|

市场调查报告书

商品编码

1708223

仓库自动化市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Warehouse Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

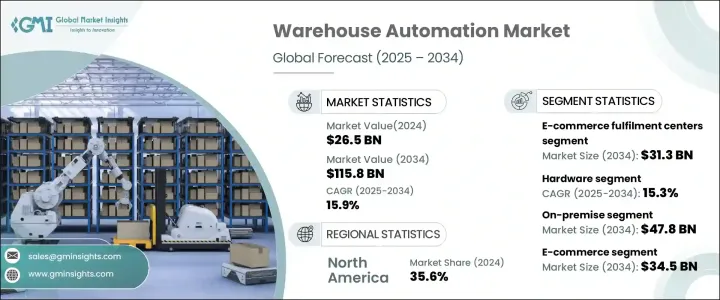

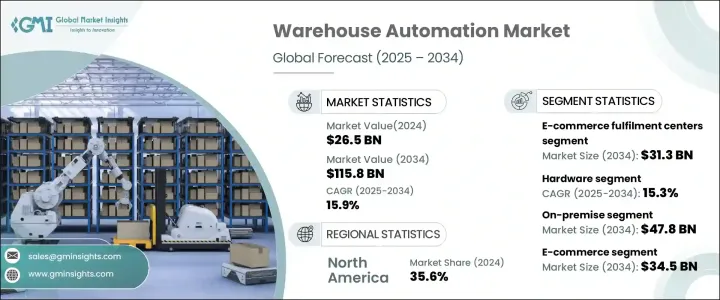

2024 年全球仓库自动化市场价值为 265 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 15.9%,这得益于仓库设施对精简、经济高效的营运的需求不断增长。随着企业努力应对日益严重的劳动力短缺和激增的电子商务需求,许多企业开始转向自动化技术,例如自主移动机器人 (AMR) 和自动储存和检索系统 (AS/RS),以优化日常流程。这些技术不仅提高了营运效率,还降低了劳动力成本并减少了人为错误,从而加快了订单履行速度并改善了库存管理。

随着企业寻求满足对更短交货时间和完美营运日益增长的期望,市场正在见证向自动化的重大转变。此外,基于云端的仓库管理系统 (WMS) 和预测分析的日益普及使组织能够做出数据驱动的决策,从而进一步改善其物流流程。为了满足当日或隔天送达的激增需求,城市地区的微型配送中心日益重要,这也促进了仓库自动化市场的加速成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 265亿美元 |

| 预测值 | 1158亿美元 |

| 复合年增长率 | 15.9% |

机器人技术和人工智慧 (AI) 的进步正在透过提高订单履行速度和操作精度来改变仓库运作。该公司正在大力投资人工智慧解决方案,以更有效地管理库存、提高拣选和分类准确性并减少营运错误。人工智慧和感测器系统与仓库自动化的整合正在提高物料处理效率,其中机器人视觉系统和高速输送机等创新发挥关键作用。企业越来越多地采用物联网 (IoT) 和人工智慧技术来实现预测性维护并确保各个仓库组件之间的无缝协调,从而提高可扩展性和创新性。

市场分为三个核心部分:硬体、软体和服务。硬体领域包括机器人、传送系统和自动化储存解决方案,预计到 2034 年将以 15.3% 的复合年增长率成长。对人工智慧驱动的机器人和配备感测器的系统的日益重视正在彻底改变物料处理,使流程更有效率,并最大限度地减少停机时间。随着公司专注于最大限度地利用仓库空间并提高营运吞吐量,对人工智慧硬体解决方案的需求持续上升。

仓库类型也在市场扩张中发挥关键作用,其中电子商务履行占据主导地位。受网上购物的快速增长以及对更快、更准确的订单处理的需求的推动,电子商务履行部门预计到 2034 年将达到 313 亿美元。该领域的关键趋势是实施节省空间的储存系统和在城市地区建立微型配送中心,以满足消费者对当天或隔天送达日益增长的期望。自动化系统被广泛用于简化挑选、分类和包装流程,使配送中心能够以最少的错误处理大规模作业。人工智慧驱动的编排系统正在进一步增强工作流程,提高库存准确性并改善供应链管理。

