|

市场调查报告书

商品编码

1716473

碳纤维复合材料市场机会、成长动力、产业趋势分析及2025-2034年预测Carbon Fibre Composites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

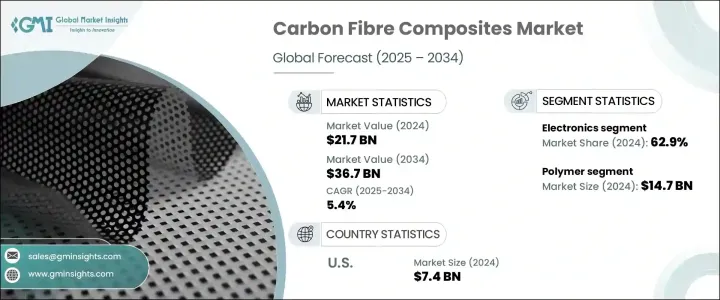

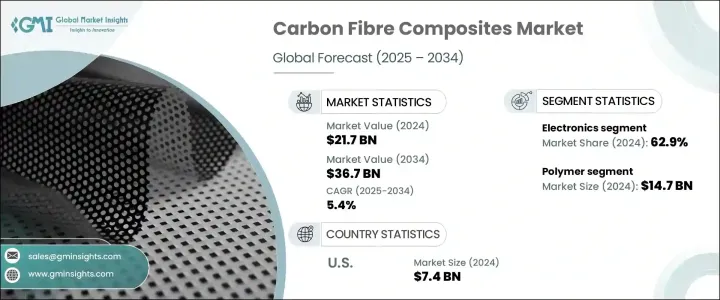

2024 年全球碳纤维复合材料市场价值为 217 亿美元,预计 2025 年至 2034 年期间将以 5.4% 的复合年增长率稳步增长。这一增长反映了各终端行业对高性能、轻质和耐用材料日益增长的需求。随着各行各业朝着永续发展的方向发展,製造商越来越多地选择碳纤维复合材料,因为与金属和合金等传统材料相比,碳纤维复合材料具有更优异的强度重量比、耐腐蚀性和长期耐用性。尤其是航太和汽车产业,在采用碳纤维复合材料以减轻结构重量、提高燃油效率和满足不断发展的减排监管标准方面处于领先地位。这些复合材料在飞机机身、汽车车身面板和风力涡轮机叶片等先进工程应用中变得不可或缺。

此外,随着运动器材、建筑、船舶和能源等行业寻求在不影响重量或强度的情况下提供增强性能的材料,碳纤维复合材料正迅速成为首选。此外,製造技术的不断进步和生产可扩展性的提高有望降低成本,使这些复合材料更适用于更广泛的应用。电动车(EV)的激增,加上对再生能源基础设施的投资不断增加,继续扩大碳纤维复合材料的应用基础,反映出一个充满活力、准备大幅扩张的市场。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 217亿美元 |

| 预测值 | 367亿美元 |

| 复合年增长率 | 5.4% |

市场根据基质材料和聚合物进行细分,其中聚合物市场在 2024 年创收 147 亿美元,预计年增长率为 5.5%。聚合物技术的创新,尤其是那些旨在增强机械性能和抵抗环境压力的技术,在市场的成长轨迹中发挥着至关重要的作用。热固性聚合物因其强度高、重量轻而广受认可,广泛应用于耐用性至关重要的结构部件中。另一方面,热塑性复合材料因其柔韧性、抗衝击性和可回收性而越来越受到关注,使其在汽车和建筑等适应性至关重要的不同行业中越来越受欢迎。人们越来越关注高性能聚合物以提高最终产品的效率和生命週期,这将进一步推动市场需求。

在各个终端使用领域中,航太在 2024 年占据全球碳纤维复合材料市场的主导份额,碳纤维增强塑胶 (CFRP) 在机身、机身和起落架等关键飞机零件中的使用率不断上升。航太製造商不断利用碳纤维复合材料来增强结构完整性并减轻飞机整体重量,从而提高燃油效率并降低营运成本。该材料固有的抗疲劳和腐蚀性能使其成为生产耐用且安全的航太部件不可或缺的材料。此外,由于客流量激增和航空公司机队扩大,全球航空旅行不断增加,推动了对轻质而坚固材料的需求。

在区域分析中,美国碳纤维复合材料市场在 2024 年创造了 74 亿美元的收入,受益于领先航太製造商的强大影响力以及先进复合材料在飞机设计中的日益融合。美国市场也获得了大量研发投资的支持,旨在创造具有增强性能的下一代碳纤维复合材料。随着需求激增,公司正在扩大其分销网络并引入新的供应商,以加强其市场影响力并满足专注于轻质、高性能材料的行业不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 飞机製造商的强大影响力

