|

市场调查报告书

商品编码

1716511

可重复使用运载火箭市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Reusable Launch Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

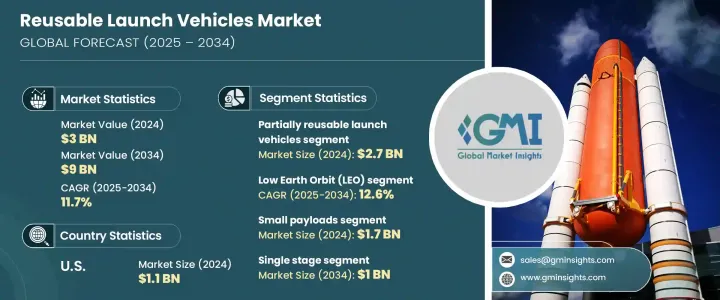

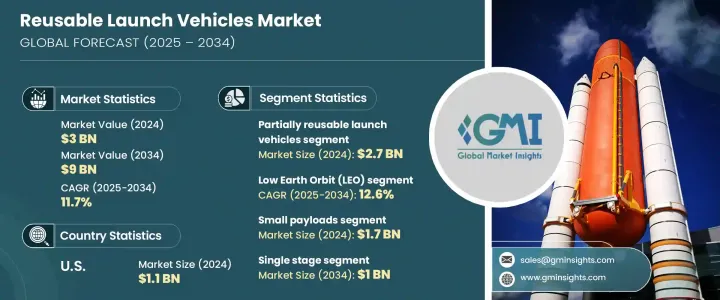

2024 年全球可重复使用运载火箭市场规模达 30 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 11.7%。对经济高效且可靠的太空访问的需求不断增长,推动了这一增长,因为可重复使用运载火箭 (RLV) 为传统消耗性火箭提供了更经济的替代方案。随着通讯、地球观测、导航和防御等应用的卫星发射频率不断增加,可重复使用解决方案的需求也变得更加明显。这些飞行器能够使用相同的硬体进行多次发射,从而显着降低太空任务的成本,使太空探索和卫星部署更加永续和商业可行。

人们对太空旅游的兴趣日益浓厚,以及航太业私部门措施的不断增加也促进了市场的成长。航太机构和私人公司都在大力投资开发下一代 RLV,以提高有效载荷能力、缩短週转时间并提高营运效率。此外,材料、推进系统和人工智慧驱动的发射技术的进步有助于延长可重复使用零件的使用寿命,进一步推动这些飞行器的普及。全球市场正在见证政府和私人投资的增加,旨在建立强大的太空基础设施,以支持科学研究、国防和商业应用的持续发射。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 90亿美元 |

| 复合年增长率 | 11.7% |

可重复使用运载火箭市场按运载火箭类型和轨道范围细分。运载工具类型包括部分可重复使用和完全可重复使用的运载工具。预计到 2034 年,完全可重复使用的运载火箭将创造 12 亿美元的市场价值。该领域仍处于发展的早期阶段,正在进行的研究和开发重点是缩短週转时间并最大限度地降低营运成本。随着人们对太空探索、卫星巨型星座和行星际任务的兴趣日益增长,完全可重复使用的运载火箭将带来巨大的长期利益,包括降低发射成本和加速部署週期。在改进热屏蔽、着陆系统和快速翻新过程方面的投资不断增加,正在加速未来任务中完全可重复使用系统的可行性。

市场也按轨道类型分类,包括地球静止轨道 (GEO)、低地球轨道 (LEO)、中地球轨道 (MEO) 和超地球轨道 (BEO)。 2024 年,MEO 细分市场占有 8.9% 的市场份额,主要原因是对安全军事通讯的需求不断增长,以及可重复使用的运载火箭能够有效地将大型长寿命卫星部署到这些轨道上的能力。随着军事和商业应用的不断扩大,使 MEO 更易于用于可重复使用运载火箭的进步预计将刺激进一步的市场成长。

2024 年,美国可重复使用运载火箭市场价值将达到 11 亿美元,这得益于美国成熟的航太工业以及专门从事可重复使用发射技术的领先製造商的存在。美国航太发射活动数量的不断增加,加上对提高成本效益和可靠性的关注,正在推动市场成长。随着太空探索的不断创新以及政府和私营部门的持续投资,美国预计将继续保持可重复使用运载火箭开发和应用的全球领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 对绕地球运行的卫星的需求不断增长

- 增加政府和军事投资

- 可重复使用性的技术进步

- 太空旅游和亚轨道飞行的兴起

- 太空製造和研究的增加

- 产业陷阱与挑战

- 初期开发成本高

- 可重复使用周期有限

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

- 子系统分析

- 导引、导航和控制系统

- 推进系统

- 遥测、追踪与指挥系统

- 电力系统

- 其他的

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按车型,2021 年至 2034 年

- 主要趋势

- 部分可重复使用的运载火箭

- 完全可重复使用的运载火箭

第六章:市场估计与预测:按轨道类型,2021 年至 2034 年

- 主要趋势

- 低地球轨道(LEO)

- 中地球轨道(MEO)

- 地球静止轨道(GEO)

- 超越地球轨道(BEO)

第七章:市场估计与预测:依酬载容量,2021 年至 2034 年

- 主要趋势

- 有效载荷较小(最多 2,000 公斤)

