|

市场调查报告书

商品编码

1716596

聚酯纤维市场机会、成长动力、产业趋势分析及2025-2034年预测Polyester Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

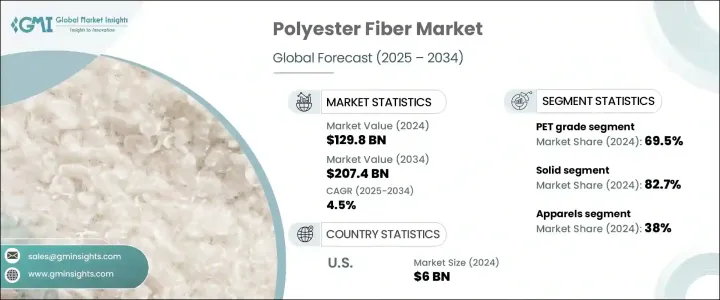

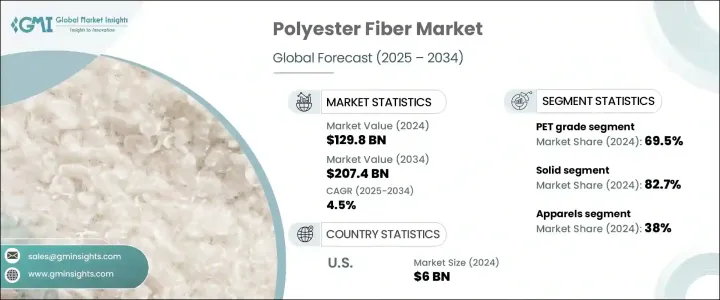

2024 年全球聚酯纤维市场价值为 1,298 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.5%。由石化产品合成的聚酯纤维仍然是全球用途最广泛、使用最广泛的合成纤维之一,这主要归功于其强度、耐用性、灵活性和成本效益。随着各行各业不断寻求具有增强功能性和可持续性的高性能材料,聚酯纤维成为纺织、汽车、家居装饰和工业应用等多个垂直领域的顶级竞争者。时尚和家居装饰领域对低维护、抗皱和快干布料的需求不断增长,加速了聚酯纤维的使用。

此外,环保和再生纤维製造等生产技术的不断创新正在推动全球市场向前发展。消费者对永续和耐用材料的认识不断提高,加上对天然纤维的经济实惠的合成替代品的需求不断增加,增强了聚酯纤维的主导地位。此外,全球市场参与者正专注于策略合作、合併和收购,以加强其生产能力和产品组合,进一步推动市场扩张。向循环经济的转变以及纺织品中再生聚酯的不断增加也在塑造该行业的成长轨迹。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1298亿美元 |

| 预测值 | 2074亿美元 |

| 复合年增长率 | 4.5% |

聚酯纤维市场依等级分为 PET(聚对苯二甲酸乙二醇酯)和 PCDT(聚-1,4-环己基-二亚甲基对苯二甲酸酯)。 2024 年,PET 级占据市场主导地位,占有 69.5% 的份额,这主要是因为它广泛应用于服装、包装和工业用布。 PET 纤维以其耐用性、轻质性以及出色的耐湿性和耐化学性而闻名,在时尚和工业应用领域中受到青睐。消费者对环保产品的日益关注推动了对 PET 纤维的需求,因为它们可以回收製成新材料,从而有效地支持永续发展目标。由于消费者优先考虑耐用、低维护且具有价值和性能的服装和产品,PET 纤维仍然是寻求满足不断变化的市场需求的製造商的首选。

根据产品类型,聚酯纤维市场分为实心纤维和空心纤维,其中实心聚酯纤维在 2024 年占据 82.7% 的份额。实心纤维因其在服装、床上用品、室内装潢和其他需要强度、耐用性和易于护理的纺织产品中的广泛应用而继续受到关注。家庭和商业领域对抗皱、快干和有弹性的布料的偏好日益增长,推动了对固体聚酯纤维的需求增加。此外,家居装饰和室内陈设的趋势强调美观和功能性,也促进了这一领域的成长。消费者和製造商都认为固体聚酯纤维是一种适用于各种应用的经济高效且高品质的解决方案,使其成为现代纺织品不可或缺的组成部分。

美国聚酯纤维市场价值预计在 2024 年达到 60 亿美元,在强劲的工业需求、先进的製造能力和有利的贸易政策的推动下,将继续保持领先地位。发达的纺织业和对国内製造业的日益重视正在巩固中国在全球聚酯纤维领域的地位。合成纤维(尤其是聚酯纤维)进口量的增加,凸显了美国各地时尚、家纺和工业用途对这些多功能材料的需求不断增长

