|

市场调查报告书

商品编码

1716620

生物医学加热和解冻设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biomedical Warming and Thawing Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

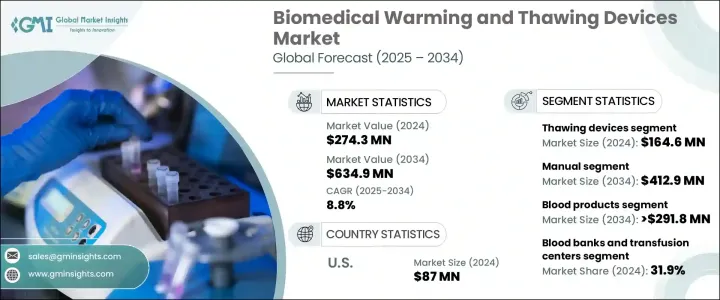

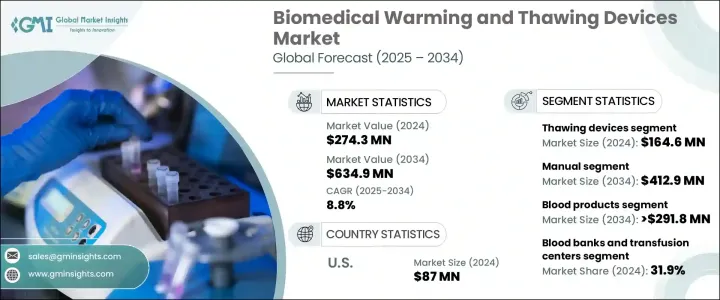

2024 年全球生物医学加热和解冻设备市场规模达到 2.743 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 8.8%。随着血库数量的增加、干细胞研究的增多以及依赖冷冻保存样本处理的 IVF 程序的使用日益增多,市场正在不断扩大。慢性病的流行、再生医学的进步以及冷冻保存在医疗保健领域的更广泛应用正在促进市场的成长。冷冻保存技术在细胞治疗、基因治疗和个人化医疗中的应用推动了对加热和解冻设备的需求。这些设备对于血库和生物库至关重要,可维持血液製品、干细胞和胚胎等冷冻保存样本的质量,这些样本对于研究和治疗至关重要。癌症和心血管疾病等慢性病的发病率上升进一步增加了医院和输血中心对这些设备的需求。

对干细胞研究和再生医学的投资也促进了市场成长。私人和政府实体正在资助开发先进的解冻设备,以改善样本的保存和利用。此外,不孕症病例的增加导致对体外受精程序的需求不断增长,其中加热和解冻设备在处理卵母细胞、胚胎和精液样本方面发挥着至关重要的作用。在这些过程中严格控製样品处理至关重要,这推动了对这些设备的持续需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.743亿美元 |

| 预测值 | 6.349亿美元 |

| 复合年增长率 | 8.8% |

解冻设备在市场上占有特别重要的地位,2024 年的营收为 1.646 亿美元。这些设备可确保冷冻保存样本的活力,并广泛用于血库,用于解冻输血和外科手术所需的血浆和血小板。具有温度控制功能的先进解冻系统可有效且安全地解冻干细胞和胚胎等敏感样本。随着再生医学和干细胞疗法的发展,解冻设备的需求预计将保持强劲。它们在生物库和 IVF 诊所中的应用日益广泛,也巩固了该领域的领先地位。

手动部分更具成本效益且适合小规模操作,预计复合年增长率为 8.6%,到 2034 年将达到 4.129 亿美元以上。手动设备在自动化程度较低的发展中地区广泛使用。这些设备操作简单,所需基础设施极少,非常适合小型实验室和诊所。它们也适合用于处理在解冻或加热过程中需要密切关注的样本,例如精液和组织样本。

按样本类型划分,血液製品占据市场主导地位,预计该细分市场的复合年增长率为 8.7%,到 2034 年将达到 2.918 亿美元以上。血浆、血小板和红血球等血液製品需要在输血和外科手术过程中精确处理。这些设备确保了紧急和常规医疗程序中使用的血液製品的安全性和有效性。外科手术和癌症治疗的增加进一步推动了医院和生物库对这些设备的需求。

血库和输血中心占据主导地位,2024 年的收入份额为 31.9%。这些设施处理紧急和外科输血所需的大量血浆和血小板解冻。自动快速解冻系统的采用正在提高这些环境中的营运效率。

在美国,生物医学加热和解冻设备市场在 2024 年的价值为 8,700 万美元,预计到 2034 年将以 8.4% 的复合年增长率成长。由于慢性病盛行率不断上升和外科手术量巨大,美国市场在北美占有相当大的份额。美国的医院和医疗机构正在整合现代解冻系统,以满足紧急情况和外科手术环境中对血液製品日益增长的需求。对再生医学和体外受精应用研究和开发的重视进一步促进了这些设备的采用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球血库和输血中心数量不断增加

