|

市场调查报告书

商品编码

1716476

透析市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dialysis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

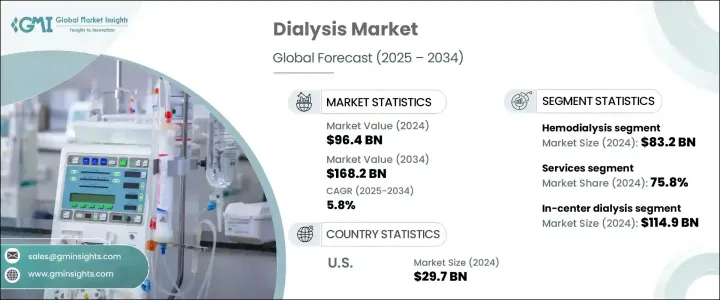

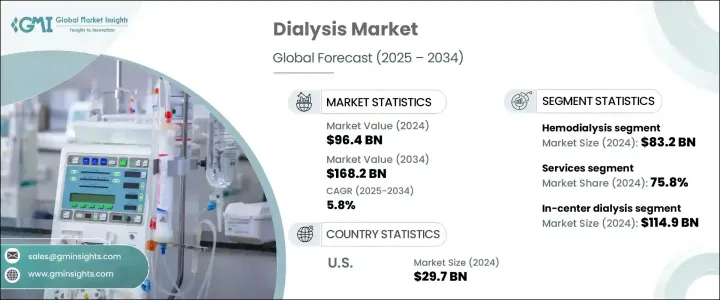

2024 年全球透析市场规模达到 964 亿美元,预计 2025 年至 2034 年间将呈现 5.8% 的复合年增长率,呈现稳定成长态势。这一增长主要受全球慢性肾病 (CKD)、终末期肾病 (ESRD) 发病率上升以及人口老化加快的推动。糖尿病和高血压是肾衰竭的两个主要原因,其负担日益加重,进一步推动了对透析治疗的需求。随着医疗保健系统面临越来越大的提供有效肾臟护理的压力,全球透析市场有望大幅扩张。此外,透析技术的进步、医疗保健支出的增加以及公共和私营部门推动的医疗保健框架的改善也促进了该市场的成长。

随着人们对肾臟疾病的认识不断提高以及患者获得创新透析疗法的机会增多,对家庭和中心透析服务的需求也在激增。此外,远距医疗、远距病人监控和具有使用者友好设计和改进的生物相容性的下一代透析机的整合正在改变治疗格局,使患者能够接受更安全、更有效的透析治疗。个人化照护的转变和家庭透析应用的成长趋势预计将在未来十年进一步加速市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 964亿美元 |

| 预测值 | 1682亿美元 |

| 复合年增长率 | 5.8% |

透析市场大致分为两大类:血液透析和腹膜透析。 2024 年,血液透析占据主导地位,创造 832 亿美元的收入。随着全球 CKD 和 ESRD 病例持续攀升,医疗保健系统满足日益增长的血液透析服务需求的压力也越来越大。血液透析仍然是最广泛使用的治疗方法,主要是因为它对治疗晚期肾衰竭具有很高的疗效。血液透析机的持续创新,包括 Dialyzer HDF、生物相容性透析器、远端监控系统和改进的人体工学设备的开发,正在提高治疗效果和患者的舒适度。这些进步有望推动全球血液透析的普及,尤其是当越来越多的患者寻求可靠、有效的长期治疗方案时。

透析市场进一步分为服务、消耗品和设备,其中服务占据主导地位,到 2024 年将创造 758 亿美元的市场价值。预计到 2034 年,服务部门的复合年增长率将达到 5.7%,包括慢性透析和急性透析服务,但慢性透析占大部分份额。 CKD 患者通常需要持续透析治疗,例如每週三到四次血液透析或每天进行腹膜透析。对透析服务的持续需求确保了稳定的收入来源,推动了该领域的长期成长。

光是美国透析市场在 2024 年的价值就达到 297 亿美元,预计 2025 年至 2034 年的复合年增长率为 6%。作为最先进的医疗保健市场之一,美国在采用尖端透析技术和家庭透析解决方案方面处于领先地位。凭藉完善的专业透析中心和强大的基础设施,该国正日益转向远端患者监控和家庭治疗。 Fresenius Medical Care 和 DaVita Inc. 等主要市场参与者正在扩大其服务网络并整合先进的透析设备以满足不断增长的需求。对创新、患者友善解决方案的推动继续促进美国市场的成长,使其成为全球透析市场的主要贡献者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 末期肾病(ESRD)患者数量不断增加