2024 年,北美仓库自动化市场占据 35.6% 的份额,该地区采用机器人和人工智慧解决方案来提高仓库效率的势头激增。该地区的企业正致力于实施自主系统,以加强储存、拣选和物料处理流程,减少对体力劳动的依赖。随着企业努力在快节奏的电子商务领域保持竞争力,越来越多地采用尖端仓库自动化解决方案,促进了市场的整体成长和技术进步。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 电子商务成长与全通路零售的扩张

- 需要提高营运效率并降低成本

- 食品饮料产业加大冷链和易腐货物的自动化程度

- 增加对机器人和人工智慧的投资以提高仓库效率

- 製药和医疗保健行业增强储存和合规性

- 产业陷阱与挑战

- 初期投资和实施成本高

- 网路安全风险与资料隐私问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依组件,2021-2034

- 主要趋势

- 硬体

- 软体

- 服务

第六章:市场估计与预测:依仓库类型,2021-2034

- 主要趋势

- 电子商务履行中心

- 零售配送中心

- 冷藏仓库

- 製造仓库

- 第三方物流(3PL)仓库

第七章:市场估计与预测:依部署模式,2021-2034

- 主要趋势

- 本地部署

- 基于云端

- 杂交种

第八章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 自动储存和检索系统(AS/RS)

- 自主移动机器人(AMR)

- 自动导引车(AGV)

- 传送带和分类系统

- 机器人拾取和处理系统

- 仓库管理和执行软体

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 订单履行自动化

- 库存追踪和管理

- 货到人 (GTP) 解决方案

- 码垛和卸垛

- 自动包装和贴标

- 逆向物流与退货处理

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 电子商务

- 食品和饮料

- 零售和消费品

- 卫生保健

- 汽车

- 工业的

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十二章:公司简介

- 6 River Systems

- AutoStore

- Bastian Solutions

- Daifuku

- Dematic

- Element Logic

- Fives

- Fortna

- Gebhardt Intralogistics

- Honeywell

- Kardex

- Knapp

- Korber

- Locus Robotics

- Murata Machinery

- Savoye

- SSI Schaefer

- Stow Robotics

- Swisslog

- Symbotic

- System Logistics

- Vanderlande

- Witron

The Global Warehouse Automation Market was valued at USD 26.5 billion in 2024 and is anticipated to grow at a CAGR of 15.9% from 2025 to 2034, driven by the increasing need for streamlined, cost-effective operations across warehouse facilities. As businesses grapple with rising labor shortages and surging e-commerce demand, many are turning to automation technologies such as autonomous mobile robots (AMRs) and automatic storage and retrieval systems (AS/RS) to optimize routine processes. These technologies not only enhance operational efficiency but also reduce labor costs and mitigate human errors, leading to faster order fulfillment and improved inventory management.

The market is witnessing a substantial shift toward automation as businesses seek to address the rising expectations for shorter delivery times and flawless operations. Additionally, the growing adoption of cloud-based warehouse management systems (WMS) and predictive analytics is enabling organizations to make data-driven decisions that further refine their logistics processes. The increasing prominence of micro-fulfillment centers in urban areas, designed to meet the surging demand for same-day or next-day deliveries, is also contributing to the accelerated growth of the warehouse automation market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.5 Billion |

| Forecast Value | $115.8 Billion |

| CAGR | 15.9% |

Advancements in robotics and artificial intelligence (AI) are transforming warehouse operations by driving improvements in order fulfillment speed and operational precision. Companies are investing heavily in AI-driven solutions to manage inventory more effectively, boost picking and sorting accuracy, and reduce operational errors. The integration of AI and sensor-powered systems into warehouse automation is enhancing material handling efficiency, with innovations such as robotic vision systems and high-speed conveyors playing a critical role. Businesses are increasingly incorporating the Internet of Things (IoT) and AI technologies to enable predictive maintenance and ensure seamless coordination between various warehouse components, resulting in greater scalability and innovation.

