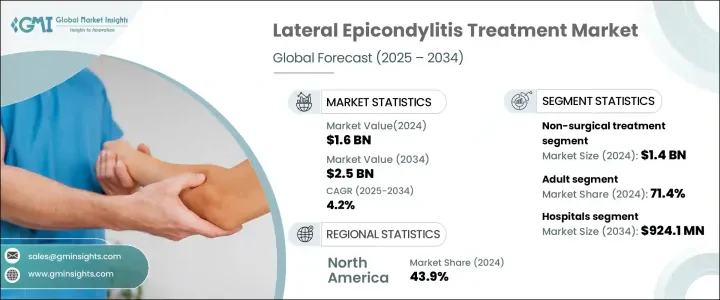

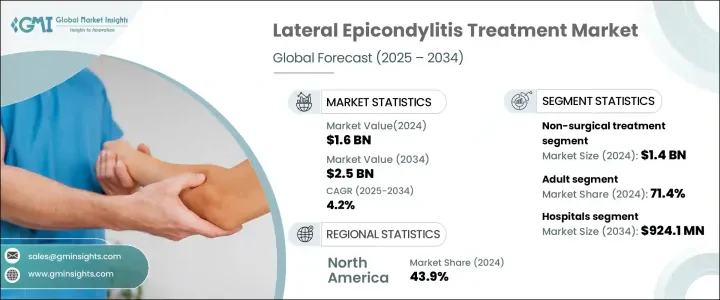

2024 年全球外上髁炎治疗市场价值为 16 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.2%。外上髁炎(俗称网球肘)盛行率的不断上升主要是由于人们参与运动和其他体育活动的增加。随着越来越多人参与高强度运动和重复性动作练习,罹患这种疾病的可能性也随之上升。此外,人们对早期诊断和治疗方案的认识不断提高,导致对手术和非手术介入的需求也越来越高。市场也见证了治疗方式的重大创新,包括生物疗法和微创手术,为治疗病情提供了更安全、更有效的解决方案。随着医疗保健提供者优先考虑以患者为中心的方法并强调预防保健的重要性,对物理治疗和皮质类固醇注射等非侵入性疗法的需求激增,促进了整体市场的成长。

推动市场扩张的另一个主要因素是老年人口的增加,老年人更容易罹患外上髁炎等肌肉骨骼疾病。尤其是已开发经济体的老龄人口越来越多地选择非手术治疗,因为与手术相比,非手术治疗恢復时间更快、风险更低。富血小板血浆 (PRP) 和干细胞治疗等创新疗法正在获得关注,并在疼痛管理和组织再生方面显示出良好的效果。这些进步不仅为传统手术提供了有效的替代方案,而且也符合患者对微创手术日益增长的偏好,进一步推动了市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 4.2% |

外上髁炎治疗市场大致分为非手术和手术治疗两类,其中非手术治疗占主导地位。 2024年,非手术治疗领域创造了14亿美元的收入。非手术疗法,包括物理疗法、药物疗法、支架疗法和衝击波疗法,已被证明在控制疼痛和加速康復方面具有很高的疗效。由于这些治疗方法安全、停机时间短且经济高效,患者越来越喜欢它们。随着越来越多的人寻求保守方法来治疗外上髁炎,对非手术治疗的需求预计将继续上升。

按年龄组分析市场时,成年人占据主导地位,占 2024 年 71.4% 的市占率。成年人由于日常工作或娱乐活动中涉及重复的动作,更容易患上外上髁炎。体育比赛和健身趋势的不断增长进一步增加了这种疾病的盛行率,推动了对有效治疗方案的需求。此外,对疼痛管理解决方案的需求推动了非手术方法的不断进步,确保患者能够获得安全可靠的治疗选择。

2024 年,美国外上髁炎治疗市场创收 6.56 亿美元,巩固了在全球市场中的重要地位。体育运动和体力劳动等体力活动的频繁发生,导致该国外上髁炎病例数量增加。美国市场高度重视提供有效的疼痛管理解决方案,包括皮质类固醇注射和局部治疗,因此持续蓬勃发展。生物治疗和再生医学领域的持续研发努力进一步巩固了中国在全球外上髁炎治疗领域的主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 外上髁炎和运动相关伤害的发生率不断上升

- 微创手术日益受到青睐

- 治疗方式的进步

- 产业陷阱与挑战

- 治疗费用高

- 替代疗法的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依治疗类型,2021 年至 2034 年

- 主要趋势

- 非手术治疗

- 药物

- 物理治疗

- 矫正器和支架

- 其他非手术治疗

- 手术治疗

- 关节镜手术

- 开放性手术

- 其他外科治疗

第六章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 儿科

- 成人

- 老年

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 骨科诊所

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 3M Company

- BTL

- DJO Global (Enovis)

