|

市场调查报告书

商品编码

1716455

间歇导管市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Intermittent Catheters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

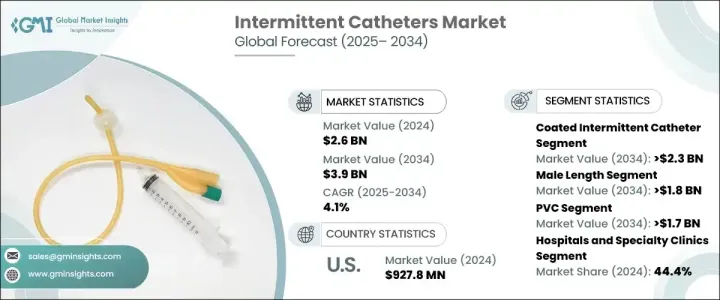

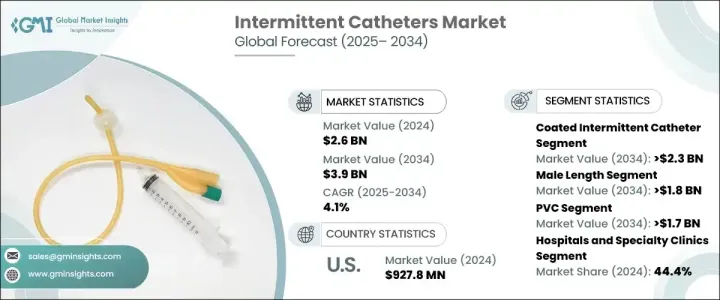

2024 年全球间歇导管市场规模达到 26 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.1%。由于尿失禁、神经性膀胱疾病盛行率不断上升以及人口快速老化需要持续的膀胱管理解决方案,市场正在稳步增长。随着人们对自我导尿益处的认识不断提高,加上医疗保健系统强调留置导尿管的更安全替代方案,推动了需求的成长。随着医护人员和患者都寻求更舒适、更卫生的选择,间歇导尿管已成为首选解决方案。导管技术的创新,例如亲水和抗菌涂层,在增强患者体验和安全性方面发挥关键作用。

这些现代设计有助于减少摩擦并最大限度地降低感染风险,鼓励患有慢性泌尿疾病的患者长期使用。此外,随着越来越多的人倾向于自我管理解决方案以获得更好的生活质量,对家庭医疗保健和以患者为中心的护理模式的日益关注导致间歇导管的采用率增加。脊髓损伤、多发性硬化症和前列腺相关疾病的发生率不断上升,尤其是在老年人群中,这推动了已开发地区和发展中地区的持续需求。该市场还受益于支持性报销框架和医疗保健倡议,旨在提高全球患者间歇性导管的可近性和可负担性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 39亿美元 |

| 复合年增长率 | 4.1% |

市场主要分为涂层导管和非涂层导管,预计在预测期内涂层导管的需求将更加强烈。 2025 年至 2034 年间,涂层间歇导管市场的复合年增长率将达到 4.4%,这得益于其在患者舒适度、易用性和感染预防方面的卓越性能。涂层导管,特别是具有亲水层的导管,在润湿时会变得滑溜,从而显着减少插入不适和尿道创伤。由于其增强的安全性和便利性,需要长期导尿的患者越来越多地选择这些先进的版本。泌尿道感染 (UTI) 风险的降低和更顺畅的导尿体验使涂层导管成为医疗保健提供者和患者的首选。

此外,间歇导管市场按长度细分,包括男性、女性和儿科版本,以满足不同的解剖需求。预计男性长度导尿管市场的复合年增长率为 4%,到 2034 年将产生 18 亿美元的市场价值。男性长度导尿管设计得更长,更适合男性生理结构,可确保更有效的膀胱引流,同时最大程度地降低尿潴留或感染等併发症的风险。这些导管使用方便,泌尿科医师广泛推荐给需要间歇性导尿的男性患者。

2024 年,美国间歇导管市场产值达到 9.278 亿美元,主要得益于尿潴留、脊髓损伤和其他慢性泌尿疾病病例的增加,尤其是在老年人群中。自我导尿的接受度不断提高以及导管设计的进步促进了市场的扩张。优惠的报销政策和政府支持性医疗保健计划进一步增强了患者获得这些基本设备的机会,使间歇导尿成为美国一种实用且被广泛采用的解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 泌尿系统疾病盛行率不断上升

