|

市场调查报告书

商品编码

1716575

直流微电网市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测DC Microgrid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

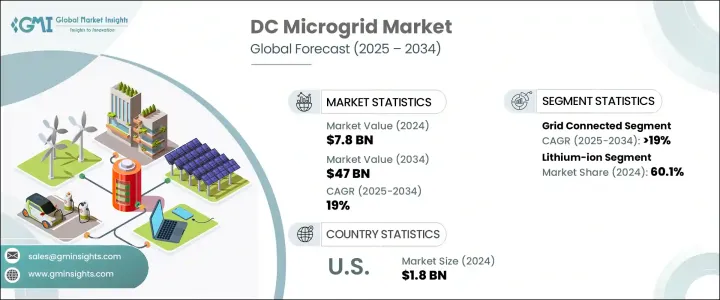

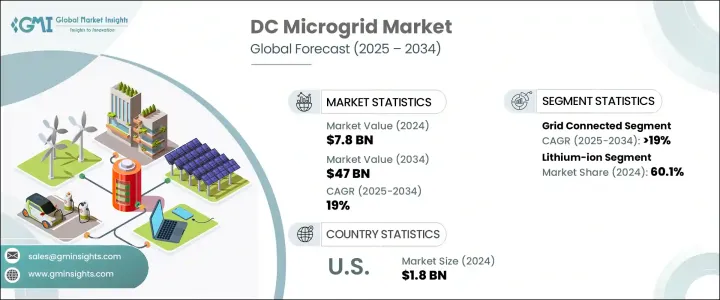

2024 年全球直流微电网市场规模估计为 78 亿美元,预计将经历大幅成长,2025 年至 2034 年的复合年增长率预计为 19%。这一增长是由对永续城市化日益增长的需求和全球对低碳能源基础设施的推动所推动的。市政当局和城市正致力于减少碳排放以实现气候目标,而直流微电网在这一转变中发挥着至关重要的作用。智慧型设备和物联网技术与直流微电网的结合不仅可以改善能源管理,还可以降低成本并提高电网稳定性,使其成为全球大都市地区的重要组成部分。

再生能源投资的不断增长预计将进一步推动市场扩张,因为将太阳能和风能整合到分散式电网中可以减少传输损耗并提高能源效率。此外,随着各国政府努力确保离网地区可靠的电力供应,偏远和农村地区电气化的努力将加速直流微电网的采用。这些地区微电网解决方案的使用日益增加将推动市场成长。电力电子和储能技术的进步将进一步提高直流微电网的可扩展性和效率。双向逆变器、固态变压器和高效电池的创新正在优化电力转换并降低营运成本,这将促进再生能源的整合并提高电网弹性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 78亿美元 |

| 预测值 | 470亿美元 |

| 复合年增长率 | 19% |

直流微电网市场分为併网型和离网型。 2025 年至 2034 年期间,併网市场将以超过 19% 的复合年增长率强劲成长。这些系统可以与现有电网顺利集成,最大限度地减少中断并确保相容性。

就储存设备而言,市场分为锂离子、铅酸、液流电池、飞轮和其他类型。 2024 年,锂离子电池领域占据主导地位,约占 60.1%。电网现代化投资的增加以及对增强能源弹性的需求预计将推动该领域的成长。政府和公用事业公司越来越关注先进的储存技术,以提高电网可靠性并更有效地整合再生能源。

2024 年,北美的市占率约为 27.8%,预计到 2034 年将进一步成长。美国直流微电网市值在 2022 年为 13 亿美元,2023 年为 15 亿美元,2024 年为 18 亿美元。清洁能源的日益普及,加上增强能源弹性和扩大电动车基础设施的努力,将推动该地区的产业向前发展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依连结性,2021 - 2034

