|

市场调查报告书

商品编码

1716546

采血椅市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Blood Drawing Chairs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

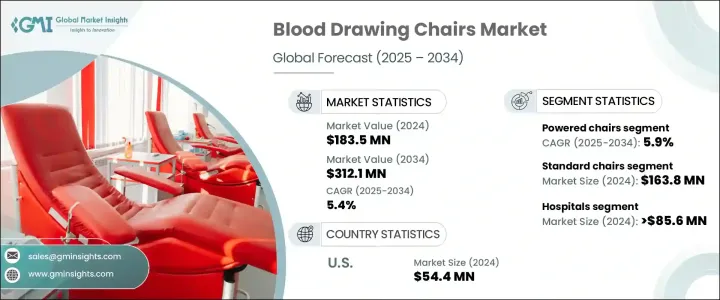

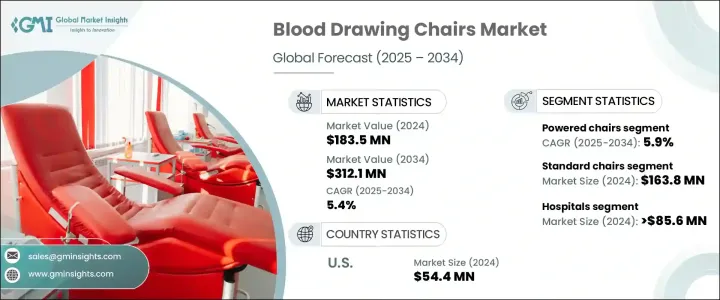

2024 年全球采血椅市场规模达到 1.835 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.4%。全球诊断中心、医院和诊所数量的不断增长,以及全球对捐血的需求不断增长,在很大程度上推动了该市场的稳定扩张。随着糖尿病、心血管疾病和癌症等慢性疾病的不断增加,常规血液检查和诊断筛检变得越来越重要,进一步推动了对高效且患者友善的血液采集解决方案的需求。医疗保健提供者越来越注重提高患者在手术过程中的舒适度和安全性,而抽血椅等专用设备对于确保顺利有效地采血过程已成为不可或缺的。

这些椅子旨在为所有年龄和身体状况的患者提供支持,帮助医护人员轻鬆地进行抽血,同时最大限度地减少患者的不适。此外,家庭医疗服务和行动采血装置的快速扩张(尤其是在已开发经济体中)正在推动对便携式和自动采血椅的需求。椅子设计的创新,包括增强的人体工学和电动调节,也促进了市场的成长,因为这使得医疗保健提供者能够有效地处理更多的患者,同时保持高品质的护理标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.835亿美元 |

| 预测值 | 3.121亿美元 |

| 复合年增长率 | 5.4% |

市场大致分为手动和电动采血椅,预计电动采血椅在 2025 年至 2034 年期间的复合年增长率为 5.9%。电动采血椅越来越受到青睐,这源自于其增强的功能和易用性。这些椅子可以让医护人员顺利调整高度和位置,显着提高病患和临床医师在采血过程中的舒适度。电动椅的多功能性也使其适用于常规抽血以外的各种医疗应用,包括小型手术和检查,从而推动其在医疗机构中的广泛应用。由于医疗保健提供者专注于改善患者的治疗效果并减少手术时间,电动采血椅的多功能性和高效性使其成为现代医疗环境中的首选。

就最终用户而言,医院、捐血中心、诊断实验室和其他医疗设施是关键部分。 2024 年医院部分的收入为 8,560 万美元,反映了住院和门诊环境中抽血椅的大量使用。医院依靠这些椅子进行常规诊断测试和术前评估,确保患者在抽血时处于舒适的位置。此外,农村和服务欠缺地区的医疗中心在刺激需求方面发挥着至关重要的作用,因为他们经常组织捐血活动和社区健康营,需要耐用舒适的抽血椅。

2024 年,美国采血椅市场产值达到 5,440 万美元,家庭护理环境中的需求激增,其中家庭采血服务和行动采血装置变得越来越受欢迎。随着越来越多的患者选择家庭医疗保健解决方案,对便携式、带衬垫且易于使用的椅子的需求正在增加,以确保患者在家庭就诊期间的安全和便利。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 血液和血液相关产品的需求日益增长

