|

市场调查报告书

商品编码

1708244

汽车高级轮胎市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Premium Tires Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

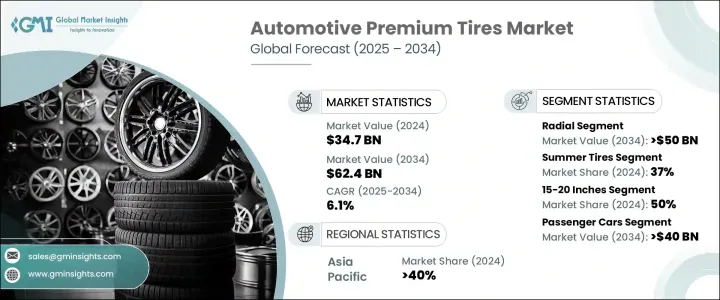

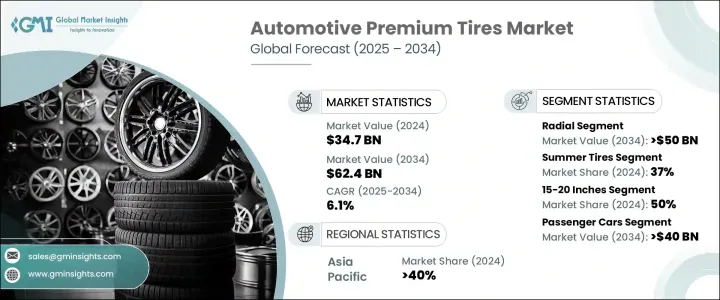

2024 年全球汽车高檔轮胎市场价值为 347 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.1%。这一增长主要受到对豪华车和高性能汽车日益增长的需求的推动,汽车製造商优先考虑卓越的轮胎质量,以提高车辆性能、舒适性和安全性。随着消费者偏好转向具有先进驾驶动力的车辆,高端轮胎製造商不断创新,增强胎面胶料、先进的橡胶配方和改进的侧壁结构。电动车(EV)的日益普及也促进了市场扩张,因为专为电动车设计的优质轮胎具有低滚动阻力、高效率和低噪音的特性。

对永续机动性的重视导致高端轮胎领域的研发活动增加。轮胎製造商正在采用环保原料、创新胎面设计和尖端技术来打造具有卓越抓地力、更长使用寿命和更高燃油效率的产品。消费者越来越意识到高性能轮胎的优势,包括更好的煞车能力、更低的噪音水平和更好的抓地力,这进一步加速了市场的成长。此外,监管机构正在执行更严格的安全和燃油效率规范,迫使汽车製造商为车辆配备符合严格标准的高品质轮胎。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 347亿美元 |

| 预测值 | 624亿美元 |

| 复合年增长率 | 6.1% |

根据轮胎结构,市场分为子午线轮胎和斜交轮胎。 2024年,子午线轮胎占据了80%的市场份额,预计到2034年将创造500亿美元的市场价值。子午线轮胎因其增强的灵活性、卓越的牵引力和更长的胎面寿命而受到高端轮胎市场的青睐。钢带结构可最大限度地减少热量积聚,提高燃油效率并延长轮胎寿命。随着对高性能车辆的需求不断增加,子午线轮胎因其高速稳定性和在恶劣驾驶条件下保持形状的能力仍然是首选,从而进一步推动了市场扩张。

市场也按轮胎类型分类,包括夏季轮胎、冬季轮胎、全季轮胎、全地形轮胎等。 2024 年,夏季轮胎占据了 37% 的市场份额,这得益于其在温暖条件下提供出色的牵引力和煞车性能的能力。夏季轮胎采用特殊的胎面胶料和设计,可最大程度地减少滚动阻力,从而提高燃油经济性并改善车辆操控性。豪华轿车和高性能汽车经常使用夏季轮胎来实现卓越的转弯能力和高速稳定性。豪华车销售的不断增长,特别是在气候较温暖的地区,继续推动对高性能夏季轮胎的需求。

2024 年,亚太地区占据全球汽车高檔轮胎市场的 40%。该地区可支配收入的增加、快速的城市化以及对高端轿车、SUV 和运动车型的需求不断增长是市场成长的主要推动因素。因此,对耐用、高性能轮胎的需求激增,促使製造商扩大其高端轮胎产品组合。领先的轮胎公司正在亚太地区投资生产设施和分销网络,以满足消费者对卓越轮胎品质、增强安全性和先进驾驶动力日益增长的需求。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 製造商

- 技术提供者

- 服务提供者

- 经销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 价格趋势

- 成本細項分析

- 衝击力

- 成长动力

- 对豪华和高性能汽车的需求不断增长

- 电动车的普及率不断提高

- 消费者对先进安全功能和耐用高性能轮胎的偏好日益增长

- 扩大网路零售及独家品牌经销权

- 产业陷阱与挑战

- 优质轮胎的初始成本高

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按轮胎,2021 - 2034 年

- 主要趋势

- 夏季轮胎

- 冬季轮胎

- 全季节轮胎

- 全地形轮胎

- 其他的

第六章:市场估计与预测:依轮胎结构,2021 - 2034 年

- 主要趋势

- 径向

- 偏见

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 防爆技术

- 自密封轮胎

- 环保轮胎

- 降噪技术

- 其他的

第八章:市场估计与预测:按轮毂尺寸,2021 - 2034

- 主要趋势

- 低于 15 英寸

- 15-20英寸

- 20吋以上

第九章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 越野车

- 轿车

- 掀背车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第 10 章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- OEM

