|

市场调查报告书

商品编码

1716597

前列腺癌治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Prostate Cancer Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

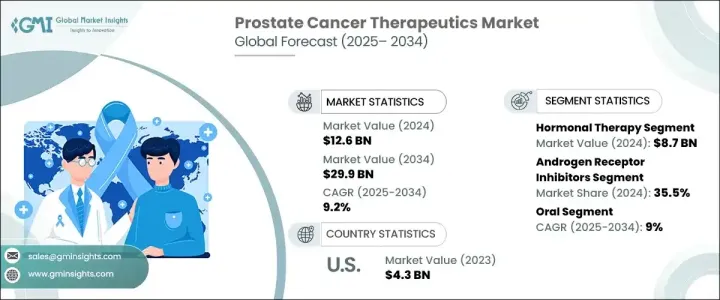

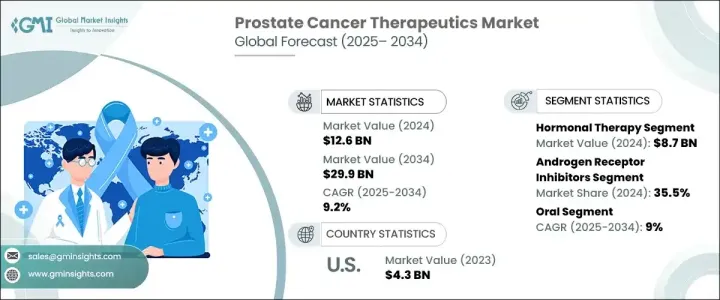

2024 年全球前列腺癌治疗市场规模达 126 亿美元,预计 2025 年至 2034 年的复合年增长率为 9.2%。市场正经历显着的发展势头,主要原因是全球前列腺癌发病率不断上升,加上人们对早期诊断和有效治疗方案的认识不断提高。前列腺癌是男性最常见的癌症之一,医疗保健系统正致力于采用先进的治疗方法来改善患者的治疗效果。男性人口老化、发病率上升以及透过政府主导的措施和癌症倡导团体提高的患者意识继续促进市场成长。

此外,精准医疗的创新以及基因组检测、生物标记识别和人工智慧成像等先进诊断工具的整合正在彻底改变前列腺癌的检测和治疗计划。製药巨头正大力投资研发,推出能够有效针对抗药性前列腺癌的新型药物和个人化疗法,为晚期患者带来新的希望。此外,对联合疗法的重视和免疫疗法的采用正在改变治疗格局,为更安全、更有效的治疗方式铺平道路。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 126亿美元 |

| 预测值 | 299亿美元 |

| 复合年增长率 | 9.2% |

市场根据不同的治疗方法进行细分,包括荷尔蒙疗法、化学疗法、免疫疗法、标靶疗法和其他治疗方案。 2024年,荷尔蒙疗法引领市场,创造87亿美元的收入。荷尔蒙疗法仍然是前列腺癌治疗的基石,因为它透过降低雄性激素水平在控制疾病进展中发挥着至关重要的作用。众所周知,这些激素,尤其是睪酮,会促进前列腺癌的生长。透过针对和抑制睪酮的产生,荷尔蒙疗法可以显着缩小肿瘤大小并缓解症状,有助于提高患者的存活率。对晚期和抗药性病例更有效的下一代荷尔蒙药物的日益普及进一步巩固了这一治疗领域在全球市场的主导地位。

根据药物类别,雄性激素受体抑制剂 (ARI) 在 2024 年占据了 35.5% 的市场。 ARI 已成为晚期前列腺癌患者的重要治疗选择,尤其是那些对传统雄性激素剥夺疗法 (ADT) 不再有反应的患者。这些抑制剂透过阻断雄激素受体讯号路径发挥作用,从而阻止癌细胞利用雄激素生长。 ARI 在早期和晚期前列腺癌治疗中的使用增加已显示出改善的临床结果,使其成为当前治疗手段中不可或缺的一部分。预计,具有增强功效和安全性的新型 ARI 的推出也将在未来几年推动其采用。

2024 年,北美占据全球前列腺癌治疗市场的 39.2% 份额。该地区的领导地位主要归功于其先进的医疗保健基础设施、尖端的癌症护理中心以及对肿瘤学研究的高度重视。高水准的公共和私人投资,以及製药公司和研究机构之间的合作努力,正在不断推动整个地区前列腺癌治疗的创新。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 摄护腺癌盛行率不断上升

