|

市场调查报告书

商品编码

1716463

电锅市场机会、成长动力、产业趋势分析及2025-2034年预测Electric Rice Cooker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

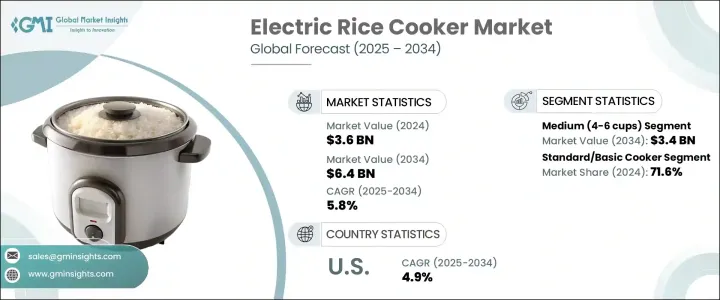

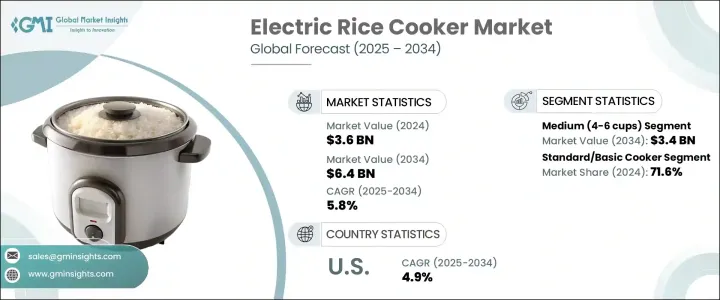

2024 年全球电饭煲市场价值为 36 亿美元,预计 2025 年至 2034 年期间将以 5.8% 的复合年增长率稳步增长。这一增长主要得益于全球可支配收入的增加和城市化进程的快速推进。随着购买力的增加,越来越多的消费者开始选择方便、高效、省时的现代厨房电器。城市化的特征是居住空间越来越小,生活节奏越来越快,导致人们不再使用传统的烹饪方式,对电饭煲等紧凑、自动化的烹饪解决方案的需求强劲。此外,智慧家庭技术和节能电器的日益普及,增强了电饭煲对不同人群的吸引力。消费者越来越寻求能够简化日常生活的智慧家电,而电锅恰好契合了这个趋势。它们的可编程设定、节能功能以及提供一致结果的能力与现代家庭不断变化的偏好完美契合。

随着越来越多的人开始忙碌地生活,电饭煲的吸引力也越来越大。由于其易于使用、高效且能够节省厨房时间,因此成为许多家庭(尤其是城市地区)的必需品。中型电锅可煮 4-6 杯米饭,2024 年的市场规模为 19 亿美元。这个细分市场之所以受欢迎,是因为其多功能性和价格实惠,非常适合小家庭、专业人士和单人家庭。中型型号在尺寸和容量之间实现了完美的平衡,让消费者无需使用更大、更耗电的电器即可准备普通餐点。此外,年轻的专业人士和注重健康的个人对家常饭菜的偏好日益增加,也极大地促进了对这些炊具的需求的增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 5.8% |

从产品类型来看,市场分为基础型电锅和多功能型电锅。基本炊具在 2024 年创造了 26 亿美元的市场价值,占据了 71.6% 的主导市场份额。它们的简单性、成本效益和可靠性使其成为许多消费者的首选,特别是在新兴市场,因为价格在购买决策中起着重要作用。基本款炊具以较低的价格提供可靠的性能,让更广泛的消费者能够使用。这些炊具在以米为主食的地区尤其受欢迎,精打细算的买家更重视其功能性而不是附加功能。同时,具有蒸煮、慢煮和可编程设定等先进功能的多功能型号正在受到那些寻求厨房电器更多功能的技术型消费者的青睐。

美国电锅市场规模在 2024 年达到 5.3 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.9%。由于强劲的消费者支出、广泛的消费者偏好以及完善的零售和电子商务管道,美国在北美保持主导地位。各大零售平台和网路商店让美国消费者可以轻鬆购买到各种电饭煲,从基本型号到更先进的多功能型号,满足不同的烹饪需求。此外,人们对亚洲美食的兴趣日益浓厚以及移民人口的不断增长进一步推动了美国对电饭煲的需求,美国消费者欣赏这些电器提供的便利性和一致性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 衝击力

- 成长动力

- 增加可支配所得和都市化

- 对快速方便的厨房电器的需求不断增长

- 技术进步与产品创新

- 产业陷阱与挑战

- 高级电饭煲成本高

- 仿冒品的竞争

- 成长动力

- 技术概述

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 标准/基本型炊具

- 多功能炊具

第六章:市场估计与预测:依数量,2021 - 2034

- 主要趋势

- 低(1-3 杯)