- 中等有效载重(2,000 公斤至 10,000 公斤)

- 重载(10,000 公斤以上)

第八章:市场估计与预测:依配置,2021 年至 2034 年

- 主要趋势

- 单级

- 多级

第九章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 卫星发射

- 太空探索

- 太空旅游

- 货物运输

- 其他的

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 政府

- 商业的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十二章:公司简介

- Arianespace

- Blue Origin

- Boeing

- China Aerospace Science and Technology Corporation (CASC)

- Lockheed Martin

- Mitsubishi Heavy Industries

- Northrop Grumman

- Relativity Space

- Rocket Lab

- Roscosmos

- Sierra Nevada Corporation

- SpaceX

- Virgin Galactic

The Global Reusable Launch Vehicles Market generated USD 3 billion in 2024 and is projected to grow at a CAGR of 11.7% between 2025 and 2034. The rising demand for cost-effective and reliable space access is fueling this growth, as reusable launch vehicles (RLVs) offer a more economical alternative to traditional expendable rockets. With the increasing frequency of satellite launches for applications such as communication, Earth observation, navigation, and defense, the need for reusable solutions is becoming more pronounced. These vehicles significantly reduce the cost of space missions by enabling multiple launches with the same hardware, making space exploration and satellite deployment more sustainable and commercially viable.

The growing interest in space tourism and the increasing number of private-sector initiatives in the aerospace industry are also contributing to market growth. Space agencies and private companies alike are investing heavily in developing next-generation RLVs to improve payload capacities, reduce turnaround times, and enhance operational efficiencies. Moreover, advancements in materials, propulsion systems, and AI-driven launch technologies are helping extend the lifespan of reusable components, further driving the adoption of these vehicles. The global market is witnessing increased government and private investments aimed at establishing a robust space infrastructure that supports continuous launches for scientific research, defense, and commercial applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $9 Billion |

| CAGR | 11.7% |

The market for reusable launch vehicles is segmented by vehicle type and orbital range. Vehicle types include partially reusable and fully reusable launch vehicles. Fully reusable launch vehicles are expected to generate USD 1.2 billion by 2034. This segment is still in the early stages of development, with ongoing research and development focused on enhancing turnaround times and minimizing operational costs. As interest in space exploration, satellite mega-constellations, and interplanetary missions grows, fully reusable launch vehicles are poised to offer substantial long-term benefits, including reduced launch costs and faster deployment cycles. Increasing investments in improving thermal shielding, landing systems, and rapid refurbishment processes are accelerating the viability of fully reusable systems for future missions.

The market is also classified by orbit type, including Geostationary Orbit (GEO), Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Beyond Earth Orbit (BEO). The MEO segment held an 8.9% market share in 2024, primarily driven by the increasing demand for secure military communications and the ability of reusable launch vehicles to efficiently deploy large, long-life satellites into these orbits. As military and commercial applications continue to expand, advancements in making MEO more accessible to reusable launch vehicles are expected to stimulate further market growth.

The U.S. reusable launch vehicles market was valued at USD 1.1 billion in 2024, driven by the country's well-established space industry and the presence of leading manufacturers specializing in reusable launch technologies. The growing number of space launch activities in the U.S., coupled with a focus on improving cost-efficiency and reliability, is propelling market growth. With continuous innovation in space exploration and sustained government and private sector investments, the U.S. is expected to remain a global leader in reusable launch vehicle development and adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for satellites orbiting the Earth

- 3.2.1.2 Increasing government and military investments

- 3.2.1.3 Technological advancements in reusability

- 3.2.1.4 Rise of space tourism and suborbital flights

- 3.2.1.5 Increase in space-based manufacturing and research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial development costs

- 3.2.2.2 Limited reusability cycles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Subsystem analysis

- 3.10.1 Guidance, navigation & control systems

- 3.10.2 Propulsion systems

- 3.10.3 Telemetry, tracking & command systems

- 3.10.4 Electrical power systems

- 3.10.5 Others

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vehicle Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Partially reusable launch vehicles

- 5.3 Fully reusable launch vehicles

Chapter 6 Market Estimates and Forecast, By Orbit Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Low Earth Orbit (LEO)

- 6.3 Medium Earth Orbit (MEO)

- 6.4 Geostationary Orbit (GEO)

- 6.5 Beyond Earth Orbit (BEO)

Chapter 7 Market Estimates and Forecast, By Payload Capacity, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Small payloads (up to 2,000 kg)

- 7.3 Medium payloads (2,000 kg to 10,000 kg)

- 7.4 Heavy payloads (above 10,000 kg)

Chapter 8 Market Estimates and Forecast, By Configuration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Single stage

- 8.3 Multi-stage

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Satellite launch

- 9.3 Space exploration

- 9.4 Space tourism

- 9.5 Cargo transport

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Government

- 10.3 Commercial

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Arianespace

- 12.2 Blue Origin

- 12.3 Boeing

- 12.4 China Aerospace Science and Technology Corporation (CASC)

- 12.5 Lockheed Martin

- 12.6 Mitsubishi Heavy Industries

- 12.7 Northrop Grumman

- 12.8 Relativity Space

- 12.9 Rocket Lab

- 12.10 Roscosmos

- 12.11 Sierra Nevada Corporation

- 12.12 SpaceX

- 12.13 Virgin Galactic