- 生物技术领域样品分析和研究的不断发展

- 导致输血的道路交通事故和创伤病例不断增加

- 产业陷阱与挑战

- 解冻生物医学产品和样本的严格规定

- 与大批量相关的问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 定价分析

- 差距分析

- 波特的分析

- PESTEL分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 解冻装置

- 加温装置

第六章:市场估计与预测:按模式,2021 - 2034 年

- 主要趋势

- 手动的

- 自动的

第七章:市场估计与预测:依样本类型,2021 - 2034 年

- 主要趋势

- 血液製品

- 卵子/胚胎

- 精液

- 其他样本类型

第八章:市场估计与预测:依最终用途 2021 - 2034

- 主要趋势

- 血库和输血中心

- 医院

- 研究实验室

- 製药公司

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Arctiko

- Barkey

- BioCision

- BioLife Solutions

- BOEKEL

- Cytiva

- eppendorf

- Haier Biomedical

- Helmer SCIENTIFIC

- IVF tech

- LABCOLD

- PHCbi

- SARTORIUS

- Thermo Fisher

The Global Biomedical Warming And Thawing Devices Market reached USD 274.3 million in 2024 and is projected to grow at a CAGR of 8.8% between 2025 and 2034. The market is expanding due to the rising number of blood banks, increasing stem cell research, and the growing use of IVF procedures that rely on cryopreserved sample handling. The prevalence of chronic diseases, advancements in regenerative medicine, and the broader application of cryopreservation in healthcare are contributing to market growth. The use of cryopreservation techniques in cell therapy, gene therapy, and personalized medicine has fueled the demand for warming and thawing devices. These devices are essential in blood banks and biobanks to maintain the quality of cryopreserved samples such as blood products, stem cells, and embryos, which are critical for research and treatment. The rising incidence of chronic conditions such as cancer and cardiovascular diseases has further increased demand for these devices in hospitals and transfusion centers.

Investments in stem cell research and regenerative medicine are also contributing to market growth. Private and government entities are funding the development of advanced thawing devices to improve sample preservation and utilization. Additionally, the increasing cases of infertility have led to a growing demand for IVF procedures, where warming and thawing devices play a crucial role in handling oocytes, embryos, and semen samples. Maintaining strict control over sample handling during these processes is essential, which drives the continued demand for these devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $274.3 Million |

| Forecast Value | $634.9 Million |

| CAGR | 8.8% |

Thawing devices, in particular, have a significant role in the market, generating USD 164.6 million in revenue in 2024. These devices ensure the viability of cryopreserved samples and are extensively used in blood banks for thawing plasma and platelets required for transfusions and surgical procedures. Advanced thawing systems with temperature control features provide effective and safe thawing of sensitive samples such as stem cells and embryos. With the growth of regenerative medicine and stem cell therapies, the demand for thawing devices is expected to remain strong. Their increasing use in biobanks and IVF clinics also supports the leading position of this segment.

The manual segment, which is more cost-effective and suitable for small-scale operations, is expected to grow at a CAGR of 8.6%, reaching over USD 412.9 million by 2034. Manual devices are widely used in developing regions where automation is less accessible. These devices, which are easy to operate and require minimal infrastructure, are ideal for small laboratories and clinics. They are also preferred for handling samples that need close attention during thawing or warming, such as semen and tissue samples.

Blood products dominate the market by sample type, with this segment expected to grow at a CAGR of 8.7%, reaching over USD 291.8 million by 2034. Blood products such as plasma, platelets, and red blood cells require precise handling during transfusion and surgical procedures. These devices ensure the safety and efficacy of blood products used in emergency and routine medical procedures. Increasing surgical procedures and cancer treatments further drive the need for these devices in hospitals and biobanks.

Blood banks and transfusion centers held a dominant market position with a 31.9% revenue share in 2024. These facilities handle large volumes of plasma and platelet thawing necessary for emergency and surgical transfusions. The adoption of automated and rapid thawing systems is improving operational efficiency in these settings.

In the U.S., the biomedical warming and thawing devices market was valued at USD 87 million in 2024 and is projected to grow at a CAGR of 8.4% through 2034. The U.S. market holds a significant share in North America due to the increasing prevalence of chronic diseases and a high volume of surgical procedures. Hospitals and healthcare institutions in the U.S. are integrating modern thawing systems to manage the growing demand for blood products in emergencies and surgical settings. The emphasis on applied research and development in regenerative medicine and IVF has further bolstered the adoption of these devices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of blood banks and blood infusion centers worldwide

- 3.2.1.2 Increased development of sample analysis and studies in the biotechnology sector

- 3.2.1.3 Rising number of road accidents and trauma cases leading to blood transfusions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Strict regulations for thawed biomedical products and samples

- 3.2.2.2 Issues related to large batch sizes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Thawing devices

- 5.3 Warming devices

Chapter 6 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

Chapter 7 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood products

- 7.3 Ovum/embryo

- 7.4 Semen

- 7.5 Other sample types

Chapter 8 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Blood banks and transfusion centers

- 8.3 Hospitals

- 8.4 Research laboratories

- 8.5 Pharmaceutical companies

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arctiko

- 10.2 Barkey

- 10.3 BioCision

- 10.4 BioLife Solutions

- 10.5 BOEKEL

- 10.6 Cytiva

- 10.7 eppendorf

- 10.8 Haier Biomedical

- 10.9 Helmer SCIENTIFIC

- 10.10 IVF tech

- 10.11 LABCOLD

- 10.12 PHCbi

- 10.13 SARTORIUS

- 10.14 Thermo Fisher