|

市场调查报告书

商品编码

1716518

磨床市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Grinding Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

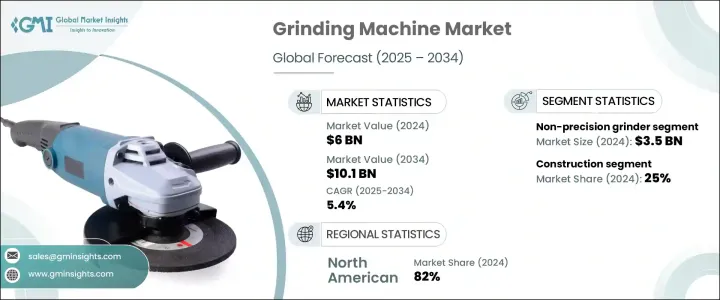

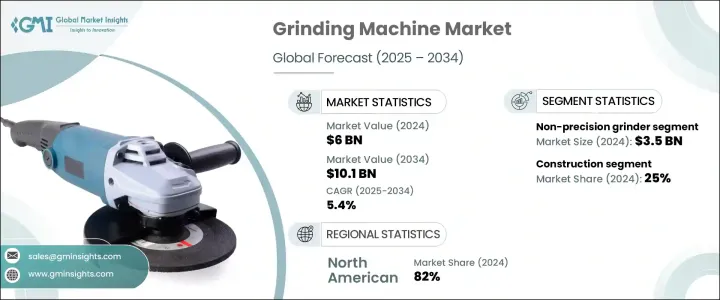

2024 年全球磨床市场价值为 60 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.4%,这得益于精密製造的快速发展、汽车行业的蓬勃发展、工业自动化的不断发展以及金属加工行业的稳步增长。磨床正在成为现代製造业不可或缺的一部分,在生产需要高精度的零件时提供无与伦比的效率和精度。随着全球各行各业都致力于实现卓越的品质、更严格的公差和更快的生产时间,对技术先进的磨床的需求持续增长。这些机器在为复杂部件提供一致、高品质的表面处理方面发挥关键作用,使其成为汽车、航太、建筑和医疗设备製造等行业必不可少的机器。

自动化趋势的日益增长,加上劳动成本的上升,也促使製造商投资于能够确保速度、一致性和最少人工干预的先进研磨技术。此外,随着全球供应链变得越来越复杂,各行各业面临着减少浪费和提高生产力的越来越大的压力,磨床提供了应对现代製造挑战所需的多功能性和精度。从磨削切削刀具到微调重型机械中使用的复杂零件,磨床在广泛的工业应用中证明了其价值,提高了生产能力并确保了零件的耐用性和性能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 60亿美元 |

| 预测值 | 101亿美元 |

| 复合年增长率 | 5.4% |

磨床市场大致分为精密磨床和非精密磨床,每种类型都可满足不同的工业需求。 2024 年,非精密磨床市场的规模为 35 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%。这些机器在需要高吞吐量和基本精加工的大规模生产环境中至关重要。另一方面,精密磨床在需要极高精度和卓越表面光洁度的领域中越来越受欢迎。由于控制系统、高性能感测器和下一代磨料的不断进步,这两种类型的需求都在激增,研磨效率、精度和可靠性得到了显着提高。增强的砂轮、更好的自动化和改进的机器控制有助于提供更光滑的表面光洁度和更高的可重复性 - 这些对于专注于高品质製造和复杂组件设计的行业来说至关重要的因素。

磨床广泛应用于汽车、航太、医疗、建筑和工业製造等行业,每个行业都依赖其製造高精度零件的能力。 2024 年,光是建筑业就占据了近 25% 的市场份额,这得益于重型机械和工具对坚固、精密工程零件的需求。随着全球建筑活动的加剧,特别是在新兴市场,磨床对于钻头、刀片和磨床等设备的研磨至关重要,可确保完美的表面处理和最佳的运作性能。

2024 年,北美磨床市场占有高达 82% 的份额,这得益于自动化、智慧製造技术的快速发展以及对工业升级的大量投资。受基础设施扩张、资料中心发展和能源产业投资的推动,美国建筑业强劲成长,进一步扩大了区域需求。政府旨在实现基础设施现代化和促进工业成长的措施也促进了北美广泛采用先进的研磨解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 精密製造需求

