|

市场调查报告书

商品编码

1716509

电解质饮料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electrolyte Drink Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

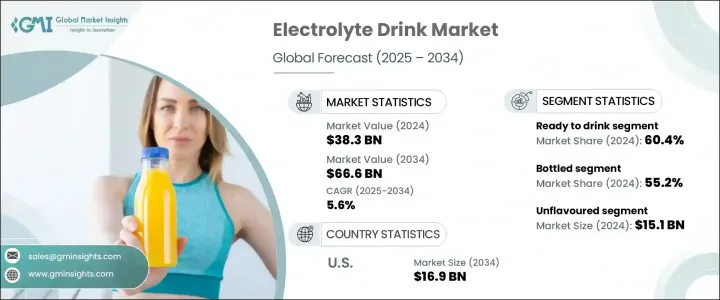

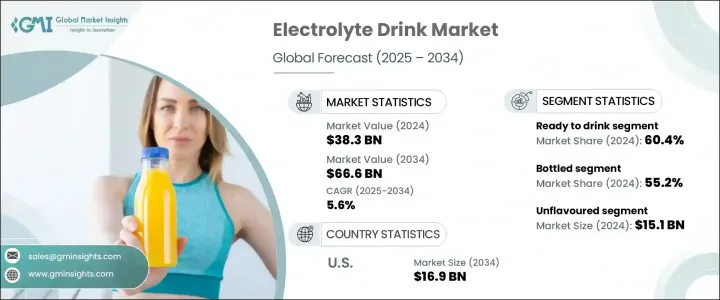

2024 年全球电解质饮料市场价值为 383 亿美元,预计 2025 年至 2034 年的复合年成长率为 5.6%。这一稳定的市场扩张主要得益于消费者越来越意识到补水在整体健康和保健中的重要作用。随着健身趋势的兴起,越来越多的人开始透过电解质饮料来补充流失的矿物质和液体,以确保在体育活动中达到最佳表现。无论是运动员、健身爱好者或过着积极生活方式的个人,对功能性饮料的需求都在不断成长。人们对体育、户外活动和整体健康日益成长的兴趣正在推动市场向前发展。

除了健身圈之外,电解质饮料在日常消费者中也越来越受欢迎,因为他们希望在忙碌的生活中保持水分。人们向更健康的生活方式转变加速了对这些饮料的需求,尤其是上班族、旅客以及那些寻求含糖苏打水和人工能量饮料替代品的人。各大品牌正在利用这一趋势,推出各种口味、创新配方和永续包装,以满足不断变化的消费者偏好。市场竞争日益激烈,迫使企业透过先进的成分组合、清洁标籤配方和策略行销活动来实现差异化。因此,电解质饮料不再只是运动员的小众产品,而是正在成为补水的主流选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 383亿美元 |

| 预测值 | 666亿美元 |

| 复合年成长率 | 5.6% |

市场依产品类型细分,包括即饮饮料、锭剂、粉末等。即饮电解质饮料因其便利性和广泛性而占据市场主导地位。同时,受携带式和易于使用的补水解决方案的需求推动,平板电脑预计在预测期内以 5.3% 的复合年成长率成长。粉状电解质饮料通常受到健身爱好者和运动员的青睐,由于其可客製化的份量和经济高效的批量购买选择,越来越受到人们的青睐。

包装创新也在市场成长中发挥关键作用。 2024 年,瓶装电解质饮料占了 55.2% 的市场占有率,其受欢迎程度源自于易于使用和携带。许多製造商专注于永续和环保的包装,包括不含 BPA 的塑胶、可回收材料和可生物分解的袋子,以吸引有环保意识的消费者。永续发展的推动预计将塑造未来的包装趋势,影响购买决策和品牌忠诚度。

受美国强劲的健身文化以及人们对健康和补水益处的认知不断提高的推动,美国电解质饮料市场在 2024 年创造了 99 亿美元的收入。消费者越来越倾向于符合现代健康趋势的低糖、清洁标籤的电解质饮料。即饮型和粉状电解质饮料越来越受到人们的欢迎,因为它们既方便又不影响品质。随着越来越多的人关注健康,市场对满足特定健康需求的电解质饮料的需求激增,包括添加维生素、天然成分和减少人工添加剂的饮料。传统品牌和新兴品牌都在不断创新,以满足不断变化的消费者期望,推动整体市场扩张。

目录

第1章:方法论与范围

第2章:执行摘要

第3章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和举措

- 监管格局

- 产业衝击力

- 成长动力

- 提高消费者对补水在整体健康中的作用的认知

- 越来越多的人参与健身活动和体育运动,增加了对补水和恢復饮料的需求。

- 人们越来越喜欢天然、低糖和清洁标籤的产品

- 产业陷阱与挑战

- 消费者的成本意识,尤其是在新兴市场,可能会限制高阶产品的成长潜力。

- 椰子水、调味水和其他天然替代品的竞争构成了威胁。

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第4章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第5章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 即饮

