|

市场调查报告书

商品编码

1716452

折弯机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bending Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

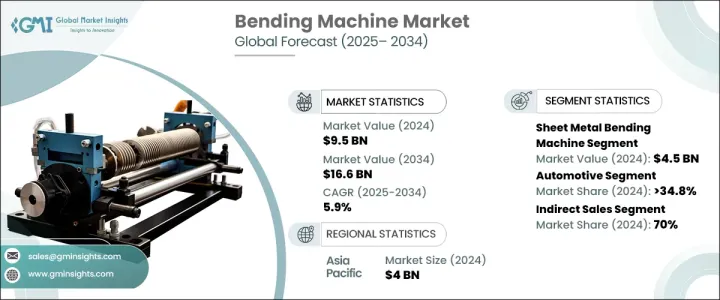

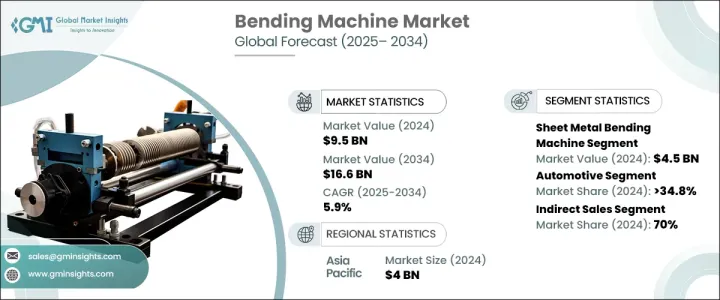

2024 年全球折弯机市场价值为 95 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.9%。折弯机在製造业、建筑业、汽车业和航太等多个行业中发挥着不可或缺的作用。这些机器用于成型金属板、管道、管子和型材,使其成为生产复杂零件和结构不可或缺的工具。随着全球工业化进程的加快,对折弯机的需求不断增加,特别是在基础设施和建筑项目迅速扩张的新兴经济体。各行业越来越多地采用自动化和精密工程,进一步促进了市场成长,推动了对能够高精度处理复杂设计的先进折弯机的需求。

技术进步正在改变折弯机的格局,CNC 和机器人模型提供了卓越的效率和精确度。然而,这些先进机器的高昂购买和维护成本可能是一个巨大的挑战,特别是对于新兴经济体中的小型製造商而言。此外,这些机器需要熟练的操作员,他们精通程式设计和管理复杂的系统,这对技术专长有限的公司来说是一个障碍。儘管面临这些挑战,但对自动化流程和客製化组件生产的日益重视正在推动各行各业采用先进的折弯机。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 95亿美元 |

| 预测值 | 166亿美元 |

| 复合年增长率 | 5.9% |

2024 年,钣金折弯机市场创收 45 亿美元,预计到 2034 年复合年增长率将达到 6.6%。钣金广泛应用于建筑、汽车、航太、电子和製造等行业,因此这些机器具有很高的价值。它们擅长弯曲复杂的形状和角度,使製造商能够高精度地满足特定的设计要求。与管道或管材折弯机相比,钣金折弯机在加工较大板材时具有成本优势,使其在经济上可行,适合大规模零件生产。轻质材料的日益普及和对客製化零件的需求进一步增强了对钣金折弯机的需求。

市场按最终用途细分为航太和国防、汽车、通用机械和设备、电气和电子以及其他,包括医疗保健和海洋应用。汽车领域在 2024 年占据了 34.8% 的市场份额,预计到 2034 年将以 5.6% 的复合年增长率成长。折弯机在汽车製造业中至关重要,它们可以製造精确和客製化的零件,例如排气系统、防滚架和底盘元件。随着汽车製造商越来越多地采用铝和先进合金等轻质材料来提高燃油效率和性能,对折弯机的需求持续上升。

2024 年,亚太地区折弯机市场的营收为 40 亿美元。该地区拥有主要的製造业中心,尤其是汽车、航太、建筑和电子行业。中国、印度和韩国等国家的快速工业扩张和基础设施发展正在推动对折弯机的需求,以生产各种零件,包括汽车零件、结构件和消费性电子产品。该地区对技术创新和精密製造的重视预计将推动市场成长,使亚太地区成为全球折弯机产业的主导者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 对部队的影响

- 成长动力

- 工业化和基础建设不断加强

- 製造业快速成长

- 製造技术的进步

- 产业陷阱与挑战

- 初期投资高

- 熟练劳动力短缺

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年(十亿美元)

- 主要趋势

- 钣金折弯机

- 弯管机

- 其他(折弯机、辊轧成型机、钢筋弯曲机)

第六章:市场估计与预测:按驱动机制,2021 - 2034 年(十亿美元)