- 主要趋势

- 已併网

- 离网

第六章:市场规模及预测:依电源分类,2021 - 2034 年

- 主要趋势

- 柴油发电机

- 天然气

- 太阳能光电

- 热电联产

- 其他的

第七章:市场规模及预测:依储存设备,2021 - 2034

- 主要趋势

- 锂离子

- 铅酸

- 液流电池

- 飞轮

- 其他的

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 卫生保健

- 教育机构

- 军队

- 公用事业

- 工业/商业

- 偏僻的

- 其他的

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第十章:公司简介

- AEG International

- ARDA Power

- ABB

- Eaton Corporation

- Enel X

- EnSync Energy Systems

- Hitachi Energy

- PowerSecure

- Schneider Electric

- SolarWorX

- Sumitomo Electric Industries

- Schaltbau Group

The Global DC Microgrid Market was estimated at USD 7.8 billion in 2024 and is expected to experience substantial growth, with a projected CAGR of 19% from 2025 to 2034. This growth is driven by the increasing demand for sustainable urbanization and the global push towards low-carbon energy infrastructure. Municipalities and cities are focusing on reducing carbon emissions to meet climate goals, with DC microgrids playing a crucial role in this transition. The integration of smart devices and IoT technologies with DC microgrids will not only improve energy management but also lower costs and enhance grid stability, making them an essential component for metropolitan areas worldwide.

The growing investment in renewable energy sources is expected to further fuel market expansion, as integrating solar and wind power into decentralized grids reduces transmission losses and boosts energy efficiency. Additionally, efforts to electrify remote and rural areas will accelerate the adoption of DC microgrids as governments work to ensure reliable electricity access in off-grid regions. The increasing use of microgrid solutions in these areas will drive market growth. Technological advancements in power electronics and energy storage will further enhance the scalability and efficiency of DC microgrids. Innovations in bidirectional inverters, solid-state transformers, and high-efficiency batteries are optimizing power conversion and reducing operational costs, which will facilitate the integration of renewable energy sources and improve grid resilience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $47 Billion |

| CAGR | 19% |

The DC microgrid market is divided into grid-connected and off-grid categories. The grid-connected market is set to grow at a robust rate of over 19% CAGR from 2025 to 2034. These systems integrate smoothly with existing electrical networks, minimizing disruptions and ensuring compatibility.

In terms of storage devices, the market is categorized into lithium-ion, lead-acid, flow batteries, flywheels, and other types. The lithium-ion segment held a dominant share of approximately 60.1% in 2024. Increased investments in grid modernization and the need for enhanced energy resilience are expected to propel growth in this segment. Governments and utilities are increasingly focusing on advanced storage technologies to improve grid reliability and integrate renewable energy more effectively.

North America held a market share of around 27.8% in 2024, with expectations of further growth by 2034. The U.S. DC microgrid market was valued at USD 1.3 billion in 2022, USD 1.5 billion in 2023, and USD 1.8 billion in 2024. The growing adoption of clean energy, coupled with efforts to enhance energy resilience and expand electric vehicle infrastructure, will drive the industry forward in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 Grid connected

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Power Source, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Diesel generators

- 6.3 Natural gas

- 6.4 Solar PV

- 6.5 CHP

- 6.6 Others

Chapter 7 Market Size and Forecast, By Storage Device, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Lithium-ion

- 7.3 Lead acid

- 7.4 Flow battery

- 7.5 Flywheels

- 7.6 Others

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 Educational institutes

- 8.4 Military

- 8.5 Utility

- 8.6 Industrial/ commercial

- 8.7 Remote

- 8.8 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East and Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 AEG International

- 10.2 ARDA Power

- 10.3 ABB

- 10.4 Eaton Corporation

- 10.5 Enel X

- 10.6 EnSync Energy Systems

- 10.7 Hitachi Energy

- 10.8 PowerSecure

- 10.9 Schneider Electric

- 10.10 SolarWorX

- 10.11 Sumitomo Electric Industries

- 10.12 Schaltbau Group