|

市场调查报告书

商品编码

1708210

单份包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Single-Serve Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

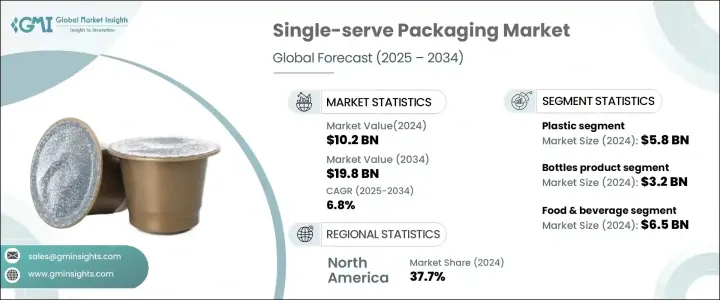

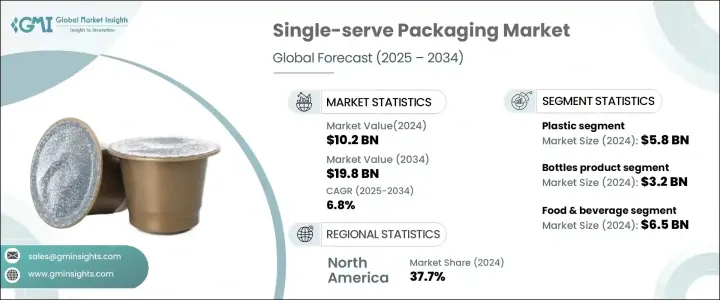

2024 年全球单份包装市场价值为 102 亿美元,预估 2025-2034 年期间复合年增长率为 6.8%。这一令人印象深刻的成长主要得益于消费者对份量控制、健康消费的偏好日益增长,以及方便食品和饮料选择的激增。随着人们越来越注重健康管理,份量控制变得越来越重要,推动了对方便且减少食物浪费的单份包装的需求。繁忙的城市生活、更长的工作时间以及时间限制加剧了对易于携带、即食(RTE)或即饮(RTD)产品的需求。单份包装形式因其便利性、便携性和高效的份量管理而受到青睐。

市场也受益于包装解决方案的技术进步,这些技术提高了产品安全性、延长了保质期并增强了美感。此外,环保意识的增强促进了环保和永续包装材料的发展,从而促进了市场成长。随着电子商务平台的持续蓬勃发展,对确保产品在运输过程中新鲜度的轻质耐用包装解决方案的需求正在稳步上升。事实证明,单份包装形式能够有效满足追求便利性和永续性的消费者不断变化的偏好。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 102亿美元 |

| 预测值 | 198亿美元 |

| 复合年增长率 | 6.8% |

市场按材料类型细分,主要类别为塑胶、纸张、金属和玻璃。塑料因其重量轻、耐用、灵活等特性,便于运输和安全存储,成为主导市场,到 2024 年价值将达到 58 亿美元。塑胶包装可以有效保护产品免受湿气、空气和光等外部因素的影响,从而延长保质期。此外,对永续性的日益重视和对环保解决方案的日益偏好迫使製造商推出符合监管标准和环境期望的可回收和生物基塑胶替代品。这些创新不仅迎合了消费者的偏好,而且还解决了人们对塑胶垃圾及其对环境的影响日益增长的担忧。

单份包装广泛应用于多种应用,包括食品和饮料、药品和个人护理。食品和饮料产业预计在 2024 年创造 65 亿美元的产值,受 RTE 和 RTD 产品的普及推动,该产业实现了大幅成长。消费者对零食包、功能性饮料和餐点套装的偏好推动了对份量控制和易于携带的包装解决方案的需求。网上购物和食品配送服务的激增进一步加强了对轻量、耐用和安全包装的需求,以保持产品在运输过程中的新鲜度。製造商越来越注重包装创新,以提高产品安全性,同时满足不断变化的消费者偏好和永续发展目标。

2024 年,北美单份包装市场占全球份额的 37.7%。该地区越来越倾向于注重健康和控制份量的消费,以及随时随地生活方式的采用,推动了对创新包装解决方案的需求。此外,监管部门对环保包装的支持以及对永续替代品的推动也促进了可回收和创新的一次性包装形式的采用。随着永续性成为焦点,生物基和可生物降解包装解决方案的整合预计将进一步加速市场的成长轨迹。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 旅行、旅游和酒店业的需求不断增长

- 控制份量和注重健康的消费需求不断增长

- 消费者生活方式与都市化进程的演变

- 即食(RTE)和即饮(RTD)产品的扩展

- 电子商务和直接面向消费者的管道的成长

- 产业陷阱与挑战

- 原物料价格波动

- 供应链中断

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 塑胶

- 纸

- 金属

- 玻璃

第六章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 小袋和小袋

- 杯子和浴缸

- 瓶子

- 泡罩包装

- 托盘

- 其他的

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 个人护理和化妆品

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Amcor plc

- Amber Packaging

- American FlexPack

- CarePac

- Constantia Flexibles

- CP Italy Srl

- Duropack Limited

- Glenroy, Inc.