- 工业自动化和智慧製造的进步

- 产业陷阱与挑战

- 技术复杂性与整合挑战

- 初期投资成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 非精密磨床

- 桌上型砂轮机

- 便携式研磨机

- 立式砂轮机

- 柔性磨床

- 精密磨床

- 外圆磨床

- 平面磨床

- 无心磨床

- 工具和刀具磨床

- 其他的

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 汽车

- 航太

- 医疗的

- 建造

- 工业製造

- 电气和电子

- 海洋产业

- 其他

第七章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第八章:公司简介

- Amada Machine Tools

- Danobat

- Doimak

- EMAG

- Gleason

- Haas Automation

- JTEKT Machinery Americas

- Junker

- Kellenberger

- Makino Milling Machine

- Okamoto

- Schaudt Mikrosa

- Studer

- Toyoda Machinery USA Corporation

- United Grinding North America

The Global Grinding Machine Market was valued at USD 6 billion in 2024 and is projected to expand at a CAGR of 5.4% between 2025 and 2034, driven by rapid advancements in precision manufacturing, the surging automotive sector, growing industrial automation, and steady growth in metalworking industries. Grinding machines are becoming an indispensable part of modern manufacturing, offering unmatched efficiency and precision in producing components that require high accuracy. As industries across the globe focus on achieving superior quality, tighter tolerances, and faster production times, the demand for technologically advanced grinding machines continues to grow. These machines play a critical role in delivering consistent, high-quality finishes on complex components, making them essential for industries such as automotive, aerospace, construction, and medical device manufacturing.

The growing trend toward automation, coupled with rising labor costs, is also pushing manufacturers to invest in sophisticated grinding technologies that can ensure speed, consistency, and minimal manual intervention. Moreover, as global supply chains become more complex and industries face mounting pressure to reduce waste and improve productivity, grinding machines offer the versatility and precision needed to meet modern manufacturing challenges. From sharpening cutting tools to fine-tuning intricate parts used in heavy machinery, grinding machines are proving their value in a wide range of industrial applications, enhancing production capabilities and ensuring component durability and performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 5.4% |

The grinding machine market is broadly segmented into precision grinders and non-precision grinders, each catering to different industrial requirements. In 2024, the non-precision grinder segment accounted for USD 3.5 billion, with expectations to grow at a CAGR of 5.1% between 2025 and 2034. These machines are crucial in mass production environments where high throughput and basic finishing are essential. On the other hand, precision grinders are gaining traction in sectors that require extreme accuracy and superior surface finish. The demand for both types is witnessing a surge due to continuous advancements in control systems, high-performance sensors, and next-generation abrasive materials, which have dramatically improved grinding efficiency, precision, and reliability. Enhanced grinding wheels, better automation, and improved machine control contribute to delivering smoother surface finishes and greater reproducibility - essential factors for industries focused on high-quality manufacturing and intricate component design.

Grinding machines find widespread application across industries such as automotive, aerospace, medical, construction, and industrial manufacturing, with each sector relying on them for their ability to create high-precision components. In 2024, the construction industry alone captured nearly 25% of the market share, fueled by the need for robust, precision-engineered parts for heavy machinery and tools. With construction activities intensifying globally, particularly in emerging markets, grinding machines are vital for sharpening equipment like drills, blades, and grinders, ensuring flawless finishes and optimal operational performance.

North America grinding machine market held an impressive 82% share in 2024, underpinned by rapid advancements in automation, smart manufacturing technologies, and significant investments in industrial upgrades. The robust growth of the US construction industry - bolstered by infrastructure expansion, data center developments, and energy sector investments - further amplifies the regional demand. Government initiatives aimed at modernizing infrastructure and promoting industrial growth are also contributing to the widespread adoption of advanced grinding solutions across North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Demand for precision manufacturing

- 3.5.1.2 Advancement in industrial automation and smart manufacturing

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Technological complexity and integration challenges

- 3.5.2.2 High initial investment costs

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Non-precision grinder

- 5.2.1 Bench grinder

- 5.2.2 Portable grinder

- 5.2.3 Pedestal grinder

- 5.2.4 Flexible grinder

- 5.3 Precision grinder

- 5.3.1 Cylindrical grinding machines

- 5.3.2 Surface grinding machines

- 5.3.3 Centre-less grinding machines

- 5.3.4 Tool and cutter grinding machines

- 5.3.5 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Aerospace

- 6.4 Medical

- 6.5 Construction

- 6.6 Industrial manufacturing

- 6.7 Electrical and electronics

- 6.8 Marine Industry

- 6.9 Other

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 UAE

- 7.6.2 Saudi Arabia

- 7.6.3 South Africa

Chapter 8 Company Profiles

- 8.1 Amada Machine Tools

- 8.2 Danobat

- 8.3 Doimak

- 8.4 EMAG

- 8.5 Gleason

- 8.6 Haas Automation

- 8.7 JTEKT Machinery Americas

- 8.8 Junker

- 8.9 Kellenberger

- 8.10 Makino Milling Machine

- 8.11 Okamoto

- 8.12 Schaudt Mikrosa

- 8.13 Studer

- 8.14 Toyoda Machinery USA Corporation

- 8.15 United Grinding North America