- 技术进步

- 提高认识和筛检项目

- 产业陷阱与挑战

- 治疗费用高昂

- 与治疗相关的副作用

- 成长动力

- 成长潜力分析

- 监管格局

- 报销场景

- 管道分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按疗法,2021 - 2034 年

- 主要趋势

- 荷尔蒙疗法

- 化疗

- 免疫疗法

- 标靶治疗

- 其他疗法

第六章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 雄性激素受体抑制剂

- GnRH受体拮抗剂

- PARP抑制剂

- 免疫检查点抑制剂

- 其他药物类别

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 注射剂

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 实体店面

- 电子商务

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Astellas Pharma

- AstraZeneca

- Bayer

- Dendreon Pharmaceuticals

- Exelixis

- Ferring

- GlaxoSmithKline

- Ipsen Pharma

- Johnson & Johnson

- Novartis

- Pfizer

- Sanofi

- Sumitomo Pharma America

- Takeda Pharmaceutical

- Tolmar

The Global Prostate Cancer Therapeutics Market generated USD 12.6 billion in 2024 and is projected to expand at a CAGR of 9.2% from 2025 to 2034. The market is witnessing significant momentum, primarily driven by the growing prevalence of prostate cancer worldwide, coupled with increasing awareness around early diagnosis and effective treatment options. With prostate cancer ranking among the most common cancers in men, healthcare systems are focusing on adopting advanced therapeutics to improve patient outcomes. The aging male population, rising incidence rates, and a surge in patient awareness through government-led initiatives and cancer advocacy groups continue to foster market growth.

Moreover, innovations in precision medicine and the integration of advanced diagnostic tools like genomic testing, biomarker identification, and AI-powered imaging are revolutionizing prostate cancer detection and treatment planning. Pharmaceutical giants are heavily investing in research and development to introduce novel drugs and personalized therapies that can effectively target resistant forms of prostate cancer, offering renewed hope for patients with advanced disease stages. Additionally, the increased emphasis on combination therapies and the adoption of immunotherapies are transforming the therapeutic landscape, making way for safer and more efficient treatment modalities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.6 Billion |

| Forecast Value | $29.9 Billion |

| CAGR | 9.2% |

The market is segmented based on different therapeutic approaches, including hormonal therapy, chemotherapy, immunotherapy, targeted therapy, and other treatment options. In 2024, hormonal therapy led the market, generating USD 8.7 billion in revenue. Hormonal therapy remains a cornerstone in prostate cancer management as it plays a crucial role in controlling the disease's progression by lowering androgen hormone levels. These hormones, especially testosterone, are known to fuel prostate cancer growth. By targeting and suppressing testosterone production, hormonal therapies significantly reduce tumor size and alleviate symptoms, which contributes to improved patient survival rates. The growing adoption of next-generation hormonal agents that are more effective in advanced and resistant cases has further cemented the dominance of this therapeutic segment in the global market.

Based on drug classes, androgen receptor inhibitors (ARIs) accounted for 35.5% of the market share in 2024. ARIs have emerged as a vital treatment option for patients with advanced prostate cancer, especially those who no longer respond to traditional androgen deprivation therapy (ADT). These inhibitors work by blocking the androgen receptor signaling pathway, thereby preventing cancer cells from utilizing androgens for growth. The increased use of ARIs in both early and late-stage prostate cancer treatment has shown improved clinical outcomes, making them indispensable in the current therapeutic arsenal. The introduction of new ARIs with enhanced efficacy and safety profiles is also expected to boost their adoption over the coming years.

North America dominated the global prostate cancer therapeutics market with a 39.2% share in 2024. The region's leadership position is largely attributed to its advanced healthcare infrastructure, cutting-edge cancer care centers, and strong focus on oncology research. High levels of public and private investments, along with collaborative efforts between pharmaceutical companies and research institutions, are continuously propelling innovation in prostate cancer treatment across the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of prostate cancer

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising awareness and screening programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Side effects associated with treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Therapy, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hormonal therapy

- 5.3 Chemotherapy

- 5.4 Immunotherapy

- 5.5 Targeted therapy

- 5.6 Other therapies

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Androgen receptor inhibitors

- 6.3 GnRH receptor antagonists

- 6.4 PARP inhibitors

- 6.5 Immune checkpoint inhibitors

- 6.6 Other drug classes

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacy

- 8.3 Brick and mortar

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Astellas Pharma

- 10.2 AstraZeneca

- 10.3 Bayer

- 10.4 Dendreon Pharmaceuticals

- 10.5 Exelixis

- 10.6 Ferring

- 10.7 GlaxoSmithKline

- 10.8 Ipsen Pharma

- 10.9 Johnson & Johnson

- 10.10 Novartis

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Sumitomo Pharma America

- 10.14 Takeda Pharmaceutical

- 10.15 Tolmar