|

市场调查报告书

商品编码

1716467

动物抗生素和抗菌剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Animal Antibiotics and Antimicrobials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

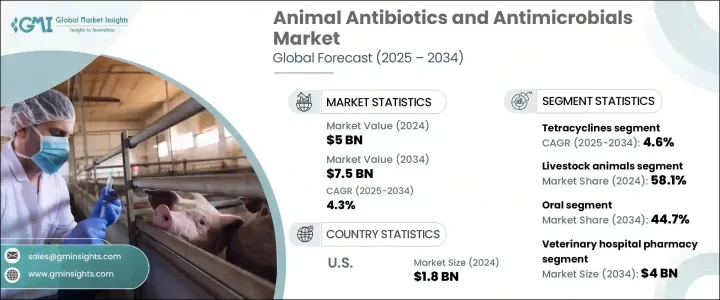

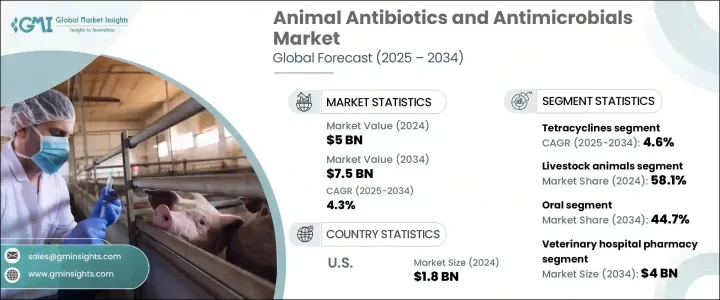

2024 年全球动物抗生素和抗菌剂市场价值为 50 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.3%。这一增长主要得益于威胁动物健康的人畜共患疾病的流行率不断上升,以及在牲畜消费不断增加的世界中对食品安全的需求日益增加。尤其是发展中国家,畜牧业正在蓬勃发展,从而更多地采取感染预防措施并改善动物健康管理。全球人口的成长以及对动物性蛋白质需求的相应增加,加剧了对可靠的抗生素和抗菌剂的需求,以维持牲畜的健康和生产力。此外,研发投入的不断增加刺激了药物配方的创新,提高了疗效,同时最大限度地减少了不良副作用,进一步促进了市场扩张。兽医基础设施的进步和对预防性动物保健的更多重视为製造商引入尖端抗菌解决方案创造了有利可图的机会,从而推动了预测期内的持续增长。

市场依产品类型细分为氨基糖苷类、四环素类、青霉素类、磺胺类、林可酰胺类、氟喹诺酮类、大环内酯类、头孢菌素类等抗生素及抗菌剂。其中,四环素类药物预计在预测期内的复合年增长率为4.6%。由于价格低廉且功效广,它们成为治疗牲畜和伴侣动物各种感染(包括呼吸道和胃肠道疾病)的热门选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 50亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 4.3% |

市场根据动物类型进一步分为伴侣动物和牲畜动物。 2024 年,畜牧业占 58.1%。该领域包括牛、猪、家禽、鱼和其他牲畜。随着城市化和全球饮食模式的转变,动物产品的消费量不断增加,推动了对保护牲畜免受感染的抗生素的需求。随着消费者越来越意识到维持动物族群健康对于预防疾病爆发的重要性,对加强牲畜健康服务的关注也日益加强。强有力的疾病控制措施的需求导致抗生素的使用增加,大大促进了市场扩张。

在美国,动物抗生素和抗菌药物市场在 2024 年创造了 18 亿美元的产值。该国先进的兽医基础设施、高宠物拥有率以及成熟的畜牧业推动了对抗生素和抗菌药物的需求。动物保健领域的投资不断增加,加上产品註册和批准数量的增加,继续推动市场成长。由于美国注重提高动物健康状况和防止人畜共通传染病的传播,它仍然是市场上的重要参与者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 宠物拥有率不断提高

- 扩大畜牧业生产

- 研发经费增加

- 动物保健意识的不断增强刺激了预防性治疗的需求

- 产业陷阱与挑战

- 治疗的不良反应

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 青霉素

- 四环素类

- 磺胺类药物

- 大环内酯类

- 氨基糖苷类

- 林可酰胺类

- 氟喹诺酮类药物

- 头孢菌素类

- 其他抗生素和抗菌产品

第六章:市场估计与预测:依动物类型,2021 年至 2034 年

- 主要趋势

- 伴侣动物

- 狗

- 猫

- 马匹

- 其他伴侣动物

- 牲畜

- 牛

- 猪

- 家禽

- 鱼

- 其他牲畜

第七章:市场估计与预测:依交付方式,2021 年至 2034 年

- 主要趋势

- 口服

- 外用

- 注射

- 其他交付方式

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 兽医院药房

- 零售药局

- 电子商务

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AdvaCare Pharma

- Boehringer Ingelheim International

- Ceva

- Dechra

- Meiji Holdings

- Merck & Co.