- Folsom Orthopaedics & Sports Medicine

- GlaxoSmithKline

- MedStar Health

- Merck & Co

- Novartis

- Ossur Corporate

- Pfizer

- Pharmascience

- ReLiva Physiotherapy & Rehab

- Scandinavian Physiotherapy Center

- Zimmer Biomet

The Global Lateral Epicondylitis Treatment Market was valued at USD 1.6 billion in 2024 and is projected to grow at a CAGR of 4.2% between 2025 and 2034. The growing prevalence of lateral epicondylitis, commonly known as tennis elbow, is primarily driven by increasing participation in sports and other physical activities. As more individuals engage in high-impact sports and repetitive motion exercises, the likelihood of developing this condition continues to rise. Additionally, heightened awareness about early diagnosis and treatment options has led to a higher demand for both surgical and non-surgical interventions. The market has also witnessed significant innovation in treatment modalities, including biological therapies and minimally invasive procedures, which offer safer and more effective solutions for managing the condition. As healthcare providers prioritize patient-centric approaches and emphasize the importance of preventive care, the demand for non-invasive therapies, such as physical therapy and corticosteroid injections, has surged, contributing to the overall market growth.

Another major factor propelling market expansion is the rising geriatric population, which is more susceptible to musculoskeletal conditions, such as lateral epicondylitis. The aging demographic, particularly in developed economies, is increasingly opting for non-surgical treatments that offer faster recovery times and lower risks compared to surgical procedures. Innovative therapies such as platelet-rich plasma (PRP) and stem cell treatments are gaining traction, offering promising outcomes in pain management and tissue regeneration. These advancements not only provide effective alternatives to traditional surgery but also align with the growing patient preference for minimally invasive options, further driving market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4.2% |

The lateral epicondylitis treatment market is broadly segmented into non-surgical and surgical treatment categories, with non-surgical options leading the way. In 2024, the non-surgical treatment segment generated USD 1.4 billion in revenue. Non-surgical therapies, including physical therapy, medications, braces, and shockwave therapy, have demonstrated high efficacy in managing pain and accelerating recovery. Patients increasingly prefer these treatments due to their safety, reduced downtime, and cost-effectiveness. As more individuals seek conservative approaches to manage lateral epicondylitis, the demand for non-surgical therapies is expected to continue its upward trajectory.

When analyzing the market by age group, adults dominated the landscape, accounting for 71.4% of the market share in 2024. Adults are more prone to developing lateral epicondylitis due to repetitive movements involved in their daily work or recreational activities. The growing number of sports competitions and fitness trends has further increased the prevalence of this condition, driving the need for effective treatment options. Furthermore, the demand for pain management solutions has led to continuous advancements in non-surgical methods, ensuring that patients have access to safe and reliable treatment options.

The U.S. lateral epicondylitis treatment market generated USD 656 million in 2024, securing its position as a key player in the global landscape. The high incidence of physical activity, including sports and manual labor, has led to an increased number of lateral epicondylitis cases in the country. With a strong emphasis on providing effective pain management solutions, including corticosteroid injections and topical treatments, the U.S. market continues to thrive. Ongoing research and development efforts in biological therapies and regenerative medicine have further strengthened the country's dominance in the global lateral epicondylitis treatment sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of lateral epicondylitis and sports-related injuries

- 3.2.1.2 Growing preference for minimally invasive procedures

- 3.2.1.3 Advancement in treatment modalities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Availability of alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Non-surgical treatment

- 5.2.1 Medications

- 5.2.2 Physical therapy

- 5.2.3 Orthotics and braces

- 5.2.4 Other non-surgical treatments

- 5.3 Surgical treatment

- 5.3.1 Arthroscopic surgery

- 5.3.2 Open surgery

- 5.3.3 Other surgical treatments

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

- 6.4 Geriatric

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Orthopedic clinics

- 7.5 Homecare settings

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 BTL

- 9.3 DJO Global (Enovis)

- 9.4 Folsom Orthopaedics & Sports Medicine

- 9.5 GlaxoSmithKline

- 9.6 MedStar Health

- 9.7 Merck & Co

- 9.8 Novartis

- 9.9 Ossur Corporate

- 9.10 Pfizer

- 9.11 Pharmascience

- 9.12 ReLiva Physiotherapy & Rehab

- 9.13 Scandinavian Physiotherapy Center

- 9.14 Zimmer Biomet