|

市场调查报告书

商品编码

1716508

资料中心自动化市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Data Center Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

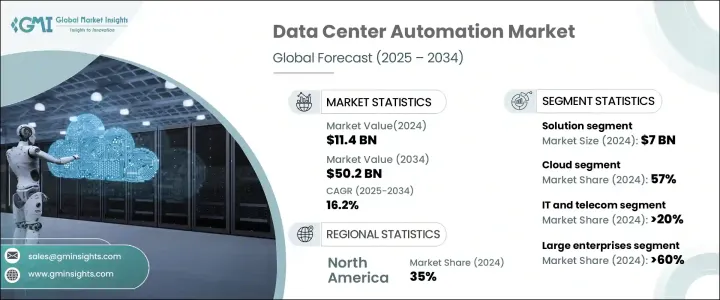

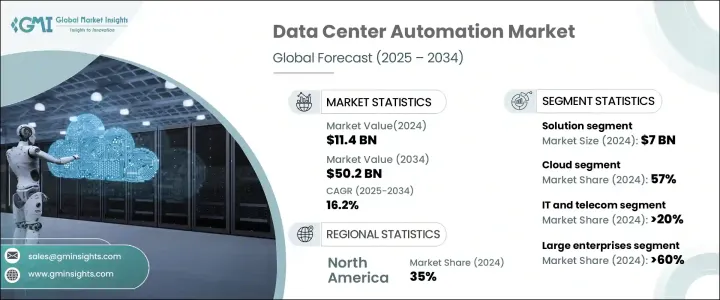

2024 年全球资料中心自动化市场规模达到 114 亿美元,预计 2025 年至 2034 年间将以 16.2% 的强劲复合年增长率成长。这一显着增长得益于云端服务、社交媒体平台、视讯串流的日益普及以及各行各业物联网设备的普及。随着组织转向基于云端的基础设施和数位存储,对高效和自动化资料中心营运的需求变得至关重要。自动化不仅提高了营运效率,还减少了人为错误,确保了大量资料的无缝管理。随着资料复杂性和数量的不断增加,企业正在转向机器学习 (ML)、人工智慧 (AI) 和云端运算等先进技术来增强可扩展性和效能。

这些技术优化了系统流程、最大限度地减少了停机时间并支援预测性维护,使公司在快速发展的数位环境中保持竞争力。此外,对网路安全和资料保护的日益重视促使组织在资料中心实施自动化,确保即时威胁侦测和安全资料处理。随着越来越多的行业采用混合和多云环境,对资料中心自动化解决方案的需求预计将激增,为自动化技术的创新进步铺平道路。政府推动采用数位基础设施和云端技术的倡议进一步加强了市场,使资料中心自动化成为现代商业策略的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 114亿美元 |

| 预测值 | 502亿美元 |

| 复合年增长率 | 16.2% |

资料中心自动化市场主要分为解决方案和服务。解决方案部分占据了 60% 的市场份额,到 2024 年创造了 70 亿美元的收入。自动化软体可协助组织优化资源分配、自动执行日常任务并增加资料中心的正常运作时间,确保无缝运作。随着企业努力提高营运效率,对支援即时资料管理和工作负载自动化的先进解决方案的需求持续上升。同时,随着企业在实施和维护自动化系统方面寻求专家指导和持续支持,服务领域正在快速成长。随着技术进步的加速,公司依靠专家见解和策略咨询来最大化其自动化投资的价值并确保长期成功。

从部署模式来看,资料中心自动化市场分为本地解决方案和基于云端的解决方案。受人们对远端可存取性、安全功能和灵活性的日益偏好推动,云端运算领域在 2024 年的份额将达到 57%。云端解决方案可以透过网路连线从任何位置无缝存取资料,使其成为跨多台装置工作的远端团队和个人的理想选择。随着资料安全成为重中之重,云端供应商正在透过提供加密、多因素身份验证和即时威胁监控来加强其安全措施,以保护敏感资讯。

北美资料中心自动化市场占了总市场份额的 35%,2024 年创造了 30 亿美元的市场价值。北美资料中心迅速采用人工智慧、机器学习和其他先进技术,推动了该地区的显着成长。企业越来越多地转向人工智慧驱动的自动化来提高营运效率、加强安全性并实现预测性维护,这导致对资料中心自动化解决方案的需求激增。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 解决方案提供者

