|

市场调查报告书

商品编码

1716617

商用热水器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Commercial Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

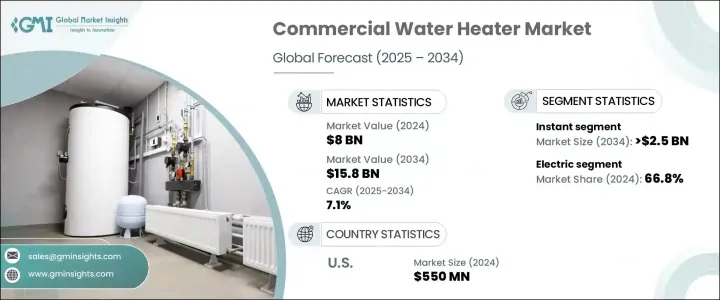

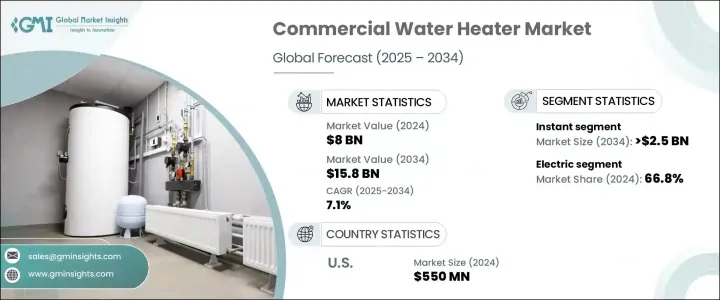

2024 年全球商用热水器市场规模达 80 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.1%。随着酒店、医疗保健、教育和商业领域的企业对节能、可持续和技术先进的热水解决方案的需求日益增加,该行业正在获得发展动力。人们越来越重视减少碳足迹,加上城市化和基础设施建设的持续推进,进一步推动了对满足现代要求的高效热水系统的需求。消费者对先进热水器的能源消耗、成本节约和环境效益的认识不断提高,这极大地影响市场趋势。

此外,世界各国政府正在推出有利的监管框架和激励措施,支持采用高效和再生能源整合热水系统。随着对智慧技术整合的关注度不断提高,配备物联网、远端监控和自动化功能的商用热水器也获得了相当大的关注,帮助最终用户优化能源使用和营运效率。对智慧和环保系统日益增长的需求为製造商开闢了新的途径,使其能够创新并提供满足商业机构不断变化的需求的解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 80亿美元 |

| 预测值 | 158亿美元 |

| 复合年增长率 | 7.1% |

市场根据加热器类型、能源和设计进行细分,以满足广泛的商业应用。其中,即热式热水器市场预计将实现显着成长,预计到 2034 年将创造 25 亿美元的市场价值。即热式热水器以其紧凑的设计和快速加热能力而闻名,其设计旨在安装在靠近使用点的地方,从而减少了对大量管道的需求并最大限度地减少了热量损失。它们节省空间的特性使其成为空间有限的商业建筑(如饭店、办公室和餐厅)的理想解决方案。随着商业设施优先考虑能源效率并寻求降低营运成本,即热式热水器的需求持续上升,使其成为市场上成长最快的类别之一。

商用热水器产业也依能源来源分类,主要分为电热水器和瓦斯热水器。 2024 年,电热水器占据市场主导地位,占有 66.8% 的份额,这得益于其可靠性、耐用性以及与太阳能等新兴再生能源的兼容性。这些装置采用坚固的组件设计,可处理重型商业用途,同时确保长期性能。随着永续发展目标推动各组织寻求更清洁的能源替代品,向电力和混合动力解决方案的转变正在加速。製造商正专注于创新符合日益严格的能源法规的高效模型,以帮助商业实体满足严格的环境和能源法规。

到 2024 年,北美商用热水器市场规模将达到 5.5 亿美元,占市场份额的 13%,这得益于严格的能源效率规定和政府的优惠激励措施,鼓励安装环保热水系统。随着越来越多的商业房地产追求LEED(能源与环境设计先锋)认证,节能热水器已成为实现绿色建筑标准和降低长期能源成本的关键组成部分。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 价格趋势分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 立即的