- 有利的报销方案

- 自我导尿的需求不断增长,加上门诊手术中心的扩张

- 产业陷阱与挑战

- 导管插入相关併发症

- 替代治疗方案的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 定价分析

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 涂层间歇导管

- 亲水性

- 抗菌

- 其他涂层间歇导管

- 无涂层间歇导管

第六章:市场估计与预测:依类别,2021 年至 2034 年

- 主要趋势

- 雄性长度

- 雌性长度

- 儿童长度

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 尿失禁

- 一般外科

- 脊椎损伤

- 其他应用

第八章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- PVC

- 硅酮

- 乳胶

- 其他材料

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和专科诊所

- 门诊手术中心

- 居家照护环境

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Adapta medical

- ASID BONZ

- B. Braun

- Becton, Dickinson and Company

- Coloplast

- ConvaTec

- Cook

- Hollister

- Hunter Urology

- Pennine Healthcare

- Romsons

- Teleflex

- Wellspect Healthcare

The Global Intermittent Catheters Market reached USD 2.6 billion in 2024 and is projected to grow at a CAGR of 4.1% between 2025 and 2034. The market is witnessing steady growth due to a rising prevalence of urinary incontinence, neurogenic bladder disorders, and a rapidly aging population that requires ongoing bladder management solutions. Increasing awareness regarding the benefits of self-catheterization, coupled with healthcare systems emphasizing safer alternatives to indwelling catheters, is pushing demand forward. As medical practitioners and patients alike seek more comfortable and hygienic options, intermittent catheters have emerged as a preferred solution. Innovations in catheter technology, such as hydrophilic and antimicrobial coatings, are playing a pivotal role in enhancing patient experience and safety.

These modern designs help reduce friction and minimize the risk of infections, encouraging long-term use among patients with chronic urinary conditions. Moreover, a growing focus on home healthcare and patient-centered care models has led to increased adoption of intermittent catheters as more individuals prefer self-managed solutions for better quality of life. Rising incidences of spinal cord injuries, multiple sclerosis, and prostate-related issues, particularly among the elderly, are fueling consistent demand across both developed and developing regions. The market is also benefiting from supportive reimbursement frameworks and healthcare initiatives aimed at improving the accessibility and affordability of intermittent catheters for patients globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 4.1% |

The market is primarily divided into coated and uncoated intermittent catheters, with coated catheters expected to witness stronger demand during the forecast period. The coated intermittent catheter segment is set to grow at a CAGR of 4.4% between 2025 and 2034, driven by its superior performance in terms of patient comfort, ease of use, and infection prevention. Coated catheters, especially those with hydrophilic layers, become slippery when moistened, significantly reducing insertion discomfort and urethral trauma. Patients requiring long-term catheterization are increasingly opting for these advanced versions due to their enhanced safety profile and convenience. The reduction in urinary tract infection (UTI) risks and smoother catheterization experience make coated catheters a preferred choice among healthcare providers and patients alike.

Additionally, the intermittent catheters market is segmented by length, including male, female, and pediatric versions to meet diverse anatomical needs. The male length catheter segment is projected to grow at a CAGR of 4% and generate USD 1.8 billion by 2034. Male-length catheters are designed to be longer and more suited for male anatomy, ensuring more effective bladder drainage with minimal risk of complications such as urinary retention or infections. These catheters offer ease of use and are widely recommended by urologists for male patients requiring intermittent catheterization.

The U.S. intermittent catheters market generated USD 927.8 million in 2024, driven by rising cases of urinary retention, spinal injuries, and other chronic urinary disorders, particularly among older adults. Growing acceptance of self-catheterization and advancements in catheter designs are contributing to the market's expansion. Favorable reimbursement policies and supportive government healthcare programs further enhance patient access to these essential devices, making intermittent catheterization a practical and widely adopted solution in the United States.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of urinary diseases

- 3.2.1.2 Favourable reimbursement scenario

- 3.2.1.3 Growing demand for self-catheterization coupled with expansion of ambulatory surgical centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with catheterization

- 3.2.2.2 Availability of alternative treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pricing analysis

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Coated intermittent catheter

- 5.2.1 Hydrophilic

- 5.2.2 Antimicrobial

- 5.2.3 Other coated intermittent catheters

- 5.3 Uncoated intermittent catheter

Chapter 6 Market Estimates and Forecast, By Category, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Male length

- 6.3 Female length

- 6.4 Pediatric length

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Urinary incontinence

- 7.3 General surgery

- 7.4 Spinal injuries

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 PVC

- 8.3 Silicone

- 8.4 Latex

- 8.5 Other materials

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and specialty clinics

- 9.3 Ambulatory surgical centers

- 9.4 Home care settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adapta medical

- 11.2 ASID BONZ

- 11.3 B. Braun

- 11.4 Becton, Dickinson and Company

- 11.5 Coloplast

- 11.6 ConvaTec

- 11.7 Cook

- 11.8 Hollister

- 11.9 Hunter Urology

- 11.10 Pennine Healthcare

- 11.11 Romsons

- 11.12 Teleflex

- 11.13 Wellspect Healthcare