- 平板电脑

- 粉末

- 其他

第6章:市场估计与预测:按包装,2021 年至 2034 年

- 主要趋势

- 瓶子

- 能

- 小袋

第7章:市场估计与预测:依口味,2021 年至 2034 年

- 主要趋势

- 无味

- 调味

第8章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 离线

- 线上

第9章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯联合大公国

第10章:公司简介

- Abbott Laboratories

- CLEAN CAUSE

- Coca-Cola

- Hydralyte

- Kraft Heinz

- Liquid IV

- Nooma

- Nuun

- PepsiCo

- PURE Sports Nutrition

The Global Electrolyte Drink Market was valued at USD 38.3 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. This steady market expansion is primarily driven by the increasing consumer awareness of the essential role hydration plays in overall health and wellness. As fitness trends gain momentum, more people are turning to electrolyte drinks to replenish lost minerals and fluids, ensuring optimal performance during physical activities. Whether it's athletes, fitness enthusiasts, or individuals leading an active lifestyle, the demand for functional beverages is on the rise. The growing interest in sports, outdoor activities, and overall well-being is propelling the market forward.

Beyond fitness circles, electrolyte drinks are gaining popularity among everyday consumers looking to maintain hydration in their busy lives. The shift toward healthier lifestyle choices has accelerated demand for these beverages, especially among office-goers, travelers, and those seeking an alternative to sugary sodas and artificial energy drinks. Brands are capitalizing on this trend by introducing a variety of flavors, innovative formulations, and sustainable packaging to cater to evolving consumer preferences. The market is becoming increasingly competitive, pushing companies to differentiate themselves through advanced ingredient combinations, clean-label formulations, and strategic marketing campaigns. As a result, electrolyte drinks are no longer just a niche product for athletes but are becoming a mainstream choice for hydration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $38.3 Billion |

| Forecast Value | $66.6 Billion |

| CAGR | 5.6% |

The market is segmented by product type, including ready-to-drink beverages, tablets, powders, and others. Ready-to-drink electrolyte beverages dominate the market due to their convenience and widespread availability. Meanwhile, tablets are anticipated to grow at a CAGR of 5.3% during the forecast period, driven by the demand for portable and easy-to-use hydration solutions. Powdered electrolyte drinks, often preferred by fitness enthusiasts and athletes, are gaining traction as they allow for customizable serving sizes and cost-effective bulk purchasing options.

Packaging innovations are also playing a critical role in market growth. Bottled electrolyte drinks accounted for 55.2% of the market share in 2024, with their popularity stemming from ease of use and portability. Many manufacturers are focusing on sustainable and eco-friendly packaging, including BPA-free plastic, recyclable materials, and biodegradable pouches, to appeal to environmentally conscious consumers. The push for sustainability is expected to shape future packaging trends, influencing purchasing decisions and brand loyalty.

The U.S. Electrolyte Drink Market generated USD 9.9 billion in 2024, fueled by the country's robust fitness culture and heightened awareness of health and hydration benefits. Consumers are increasingly gravitating toward low-sugar, clean-label electrolyte beverages that align with modern health trends. Ready-to-drink and powdered electrolyte drinks are gaining significant traction, as they offer convenience without compromising on quality. As more individuals focus on wellness, the market is witnessing a surge in demand for electrolyte drinks that cater to specific health needs, including those with added vitamins, natural ingredients, and reduced artificial additives. Both legacy brands and emerging players are innovating to meet evolving consumer expectations, driving overall market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing consumer awareness of hydration’s role in overall wellness

- 3.6.1.2 Rising participation in fitness activities and sports boosts the need for hydration and recovery drinks.

- 3.6.1.3 Growing preference for natural, low-sugar, and clean-label products

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Consumers cost-consciousness, especially in emerging markets, can limit growth potential for premium products.

- 3.6.2.2 Competition from coconut water, flavored waters, and other natural alternatives poses a threat.

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product type, 2021 – 2034 (USD Bn) (Ton)

- 5.1 Key trends

- 5.2 Ready to drink

- 5.3 Tablets

- 5.4 Powder

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging, 2021 – 2034 (USD Bn) (Ton)

- 6.1 Key trends

- 6.2 Bottle

- 6.3 Can

- 6.4 Pouch

Chapter 7 Market Estimates and Forecast, By Flavour, 2021 – 2034 (USD Bn) (Ton)

- 7.1 Key trends

- 7.2 Unflavoured

- 7.3 Flavoured

Chapter 8 Market Estimates and Forecast, By Distribution channel, 2021 – 2034 (USD Bn) (Ton)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn) (Ton)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 CLEAN CAUSE

- 10.3 Coca-Cola

- 10.4 Hydralyte

- 10.5 Kraft Heinz

- 10.6 Liquid IV

- 10.7 Nooma

- 10.8 Nuun

- 10.9 PepsiCo

- 10.10 PURE Sports Nutrition