- 糖尿病发生率上升

- 肾臟捐赠短缺

- 透析治疗的有利报销方案

- 已开发国家和开发中国家的研发投资不断增加

- 产业陷阱与挑战

- 产品召回

- 透析治疗相关併发症

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 报销场景

- 波特的分析

- PESTEL分析

- 差距分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 血液透析

- 腹膜透析

第六章:市场估计与预测:按产品和服务,2021 - 2034 年

- 主要趋势

- 服务

- 慢性透析

- 急性透析

- 耗材

- 透析器

- 导管

- 访问产品

- 浓缩物

- 其他耗材

- 装置

- 透析机

- 水处理系统

- 其他设备

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 中心透析

- 居家透析

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- angiodynamics

- Asahi KASEI

- B. Braun

- Baxter

- Becton, Dickinson and Company

- DaVita

- Dialife

- Fresenius

- JMS

- Medtronic

- NIKKISO

- NIPRO

- Rogosin Institute

- SATELLITE HEALTHCARE

- SB-KAWASUMI

- Teleflex

- TORAY

- US RENAL CARE

The Global Dialysis Market reached USD 96.4 billion in 2024 and is expected to witness a steady growth trajectory at a CAGR of 5.8% between 2025 and 2034. This growth is primarily driven by the rising incidence of chronic kidney disease (CKD), end-stage renal disease (ESRD), and a rapidly aging population worldwide. The increasing burden of diabetes and hypertension, the two major causes of kidney failure, is further propelling the demand for dialysis treatments. With healthcare systems under mounting pressure to provide effective renal care, the global dialysis market is poised to expand significantly. Additionally, advancements in dialysis technology, growing healthcare expenditures, and improved healthcare frameworks driven by public and private sectors are contributing to this market's growth.

The demand for home-based and in-center dialysis services is also surging, supported by rising awareness of renal diseases and enhanced patient access to innovative dialysis therapies. Furthermore, the integration of telemedicine, remote patient monitoring, and next-generation dialysis machines with user-friendly designs and improved biocompatibility are transforming the treatment landscape, allowing patients to undergo safer and more efficient dialysis sessions. The shift toward personalized care and the growing trend of home dialysis adoption are expected to further accelerate market expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $96.4 Billion |

| Forecast Value | $168.2 Billion |

| CAGR | 5.8% |

The dialysis market is broadly segmented into two main types-hemodialysis and peritoneal dialysis. Hemodialysis accounted for a dominant share in 2024, generating USD 83.2 billion in revenue. As CKD and ESRD cases continue to climb globally, the pressure on healthcare systems to meet the growing demand for hemodialysis services is intensifying. Hemodialysis remains the most widely used treatment method, primarily because of its high efficacy in managing advanced kidney failure. The ongoing innovations in hemodialysis machines, including the development of Dialyzer HDF, biocompatible dialyzers, telemonitoring systems, and improved ergonomic equipment, are enhancing treatment outcomes and patient comfort. These advancements are expected to boost the adoption of hemodialysis worldwide, especially as more patients seek reliable and efficient long-term treatment options.

The dialysis market is further categorized into services, consumables, and equipment, with services dominating the landscape by generating USD 75.8 billion in 2024. Expected to grow at a 5.7% CAGR through 2034, the services segment includes both chronic and acute dialysis services, though chronic dialysis accounts for the majority share. Patients with CKD typically require ongoing dialysis treatments, such as three to four hemodialysis sessions weekly or daily peritoneal dialysis. This sustained need for dialysis services ensures a consistent revenue stream, driving long-term growth in this segment.

U.S. Dialysis Market alone was valued at USD 29.7 billion in 2024, with an anticipated growth rate of 6% CAGR from 2025 to 2034. As one of the most advanced healthcare markets, the U.S. is at the forefront of adopting cutting-edge dialysis technologies and home dialysis solutions. With well-established specialized dialysis centers and robust infrastructure, the country is witnessing an increasing shift toward remote patient monitoring and home-based treatments. Key market players such as Fresenius Medical Care and DaVita Inc. are expanding their service networks and integrating advanced dialysis equipment to meet rising demand. The push for innovative, patient-friendly solutions continues to enhance market growth across the U.S., positioning it as a leading contributor to the global dialysis market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of end-stage renal diseases (ESRD) patients

- 3.2.1.2 Increasing incidence of diabetes

- 3.2.1.3 Shortage of donor kidneys

- 3.2.1.4 Favorable reimbursement scenario for dialysis treatment

- 3.2.1.5 Growing research and development investments in developed and developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Product recalls

- 3.2.2.2 Complications associated with dialysis treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hemodialysis

- 5.3 Peritoneal dialysis

Chapter 6 Market Estimates and Forecast, By Product and Services, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Services

- 6.2.1 Chronic dialysis

- 6.2.2 Acute dialysis

- 6.3 Consumables

- 6.3.1 Dialyzers

- 6.3.2 Catheters

- 6.3.3 Access products

- 6.3.4 Concentrates

- 6.3.5 Other consumables

- 6.4 Equipment

- 6.4.1 Dialysis machines

- 6.4.2 Water treatment systems

- 6.4.3 Other equipment

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-center dialysis

- 7.3 Home dialysis

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 angiodynamics

- 9.2 Asahi KASEI

- 9.3 B. Braun

- 9.4 Baxter

- 9.5 Becton, Dickinson and Company

- 9.6 DaVita

- 9.7 Dialife

- 9.8 Fresenius

- 9.9 JMS

- 9.10 Medtronic

- 9.11 NIKKISO

- 9.12 NIPRO

- 9.13 Rogosin Institute

- 9.14 SATELLITE HEALTHCARE

- 9.15 SB-KAWASUMI

- 9.16 Teleflex

- 9.17 TORAY

- 9.18 U.S. RENAL CARE