- Huhtamaki

- IMA Group

- Mondi

- Polysack Flexible Packaging Ltd.

- ProAmpac

- Rain Nutrience

- RATTPACK

- RCP Ranstadt GmbH

- TIPA LTD

- Transcontinental Inc.

- Winpak LTD.

The Global Single-Serve Packaging Market was valued at USD 10.2 billion in 2024 and is projected to grow at a CAGR of 6.8% during 2025-2034. This impressive growth is primarily fueled by rising consumer preferences for portion-controlled, health-conscious consumption and the proliferation of convenient food and beverage options. As individuals become more focused on managing their health, portion control has gained prominence, driving demand for single-serve packaging that offers convenience and reduced food wastage. Busy urban lifestyles, longer working hours, and time constraints have intensified the need for easy-to-carry and ready-to-eat (RTE) or ready-to-drink (RTD) products. Single-serve packaging formats have gained traction as they provide convenience, portability, and efficient portion management.

The market is also benefiting from technological advancements in packaging solutions that improve product safety, extend shelf life, and enhance aesthetic appeal. Additionally, increased environmental consciousness has prompted the development of eco-friendly and sustainable packaging materials, boosting market growth. As e-commerce platforms continue to thrive, the demand for lightweight and durable packaging solutions that ensure product freshness during transportation is steadily rising. Single-serve packaging formats have proven to be effective in catering to the evolving preferences of consumers who seek both convenience and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 6.8% |

The market is segmented by material type, with plastic, paper, metal, and glass being the primary categories. Plastic emerged as the dominant segment, valued at USD 5.8 billion in 2024, due to its lightweight, durable, and flexible characteristics that facilitate easy transportation and secure storage. Plastic packaging effectively shields products from external elements such as moisture, air, and light, thereby extending shelf life. Moreover, the growing emphasis on sustainability and the increasing preference for environmentally friendly solutions have compelled manufacturers to introduce recyclable and bio-based plastic alternatives that align with regulatory standards and environmental expectations. These innovations not only cater to consumer preferences but also address the rising concerns surrounding plastic waste and its impact on the environment.

Single-serve packaging is extensively utilized across multiple applications, including food and beverage, pharmaceuticals, and personal care. The food and beverage segment, generating USD 6.5 billion in 2024, witnessed substantial growth driven by the popularity of RTE and RTD products. Consumers' preference for snack packs, functional beverages, and meal kits has fueled demand for portion-controlled and easily portable packaging solutions. The surge in online grocery shopping and food delivery services further reinforces the need for lightweight, durable, and secure packaging that maintains product freshness during transit. Manufacturers are increasingly focusing on packaging innovations that enhance product safety while aligning with changing consumer preferences and sustainability goals.

North America single-serve packaging market accounted for 37.7% of the global share in 2024. The region's growing inclination toward health-conscious and portion-controlled consumption, along with the adoption of on-the-go lifestyles, has driven demand for innovative packaging solutions. Additionally, regulatory support for eco-friendly packaging and the push for sustainable alternatives have encouraged the adoption of recyclable and innovative single-serve packaging formats. As sustainability takes center stage, the integration of bio-based and biodegradable packaging solutions is expected to further accelerate the market's growth trajectory.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand in the travel, tourism, and hospitality sectors

- 3.2.1.2 Rising demand for portion control and health-conscious consumption

- 3.2.1.3 Evolving consumer lifestyles and urbanization

- 3.2.1.4 Expansion of the ready-to-eat (RTE) and ready-to-drink (RTD) segments

- 3.2.1.5 Growth of e-commerce and direct-to-consumer channels

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuation in raw materials price

- 3.2.2.2 Supply chain disruption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper

- 5.4 Metal

- 5.5 Glass

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Pouches & sachets

- 6.3 Cups & tubs

- 6.4 Bottles

- 6.5 Blister packs

- 6.6 Trays

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Amber Packaging

- 9.3 American FlexPack

- 9.4 CarePac

- 9.5 Constantia Flexibles

- 9.6 CP Italy S.r.l.

- 9.7 Duropack Limited

- 9.8 Glenroy, Inc.

- 9.9 Huhtamaki

- 9.10 IMA Group

- 9.11 Mondi

- 9.12 Polysack Flexible Packaging Ltd.

- 9.13 ProAmpac

- 9.14 Rain Nutrience

- 9.15 RATTPACK

- 9.16 RCP Ranstadt GmbH

- 9.17 TIPA LTD

- 9.18 Transcontinental Inc.

- 9.19 Winpak LTD.