- 碳纤维复合材料发展的支持措施和计划

- 增加汽车产量

- 风能发电技术的发展和商用车需求的成长

- 基础建设不断推进,碳纤维製造商数量不断增加

- 产业陷阱与挑战

- 碳复合材料回收的复杂性以及高成本

- 严格的环境法规

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依基质材料,2021 年至 2034 年

- 主要趋势

- 聚合物

- 热固性

- 热塑性塑料

- 碳

- 陶瓷

- 金属

- 杂交种

第六章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 航太

- 汽车

- 风力涡轮机

- 运动与休閒

- 土木工程

- 海洋

- 其他的

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Advanced Composites

- Formosa Plastics

- Hengshen

- Hexcel Corporation

- HS Hyosung Advanced Materials

- Huayuan Advanced Materials

- Mitsubishi Chemical Group

- Nippon Graphite Fiber

- Rock West Composites

- SGL Carbon

- Solvay

- Strongwell Corporation

- Teijin

- Toray Industries

- ZOLTEK Corporation

The Global Carbon Fibre Composites Market, valued at USD 21.7 billion in 2024, is projected to witness steady growth at a CAGR of 5.4% from 2025 to 2034. This growth reflects the rising demand for high-performance, lightweight, and durable materials across various end-use industries. As industries push toward sustainability, manufacturers are increasingly turning to carbon fiber composites for their superior strength-to-weight ratio, corrosion resistance, and long-term durability compared to traditional materials like metals and alloys. The aerospace and automotive sectors, in particular, are leading the way in adopting carbon fibre composites to reduce structural weight, enhance fuel efficiency, and meet evolving regulatory standards for emissions reduction. These composites are becoming indispensable in advanced engineering applications such as aircraft fuselages, automotive body panels, and wind turbine blades.

Additionally, as industries such as sports equipment, construction, marine, and energy seek materials that offer enhanced performance without compromising on weight or strength, carbon fibre composites are rapidly emerging as a preferred choice. Moreover, ongoing advancements in manufacturing techniques and increasing production scalability are expected to drive down costs, making these composites more accessible for broader applications. The surge in electric vehicles (EVs), combined with rising investments in renewable energy infrastructure, continues to expand the application base of carbon fibre composites, reflecting a dynamic market poised for substantial expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.7 Billion |

| Forecast Value | $36.7 Billion |

| CAGR | 5.4% |

The market is segmented based on matrix materials and polymers, with the polymer segment generating USD 14.7 billion in 2024 and projected to grow at an annual rate of 5.5%. Innovations in polymer technologies, especially those designed for enhanced mechanical properties and resistance to environmental stress, are playing a crucial role in the market's growth trajectory. Thermosetting polymers, widely recognized for their strength and lightweight, are extensively used in structural components where durability is key. On the other hand, thermoplastic composites are gaining traction due to their flexibility, impact resistance, and recyclability, making them increasingly popular across diverse industries such as automotive and construction where adaptability is vital. The growing focus on high-performance polymers to improve the efficiency and lifecycle of final products is set to further drive market demand.

Among various end-use sectors, aerospace holds a dominant share of the global carbon fibre composites market in 2024, with rising utilization of carbon fibre-reinforced plastics (CFRP) in critical aircraft components like airframes, fuselages, and landing gear. Aerospace manufacturers are continuously leveraging carbon fibre composites to enhance structural integrity and reduce overall aircraft weight, which leads to improved fuel efficiency and lower operating costs. The material's inherent resistance to fatigue and corrosion makes it indispensable for producing durable and safe aerospace components. Moreover, increasing global air travel, driven by surging passenger traffic and expanding airline fleets, is propelling the demand for lightweight yet robust materials.

In regional analysis, the U.S. Carbon Fibre Composites Market generated USD 7.4 billion in 2024, benefiting from a strong presence of leading aerospace manufacturers and the rising integration of advanced composite materials in aircraft designs. The U.S. market is also supported by significant investments in research and development aimed at creating next-generation carbon fibre composites with enhanced performance attributes. As demand surges, companies are expanding their distribution networks and onboarding new suppliers to strengthen their market presence and meet the evolving needs of industries focusing on lightweight, high-performance materials.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Strong presence of aircraft manufacturers

- 3.6.1.2 Supportive initiatives and programs for development of carbon fibre composites

- 3.6.1.3 Increasing vehicle production

- 3.6.1.4 Development in wind energy generation technologies and growing commercial vehicles demand

- 3.6.1.5 Growing infrastructure development and rising presence of carbon fibre manufacturers

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complexity associated with recycling along with high costs of carbon composites

- 3.6.2.2 Stringent environmental regulations

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Matrix Material, 2021 – 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Polymer

- 5.2.1 Thermosetting

- 5.2.2 Thermoplastics

- 5.3 Carbon

- 5.4 Ceramics

- 5.5 Metal

- 5.6 Hybrid

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Aerospace

- 6.3 Automotive

- 6.4 Wind turbines

- 6.5 Sport & leisure

- 6.6 Civil engineering

- 6.7 Marine

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Neatherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Advanced Composites

- 8.2 Formosa Plastics

- 8.3 Hengshen

- 8.4 Hexcel Corporation

- 8.5 HS Hyosung Advanced Materials

- 8.6 Huayuan Advanced Materials

- 8.7 Mitsubishi Chemical Group

- 8.8 Nippon Graphite Fiber

- 8.9 Rock West Composites

- 8.10 SGL Carbon

- 8.11 Solvay

- 8.12 Strongwell Corporation

- 8.13 Teijin

- 8.14 Toray Industries

- 8.15 ZOLTEK Corporation