|

市场调查报告书

商品编码

1716570

公用事业规模空气绝缘变压器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Utility Scale Air Insulated Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

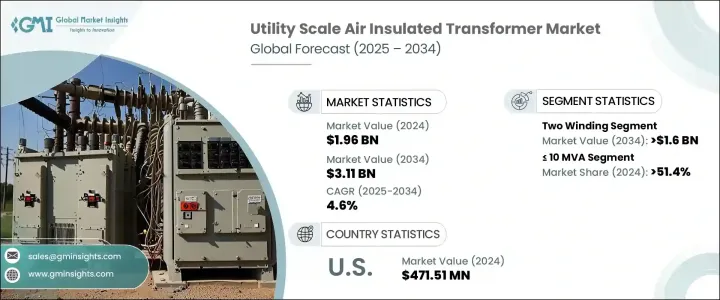

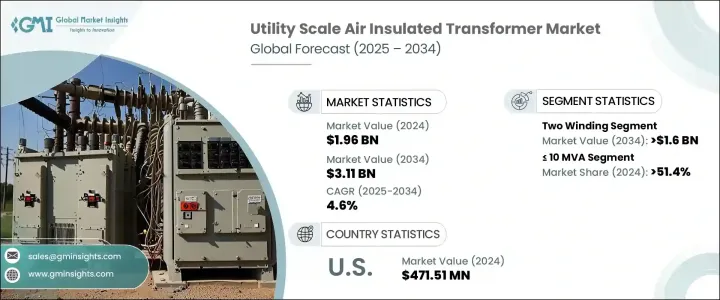

2024 年全球公用事业规模空气绝缘变压器市值为 19.6 亿美元,预计 2025 年至 2034 年期间将以 4.6% 的强劲复合年增长率成长。这一成长是由全球电力需求的不断成长所驱动,受到快速城市化、工业成长和经济扩张(尤其是新兴市场)的刺激。日益增长的能源需求促使各国对输配电网路进行现代化改造,进一步加速了空气绝缘开关设备 (AIS) 变压器的大规模采用。随着经济的持续扩张和对可靠电力传输的需求激增,公用事业规模的 AIS 变压器对于确保高效和不间断的电力供应变得至关重要。特别是那些致力于扩大和加强电力基础设施以满足日益增长的能源需求的地区正在推动这些变压器技术的采用。

随着对 AIS 变压器的需求不断增长,双绕组变压器领域预计将占据市场主导地位,到 2034 年预计收入将达到 16 亿美元。这些变压器对于输电系统至关重要,特别是当需要在长距离升压或降压时。 AIS 变压器设计的技术进步,包括铁芯和绕组技术、冷却机制和绝缘材料的增强,提高了效率、性能和寿命。这些升级使它们在现代高需求电网中更加可靠。此外,随着对更复杂的电源管理的需求不断增长以及向永续能源解决方案的转变,这一领域也在不断发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19.6亿美元 |

| 预测值 | 31.1亿美元 |

| 复合年增长率 | 4.6% |

市场分为不同的等级,包括<= 10 MVA、> 10 MVA 至<= 100 MVA、> 100 MVA 至 <= 600 MVA 和 > 600 MVA。其中,预计 <= 10 MVA 部分将占据最大的市场份额,到 2024 年将达到 51.4% 的市场份额。该部分将稳步增长,因为使用煤炭、天然气、水力和核能的大型发电厂严重依赖这些变压器进行高效的电力处理和长距离传输。

在美国,公用事业规模空气绝缘变压器市场在 2024 年创造了 4.7151 亿美元的产值。清洁电力计划和绿色新政等联邦和州政策已使该国将脱碳工作列为优先事项。推动再生能源的应用需要对国家电力传输基础设施进行重大升级,包括变电站和输电网路。为了有效处理与再生能源相关的更高功率负荷,对 AIS 变压器的需求也随之增加。随着美国不断扩大其再生能源产能,对耐用、高效、可靠的电力基础设施的需求只会越来越强烈。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:按绕组类型,2021 - 2034

