|

市场调查报告书

商品编码

1716449

伴侣动物药物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Companion Animal Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

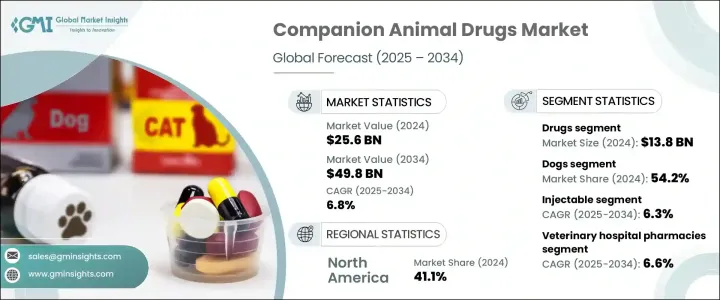

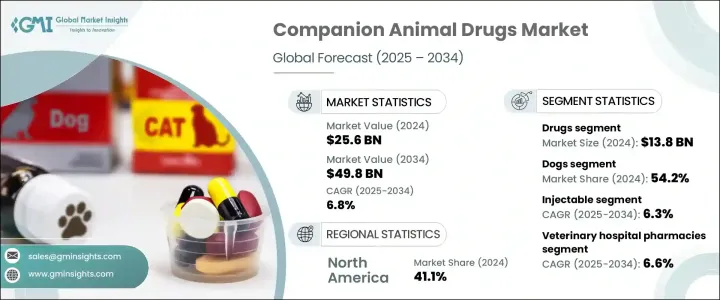

2024 年全球伴侣动物药物市场价值为 256 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.8%。伴侣动物的收养率不断提高、宠物慢性病盛行率不断上升以及宠物主人对先进治疗和兽医护理的投资意愿不断增强,推动了这一增长。宠物主人越来越多地将他们的动物视为家庭成员,这促使他们花钱进行预防性护理、接种疫苗和药物治疗,以确保它们的健康。这种态度的转变对市场扩张做出了巨大贡献。随着兽医科学的不断进步,创新配方、标靶治疗和改进的药物传递方法正在提高宠物主人的治疗效果和依从性,从而加速市场成长。

药品领域在 2024 年占据了 138 亿美元的最高市场份额,由于宠物慢性病和感染发病率的上升,该领域将继续占据市场主导地位。宠物拥有量的增加和宠物人性化趋势的日益增强推动了对抗生素、消炎药和杀寄生虫药的需求。製药公司正积极投资研发,推出咀嚼片和调味药物等新剂型,让给药更容易,提高依从性。兽医学领域的监管批准和创新也在推动该领域持续成长方面发挥了关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 256亿美元 |

| 预测值 | 498亿美元 |

| 复合年增长率 | 6.8% |

按动物类型划分,受高收养率和狗护理支出增加的推动,狗类在 2024 年保持了 54.2% 的最大收入份额。人们对狗的慢性疾病(如癌症和糖尿病)的认识不断提高,导致对先进治疗和药物的需求增加。这些疾病的盛行率不断上升,凸显了对有效治疗的需求,促使製药公司开发针对犬类健康的专门药物。全面的医疗保健选择和宠物主人支出的增加进一步促进了该领域的成长。

注射给药途径在 2024 年占据最大的市场份额,预计在预测期内将以 6.3% 的复合年增长率实现显着增长。注射药物,包括疫苗、抗生素和止痛药,具有快速起效和精确剂量的特点,是紧急治疗的理想选择。注射药物传输技术的进步和无针注射器的引入提高了宠物及其主人的便利性并减少了压力,促使人们越来越喜欢这种方式。

2024 年,兽医院药局占据了配销通路的主导地位,预计 2025 年至 2034 年的复合年增长率将达到 6.6%。这些药房提供各种动物保健产品,包括处方药、疫苗和补充剂,使其成为宠物主人的可靠来源。他们建立的声誉、品质保证以及配药方面的专业知识推动了他们在市场上的持续主导地位。

2024 年,北美占最大市场份额,为 41.1%,其中美国的收入为 91 亿美元。该地区受益于发达的兽医医疗保健体系、较高的宠物拥有率以及宠物医疗保健支出的增加,支持了伴侣动物药物市场的持续成长。领先製药公司的存在进一步确保了创新有效药物的稳定供应,推动了该地区市场的扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球宠物保险需求激增

- 伴侣动物肥胖率上升

- 全球政府加大对宠物照护的支持

- 在线兽医药房的需求不断增长

- 产业陷阱与挑战

- 伴侣动物药物成本高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 差距分析

- 消费者行为趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 药物

- 抗寄生虫药

- 消炎剂

- 抗感染药物

- 皮质类固醇

- 镇静剂

- 心血管药物

- 胃肠道药物

- 疫苗

- 减毒活疫苗(MLV)

- 灭活疫苗

- 重组疫苗

- 药物饲料添加剂

- 抗生素

- 维生素

- 胺基酸

- 酵素

- 抗氧化剂

- 益生元和益生菌

- 矿物质

- 碳水化合物

- 丙二醇

第六章:市场估计与预测:依动物类型,2021 年至 2034 年

- 主要趋势

- 狗

- 猫

- 马匹

- 其他动物类型

第七章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 注射剂

- 外用

- 其他给药途径

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 兽医院药房

- 电子商务

- 零售药局

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 波兰

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 台湾

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 海湾合作委员会国家

- 以色列

第十章:公司简介

- Agrolabo

- Boehringer Ingelheim International

- Ceva Sante Animale

- Chanelle Pharma

- Dechra Pharmaceuticals

- Elanco Animal Health Incorporated

- Endovac Animal Health

- HIPRA

- Indian Immunologicals

- Merck.

