|

市场调查报告书

商品编码

1716571

汽车碰撞评估软体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Auto Collision Estimating Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

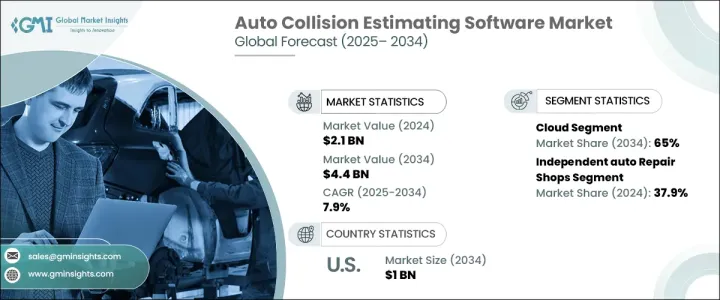

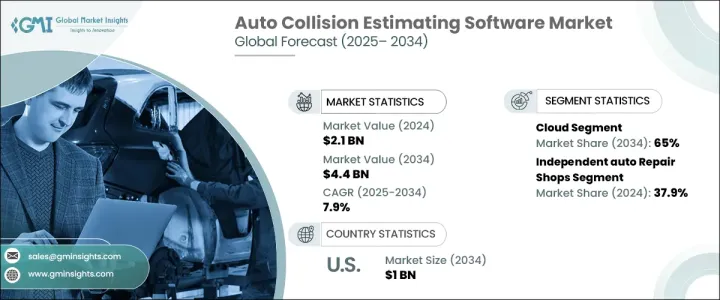

2024 年全球汽车碰撞估算软体市场规模达到 21 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.9%。由于道路上车辆数量的增加,导致事故和碰撞案件发生的频率更高,市场发展势头强劲。随着城市化加快和汽车拥有量的增加,汽车修理厂面临越来越大的压力,需要提供更快、更准确的维修评估。为了满足这项需求,修理厂正在采用先进的碰撞评估软体解决方案,不仅可以自动化评估流程,还可以提高营运效率。这些工具对于改善工作流程管理、减少人力错误和加快保险索赔处理至关重要。随着汽车产业不断推出新车型和先进安全技术,碰撞修復的复杂性也随之增加。汽车碰撞估算软体透过提供即时洞察和简化的估算生成,帮助维修专业人员跟上这些不断变化的需求。此外,随着消费者对快速服务和透明度的期望不断提高,维修店正在利用这些解决方案提供准确的估价,确保更高的客户满意度和信任度。由于保险公司也强调准确性和更快的索赔结算,采用估算软体已成为维持现代汽车维修生态系统竞争力的关键。

汽车碰撞评估软体市场根据部署模型分为内部部署系统和基于云端的系统。其中,预计到 2034 年,基于云端的软体将占据 65% 的市场。人们对基于云端的解决方案日益增长的偏好源于其灵活性、可扩展性和成本效益。与需要在硬体和许可证方面进行大量前期投资的传统系统不同,基于云端的平台以订阅的方式运营,因此更实惠,特别是对于中小型维修企业而言。这些平台可以透过任何支援互联网的设备远端访问,使维修店员工能够在必要时从多个地点甚至在家中管理任务。这种可访问性不仅简化了内部工作流程,还有助于更快地回应客户,最终带来更好的服务体验。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 44亿美元 |

| 复合年增长率 | 7.9% |

根据最终用户,市场分为经销商、独立汽车修理厂、车队管理公司和保险提供者。独立维修店在 2024 年占据了 37.9% 的市场份额,因为他们严重依赖估算软体为客户提供快速且准确的评估。该软体透过透明可靠的成本估算提高小型商店的营运效率并增强客户信任,从而帮助小型商店与大型经销商竞争。透过减少週转时间和提高服务质量,这些独立企业更有能力建立客户忠诚度并确保重复业务。

在快速数位转型和自动化进步的推动下,美国汽车碰撞估算软体市场预计到 2034 年将创造 10 亿美元的收入。该国的高汽车拥有率和频繁的保险索赔加速了对创新软体解决方案的需求。凭藉强大的维修店和保险公司网络,加上人工智慧损害评估和自动索赔处理的采用,美国仍然是塑造全球汽车碰撞评估软体市场未来的关键参与者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 维修设施

