|

市场调查报告书

商品编码

1708222

高阻隔包装薄膜市场机会、成长动力、产业趋势分析及2025-2034年预测High Barrier Packaging Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

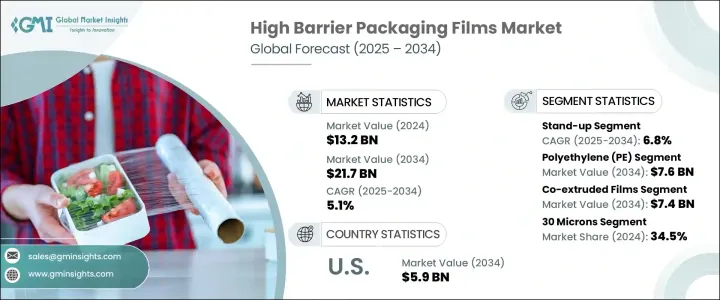

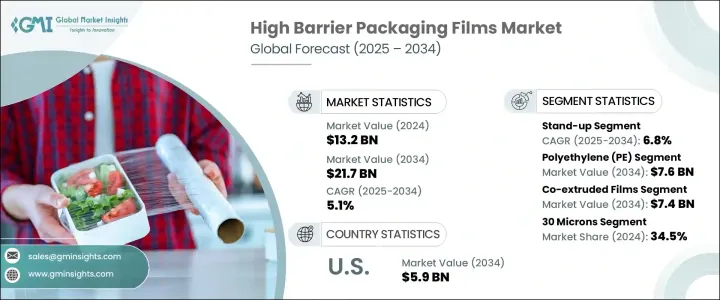

2024 年全球高阻隔包装薄膜市场规模达 132 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%,这得益于製药行业的快速增长、电子商务的扩张以及在线食品配送服务日益普及。随着製药公司不断创新和扩张,对保护敏感产品的先进包装解决方案的需求变得更加迫切。高阻隔包装膜可确保最佳地防止湿气、氧气和其他污染物,同时延长药品的保质期。此外,电子商务行业的蓬勃发展和线上食品配送服务的激增进一步刺激了对在运输和储存过程中保持产品完整性的高性能包装的需求。消费者对安全、卫生和永续包装的期望不断提高也促进了市场的成长。此外,不断增强的环保意识正在推动製造商投资可回收、可生物降解和高阻隔材料,以符合循环经济目标。

市场涵盖各种包装形式,包括自立袋、平袋、袋子和麻袋、泡罩和蛤壳、包装和盖膜、小袋和条形包装。其中,自立袋预计将经历最高成长,到 2034 年的复合年增长率为 6.8%。这种成长主要归因于消费者对轻量、高阻隔软包装的偏好日益增长,尤其是对于零食和即食食品而言。製造商越来越多地采用高品质的可回收材料并整合先进的可重新密封功能,以满足消费者对便利性和永续性的需求。随着对塑胶废物的环境担忧日益加剧,产业参与者正在开发减少环境影响同时保持产品安全和新鲜度的包装解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 132亿美元 |

| 预测值 | 217亿美元 |

| 复合年增长率 | 5.1% |

就材料种类而言,高阻隔包装薄膜市场分为聚乙烯(PE)、聚丙烯(PP)、聚对苯二甲酸乙二醇酯(PET)、聚偏氯乙烯(PVDC)、乙烯乙烯醇(EVOH)、聚酰胺(尼龙)等。聚乙烯 (PE) 预计将占据该领域的主导地位,到 2034 年将达到 76 亿美元。随着公司强调永续实践以满足监管要求和客户期望,可回收和生物基 PE 材料正在发生显着转变。製造商正在开发创新的单一材料 PE 薄膜,这种薄膜具有卓越的氧气和防潮性能,在确保产品保护的同时促进永续性。 PE 材料的这些进步正在推动这一领域的成长,并满足对环保包装日益增长的需求。

受方便食品和即食食品需求不断增长的推动,北美高阻隔包装薄膜市场在 2024 年占据 38.4% 的份额。随着消费者偏好转向保质期更长、更新鲜的包装食品,对高阻隔包装解决方案的需求持续成长。该地区预包装冷冻食品、零食和食品托盘的消费量显着增长,这进一步推动了高阻隔包装薄膜的采用。此外,该地区对创新的高度重视,加上对永续和环保包装解决方案日益增长的需求,预计将保持北美在市场上的主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 电子商务和线上食品配送的成长

- 製药业扩张

- 真空和气调包装(MAP)的需求不断增长

- 乳製品和肉类包装产业的扩张

- 快速的城市化和不断变化的生活方式推动包装商品

- 产业陷阱与挑战

- 先进阻隔膜生产成本高

- 石化产品价格波动影响原物料供应

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚对苯二甲酸乙二酯(PET)

- 聚偏二氯乙烯(PVDC)

- 乙烯乙烯醇 (EVOH)

- 聚酰胺(尼龙)