- 主要趋势

- 两绕组

- 自耦变压器

第六章:市场规模与预测:依评级,2021-2034 年,

- 主要趋势

- ≤10兆伏安

- > 10 MVA 至 ≤ 100 MVA

- > 100 MVA 至 ≤ 600 MVA

- > 600 兆伏安

第七章:市场规模及预测:依地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- ARTECHE

- Celme

- CG Power & Industrial Solutions

- DAIHEN Corporation

- Eaton

- Elsewedy Electric

- General Electric

- Hyosung Heavy Industries

- IMEFY GROUP

- Kirloskar Electric Company

- Mitsubishi Electric Corporation

- Ormazabal

- Pfiffner Group

- Schneider Electric

- Siemens Energy

- Toshiba International Corporation

- Trench Group

The Global Utility Scale Air Insulated Transformer Market was valued at USD 1.96 billion in 2024 and is expected to grow at a robust CAGR of 4.6% from 2025 to 2034. This growth is driven by the rising demand for electricity across the globe, spurred by rapid urbanization, industrial growth, and the expansion of economies, especially in emerging markets. The increasing need for energy is prompting nations to modernize their power transmission and distribution networks, further accelerating the adoption of Air Insulated Switchgear (AIS) transformers on a large scale. As economies continue to expand and the demand for reliable electricity transmission surges, utility-scale AIS transformers are becoming crucial to ensure efficient and uninterrupted power supply. In particular, regions focusing on expanding and enhancing their electrical infrastructure to meet growing energy needs are driving the adoption of these transformer technologies.

With the demand for AIS transformers growing, the two-winding transformer segment is expected to dominate the market, with an estimated revenue generation of USD 1.6 billion by 2034. These transformers are essential for transmission systems, particularly when it is required to either step up or step down voltage over long distances. The technological advancements in AIS transformer design, including enhancements in core and winding technology, cooling mechanisms, and insulation materials, have led to improved efficiency, performance, and longevity. These upgrades make them even more reliable in modern, high-demand power grids. Furthermore, this segment continues to evolve with the growing need for more sophisticated power management and the shift toward sustainable energy solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.96 Billion |

| Forecast Value | $3.11 Billion |

| CAGR | 4.6% |

The market is segmented into different ratings, including <= 10 MVA, > 10 MVA to <= 100 MVA, > 100 MVA to <= 600 MVA, and > 600 MVA. Among these, the <= 10 MVA segment is predicted to hold the largest market share, with 51.4% of the market in 2024. This segment is set to grow steadily, as large-scale power plants that use coal, natural gas, hydro, and nuclear energy rely heavily on these transformers for efficient power handling and transmission over long distances.

In the U.S., the Utility Scale Air Insulated Transformer Market generated USD 471.51 million in 2024. Federal and state policies such as the Clean Power Plan and the Green New Deal have positioned the country to prioritize decarbonization efforts. The push toward renewable energy adoption requires significant upgrades to the nation's power transmission infrastructure, including substations and transmission networks. To efficiently handle the higher power loads associated with renewable energy sources, the demand for AIS transformers has escalated. As the U.S. continues to expand its renewable energy capacity, the need for durable, efficient, and reliable power infrastructure will only intensify.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Winding, 2021 - 2034, (USD Million, '000 Units)

- 5.1 Key trends

- 5.2 Two winding

- 5.3 Auto transformer

Chapter 6 Market Size and Forecast, By Rating, 2021 - 2034, (USD Million, '000 Units)

- 6.1 Key trends

- 6.2 ≤ 10 MVA

- 6.3 > 10 MVA to ≤ 100 MVA

- 6.4 > 100 MVA to ≤ 600 MVA

- 6.5 > 600 MVA

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (USD Million, '000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Russia

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 ARTECHE

- 8.3 Celme

- 8.4 CG Power & Industrial Solutions

- 8.5 DAIHEN Corporation

- 8.6 Eaton

- 8.7 Elsewedy Electric

- 8.8 General Electric

- 8.9 Hyosung Heavy Industries

- 8.10 IMEFY GROUP

- 8.11 Kirloskar Electric Company

- 8.12 Mitsubishi Electric Corporation

- 8.13 Ormazabal

- 8.14 Pfiffner Group

- 8.15 Schneider Electric

- 8.16 Siemens Energy

- 8.17 Toshiba International Corporation

- 8.18 Trench Group