|

市场调查报告书

商品编码

1708241

汽车热泵市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Pump for Thermal System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

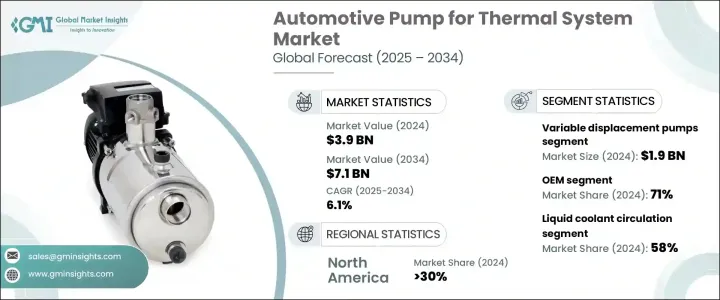

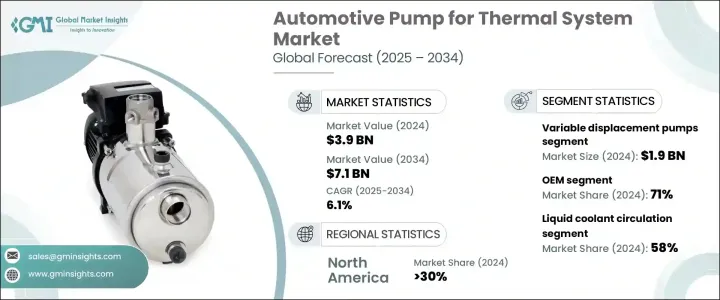

2024 年全球汽车热系统帮浦市场价值为 39 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.1%。随着汽车产业向电动车 (EV) 和混合动力电动车 (HEV) 转变,对高效能热管理系统的需求正在上升。这些系统对于维持车辆各个零件(包括电池和电力电子设备)的最佳温度至关重要,而这些零件对于电动车的性能至关重要。由于这些热系统透过保持温度稳定性来帮助增强车辆功能和电池寿命,因此对先进冷却解决方案的需求正在增长。

推动这一市场发展的一个重要因素是热能回收系统(TERS)的兴起,该系统用于捕获引擎或排气系统产生的废热。这些系统提高了整体能源效率,并进一步推动了对汽车帮浦的需求。这些帮浦透过在系统中循环冷却剂、传输加热的液体能量来操作辅助功能或增强驾驶性能发挥至关重要的作用。它们对于现代汽车(包括电动车和混合动力汽车)的开发至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 71亿美元 |

| 复合年增长率 | 6.1% |

市场根据泵浦类型细分,主要包括离心泵浦、正排量泵浦和变数泵浦。变数排气量帮浦在 2024 年占据 19 亿美元的市场份额,预计在预测期内将呈现显着成长。这些泵浦因其在复杂热系统中的灵活性和响应性而受到青睐,它们可以在不同的驾驶条件下提供更好的控制,例如高性能驾驶或寒冷天气和交通拥堵情况。

市场也根据销售管道分为OEM和售后市场。 2024 年, OEM部门占据 71% 的主导市场。 OEM 使用直接面向消费者的平台(包括电子商务)来分销替换零件和售后泵。这种方法不仅扩大了他们的市场覆盖范围,而且还增强了客户支援和回馈。

根据冷媒类型,市场分为油性冷媒、液体冷却剂循环冷媒和空气基冷媒。受电动和混合动力汽车对高效电池温度管理的需求不断增长的推动,液体冷却剂循环领域在 2024 年占据 58% 的多数份额。

汽车热力系统帮浦市场进一步按推进类型分类,其中内燃机 (IC) 部分在 2024 年占据最大份额。热管理对于涡轮增压引擎尤其重要,因为需要有效的冷却系统来防止过热并确保持久性能。

在北美,市场由美国主导,到 2024 年,该地区将占据全球市场份额的 30% 以上。由于电池技术的进步和对更节能汽车的追求,对电动车热管理系统的需求正在增加。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件供应商

- 泵浦装配工

- 服务提供者

- 技术提供者

- 最终用途

- 利润率分析

- 成本細項分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动和混合动力汽车需求不断增长

- 热能回收系统的采用日益增多

- 售后市场和更换需求的扩大

- 自动驾驶和连网汽车的成长

- 产业陷阱与挑战

- 先进泵浦技术成本高昂

- 改造先进热泵的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按泵浦分类,2021 - 2034 年

- 主要趋势

- 离心泵

- 电动水泵

- 机械水泵

- 容积泵

- 齿轮泵浦

- 叶片泵

- 活塞泵

- 螺桿泵

- 变数泵

第六章:市场估计与预测:按瓦特,2021 - 2034 年

- 主要趋势

- 低于50瓦

- 50瓦 – 100瓦

- 100瓦 – 500瓦

- 500W以上

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 纯电动车

- 插电式混合动力

- 油电混合车

第八章:市场估计与预测:按冷媒,2021 - 2034 年

- 主要趋势

- 油基

- 液体冷却剂循环(LCC)