- 血液相关疾病盛行率上升

- 提高捐血意识

- 不断增长的诊断测试和实验室服务

- 产业陷阱与挑战

- 高级采血椅价格昂贵

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术格局

- 定价分析

- 波特的分析

- PESTEL分析

- 价值链分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 手动椅

- 电动椅

第六章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 标准椅子

- 可调节的

- 不可调节

- 躺椅

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 医院

- 捐血中心

- 诊断实验室

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Clinton Industries

- The Brewer Company

- DUKAL Corporation

- Med Care Manufacturing

- Zhangjiagang Medi Medical Equipment

- VELA Medical

- SEERS Medical

- Plinth Medical

- Promotal

- Naugra Medical

- Remi Lab World

The Global Blood Drawing Chairs Market reached USD 183.5 million in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. The steady expansion of this market is largely fueled by the growing number of diagnostic centers, hospitals, and clinics worldwide, alongside a rising global demand for blood donations. As chronic diseases such as diabetes, cardiovascular conditions, and cancer continue to escalate, routine blood tests and diagnostic screenings are becoming essential, further driving the demand for efficient and patient-friendly blood collection solutions. Healthcare providers are increasingly focusing on enhancing patient comfort and safety during procedures, and specialized equipment like blood drawing chairs has become indispensable for ensuring smooth and effective blood collection processes.

These chairs are designed to support patients of all ages and physical conditions, helping healthcare professionals carry out blood draws with ease while minimizing patient discomfort. Additionally, the rapid expansion of home healthcare services and mobile phlebotomy units, especially in developed economies, is pushing the demand for portable and automated blood drawing chairs. Innovations in chair design, including enhanced ergonomics and motorized adjustments, are also contributing to market growth by allowing healthcare providers to handle a higher volume of patients efficiently while maintaining quality care standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $183.5 Million |

| Forecast Value | $312.1 Million |

| CAGR | 5.4% |

The market is broadly segmented into manual and powered blood drawing chairs, with powered chairs expected to exhibit a 5.9% CAGR from 2025 to 2034. The increasing preference for powered chairs stems from their enhanced functionality and ease of use. These chairs allow healthcare staff to adjust the height and position smoothly, significantly improving both patient and clinician comfort during blood collection. The multifunctionality of powered chairs also makes them suitable for various medical applications beyond routine blood draws, including minor procedures and examinations, driving their wider adoption across healthcare facilities. As healthcare providers focus on improving patient outcomes and reducing procedural time, the versatility and efficiency of powered blood drawing chairs make them a preferred choice in modern medical environments.

In terms of end users, hospitals, blood donation centers, diagnostic labs, and other medical facilities represent key segments. The hospital segment accounted for USD 85.6 million in 2024, reflecting the substantial use of blood drawing chairs in inpatient and outpatient settings. Hospitals rely on these chairs to facilitate routine diagnostic testing and pre-surgical evaluations, ensuring patients are positioned comfortably during blood draws. Furthermore, healthcare centers in rural and underserved regions are playing a vital role in fueling demand, as they frequently organize blood donation drives and community health camps that require durable and comfortable blood drawing chairs.

The U.S. blood drawing chairs market generated USD 54.4 million in 2024, with demand surging in homecare settings where in-home phlebotomy services and mobile blood collection units are becoming increasingly popular. As more patients opt for at-home healthcare solutions, the need for portable, cushioned, and easy-to-use chairs that ensure patient safety and convenience during home visits is on the rise.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing need for blood and blood-related products

- 3.2.1.2 Rising prevalence of blood-related disorders

- 3.2.1.3 Increasing awareness towards blood donation

- 3.2.1.4 Growing diagnostic testing and laboratory services

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced blood drawing chairs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technological landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

- 3.10 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Manual chairs

- 5.3 Powered chairs

Chapter 6 Market Estimates and Forecast, By Type, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standard chairs

- 6.2.1 Adjustable

- 6.2.2 Non-adjustable

- 6.3 Recliner chairs

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Blood donation centers

- 7.4 Diagnostic laboratories

- 7.5 Ambulatory surgical centers

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Clinton Industries

- 9.2 The Brewer Company

- 9.3 DUKAL Corporation

- 9.4 Med Care Manufacturing

- 9.5 Zhangjiagang Medi Medical Equipment

- 9.6 VELA Medical

- 9.7 SEERS Medical

- 9.8 Plinth Medical

- 9.9 Promotal

- 9.10 Naugra Medical

- 9.11 Remi Lab World