- 其他的

第六章:市场估计与预测:依包装形式,2021 - 2034 年

- 主要趋势

- 自立袋

- 扁平袋

- 袋子和麻袋

- 水泡和蛤壳

- 包装膜和盖膜

- 小袋装和条状包装

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 共挤薄膜

- 金属化薄膜

- 溅镀薄膜

- 原子层沉积(ALD)薄膜

- 层压薄膜

第八章:市场预估与预测:依薄膜厚度,2021 - 2034 年

- 主要趋势

- 高达 30 微米

- 30-50微米

- 50-70微米

- 70微米以上

第九章:市场估计与预测:依应用类型,2021 - 2034

- 主要趋势

- 新鲜食品包装

- 加工食品包装

- 饮料包装

- 保健产品

- 个人护理和化妆品

- 工业部件

- 农产品

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药和医疗

- 电子和半导体

- 工业的

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十二章:公司简介

- 3M

- ACG

- Amcor

- Bemis Manufacturing

- Berry Global

- Celplast Metallized Products

- Cosmo Films

- Innovia Films

- Jindal Poly Films

- Klockner Pentaplast

- Mitsubishi Chemical Advanced Materials

- Mondi

- Oike

- Perlen Packaging

- Sealed Air

- Sigma Plastics Group

- Sonoco Products

- Toppan

- Toray Plastics

- Uflex

- Winpak

The Global High Barrier Packaging Films Market generated USD 13.2 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2034, driven by the rapid growth of the pharmaceutical sector, the expansion of e-commerce, and the increasing popularity of online food delivery services. As pharmaceutical companies continue to innovate and expand, the need for advanced packaging solutions that protect sensitive products becomes more critical. High barrier packaging films ensure optimal protection against moisture, oxygen, and other contaminants while extending the shelf life of pharmaceuticals. Moreover, the booming e-commerce industry and the surge in online food delivery services have further fueled the demand for high-performance packaging that maintains product integrity during shipping and storage. Rising consumer expectations for secure, hygienic, and sustainable packaging have also contributed to market growth. Additionally, increasing environmental awareness is driving manufacturers to invest in recyclable, biodegradable, and high-barrier materials to align with circular economy goals.

The market encompasses a variety of packaging formats, including stand-up pouches, flat pouches, bags and sacks, blisters and clamshells, wraps and lidding films, and sachets and stick packs. Among these, stand-up pouches are projected to experience the highest growth, with a CAGR of 6.8% through 2034. This growth is largely attributed to the rising consumer preference for lightweight, high-barrier flexible packaging, particularly for snacks and ready-to-eat meals. Manufacturers are increasingly adopting high-quality recyclable materials and integrating advanced resealable features to meet consumer demands for convenience and sustainability. As environmental concerns about plastic waste intensify, industry players are developing packaging solutions that reduce environmental impact while maintaining product safety and freshness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 5.1% |

In terms of material type, the high barrier packaging films market is segmented into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinylidene chloride (PVDC), ethylene vinyl alcohol (EVOH), polyamide (nylon), and others. Polyethylene (PE) is expected to dominate the segment, reaching USD 7.6 billion by 2034. A notable shift is underway towards recyclable and bio-based PE materials as companies emphasize sustainable practices to meet regulatory requirements and customer expectations. Manufacturers are developing innovative mono-material PE films that offer superior oxygen and moisture barriers, ensuring product protection while promoting sustainability. These advancements in PE materials are driving the growth of this segment and catering to the rising demand for environmentally responsible packaging.

North America High Barrier Packaging Films Market held a 38.4% share in 2024, propelled by increasing demand for convenience foods and ready-to-eat meals. As consumer preferences shift towards packaged foods that provide extended shelf life and freshness, the demand for high-barrier packaging solutions continues to grow. The region is witnessing a notable rise in the consumption of prepackaged frozen meals, snacks, and food trays, which further boosts the adoption of high barrier packaging films. Additionally, the region's strong emphasis on innovation, combined with the growing need for sustainable and eco-friendly packaging solutions, is expected to maintain North America's dominant position in the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in e-commerce and online food delivery

- 3.2.1.2 Expansion of pharmaceutical industry

- 3.2.1.3 Rising demand for vacuum and modified atmosphere packaging (MAP)

- 3.2.1.4 Expansion of the dairy and meat packaging industry

- 3.2.1.5 Rapid urbanization and changing lifestyles driving packaged goods

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs of advanced barrier films

- 3.2.2.2 Volatility in petrochemical prices affecting raw material supply

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene Terephthalate (PET)

- 5.5 Polyvinylidene Chloride (PVDC)

- 5.6 Ethylene Vinyl Alcohol (EVOH)

- 5.7 Polyamide (Nylon)

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Packaging Format, 2021 - 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Stand-up pouches

- 6.3 Flat pouches

- 6.4 Bags & sacks

- 6.5 Blisters & clamshells

- 6.6 Wraps & lidding films

- 6.7 Sachets & stick packs

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Co-extruded films

- 7.3 Metallized films

- 7.4 Sputtered films

- 7.5 Atomic Layer Deposition (ALD) Films

- 7.6 Laminated films

Chapter 8 Market Estimates & Forecast, By Film Thickness, 2021 - 2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Up to 30 microns

- 8.3 30-50 microns

- 8.4 50-70 microns

- 8.5 Above 70 microns

Chapter 9 Market Estimates & Forecast, By Application Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 Fresh food packaging

- 9.3 Processed food packaging

- 9.4 Beverage packaging

- 9.5 Healthcare products

- 9.6 Personal care & cosmetics

- 9.7 Industrial components

- 9.8 Agricultural products

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion & Kilo Tons)

- 10.1 Key trends

- 10.2 Food & beverages

- 10.3 Pharmaceuticals & medical

- 10.4 Electronics & semiconductor

- 10.5 Industrial

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 3M

- 12.2 ACG

- 12.3 Amcor

- 12.4 Bemis Manufacturing

- 12.5 Berry Global

- 12.6 Celplast Metallized Products

- 12.7 Cosmo Films

- 12.8 Innovia Films

- 12.9 Jindal Poly Films

- 12.10 Klockner Pentaplast

- 12.11 Mitsubishi Chemical Advanced Materials

- 12.12 Mondi

- 12.13 Oike

- 12.14 Perlen Packaging

- 12.15 Sealed Air

- 12.16 Sigma Plastics Group

- 12.17 Sonoco Products

- 12.18 Toppan

- 12.19 Toray Plastics

- 12.20 Uflex

- 12.21 Winpak