|

市场调查报告书

商品编码

1708239

1 型商用电涌保护装置市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Type 1 Commercial Surge Protection Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

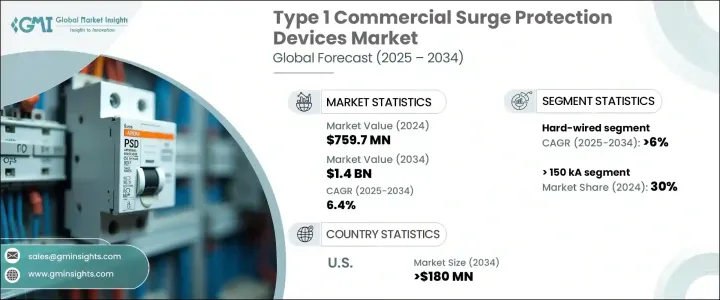

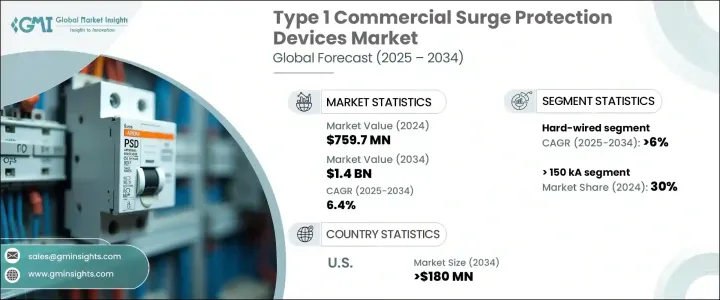

2024 年全球 1 型商用电涌保护装置市值为 7.597 亿美元,预计 2025 年至 2034 年期间将以 6.4% 的复合年增长率强劲增长。这一成长主要源自于对保护电气系统免受电涌影响的需求日益增长,而电涌会带来资料遗失、财务损失和设备故障等重大风险。电涌保护装置在降低这些风险方面发挥着至关重要的作用,尤其是随着越来越多的产业采用复杂的 IT 基础架构、资料中心和先进的电子系统。

由于企业营运对科技的依赖性日益增强,电涌保护装置市场变得越来越重要。随着智慧建筑技术的发展,对可靠电涌保护的需求也随之激增。世界各国政府也大力投资电网现代化建设,进一步推动了市场的扩张。此外,人们对节能电气系统的日益重视也推动了对这些保护装置的进一步需求。这些解决方案对于保护设施免受因电网不稳定、雷击和其他不可预测的电力波动而发生的瞬态电压突波的影响至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.597亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 6.4% |

通常安装在服务主面板上的硬接线 1 型商用电涌保护装置预计到 2034 年将以 6% 的复合年增长率成长。这些系统对于保护整个设施免受电涌的影响至关重要,电涌通常是由雷击或电气开关动作等外部事件引起的。它们在系统层级提供保护的能力对于高风险商业应用尤其有价值,可确保电源干扰不会造成大范围的营运中断。

额定电流 <= 50 kA 的突波保护装置也越来越受欢迎,预计到 2034 年市场复合年增长率将达到 5.5%。推动这一成长的因素是,人们越来越意识到医疗保健、资料中心和研究设施等关键领域对突波保护的迫切需求。随着雷暴和雷击等极端天气事件变得越来越频繁,这些产业对强大的突波保护系统的需求持续上升。

在北美,1 型商用电涌保护装置市场预计到 2034 年将以 6% 的复合年增长率成长。市场的成长主要归因于电网现代化的进步,以及商业环境中伺服器、自动化系统和医疗设备等敏感电子设备的部署增加。对这些技术的日益依赖提高了对电涌保护的需求,进一步推动了该地区市场的成长。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 硬连线

- 外挂

- 电源线

- 电力控制装置

第六章:市场规模及预测:依功率等级,2021 - 2034 年

- 主要趋势

- ≤50千安

- > 50 kA 至 100 kA

- > 100 kA 至 150 kA

- > 150 千安

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 荷兰

- 奥地利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 马来西亚

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 南非

- 奈及利亚

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Belkin

- Eaton

- Emerson Electric

- Hubbell

- Intermatic

- Legrand

- Leviton Manufacturing

- Littelfuse

- LS Electric

- Mersen

- Raycap

- Phoenix Contact

- Schneider Electric

- Siemens

- Socomec

The Global Type 1 Commercial Surge Protection Devices Market was valued at USD 759.7 million in 2024 and is anticipated to experience robust growth at a CAGR of 6.4% from 2025 to 2034. This growth is primarily driven by the increasing need for safeguarding electrical systems from power surges, which pose significant risks such as data loss, financial damages, and equipment malfunctions. Surge protection devices play a vital role in mitigating these risks, particularly as more industries adopt complex IT infrastructures, data centers, and advanced electronic systems.

The surge protection device market is becoming increasingly essential due to the growing dependence on technology in business operations. As smart building technologies gain traction, the demand for reliable surge protection has surged in parallel. Governments worldwide are also investing heavily in grid modernization efforts, which are further propelling the market's expansion. Additionally, the increased emphasis on energy-efficient electrical systems is driving further demand for these protective devices. These solutions are indispensable in safeguarding facilities from transient voltage surges, which can occur due to grid instability, lightning strikes, and other unpredictable power fluctuations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $759.7 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 6.4% |

The hard-wired Type 1 commercial surge protection devices, typically installed at service main panels, are expected to grow at a CAGR of 6% through 2034. These systems are crucial in protecting entire facilities from power surges, often resulting from external events like lightning strikes or electrical switching actions. Their ability to provide protection at the system level is particularly valuable for high-risk commercial applications, ensuring that power disturbances do not cause widespread operational disruptions.

Surge protection devices rated <= 50 kA are also gaining traction, with the market projected to grow at a CAGR of 5.5% through 2034. This growth is driven by heightened awareness about the critical need for surge protection in key sectors such as healthcare, data centers, and research facilities. As extreme weather events like thunderstorms and lightning strikes become more frequent, the demand for robust surge protection systems continues to rise across these industries.

In North America, the Type 1 Commercial Surge Protection Devices Market is poised to grow at a CAGR of 6% through 2034. The market's growth is largely attributed to advances in grid modernization, alongside the increased deployment of sensitive electronic equipment such as servers, automated systems, and medical devices within commercial settings. The increasing reliance on these technologies has heightened the need for surge protection, further fueling the region's market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 Hard-wired

- 5.3 Plug-in

- 5.4 Line cord

- 5.5 Power control devices

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 ≤ 50 kA

- 6.3 > 50 kA to 100 kA

- 6.4 > 100 kA to 150 kA

- 6.5 > 150 kA

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Russia

- 7.3.4 UK

- 7.3.5 Italy

- 7.3.6 Spain

- 7.3.7 Netherlands

- 7.3.8 Austria

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 Australia

- 7.4.6 New Zealand

- 7.4.7 Malaysia

- 7.4.8 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Egypt

- 7.5.5 South Africa

- 7.5.6 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Belkin

- 8.3 Eaton

- 8.4 Emerson Electric

- 8.5 Hubbell

- 8.6 Intermatic

- 8.7 Legrand

- 8.8 Leviton Manufacturing

- 8.9 Littelfuse

- 8.10 LS Electric

- 8.11 Mersen

- 8.12 Raycap

- 8.13 Phoenix Contact

- 8.14 Schneider Electric

- 8.15 Siemens

- 8.16 Socomec