- Norbrook

- Symrise

- Vetoquinol

- Virbac

- Zoetis

The Global Companion Animal Drugs Market was valued at USD 25.6 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2034. The increasing adoption of companion animals, the rising prevalence of chronic diseases in pets, and the growing willingness of pet owners to invest in advanced treatments and veterinary care are fueling this growth. Pet owners increasingly perceive their animals as family members, prompting them to spend on preventive care, vaccinations, and medications to ensure their well-being. This shift in attitude has contributed significantly to the expansion of the market. As veterinary science continues to advance, innovative formulations, targeted therapies, and improved drug delivery methods are enhancing treatment efficacy and compliance among pet owners, thereby accelerating market growth.

The drugs segment, which accounted for the highest market share of USD 13.8 billion in 2024, continues to dominate the market due to the rising incidence of chronic diseases and infections in pets. Increased pet ownership and the growing trend of pet humanization have boosted the demand for antibiotics, anti-inflammatory drugs, and parasiticides. Pharmaceutical companies are actively investing in research and development to introduce novel formulations such as chewable tablets and flavored medications, making administration easier and improving compliance. Regulatory approvals and innovations in veterinary medicine have also played a pivotal role in driving the sustained growth of this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $49.8 Billion |

| CAGR | 6.8% |

By animal type, the dogs segment maintained the largest revenue share of 54.2% in 2024, driven by high adoption rates and increased spending on dog care. Growing awareness of chronic diseases among dogs, such as cancer and diabetes, has led to a higher demand for advanced treatments and medications. The rising prevalence of these conditions highlights the need for effective therapies, encouraging pharmaceutical companies to develop specialized drugs targeting canine health. The availability of comprehensive healthcare options and increased expenditure by pet owners further bolster segment growth.

The injectable route of administration, which held the largest market share in 2024, is anticipated to witness significant growth at a CAGR of 6.3% during the forecast period. Injectable drugs, including vaccines, antibiotics, and analgesics, offer rapid onset of action and precise dosing, making them ideal for emergency treatments. Advancements in injectable drug delivery technologies and the introduction of needle-free injectors have enhanced convenience and reduced stress for both pets and their owners, contributing to the growing preference for this route.

Veterinary hospital pharmacies dominated the distribution channel in 2024 and are projected to grow at a CAGR of 6.6% from 2025 to 2034. These pharmacies offer a wide range of animal healthcare products, including prescription drugs, vaccines, and supplements, making them a reliable source for pet owners. Their established reputation, quality assurance, and expertise in dispensing medications drive their continued dominance in the market.

North America accounted for the largest market share of 41.1% in 2024, with the U.S. generating USD 9.1 billion in revenue. The region benefits from a well-developed veterinary healthcare system, high pet ownership rates, and increased spending on pet healthcare, supporting the continuous growth of the companion animal drugs market. The presence of leading pharmaceutical companies further ensures a steady supply of innovative and effective drugs, driving the expansion of the market in this region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging demand for pet insurance policies worldwide

- 3.2.1.2 Rising rate of obesity in companion animals

- 3.2.1.3 Increasing government support for pet care across the globe

- 3.2.1.4 Growing demand for online veterinary pharmacies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with companion animal drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 GAP analysis

- 3.6 Consumer behaviour trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Drugs

- 5.2.1 Antiparasitic

- 5.2.2 Anti-inflammatory

- 5.2.3 Anti-infectives

- 5.2.4 Corticosteroids

- 5.2.5 Tranquilizers

- 5.2.6 Cardiovascular drugs

- 5.2.7 Gastrointestinal drugs

- 5.3 Vaccines

- 5.3.1 Modified live vaccines (MLV)

- 5.3.2 Killed inactivated vaccines

- 5.3.3 Recombinant vaccines

- 5.4 Medicated feed additives

- 5.4.1 Antibiotics

- 5.4.2 Vitamins

- 5.4.3 Amino acids

- 5.4.4 Enzymes

- 5.4.5 Antioxidants

- 5.4.6 Prebiotics and probiotics

- 5.4.7 Minerals

- 5.4.8 Carbohydrates

- 5.4.9 Propandiol

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Horses

- 6.5 Other animal types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

- 7.4 Topical

- 7.5 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 E-commerce

- 8.4 Retail pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Poland

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Taiwan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 GCC Countries

- 9.6.3 Israel

Chapter 10 Company Profiles

- 10.1 Agrolabo

- 10.2 Boehringer Ingelheim International

- 10.3 Ceva Sante Animale

- 10.4 Chanelle Pharma

- 10.5 Dechra Pharmaceuticals

- 10.6 Elanco Animal Health Incorporated

- 10.7 Endovac Animal Health

- 10.8 HIPRA

- 10.9 Indian Immunologicals

- 10.10 Merck.

- 10.11 Norbrook

- 10.12 Symrise

- 10.13 Vetoquinol

- 10.14 Virbac

- 10.15 Zoetis