- 空基

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aisin

- BorgWarner

- Bosch (Robert Bosch)

- Continental

- Denso

- Eberspaecher

- Fluid-o-Tech

- Grayson

- Hanon Systems

- Hitachi Astemo

- Infineon Technologies

- Johnson Electric Holdings Limited

- MAHLE

- Marelli

- Modine

- Nidec Corporation

- Rheinmetall AG

- Schaeffler

- Valeo

- ZF

The Global Automotive Pump for Thermal System Market, valued at USD 3.9 billion in 2024, is projected to grow at a CAGR of 6.1% from 2025 to 2034. As the automotive industry shifts towards electric vehicles (EVs) and hybrid electric vehicles (HEVs), the demand for efficient thermal management systems is rising. These systems are crucial for maintaining optimal temperatures in various vehicle components, including batteries and power electronics, which are critical to EV performance. The demand for advanced cooling solutions is growing as these thermal systems help enhance vehicle functionality and battery life by maintaining temperature stability.

A significant factor driving this market is the rise of thermal energy recovery systems (TERS), which are used to capture waste heat produced by engine or exhaust systems. These systems improve overall energy efficiency and further boost the demand for automotive pumps. These pumps play a vital role by circulating coolant through the system, transferring heated liquid energy to operate auxiliary features, or enhancing driving performance. They are essential in the development of modern vehicles, including EVs and HEVs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 6.1% |

The market is segmented based on pump type, with centrifugal pumps, positive displacement pumps, and variable displacement pumps being the main categories. Variable displacement pumps accounted for USD 1.9 billion of the market in 2024 and are expected to show significant growth over the forecast period. These pumps are preferred for their flexibility and responsiveness in complex thermal systems, where they provide better control under varying driving conditions, such as high-performance driving or in cold weather and heavy traffic situations.

The market is also divided by sales channel into OEM and aftermarket segments. In 2024, the OEM segment held a dominant market share of 71%. OEMs use direct-to-consumer platforms, including e-commerce, to distribute replacement parts and aftermarket pumps. This approach not only improves their market reach but also enhances customer support and feedback.

By refrigerant type, the market is segmented into oil-based, liquid coolant circulation, and air-based refrigerants. The liquid coolant circulation segment held a majority share of 58% in 2024, driven by the growing demand for efficient battery temperature management in electric and hybrid vehicles.

The automotive pump for thermal system market is further categorized by propulsion type, with the internal combustion (IC) engine segment holding the largest share in 2024. Thermal management is particularly crucial in turbocharged engines, where effective cooling systems are required to prevent overheating and ensure long-lasting performance.

In North America, the market was dominated by the U.S., with the region accounting for over 30% of the global market share in 2024. The demand for thermal management systems in EVs is increasing due to advancements in battery technology and the push for more energy-efficient vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component supplier

- 3.2.3 Pump assemblers

- 3.2.4 Service provider

- 3.2.5 Technology provider

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for electric and hybrid vehicles

- 3.8.1.2 Growing adoption of thermal energy recovery systems

- 3.8.1.3 Expansion of aftermarket and replacement demand

- 3.8.1.4 Growth of autonomous and connected vehicles

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High cost of advanced pump technologies

- 3.8.2.2 Complexity in retrofitting advanced thermal pumps

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Pump, 2021 - 2034 ($Mn & Units)

- 5.1 Key trends

- 5.2 Centrifugal pumps

- 5.2.1 Electric water pump

- 5.2.2 Mechanical water pump

- 5.3 Positive displacement pumps

- 5.3.1 Gear pump

- 5.3.2 Vane pump

- 5.3.3 Piston pump

- 5.3.4 Screw pump

- 5.4 Variable displacement pumps

Chapter 6 Market Estimates & Forecast, By Watt, 2021 - 2034 ($Mn & Units)

- 6.1 Key trends

- 6.2 Below 50 W

- 6.3 50W – 100W

- 6.4 100W – 500W

- 6.5 Above 500W

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn & Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 BEV

- 7.4 PHEV

- 7.5 HEV

Chapter 8 Market Estimates & Forecast, By Refrigerant, 2021 - 2034 ($Mn & Units)

- 8.1 Key trends

- 8.2 Oil-based

- 8.3 Liquid Coolant Circulation (LCC)

- 8.4 Air-based

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.5.3 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aisin

- 10.2 BorgWarner

- 10.3 Bosch (Robert Bosch)

- 10.4 Continental

- 10.5 Denso

- 10.6 Eberspaecher

- 10.7 Fluid-o-Tech

- 10.8 Grayson

- 10.9 Hanon Systems

- 10.10 Hitachi Astemo

- 10.11 Infineon Technologies

- 10.12 Johnson Electric Holdings Limited

- 10.13 MAHLE

- 10.14 Marelli

- 10.15 Modine

- 10.16 Nidec Corporation

- 10.17 Rheinmetall AG

- 10.18 Schaeffler

- 10.19 Valeo

- 10.20 ZF