- 主要趋势

- 电的

- 油压

- 气动

- 机械的

第七章:市场估计与预测:按营运技术,2021 - 2034 年(十亿美元)

- 主要趋势

- 传统的

- 计算机数控(CNC)

第八章:市场估计与预测:按最终用途,2021 - 2034 年(十亿美元)

- 主要趋势

- 航太与国防

- 汽车

- 通用机械及设备

- 建筑与施工

- 其他(采矿、海洋等)

第九章:市场估计与预测:按配销通路,2021 - 2034 年(十亿美元)

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 - 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Amada

- Amob

- Baileigh Industrial

- BLM Group

- Bystronic Group

- Euromac

- Horn Machine Tools

- Murata Machinery

- Pedax

- Prima Industrie

- Sahinler Metal Makina Industry

- Shuz Tung Machinery Industrial

- Transfluid

- Trumpf

- Wafios

The Global Bending Machine Market was valued at USD 9.5 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2034. Bending machines play an integral role across multiple industries, including manufacturing, construction, automotive, and aerospace. These machines are used to shape sheet metal, pipes, tubes, and profiles, making them indispensable in producing complex components and structures. As global industrialization accelerates, the demand for bending machines is increasing, especially in emerging economies where infrastructure and construction projects are expanding rapidly. The rising adoption of automation and precision engineering in various sectors further boosts market growth, driving demand for advanced bending machines that can handle intricate designs with high accuracy.

Technological advancements are transforming the bending machine landscape, with CNC and robotic models offering superior efficiency and precision. However, the high acquisition and maintenance costs of these advanced machines can be a significant challenge, particularly for smaller manufacturers in emerging economies. Additionally, these machines require skilled operators proficient in programming and managing complex systems, posing a barrier for companies with limited technical expertise. Despite these challenges, the growing emphasis on automated processes and customized component production is fueling the adoption of advanced bending machines across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $16.6 Billion |

| CAGR | 5.9% |

The sheet metal bending machine segment generated USD 4.5 billion in 2024 and is projected to grow at a CAGR of 6.6% through 2034. Sheet metal is extensively used across industries such as construction, automotive, aerospace, electronics, and manufacturing, making these machines highly valuable. They excel in bending intricate shapes and angles, enabling manufacturers to meet specific design requirements with high precision. Compared to pipe or tube bending machines, sheet metal bending machines offer cost advantages when processing larger sheets, making them economically viable for large-scale component production. The growing adoption of lightweight materials and the need for customized parts further enhance the demand for sheet metal bending machines.

The market is segmented by end-use into aerospace & defense, automotive, general machinery & equipment, electrical & electronics, and others, including healthcare and marine applications. The automotive segment accounted for 34.8% of the market share in 2024 and is expected to grow at a CAGR of 5.6% through 2034. Bending machines are essential in automotive manufacturing, where they create precise and customized components such as exhaust systems, roll cages, and chassis elements. As automakers increasingly incorporate lightweight materials like aluminum and advanced alloys to improve fuel efficiency and performance, the demand for bending machines continues to rise.

Asia Pacific generated USD 4 billion in revenue from the bending machine market in 2024. The region hosts major manufacturing hubs, particularly in the automotive, aerospace, construction, and electronics sectors. Rapid industrial expansion and infrastructure development in countries like China, India, and South Korea are driving the demand for bending machines to produce a wide range of components, including automotive parts, structural elements, and consumer electronics. The region's emphasis on technological innovation and precision manufacturing is expected to propel market growth, making the Asia Pacific a dominant player in the global bending machine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact on forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing industrialization and infrastructure development

- 3.9.1.2 Rapid growth in the manufacturing sector

- 3.9.1.3 Advancements in manufacturing technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial investment

- 3.9.2.2 Shortage of skilled labor

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Sheet metal bending machine

- 5.3 Pipe/tube bending machine

- 5.4 Others (press brake, roll forming, bar bending)

Chapter 6 Market Estimates & Forecast, By Driving Mechanism, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Hydraulic

- 6.4 Pneumatic

- 6.5 Mechanical

Chapter 7 Market Estimates & Forecast, By Operating Technology, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Computer numerically controlled (CNC)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.3 Automotive

- 8.4 General machinery & equipment

- 8.5 Building & construction

- 8.6 Others (mining, marine, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amada

- 11.2 Amob

- 11.3 Baileigh Industrial

- 11.4 BLM Group

- 11.5 Bystronic Group

- 11.6 Euromac

- 11.7 Horn Machine Tools

- 11.8 Murata Machinery

- 11.9 Pedax

- 11.10 Prima Industrie

- 11.11 Sahinler Metal Makina Industry

- 11.12 Shuz Tung Machinery Industrial

- 11.13 Transfluid

- 11.14 Trumpf

- 11.15 Wafios