- 售后市场

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- Apollo Tyres

- Bridgestone

- CEAT

- Continental

- Cooper Tire & Rubber

- Dunlop Tires

- Falken Tire

- Goodyear Tire & Rubber

- Hankook

- Kumho Tire

- Maxxis Tires

- Michelin

- MRF

- Nitto Tire

- Nokian

- Pirelli

- Sumitomo Rubber Industries

- Toyo Tire

- Vredestein Bande

- Yokohama Rubber

The Global Automotive Premium Tires Market was valued at USD 34.7 billion in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. This growth is largely driven by the increasing demand for luxury vehicles and high-performance cars, with automakers prioritizing superior tire quality to enhance vehicle performance, comfort, and safety. As consumer preferences shift toward vehicles offering advanced driving dynamics, premium tire manufacturers continue to innovate with enhanced tread compounds, advanced rubber formulations, and improved sidewall structures. The rising adoption of electric vehicles (EVs) also contributes to market expansion, as premium tires designed for EVs offer low rolling resistance, improved efficiency, and noise reduction.

The emphasis on sustainable mobility has led to an increase in research and development activities in the premium tires sector. Tire manufacturers are incorporating environmentally friendly raw materials, innovative tread designs, and cutting-edge technology to create products that offer superior grip, extended lifespan, and fuel efficiency. The growing consumer awareness of the benefits of high-performance tires, including improved braking capabilities, lower noise levels, and better road grip, further accelerates market growth. Additionally, regulatory bodies are enforcing stricter safety and fuel efficiency norms, compelling automakers to equip vehicles with high-quality tires that meet stringent standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.7 Billion |

| Forecast Value | $62.4 Billion |

| CAGR | 6.1% |

The market is segmented based on tire construction into radial and bias designs. In 2024, radial tires accounted for 80% of the market share and are expected to generate USD 50 billion by 2034. Radial tires are preferred in the premium tire market due to their enhanced flexibility, superior traction, and extended tread life. The steel-belted construction minimizes heat buildup, improving fuel efficiency and prolonging tire lifespan. As the demand for performance vehicles increases, radial tires remain the preferred choice for their high-speed stability and ability to maintain shape under challenging driving conditions, further fueling market expansion.

The market is also categorized by tire types, including summer tires, winter tires, all-season tires, all-terrain tires, and others. In 2024, summer tires held a 37% market share, driven by their ability to provide exceptional traction and braking performance in warm conditions. With specialized tread compounds and designs that minimize rolling resistance, summer tires enhance fuel economy and improve vehicle handling. Luxury sedans and high-performance cars frequently utilize summer tires to achieve superior cornering capabilities and high-speed stability. The increasing sales of luxury vehicles, particularly in regions with warmer climates, continue to boost demand for high-performance summer tires.

Asia Pacific accounted for 40% of the global automotive premium tires market share in 2024. The region's rising disposable income, rapid urbanization, and growing demand for high-end sedans, SUVs, and sports models are major contributors to market growth. As a result, the need for durable, high-performance tires has surged, prompting manufacturers to expand their premium tire portfolios. Leading tire companies are investing in production facilities and distribution networks across Asia Pacific to cater to the increasing consumer demand for superior tire quality, enhanced safety, and advanced driving dynamics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Manufacturers

- 3.2.3 Technology providers

- 3.2.4 Service providers

- 3.2.5 Distributors

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for luxury and high-performance vehicles

- 3.10.1.2 Increasing adoption of electric vehicles

- 3.10.1.3 Rising consumer preference for advanced safety features and durable high-performance tires

- 3.10.1.4 Expansion of online retail and exclusive brand dealerships

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost of premium tires

- 3.10.2.2 Fluctuations in raw material prices

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Tire, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Summer tires

- 5.3 Winter tires

- 5.4 All-season tires

- 5.5 All terrain tires

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Tire Construction, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Radial

- 6.3 Bias

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Run-flat technology

- 7.3 Self-sealing tires

- 7.4 Eco-friendly tires

- 7.5 Noise reduction technology

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Rim Size, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Below 15 inches

- 8.3 15-20 inches

- 8.4 Above 20 inches

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 SUV

- 9.2.2 Sedan

- 9.2.3 Hatchback

- 9.3 Commercial vehicles

- 9.3.1 Light Commercial Vehicles (LCV)

- 9.3.2 Medium Commercial Vehicles (MCV)

- 9.3.3 Heavy Commercial Vehicles (HCV)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Apollo Tyres

- 12.2 Bridgestone

- 12.3 CEAT

- 12.4 Continental

- 12.5 Cooper Tire & Rubber

- 12.6 Dunlop Tires

- 12.7 Falken Tire

- 12.8 Goodyear Tire & Rubber

- 12.9 Hankook

- 12.10 Kumho Tire

- 12.11 Maxxis Tires

- 12.12 Michelin

- 12.13 MRF

- 12.14 Nitto Tire

- 12.15 Nokian

- 12.16 Pirelli

- 12.17 Sumitomo Rubber Industries

- 12.18 Toyo Tire

- 12.19 Vredestein Bande

- 12.20 Yokohama Rubber