- Vetoquinol

- Virbac

- Zoetis

- Zovixpharma

The Global Animal Antibiotics and Antimicrobials Market was valued at USD 5 billion in 2024 and is expected to grow at a CAGR of 4.3% between 2025 and 2034. This growth is primarily driven by the rising prevalence of zoonotic diseases that threaten animal health and the increasing need for food safety in a world where livestock consumption is escalating. Developing nations, in particular, are witnessing a surge in livestock farming, leading to greater adoption of infection prevention measures and improvements in animal health management. The growing global population and the corresponding rise in demand for animal-based protein have intensified the need for reliable antibiotics and antimicrobials to maintain livestock health and productivity. Additionally, rising investments in research and development have spurred innovations in drug formulations that enhance effectiveness while minimizing adverse side effects, further bolstering market expansion. Advancements in veterinary infrastructure and a greater emphasis on preventive animal healthcare have created lucrative opportunities for manufacturers to introduce cutting-edge antimicrobial solutions, driving consistent growth over the forecast period.

The market is segmented by product type into aminoglycosides, tetracyclines, penicillins, sulfonamides, lincosamides, fluoroquinolones, macrolides, cephalosporins, and other antibiotics and antimicrobial agents. Among these, tetracyclines are expected to grow at a CAGR of 4.6% during the forecast period. Their affordability and broad-spectrum efficacy make them a popular choice for managing a variety of infections, including respiratory and gastrointestinal conditions, across both livestock and companion animals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 4.3% |

The market is further divided by animal type into companion animals and livestock animals. The livestock segment held a 58.1% share in 2024. This segment encompasses cattle, swine, poultry, fish, and other livestock. With urbanization progressing and dietary patterns shifting globally, the consumption of animal-based products is increasing, driving demand for antibiotics to safeguard livestock from infections. As consumers become more aware of the importance of maintaining healthy animal populations to prevent disease outbreaks, the focus on enhancing livestock health services has intensified. The need for robust disease control measures has led to an uptick in the adoption of antibiotics, contributing significantly to market expansion.

In the U.S., the Animal Antibiotics and Antimicrobials Market generated USD 1.8 billion in 2024. The country's advanced veterinary infrastructure, high rates of pet ownership, and well-established livestock industry have fueled the demand for antibiotics and antimicrobials. Rising investments in animal healthcare, coupled with an increasing number of product registrations and approvals, continue to drive market growth. The U.S. remains a prominent player in the market due to its focus on enhancing animal health outcomes and preventing the spread of zoonotic diseases.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership rate

- 3.2.1.2 Expanding livestock production

- 3.2.1.3 Rising research and development funding

- 3.2.1.4 Growing awareness of animal healthcare spurring demand for preventive treatment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of treatments

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Penicillins

- 5.3 Tetracyclines

- 5.4 Sulfonamides

- 5.5 Macrolides

- 5.6 Aminoglycosides

- 5.7 Lincosamides

- 5.8 Fluoroquinolones

- 5.9 Cephalosporins

- 5.10 Other antibiotics and antimicrobial products

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Horses

- 6.2.4 Other companion animals

- 6.3 Livestock animals

- 6.3.1 Cattle

- 6.3.2 Swine

- 6.3.3 Poultry

- 6.3.4 Fish

- 6.3.5 Other livestock animals

Chapter 7 Market Estimates and Forecast, By Mode of Delivery, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Injections

- 7.5 Other modes of delivery

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AdvaCare Pharma

- 10.2 Boehringer Ingelheim International

- 10.3 Ceva

- 10.4 Dechra

- 10.5 Meiji Holdings

- 10.6 Merck & Co.

- 10.7 Vetoquinol

- 10.8 Virbac

- 10.9 Zoetis

- 10.10 Zovixpharma