|

市场调查报告书

商品编码

1716588

资料中心机器人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Data Center Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

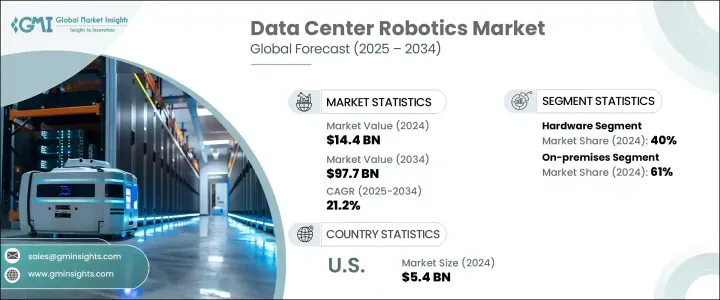

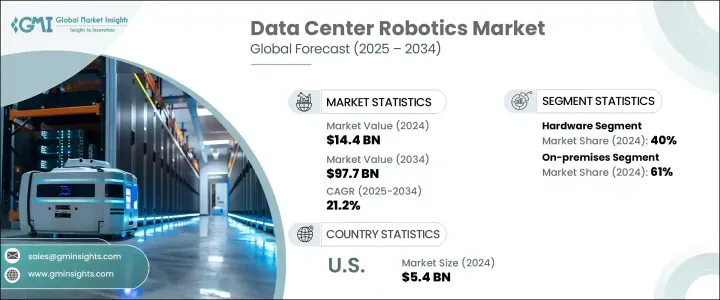

全球资料中心机器人市场在 2024 年的估值为 144 亿美元,预计在 2025 年至 2034 年期间的复合年增长率将达到 21.2%,这得益于资料中心自动化需求的不断增长。提高生产力、减少人力劳动和增强营运效率的需求推动了对机器人的需求。透过自动执行伺服器维护、电缆管理和环境监控等基本任务,机器人可以最大限度地减少人为错误并减少停机时间,从而以最少的监督实现更顺畅、更有效率的运作。

随着资料中心数量和规模的不断增长,特别是超大规模和边缘设施的兴起,机器人的角色变得越来越重要。这些自动化系统对于管理需要处理的大量任务至关重要,包括设备处理、伺服器监督和冷却最佳化。这些流程的自动化有助于最大限度地减少停机时间和空閒时间,从而在资料需求不断增长的情况下提高生产力。对更有效率、更具可扩展性的机器人解决方案的需求不断增长,反映了对资料中心日益增长的依赖以及维护其复杂基础设施的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 144亿美元 |

| 预测值 | 977亿美元 |

| 复合年增长率 | 21.2% |

市场分为硬体、软体和服务,其中硬体目前占据市场主导地位,到 2024 年将占据约 40% 的份额。预计该领域将继续强劲成长,复合年增长率将超过 19.5%。自主移动机器人 (AMR) 和机械手臂等自动化技术正逐步取代体力劳动,以实现更快、更准确的维护和设备处理。

资料中心机器人也根据部署模型进行分类,市场分为内部部署模型和基于云端的模型。到 2024 年,本地部署市场将占据大部分份额,达到 61%。预计到 2034 年,该领域的复合年增长率将超过 20.5%。内部部署具有显着优势,包括对机器人系统的更大控制,这有助于提高效能并减少对外部网路的依赖,最大限度地减少延迟并实现对伺服器监控和自动化等任务的更快回应。

在机器人类型领域,服务机器人因其在自动化操作和提高系统可靠性方面的关键作用而占据主导地位。这些机器人越来越多地用于监控加热、冷却和安全巡逻等任务,从而提高了资料中心的整体效能。服务机器人还提供远端管理,使IT人员可以远端监督操作,从而进一步提高营运效率。

在北美,美国占据主导地位,占有该地区 93% 的市场份额。美国继续透过其技术中心推动成长,各大公司投资机器人技术来维护伺服器基础设施并优化能源消耗。随着对高效能运算、人工智慧和云端操作的需求不断增长,资料中心机器人正成为确保可靠、高效营运的关键部分。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 零件供应商

- 製造商

- 系统整合商

- 技术提供者

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 自动化需求不断成长

- 不断扩大资料中心规模

- 云端运算和人工智慧工作负载的成长

- 对增强安全性的需求日益增长

- 产业陷阱与挑战

- 初期投资成本高

- 与现有基础设施的复杂集成

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 感应器

- 执行器

- 马达

- 视觉系统

- 人工智慧处理器

- 其他的

- 软体

- 服务

第六章:市场估计与预测:按机器人,2021 - 2034 年

- 主要趋势

- 协作机器人

- 工业机器人

- 服务机器人

- 其他的

第七章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第八章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 金融服务业

