|

市场调查报告书

商品编码

1708215

多核苷酸注射剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Polynucleotides Injectables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

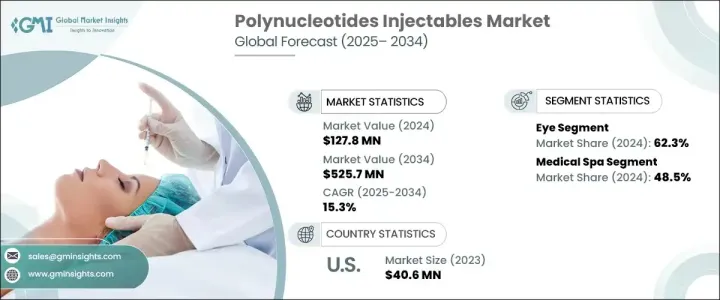

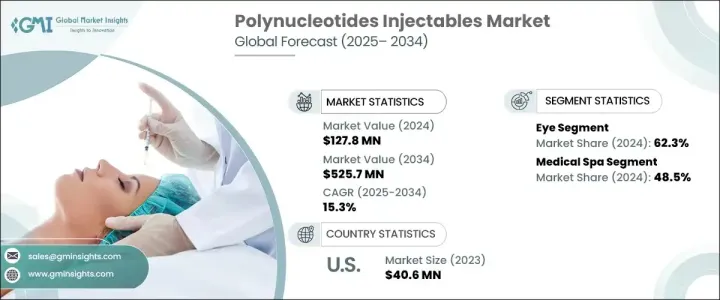

2024 年全球多核苷酸注射剂市场价值为 1.278 亿美元,预计将经历强劲成长,2025 年至 2034 年期间的复合年增长率为 15.3%。这些注射治疗含有纯化的 DNA 片段,主要用于再生医学和美容应用。它们具有促进组织再生、减少发炎和增强保湿的能力,因此在改善皮肤弹性、促进组织修復和支持关节健康方面备受追捧。由于消费者对非侵入性手术及其已证实的益处的兴趣日益浓厚,推动了对这些先进治疗方法的需求,市场也因此而受到青睐。政府政策和监管部门的批准也在推动市场成长方面发挥关键作用,为在临床和美容环境中采用多核苷酸注射剂创造了良好的环境。

在各种应用中,眼部治疗已成为市场的主要部分。到 2024 年,该部分将占市场收入的 62.3%,预计其成长仍将持续。注射剂透过刺激胶原蛋白的产生和增强皮肤弹性,可以有效解决眼窝凹陷、皱纹和黑眼圈等美容问题。这些非侵入性治疗方法的流行使其成为希望恢復眼部敏感皮肤活力的个人的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.278亿美元 |

| 预测值 | 5.257亿美元 |

| 复合年增长率 | 15.3% |

医疗水疗中心已成为市场的主要推动力,为市场扩张做出了重大贡献。这些水疗中心占据了总市场份额的 48.5%,2024 年创造了 6,200 万美元的收入。随着非手术美容疗程越来越受欢迎,消费者越来越多地选择医疗水疗中心,因为它们方便、实惠,并且能够提供个人化的解决方案。对最短恢復时间和自然效果的偏好进一步刺激了这些机构对多核苷酸注射剂的需求。

从地理上看,北美预计将引领市场成长,预计 2024 年营收将达到 5,300 万美元。美国预计将占据主导地位,2023 年贡献 4,060 万美元,这得益于高可支配收入和高端自我照护治疗日益增长的趋势。随着该地区的消费者越来越重视非侵入性手术和美容健康,对多核苷酸注射剂的需求将会上升,进一步推动市场扩张。

随着这些注射剂在医疗和美容用途中的应用越来越广泛,预计其市场将在各个地区继续稳步增长,特别是在医疗水疗和眼部治疗应用领域。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 对美学和再生解决方案的需求不断增加

- 多核苷酸注射技术的进展

- 消费者对美容皮肤护理的认识不断提高

- 有利的监管批准

- 产业陷阱与挑战

- 副作用和安全问题

- 成本高且可近性有限

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 眼睛

- 嘴唇

- 前额

- 下颚线和颧骨

- 其他应用

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医疗水疗中心

- 美容及整容中心

- 医院

第七章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- AMEELA

- BR Pharm

- Croma Pharma

- DermaFocus

- Fox Pharma

- Genoss

- Lkc Pharma

- Mastelli

- Pluryal

- Promoitalia Laboratories

The Global Polynucleotides Injectables Market, valued at USD 127.8 million in 2024, is projected to experience robust growth, expanding at a CAGR of 15.3% between 2025 and 2034. These injectable treatments, which contain purified DNA fragments, are primarily used in regenerative medicine and aesthetic applications. Their ability to promote tissue regeneration, reduce inflammation, and enhance hydration makes them highly sought after for improving skin elasticity, encouraging tissue repair, and supporting joint health. The market is gaining traction due to increasing consumer interest in non-invasive procedures and their proven benefits, driving demand for these advanced treatments. Government policies and regulatory approvals also play a critical role in propelling market growth, creating a favorable environment for the adoption of polynucleotide injectables in both clinical and aesthetic settings.

Among the various applications, eye treatment has emerged as the dominant segment in the market. By 2024, this segment accounted for 62.3% of market revenue, and its growth is expected to continue. The injectables are highly effective in addressing cosmetic concerns such as under-eye hollows, wrinkles, and dark circles by stimulating collagen production and enhancing skin elasticity. The popularity of these treatments in non-invasive procedures has positioned them as a preferred option for individuals looking to rejuvenate the sensitive skin around the eyes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $127.8 Million |

| Forecast Value | $525.7 Million |

| CAGR | 15.3% |

Medical spas have become a major driving force in the market, contributing significantly to its expansion. These spas accounted for 48.5% of the total market share, generating USD 62 million in 2024. As non-surgical aesthetic treatments gain popularity, consumers increasingly choose medical spas for their convenience, affordability, and ability to provide personalized solutions. The preference for minimal recovery time and natural-looking results further boosts the demand for polynucleotide injectables in these establishments.

Geographically, North America is expected to lead the market growth, with revenues projected to reach USD 53 million in 2024. The U.S. is expected to dominate, contributing USD 40.6 million in 2023, driven by a high disposable income and a growing trend toward premium self-care treatments. As consumers in the region increasingly prioritize non-invasive procedures and aesthetic wellness, the demand for polynucleotide injectables is set to rise, further fueling market expansion.

As these injectables become more widely used for both medical and cosmetic purposes, their market is anticipated to continue growing steadily across various regions, particularly in medical spas and eye treatment applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for aesthetic and regenerative solutions

- 3.2.1.2 Advancements in polynucleotide injectable technologies

- 3.2.1.3 Growing consumer awareness about aesthetic skin treatments

- 3.2.1.4 Favorable regulatory approvals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and safety concerns

- 3.2.2.2 High costs and limited accessibility

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Eyes

- 5.3 Lips

- 5.4 Forehead

- 5.5 Jawline and cheekbones

- 5.6 Other applications

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Medical spas

- 6.3 Aesthetic and cosmetic centers

- 6.4 Hospitals

Chapter 7 Market Estimates and Forecast, By Region, 2021- 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AMEELA

- 8.2 BR Pharm

- 8.3 Croma Pharma

- 8.4 DermaFocus

- 8.5 Fox Pharma

- 8.6 Genoss

- 8.7 Lkc Pharma

- 8.8 Mastelli

- 8.9 Pluryal

- 8.10 Promoitalia Laboratories