|

市场调查报告书

商品编码

1716524

木材切割机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Timber Cutting Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

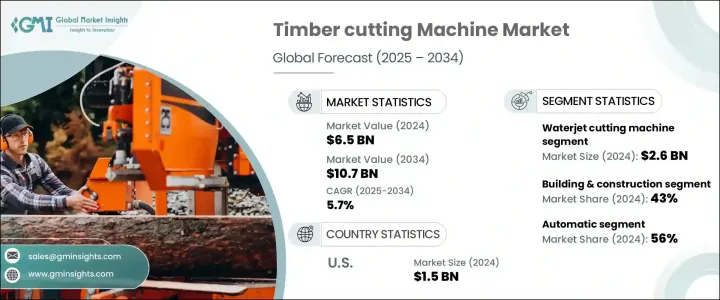

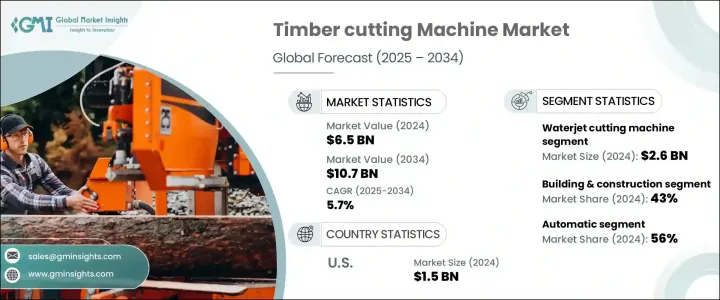

2024 年全球木材切割机市场价值为 65 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。对木材和木材产品的需求不断增长,以及对木材加工和森林管理的投资增加,正在推动市场扩张。木材在木工行业中发挥着至关重要的作用,广泛用于製造横梁、地板、镶板和家具。随着城镇化和基础设施项目的不断发展,对木材产品的需求不断增加,推动了高效能木材切割机的销售。不断扩大的家具市场(尤其是发展中国家的家具市场)推动了对大批量生产木材切割技术的需求。此外,木材出口的增加需要能够加工大量木材以供出口市场的机器。对胶合板、单板和建筑木材等加工木材的需求也在增长,这推动了先进切割技术的采用。

2024 年,水刀切割机领域将以 26 亿美元的营收引领市场。同时,预计到 2034 年,雷射切割机领域将以 6.1% 的复合年增长率显着成长。雷射切割技术具有卓越的精度和质量,使其成为现代木工的宝贵工具。该技术可以实现干净的切割,最大程度地减少材料损失,非常适合复杂的图案和小细节。先进的雷射技术可以处理不同类型和厚度的木材,增加了木工应用的多功能性。除了切割之外,新开发的雷射系统还可以雕刻和标记木材,从而能够创造出复杂的设计、纹理和标誌。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 107亿美元 |

| 复合年增长率 | 5.7% |

到 2024 年,建筑和施工领域将占木材切割机市场的约 43%。发展中经济体的快速城市化和工业化正在推动结构应用和室内装饰对木材的需求。亚太等地区建筑活动的增加对这一领域的成长做出了重大贡献。木製家具产业也正在经历向木材切割自动化和精准化的转变。製造商正在采用先进的机械来满足客製化和永续木製家具日益增长的需求,提高生产力并最大限度地减少材料浪费。随着技术创新继续塑造产业并满足消费者对高品质和环保家具的需求,预计这一趋势将持续下去。

由于人们对高精度先进系统的偏好日益增长,自动化领域将在 2024 年占据木材切割机市场约 56% 的份额。自动切割机透过最大限度地减少材料浪费和切割成本来提高效率。这些系统收集有关材料类型、数量和尺寸的重要资料,从而允许专门的软体优化材料使用并提高生产力。自动化机器专为在单层切割过程中提供卓越的性能而设计,可用于传送带和静态设定。

2024年,美国在北美木材切割机市场占据主导地位,占有该地区约80%的份额,创造15亿美元的收入。美国市场的扩张受到技术进步、木材和木材产品需求增加以及木材出口增加的推动。美国在工业原木生产、木浆、木屑颗粒和锯木领域仍保持全球领先地位,进一步巩固了在市场上的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 木材和木材产品需求不断增长