- 软体供应商

- 系统整合商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 案例研究

- 衝击力

- 成长动力

- 道路上车辆数量不断增加

- 现代车辆日益复杂

- 先进技术的融合

- 保险业趋势的变化

- 产业陷阱与挑战

- 初始成本高

- 资料安全和隐私问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体

- 服务

第六章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 云

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 独立汽车修理店

- 经销商

- 车队管理公司

- 保险公司

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- ABF System Software

- Alldata

- Audatex Solutions

- AutoLeap

- Auto Repair Invoice

- AutoTraker

- CCC Intelligent Solutions

- Constellation RO Writer

- Enlyte Group

- Estify

- Exzeo

- Genio

- Mitchell Repair Information Company

- RepairShopr

- Scott Systems

- Shop Ware

- Smart Estimator

- Torque360

- Utility Mobile

- Web-Est

The Global Auto Collision Estimating Software Market reached USD 2.1 billion in 2024 and is expected to witness a CAGR of 7.9% between 2025 and 2034. The market is gaining significant momentum due to the increasing number of vehicles on the road, which has led to a higher frequency of accidents and collision cases. As urbanization grows and vehicle ownership rises, auto-body shops face mounting pressure to deliver faster and more accurate repair assessments. To keep up with this demand, repair shops are adopting advanced collision estimating software solutions that not only automate the assessment process but also enhance operational efficiency. These tools are now essential for improving workflow management, reducing manual errors, and speeding up insurance claims processing. As the automotive industry evolves with new vehicle models and advanced safety technologies, the complexity of collision repair has grown. Auto collision estimating software helps repair professionals keep pace with these evolving demands by offering real-time insights and streamlined estimate generation. Additionally, as consumer expectations for quick service and transparency increase, repair shops are leveraging these solutions to provide accurate estimates, ensuring higher customer satisfaction and trust. With insurance companies also emphasizing precision and faster claims settlements, the adoption of estimating software has become integral to maintaining competitiveness in the modern auto repair ecosystem.

The auto collision estimating software market is segmented based on deployment models into on-premises and cloud-based systems. Among these, cloud-based software is expected to dominate with a 65% market share by 2034. The growing preference for cloud-based solutions stems from their flexibility, scalability, and cost-effectiveness. Unlike traditional systems that require a heavy upfront investment in hardware and licenses, cloud-based platforms operate on a subscription basis, making them more affordable, especially for small and medium repair businesses. These platforms can be accessed remotely from any internet-enabled device, enabling repair shop employees to manage tasks from multiple locations or even from home when necessary. This accessibility not only streamlines internal workflows but also helps in offering quicker responses to customers, ultimately driving better service experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 7.9% |

Based on end users, the market is categorized into dealerships, independent auto repair shops, fleet management companies, and insurance providers. Independent repair shops held a leading 37.9% market share in 2024, as they heavily rely on estimating software to deliver quick and accurate assessments to their customers. This software helps smaller shops compete with larger dealerships by improving their operational efficiency and enhancing customer trust through transparent and reliable cost estimates. By reducing turnaround time and improving service quality, these independent businesses are better positioned to build customer loyalty and secure repeat business.

U.S. auto collision estimating software market is projected to generate USD 1 billion by 2034, fueled by rapid digital transformation and advancements in automation. The country's high rate of vehicle ownership and frequent insurance claims have accelerated demand for innovative software solutions. With a robust network of repair shops and insurance companies, coupled with the adoption of AI-powered damage assessment and automated claims processing, the U.S. remains a pivotal player in shaping the future of the global auto collision estimating software market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Repair facilities

- 3.2.2 Software provider

- 3.2.3 System integrators

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Case studies

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising number of vehicles on the road

- 3.9.1.2 Growing complexity of modern vehicles

- 3.9.1.3 Integration of advanced technologies

- 3.9.1.4 Shifting insurance industry trends

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs

- 3.9.2.2 Data security and privacy concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Independent auto repair shops

- 7.3 Dealerships

- 7.4 Fleet management companies

- 7.5 Insurance companies

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 ABF System Software

- 9.2 Alldata

- 9.3 Audatex Solutions

- 9.4 AutoLeap

- 9.5 Auto Repair Invoice

- 9.6 AutoTraker

- 9.7 CCC Intelligent Solutions

- 9.8 Constellation R.O. Writer

- 9.9 Enlyte Group

- 9.10 Estify

- 9.11 Exzeo

- 9.12 Genio

- 9.13 Mitchell Repair Information Company

- 9.14 RepairShopr

- 9.15 Scott Systems

- 9.16 Shop Ware

- 9.17 Smart Estimator

- 9.18 Torque360

- 9.19 Utility Mobile

- 9.20 Web-Est