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 併购

- 生产工艺的技术进步

- 汽车和工业应用的成长

- 产业陷阱与挑战

- 环境法规

- 来自替代纤维的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依等级,2021-2034 年

- 主要趋势

- 宠物

- 聚二甲基二烯丙基氯化铵

第六章:市场估计与预测:按产品,2021-2034 年

- 主要趋势

- 坚硬的

- 空洞的

第七章:市场估计与预测:按应用,2021-2034 年

- 主要趋势

- 地毯和地垫

- 不非织物纤维

- 纤维填充

- 服饰

- 家纺

- 其他的

第八章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Alpek Polyester

- Far Eastern Group

- GreenFiber International

- Indorama Ventures

- Nan Ya Plastics Corporation

- Reliance Industries Limited

- Sinopec

- Stein Fibers

- Swicofil

- Teijin Limited

- Toray Industries

- William Barnet and Son

- Zhejiang Hengsheng Chemical Fiber Group

The Global Polyester Fiber Market, valued at USD 129.8 billion in 2024, is projected to grow at a CAGR of 4.5% from 2025 to 2034. Polyester fiber, synthesized from petrochemicals, remains one of the most versatile and widely used synthetic fibers worldwide, primarily due to its strength, durability, flexibility, and cost-effectiveness. As industries continuously seek high-performance materials that offer enhanced functionality and sustainability, polyester fiber emerges as a top contender across multiple verticals, including textiles, automotive, home furnishings, and industrial applications. The rising demand for low-maintenance, wrinkle-resistant, and quick-drying fabrics in the fashion and home decor segments is accelerating the use of polyester fibers.

Additionally, ongoing innovations in production technologies, such as eco-friendly and recycled fiber manufacturing, are driving the global market forward. Heightened consumer awareness about sustainable and durable materials, coupled with increasing demand for affordable synthetic alternatives to natural fibers, is reinforcing polyester fiber's dominance. Moreover, global market players are focusing on strategic collaborations, mergers, and acquisitions to strengthen their production capacities and product portfolios, further fueling market expansion. The shift toward circular economies and the rising incorporation of recycled polyester in textiles are also shaping the industry's growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $129.8 Billion |

| Forecast Value | $207.4 Billion |

| CAGR | 4.5% |

The polyester fiber market is segmented by grade into PET (polyethylene terephthalate) and PCDT (poly-1,4-cyclohexylene-dimethylene terephthalate). PET grade dominated the market with a 69.5% share in 2024, primarily due to its extensive use in clothing, packaging, and industrial fabrics. Known for its durability, lightweight nature, and excellent resistance to moisture and chemicals, PET fiber continues to be favored in fashion and industrial applications alike. The increasing consumer focus on eco-friendly products is driving the demand for PET fibers since they can be recycled into new materials, effectively supporting sustainability goals. As consumers prioritize long-lasting, low-maintenance garments and products that offer value and performance, PET fibers remain the preferred choice for manufacturers looking to meet evolving market demands.

By product type, the polyester fiber market is divided into solid and hollow fibers, with solid polyester fibers capturing an 82.7% share in 2024. Solid fibers continue gaining traction owing to their widespread use in apparel, bedding, upholstery, and other textile products that require strength, durability, and ease of care. The growing preference for wrinkle-resistant, fast-drying, and resilient fabrics in both home and commercial sectors is pushing the demand for solid polyester fibers higher. Additionally, trends in home decor and interior furnishings that emphasize aesthetic appeal along with functionality are contributing to the growth of this segment. Consumers and manufacturers alike are recognizing solid polyester fibers as a cost-effective and high-quality solution for various applications, making them an indispensable component of modern textiles.

U.S. polyester fiber market, valued at USD 6 billion in 2024, continues to hold a leading position, driven by robust industrial demand, advanced manufacturing capabilities, and favorable trade policies. The well-developed textile industry and growing emphasis on domestic manufacturing are reinforcing the country's stronghold in the global polyester fiber space. Increasing imports of synthetic fibers, especially polyester, highlight the rising need for these versatile materials in fashion, home textiles, and industrial uses across the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Merger and acquisitions

- 3.6.1.2 Technological advancements in production process

- 3.6.1.3 Growth in automotive and industrial applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental regulations

- 3.6.2.2 Competition from alternative fibers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Grade, 2021–2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 PET

- 5.3 PCDT

Chapter 6 Market Estimates and Forecast, By Product, 2021–2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.3 Hollow

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Carpets & rugs

- 7.3 Non-woven fiber

- 7.4 Fiberfill

- 7.5 Apparel

- 7.6 Home textile

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alpek Polyester

- 9.2 Far Eastern Group

- 9.3 GreenFiber International

- 9.4 Indorama Ventures

- 9.5 Nan Ya Plastics Corporation

- 9.6 Reliance Industries Limited

- 9.7 Sinopec

- 9.8 Stein Fibers

- 9.9 Swicofil

- 9.10 Teijin Limited

- 9.11 Toray Industries

- 9.12 William Barnet and Son

- 9.13 Zhejiang Hengsheng Chemical Fiber Group