- 主机託管

- 活力

- 政府

- 卫生保健

- 製造业

- IT与电信

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- 365 Data Centers

- ABB

- Amazon Web Services

- Boston Dynamics

- China Telecom

- Cisco Systems

- ConnectWise

- Digital Realty

- Equinix

- Fanuc

- Hewlett Packard Enterprise Development

- Huawei Technologies

- IBM

- Microsoft Corporation

- NTT Communications

- Rockwell Automation

- Siemens

- SoftBank Robotics

- Verizon

The Global Data Center Robotics Market, with a valuation of USD 14.4 billion in 2024, is expected to grow at a CAGR of 21.2% from 2025 to 2034, driven by the increasing need for automation in data centers. The demand for robotics is being fueled by the necessity for improved productivity, reduced human labor, and enhanced operational efficiency. By automating essential tasks such as server maintenance, cable management, and environmental monitoring, robotics are minimizing human errors and reducing downtime, enabling smoother, more efficient operations with minimal supervision.

As data centers continue to grow in number and scale, particularly with the rise of hyperscale and edge facilities, the role of robotics becomes increasingly vital. These automated systems are essential for managing the vast array of tasks that need to be handled, including equipment handling, server supervision, and cooling optimization. The automation of these processes helps to minimize downtime and idle time, improving productivity in the face of rising data demands. This expanding need for more efficient and scalable robotic solutions reflects the growing reliance on data centers and the need to maintain their complex infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $97.7 Billion |

| CAGR | 21.2% |

The market is segmented into hardware, software, and services, with hardware currently leading the market, accounting for approximately 40% of the share in 2024. This segment is expected to continue its strong growth, expanding at a CAGR of over 19.5%. Automation technologies such as autonomous mobile robots (AMRs) and robotic arms are gradually replacing manual labor, enabling faster, more accurate maintenance and equipment handling.

Data center robotics are also categorized based on deployment model, with the market divided between on-premises and cloud-based models. In 2024, the on-premises segment holds the majority share, representing 61% of the market. This segment is expected to grow at a CAGR of more than 20.5% through 2034. On-premises deployment offers significant advantages, including greater control over robotic systems, which helps improve performance and reduces reliance on external networks, minimizing latency and enabling quicker responses for tasks like server monitoring and automation.

Within the robot type segment, service robots are poised to dominate, thanks to their pivotal role in automating operations and improving system reliability. These robots are increasingly utilized for monitoring tasks such as heating, cooling, and security patrols, enhancing the overall performance of data centers. Service robots also provide remote management, allowing IT staff to oversee operations from a distance, which further boosts operational efficiency.

In North America, the U.S. leads the market with a substantial 93% market share in the region. The U.S. continues to drive growth through its tech hubs, with major corporations investing in robotics to maintain server infrastructure and optimize energy consumption. As demand for high-performance computing, AI, and cloud operations grows, data center robotics are becoming a critical part of ensuring reliable, efficient operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Manufacturers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for automation

- 3.8.1.2 Increasing data center expansion

- 3.8.1.3 Growth in cloud computing and AI workloads

- 3.8.1.4 Growing need for enhanced security

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial investment costs

- 3.8.2.2 Complex integration with existing infrastructure

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensor

- 5.2.2 Actuator

- 5.2.3 Motors

- 5.2.4 Vision systems

- 5.2.5 AI processors

- 5.2.6 Others

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Robot, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Collaborative robots

- 6.3 Industrial robots

- 6.4 Service robots

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Colocation

- 9.4 Energy

- 9.5 Government

- 9.6 Healthcare

- 9.7 Manufacturing

- 9.8 IT & telecom

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 365 Data Centers

- 11.2 ABB

- 11.3 Amazon Web Services

- 11.4 Boston Dynamics

- 11.5 China Telecom

- 11.6 Cisco Systems

- 11.7 ConnectWise

- 11.8 Digital Realty

- 11.9 Equinix

- 11.10 Fanuc

- 11.11 Google

- 11.12 Hewlett Packard Enterprise Development

- 11.13 Huawei Technologies

- 11.14 IBM

- 11.15 Microsoft Corporation

- 11.16 NTT Communications

- 11.17 Rockwell Automation

- 11.18 Siemens

- 11.19 SoftBank Robotics

- 11.20 Verizon