- 云端服务供应商

- 系统整合商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 资料量不断成长

- 云端运算、机器学习和人工智慧的兴起

- 降低营运成本

- 解决问题以最大程度地减少停机时间

- 产业陷阱与挑战

- 缺乏熟练的专业人员

- 实施的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 伺服器自动化

- 网路自动化

- 储存自动化

- 安全自动化

- 其他的

- 服务

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 云

第七章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 金融服务业

- 主机託管

- 活力

- 政府

- 卫生保健

- 製造业

- 资讯科技和电信

- 其他的

第九章:市场估计与预测:依资料中心类型,2021 - 2034 年

- 主要趋势

- 企业资料中心

- 主机代管资料中心

- 公共云端资料中心

- 边缘资料中心

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- ABB

- Arista Networks

- BMC Software

- Broadcom

- Cisco

- Citrix

- Fujitsu

- HPE

- Huawei Enterprise

- IBM

- Juniper

- Microsoft

- NTT Communications

- Open Text (Micro Focus)

- Progress Chef

- Puppet (Perforce)

- Rockwell Automation

- VMware

The Global Data Center Automation Market reached USD 11.4 billion in 2024 and is projected to grow at a robust CAGR of 16.2% between 2025 and 2034. This remarkable growth is driven by the rising adoption of cloud services, social media platforms, video streaming, and the proliferation of IoT devices across industries. As organizations shift towards cloud-based infrastructure and digital storage, the need for efficient and automated data center operations has become paramount. Automation not only improves operational efficiency but also reduces human errors, ensuring seamless management of vast amounts of data. With increasing data complexity and volume, businesses are turning to advanced technologies like machine learning (ML), artificial intelligence (AI), and cloud computing to enhance scalability and performance.

These technologies optimize system processes, minimize downtime, and support predictive maintenance, allowing companies to stay competitive in a rapidly evolving digital landscape. Moreover, the growing emphasis on cybersecurity and data protection is pushing organizations to implement automation in data centers, ensuring real-time threat detection and secure data handling. As more industries adopt hybrid and multi-cloud environments, the demand for data center automation solutions is expected to surge, paving the way for innovative advancements in automation technologies. Government initiatives promoting the adoption of digital infrastructure and cloud technologies further strengthen the market, making data center automation a critical component of modern business strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.4 Billion |

| Forecast Value | $50.2 Billion |

| CAGR | 16.2% |

The data center automation market is primarily segmented into solutions and services. The solution segment dominated the market with a 60% share, generating USD 7 billion in 2024. Automation software helps organizations optimize resource allocation, automate routine tasks, and increase the uptime of data centers, ensuring seamless operations. As businesses strive to enhance operational efficiency, the demand for advanced solutions that enable real-time data management and workload automation continues to rise. Meanwhile, the service segment is growing rapidly as organizations seek expert guidance and ongoing support in implementing and maintaining automated systems. As technological advancements accelerate, companies rely on expert insights and strategic consulting to maximize the value of their automation investments and ensure long-term success.

In terms of deployment mode, the data center automation market is divided into on-premises and cloud-based solutions. The cloud segment held a 57% share in 2024, driven by the growing preference for remote accessibility, security features, and flexibility. Cloud solutions enable seamless access to data from any location through an internet connection, making them ideal for remote teams and individuals working across multiple devices. With data security becoming a top priority, cloud providers are enhancing their security measures by offering encryption, multi-factor authentication, and real-time threat monitoring to protect sensitive information.

North America data center automation market accounted for 35% of the total market share, generating USD 3 billion in 2024. The rapid adoption of AI, ML, and other advanced technologies across data centers in North America is driving significant growth in the region. Businesses are increasingly turning to AI-driven automation to enhance operational efficiency, strengthen security, and enable predictive maintenance, contributing to the surging demand for data center automation solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Solution providers

- 3.2.2 Cloud service providers

- 3.2.3 System integrators

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising volumes of data

- 3.8.1.2 The rise of cloud computing, machine learning and artificial intelligence

- 3.8.1.3 Reduction of operational cost

- 3.8.1.4 Resolve issues to minimize the downtime

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lack of skilled professionals

- 3.8.2.2 Complexity in implementation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Server automation

- 5.2.2 Network automation

- 5.2.3 Storage automation

- 5.2.4 Security automation

- 5.2.5 Others

- 5.3 Service

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-Premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Colocation

- 8.4 Energy

- 8.5 Government

- 8.6 Healthcare

- 8.7 Manufacturing

- 8.8 IT & Telecom

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Data Center Type, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Enterprise data center

- 9.3 Colocation data center

- 9.4 Public cloud data center

- 9.5 Edge data center

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Arista Networks

- 11.3 BMC Software

- 11.4 Broadcom

- 11.5 Cisco

- 11.6 Citrix

- 11.7 Fujitsu

- 11.8 HPE

- 11.9 Huawei Enterprise

- 11.10 IBM

- 11.11 Juniper

- 11.12 Microsoft

- 11.13 NTT Communications

- 11.14 Open Text (Micro Focus)

- 11.15 Progress Chef

- 11.16 Puppet (Perforce)

- 11.17 Rockwell Automation

- 11.18 VMware