|

市场调查报告书

商品编码

1716605

夯实机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tamping Rammer Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

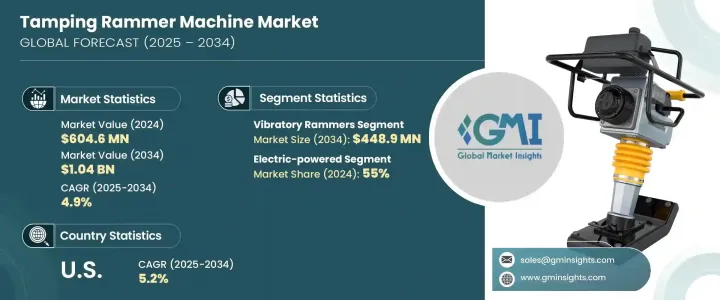

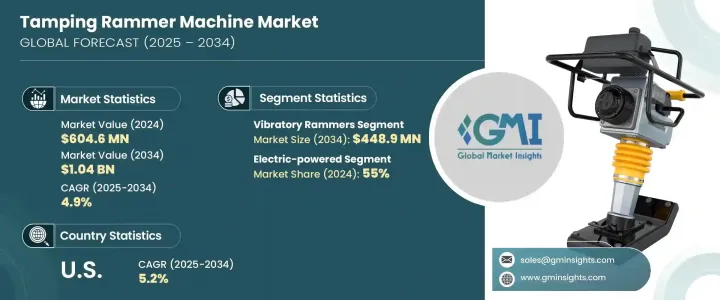

2024 年全球夯实夯机市值为 6.046 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.9%。建筑活动和基础设施发展的增加极大地促进了对夯实夯机的需求。随着都市化及人口成长,住宅、商业综合体、道路等各类基础建设的建设需求不断扩大。夯实机对于压实砾石、土壤和沥青至关重要,可确保这些结构的稳定性和耐用性。建筑业的成长,特别是新兴经济体的建筑业的成长,是这些机器需求不断增长的主要驱动力。当承包商努力在专案中实现高效压实时,夯实机为确保适当的土壤密度提供了理想的解决方案,这对于结构完整性至关重要。

夯实机因其效率而受到青睐,它可以帮助承包商最大限度地降低劳动力成本和专案时间表。它们能够快速有效地压实狭窄或难以到达的空间内的材料,这是一大优点。虽然振动平板压实机、手扶压路机和沟槽压路机等替代技术也用于土壤压实,但夯实机在市场上仍占有重要地位。儘管有这样的替代方案,夯实机仍然具有非凡的价值,特别是对于大型机器无法操作的狭窄空间内的任务。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.046亿美元 |

| 预测值 | 10.4亿美元 |

| 复合年增长率 | 4.9% |

就产品类型而言,市场分为衝击夯、震动夯、手扶夯和遥控夯。振动夯实机预计将占据主导地位,2024 年市场价值为 2.496 亿美元,到 2034 年将成长到 4.489 亿美元。这些机器在黏性土壤和混合土壤中非常有效,可以用最小的力气快速压实,非常适合中型到重型任务。与手动压实方法相比,振动夯实机还节省时间和能源,因此在公用设施安装等小型专案中很受欢迎。

市场按动力源细分,电动夯实机占据市场主导地位,到 2024 年将占 55% 的份额。这些机器由于零排放和低噪音,特别适合室内应用。电池供电的夯实机便于携带,且不会产生汽油供电电机型的排放,适合室内和室外使用。在电力供应有限的户外环境中,汽油动力夯实机仍然很有用。

建筑业是最大的终端用途领域,2024 年将占超过 30.86% 的市场份额,预计到 2034 年将以 5.3% 的速度成长。这些机器对于道路工程、路面铺设和沟槽回填等各种任务至关重要,尤其是在狭窄或密闭的空间。在大量基础设施投资的推动下,美国市场预计在预测期内以 5.2% 的复合年增长率成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 衝击力

- 成长动力

- 增加建筑活动

- 基础建设发展

- 便携式设备需求不断成长

- 技术进步

- 产业陷阱与挑战

- 来自替代技术的竞争

- 环境问题

- 成长动力

- 成长潜力分析

- 技术概述

- 贸易分析(HS 编码 – 84306100)

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 振动夯实机

- 衝击夯

- 手扶式衝击夯

- 遥控夯锤

第六章:市场估计与预测:按电源,2021-2034

- 主要趋势

- 汽油动力

- 电动

- 电池供电

第七章:市场估计与预测:依类别,2021-2034

- 主要趋势

- 自动的

- 手动的

- 半自动

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 建造

- 基础设施

- 矿业

- 庭园绿化

- 农业

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Ammann Group

- Atlas Copco

- Belle Group

- Bomag GmbH

- Caterpillar Inc.