- 中(4-6杯)

- 大号(7+杯)

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 离线

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Aroma Housewares Company

- Black & Decker

- Breville Group Limited

- Cuckoo Electronics Company

- Electrolux AB

- Hamilton Holdings Company

- Hitachi Limited

- Koninklijke Philips NV

- Midea Group Company

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Tiger Corporation

- Toshiba Corporation

- Xiaomi Corporation

- Zojirushi Corporation

The Global Electric Rice Cooker Market, valued at USD 3.6 billion in 2024, is expected to experience steady growth at a CAGR of 5.8% from 2025 to 2034. This growth is primarily fueled by rising disposable incomes and the rapid pace of urbanization worldwide. As purchasing power increases, more consumers are turning to modern kitchen appliances that offer convenience, efficiency, and time-saving capabilities. Urbanization, characterized by smaller living spaces and increasingly fast-paced lifestyles, has led to a shift away from traditional cooking methods, creating a strong demand for compact and automated cooking solutions like electric rice cookers. Furthermore, the growing popularity of smart home technologies and energy-efficient appliances is enhancing the appeal of electric rice cookers across various demographics. Consumers are increasingly seeking smart appliances that simplify daily routines, and electric rice cookers fit seamlessly into this trend. Their programmable settings, energy-saving features, and ability to deliver consistent results align perfectly with the evolving preferences of modern households.

As more individuals adopt busy routines, the appeal of electric rice cookers continues to grow. Their ease of use, efficiency, and ability to save time in the kitchen have made them an essential item in many households, particularly in urban areas. The medium-sized cookers, capable of cooking 4-6 cups of rice, generated USD 1.9 billion in 2024. This segment's popularity stems from its versatility and affordability, making it ideal for small families, working professionals, and single-person households. Medium-sized models strike a perfect balance between size and capacity, allowing consumers to prepare regular meals without the need for larger, more power-hungry appliances. Additionally, the increasing preference for home-cooked meals among young professionals and health-conscious individuals has contributed significantly to the rising demand for these cookers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.8% |

In terms of product types, the market is divided between basic electric rice cookers and multifunctional models. Basic cookers, which generated USD 2.6 billion in 2024, held a dominant 71.6% market share. Their simplicity, cost-effectiveness, and reliability have made them the preferred choice for many consumers, particularly in emerging markets where affordability plays a significant role in purchasing decisions. Basic cookers provide dependable performance at a lower price point, making them accessible to a wider range of consumers. These cookers are especially popular in regions where rice is a staple food, and budget-conscious buyers prioritize function over additional features. Meanwhile, multifunctional models offering advanced features, such as steaming, slow cooking, and programmable settings, are gaining traction among tech-savvy consumers seeking more versatility in their kitchen appliances.

The U.S. Electric Rice Cooker Market reached USD 0.53 billion in 2024, with a projected CAGR of 4.9% from 2025 to 2034. The U.S. maintains a dominant position in North America due to strong consumer spending, a wide range of consumer preferences, and the presence of well-established retail and e-commerce channels. Major retail platforms and online stores make it easy for American consumers to access a variety of electric rice cookers, from basic models to more advanced, multifunctional units catering to diverse cooking needs. Additionally, the increasing interest in Asian cuisine and the growing immigrant population have further driven demand for electric rice cookers in the U.S., where consumers appreciate the convenience and consistency these appliances offer.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing disposable income and urbanization

- 3.2.1.2 Growing demand for quick and convenient kitchen appliances

- 3.2.1.3 Technological advancements and product innovations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced electric rice cookers

- 3.2.2.2 Competition from counterfeit products

- 3.2.1 Growth drivers

- 3.3 Technological overview

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key Trends

- 5.2 Standard/Basic cooker

- 5.3 Multifunctional cooker

Chapter 6 Market Estimates & Forecast, By Volume, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low (1-3 Cups)

- 6.3 Medium (4-6 Cups)

- 6.4 Large (7+ Cups)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Aroma Housewares Company

- 10.2 Black & Decker

- 10.3 Breville Group Limited

- 10.4 Cuckoo Electronics Company

- 10.5 Electrolux AB

- 10.6 Hamilton Holdings Company

- 10.7 Hitachi Limited

- 10.8 Koninklijke Philips NV

- 10.9 Midea Group Company

- 10.10 Mitsubishi Electric Corporation

- 10.11 Panasonic Corporation

- 10.12 Tiger Corporation

- 10.13 Toshiba Corporation

- 10.14 Xiaomi Corporation

- 10.15 Zojirushi Corporation