The market is segmented into three core components: hardware, software, and services. The hardware segment, which includes robotics, conveyor systems, and automated storage solutions, is projected to grow at a CAGR of 15.3% by 2034. A growing emphasis on AI-driven robotics and sensor-equipped systems is revolutionizing material handling, making processes more efficient, and minimizing downtime. As companies focus on maximizing warehouse space utilization and improving operational throughput, the demand for AI-powered hardware solutions continues to rise.

Warehouse types are also playing a pivotal role in the market's expansion, with e-commerce fulfillment leading the way. The e-commerce fulfillment segment is expected to reach USD 31.3 billion by 2034, fueled by the rapid growth of online shopping and the need for faster, more accurate order processing. A key trend within this segment is the implementation of space-efficient storage systems and the establishment of micro-fulfillment centers in urban locations to meet rising consumer expectations for same-day or next-day delivery. Automated systems are being widely used to streamline picking, sorting, and packaging processes, enabling fulfillment centers to handle large-scale operations with minimal errors. AI-driven orchestration systems are further enhancing workflows, allowing for better inventory accuracy and improved supply chain management.

North America Warehouse Automation Market accounted for a 35.6% share in 2024, with the region experiencing a surge in the adoption of robotics and AI-powered solutions to improve warehouse efficiency. Businesses across the region are focusing on implementing autonomous systems to enhance storage, picking, and material handling processes, reducing the reliance on manual labor. With companies striving to stay competitive in the fast-paced e-commerce landscape, the increased adoption of cutting-edge warehouse automation solutions is contributing to the overall growth and technological advancement of the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce growth and omnichannel retailing

- 3.2.1.2 Need for operational efficiency and cost reduction

- 3.2.1.3 Food & beverage industry increasing automation for cold chain and perishable goods

- 3.2.1.4 Rising investments in robotics and AI to enhance warehouse efficiency

- 3.2.1.5 Pharmaceutical & healthcare sectors enhancing storage and compliance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and implementation costs

- 3.2.2.2 Cybersecurity risks and data privacy concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Warehouse Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 E-commerce fulfillment centers

- 6.3 Retail distribution centers

- 6.4 Cold storage warehouses

- 6.5 Manufacturing warehouses

- 6.6 Third-party logistics (3PL) warehouses

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 On-premise

- 7.3 Cloud-based

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Automated storage and retrieval systems (AS/RS)

- 8.3 Autonomous mobile robots (AMRs)

- 8.4 Automated guided vehicles (AGVs)

- 8.5 Conveyor & sortation systems

- 8.6 Robotic picking & handling systems

- 8.7 Warehouse management & execution software

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Order fulfillment automation

- 9.3 Inventory tracking & management

- 9.4 Goods-to-person (GTP) solutions

- 9.5 Palletizing & depalletizing

- 9.6 Automated packaging & labeling

- 9.7 Reverse logistics & returns handling

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 E-commerce

- 10.3 Food & beverage

- 10.4 Retail & consumer goods

- 10.5 Healthcare

- 10.6 Automotive

- 10.7 Industrial

- 10.8 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 6 River Systems

- 12.2 AutoStore

- 12.3 Bastian Solutions

- 12.4 Daifuku

- 12.5 Dematic

- 12.6 Element Logic

- 12.7 Fives

- 12.8 Fortna

- 12.9 Gebhardt Intralogistics

- 12.10 Honeywell

- 12.11 Kardex

- 12.12 Knapp

- 12.13 Korber

- 12.14 Locus Robotics

- 12.15 Murata Machinery

- 12.16 Savoye

- 12.17 SSI Schaefer

- 12.18 Stow Robotics

- 12.19 Swisslog

- 12.20 Symbotic

- 12.21 System Logistics

- 12.22 Vanderlande

- 12.23 Witron