- Chicago Pneumatic

- Doosan Corporation

- Husqvarna Group

- JCB

- MBW Inc.

- Mikasa Sangyo Co., Ltd.

- Multiquip Inc.

- Toro Company

- Wacker Neuson

- Weber MT

The Global Tamping Rammer Machine Market was valued at USD 604.6 million in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The rise in construction activities and infrastructure development is significantly contributing to the demand for tamping rammers. With urbanization and population growth, the need for constructing various types of infrastructure, including residential buildings, commercial complexes, and roads, continues to expand. Tamping rammers are critical in compacting gravel, soil, and asphalt, ensuring the stability and durability of these structures. The growth of the construction industry, particularly in emerging economies, is a key driver behind the increasing demand for these machines. As contractors strive for efficient compaction in their projects, tamping rammers provide an ideal solution for ensuring proper soil density, which is essential for structural integrity.

Tamping rammers are favored due to their efficiency, helping contractors minimize labor costs and project timelines. Their ability to quickly and effectively compact materials in tight or difficult-to-reach spaces is a major advantage. While alternative technologies such as vibratory plate compactors, walk-behind rollers, and trench rollers are also used for soil compaction, tamping rammers maintain their significance in the market. Despite the presence of such alternatives, tamping rammers offer exceptional value, particularly for tasks in confined spaces where larger machines cannot operate.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $604.6 Million |

| Forecast Value | $1.04 Billion |

| CAGR | 4.9% |

In terms of product type, the market is divided into percussion rammers, vibratory rammers, walk-behind rammers, and remote-controlled rammers. Vibratory rammers are expected to dominate, with a market value of USD 249.6 million in 2024, growing to USD 448.9 million by 2034. These machines are highly effective in cohesive and mixed soils, providing rapid compaction with minimal effort, which is ideal for medium-to-heavy tasks. Vibratory rammers also save time and energy compared to manual compaction methods, making them popular for small projects such as utility installations.

The market is segmented by power source, with electric-powered rammers leading the market with a 55% share in 2024. These machines are particularly suitable for indoor applications due to their zero emissions and low noise. Battery-powered rammers offer portability without the emissions of gasoline-powered models, making them versatile for both indoor and outdoor use. Gasoline-powered rammers remain useful in outdoor environments where electricity access is limited.

The construction sector is the largest end-use segment, accounting for over 30.86% of the market share in 2024, and it is expected to grow at a rate of 5.3% by 2034. These machines are essential for various tasks in roadwork, pavement laying, and trench backfilling, particularly in narrow or confined spaces. The market in the U.S. is projected to grow at a CAGR of 5.2% during the forecast period, driven by significant infrastructure investments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing construction activities

- 3.9.1.2 Infrastructure development

- 3.9.1.3 Growing demand for portable equipment

- 3.9.1.4 Technological advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Competition from alternative technologies

- 3.9.2.2 Environmental concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Technological overview

- 3.12 Trade analysis (HS Code – 84306100)

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vibratory rammers

- 5.3 Percussion rammers

- 5.4 Walk-behind rammers

- 5.5 Remote-controlled rammers

Chapter 6 Market Estimates & Forecast, By Power Source, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Gasoline-powered

- 6.3 Electric-powered

- 6.4 Battery-powered

Chapter 7 Market Estimates & Forecast, By Category, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Manual

- 7.4 Semi-automatic

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Infrastructure

- 8.4 Mining

- 8.5 Landscaping and gardening

- 8.6 Agriculture

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Ammann Group

- 11.2 Atlas Copco

- 11.3 Belle Group

- 11.4 Bomag GmbH

- 11.5 Caterpillar Inc.

- 11.6 Chicago Pneumatic

- 11.7 Doosan Corporation

- 11.8 Husqvarna Group

- 11.9 JCB

- 11.10 MBW Inc.

- 11.11 Mikasa Sangyo Co., Ltd.

- 11.12 Multiquip Inc.

- 11.13 Toro Company

- 11.14 Wacker Neuson

- 11.15 Weber MT