- 贮存

第六章:市场规模及预测:依能源类型,2021 年至 2034 年

- 主要趋势

- 电的

- 气体

第七章:市场规模及预测:依产能,2021 年至 2034 年

- 主要趋势

- <30公升

- 30-100公升

- 100-250升

- 250-400升

- >400公升

第 8 章:市场规模与预测:按应用,2021 年至 2034 年

- 主要趋势

- 学院/大学

- 办公室

- 政府/军队

- 其他的

第九章:市场规模及预测:按通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 经销商

- 零售

第 10 章:市场规模与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 荷兰

- 葡萄牙

- 罗马尼亚

- 瑞士

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司简介

- American Standard Water Heaters

- AO Smith

- AQUAMAX Australia

- Bosch Thermotechnology

- Bradford White Corporation

- BDR Thermea Group

- GE Appliances

- Heatre Sadia

- HTP

- ORBITAL HORIZON

- Powrmatic

- Racold

- Rinnai Corporation

- Rheem Manufacturing Company

- STIEBEL ELTRON GmbH & Co. KG

- State Industries

- Saudi Ceramic Company

- Toshiba Corporation

- Westinghouse Electric Corporation

The Global Commercial Water Heater Market reached USD 8 billion in 2024 and is estimated to grow at a CAGR of 7.1% between 2025 and 2034. The industry is gaining momentum as businesses across hospitality, healthcare, education, and commercial sectors increasingly demand energy-efficient, sustainable, and technologically advanced water heating solutions. The rising emphasis on reducing carbon footprints, coupled with growing urbanization and infrastructural developments, is further fueling the need for efficient water heating systems that meet modern-day requirements. Heightened consumer awareness of energy consumption, cost savings, and environmental benefits associated with advanced water heaters is significantly shaping market trends.

Moreover, governments worldwide are introducing favorable regulatory frameworks and incentives that support the adoption of high-efficiency and renewable energy-integrated water heating systems. As the focus on smart technology integration grows, commercial water heaters equipped with IoT, remote monitoring, and automation features are also gaining considerable traction, helping end-users optimize energy use and operational efficiency. This increasing demand for intelligent and eco-friendly systems is opening new avenues for manufacturers to innovate and deliver solutions tailored to the evolving needs of commercial establishments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8 Billion |

| Forecast Value | $15.8 Billion |

| CAGR | 7.1% |

The market is segmented based on heater type, energy source, and design, catering to a broad range of commercial applications. Among these, the instant water heater segment is poised for remarkable growth and is projected to generate USD 2.5 billion by 2034. Instant water heaters, known for their compact design and rapid heating capability, are engineered to be installed close to points of use, reducing the need for extensive piping and minimizing heat loss. Their space-saving nature makes them an ideal solution for commercial buildings with limited space, such as hotels, offices, and restaurants. As commercial facilities prioritize energy efficiency and seek to lower operational costs, the demand for instant water heaters continues to rise, making them one of the fastest-growing categories in the market.

The commercial water heater industry is also classified by energy source, primarily into electric and gas heaters. Electric water heaters dominated the market with a 66.8% share in 2024, driven by their reliability, durability, and compatibility with emerging renewable energy sources like solar power. These units are designed with robust components to handle heavy-duty commercial usage while ensuring long-term performance. As sustainability goals push organizations to seek cleaner energy alternatives, the transition towards electric and hybrid solutions is accelerating. Manufacturers are focusing on innovating high-efficiency models that comply with tightening energy regulations, helping commercial entities meet stringent environmental and energy codes.

North America commercial water heater market accounted for USD 550 million and a 13% share in 2024, supported by strict energy efficiency mandates and attractive government incentives that encourage the installation of eco-friendly water heating systems. With more commercial properties aiming for LEED (Leadership in Energy and Environmental Design) certification, energy-efficient water heaters have become a critical component for achieving green building standards and reducing long-term energy costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Energy Source, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Gas

Chapter 7 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 <30 liters

- 7.3 30-100 liters

- 7.4 100-250 liters

- 7.5 250-400 liters

- 7.6 >400 liters

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 College/University

- 8.3 Offices

- 8.4 Government/Military

- 8.5 Others

Chapter 9 Market Size and Forecast, By Channel, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Dealer

- 9.4 Retail

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & ‘000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Portugal

- 10.3.8 Romania

- 10.3.9 Switzerland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 South Africa

- 10.5.4 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 American Standard Water Heaters

- 11.2 A.O Smith

- 11.3 AQUAMAX Australia

- 11.4 Bosch Thermotechnology

- 11.5 Bradford White Corporation

- 11.6 BDR Thermea Group

- 11.7 GE Appliances

- 11.8 Heatre Sadia

- 11.9 HTP

- 11.10 ORBITAL HORIZON

- 11.11 Powrmatic

- 11.12 Racold

- 11.13 Rinnai Corporation

- 11.14 Rheem Manufacturing Company

- 11.15 STIEBEL ELTRON GmbH & Co. KG

- 11.16 State Industries

- 11.17 Saudi Ceramic Company

- 11.18 Toshiba Corporation

- 11.19 Westinghouse Electric Corporation