- 木材加工和出口增加

- 产业陷阱与挑战

- 初期投资高

- 维护成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按机器技术,2021-2034 年

- 主要趋势

- 雷射切割机

- 铣削切割机

- 水刀切割机

- 锯切机

第六章:市场估计与预测:依营运机制,2021-2034 年

- 主要趋势

- 自动的

- 半自动

- 手动的

第七章:市场估计与预测:按机器安装量,2021-2034 年

- 主要趋势

- 水平的

- 垂直的

第八章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 家具製造

- 建筑与施工

- 林业和伐木业

- 其他(纸浆和纸张、包装等)

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Bezner-Oswald

- Gelgoog Company

- Homag

- Kikukawa Enterprise

- Mebor

- Michael Weinig

- Nihar Industries

- Salvador

- Salvamac

- SCM

- Socomec

- TL Pathak

- Umaboy

- Walter Werkzeuge

- Weho Machinery

The Global Timber Cutting Machine Market was valued at USD 6.5 billion in 2024 and is projected to expand at a CAGR of 5.7% from 2025 to 2034. The growing demand for wood and timber products, along with increased investment in timber processing and forest management, is driving market expansion. Timber plays a crucial role in the woodwork industry, being widely used for making beams, flooring, paneling, and furniture. As urbanization and infrastructure projects continue to grow, the need for timber products is increasing, driving the sales of efficient timber cutting machines. The expanding furniture market, especially in developing nations, is contributing to the demand for wood cutting technologies for high-volume production. Additionally, rising timber exports require machines capable of processing large volumes of wood for export markets. Demand is also rising for processed wood materials, including plywood, veneer, and construction timber, which is boosting the adoption of advanced cutting technologies.

In 2024, the waterjet cutting machine segment led the market with revenues of USD 2.6 billion. Meanwhile, the laser cutting machine segment is predicted to witness notable growth at a CAGR of 6.1% through 2034. Laser cutting technology offers exceptional precision and quality, making it a valuable tool in modern woodworking. This technology provides clean cuts with minimal material loss, making it ideal for intricate patterns and small details. Advanced laser technology can handle different types and thicknesses of wood, adding versatility to woodworking applications. Apart from cutting, newly developed laser systems can also engrave and mark wood, enabling the creation of intricate designs, textures, and logos.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.7% |

The building and construction segment accounted for approximately 43% of the timber cutting machine market in 2024. Rapid urbanization and industrialization in developing economies are driving the demand for wood in structural applications and interior decor. Rising construction activity in regions such as Asia-Pacific is contributing significantly to the growth of this segment. The wood furniture industry is also experiencing a shift toward automation and precision in timber cutting. Manufacturers are adopting advanced machinery to meet the growing need for customized and sustainable wooden furniture, enhancing productivity and minimizing material waste. This trend is expected to persist as technological innovations continue to shape the industry and address consumer demands for high-quality and environmentally friendly furniture.

The automatic segment captured around 56% of the timber cutting machine market in 2024 due to the growing preference for advanced systems that offer high precision. Automated cutting machines improve efficiency by minimizing material waste and cutting costs. These systems collect essential data on material type, quantity, and dimensions, allowing specialized software to optimize material usage and enhance productivity. Automated machines are designed for superior performance in single-ply cutting processes and can be used in both conveyor and static setups.

In 2024, the United States dominated the North American timber cutting machine market, holding around 80% of the region's share and generating USD 1.5 billion in revenue. The expansion of the U.S. market is fueled by technological advancements, increased demand for wood and timber-based products, and rising wood exports. The U.S. remains a global leader in industrial roundwood production, wood pulp, wood pellets, and sawn wood, further reinforcing its position in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for wood and timber products

- 3.6.1.2 Increase in timber processing and export

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment

- 3.6.2.2 High maintenance cost

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Technology, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Laser cutting machine

- 5.3 Milling cutting machine

- 5.4 Waterjet cutting machine

- 5.5 Saw cutting machine

Chapter 6 Market Estimates & Forecast, By Operating Mechanism, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By Machine Installation, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Horizontal

- 7.3 Vertical

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Furniture manufacturing

- 8.3 Building & construction

- 8.4 Forestry and logging

- 8.5 Others (pulp & paper, packaging, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bezner-Oswald

- 11.2 Gelgoog Company

- 11.3 Homag

- 11.4 Kikukawa Enterprise

- 11.5 Mebor

- 11.6 Michael Weinig

- 11.7 Nihar Industries

- 11.8 Salvador

- 11.9 Salvamac

- 11.10 SCM

- 11.11 Socomec

- 11.12 T.L Pathak

- 11.13 Umaboy

- 11.14 Walter Werkzeuge

- 11.15 Weho Machinery