|

市场调查报告书

商品编码

1716636

公车调度管理系统软体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bus Dispatch Management System Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

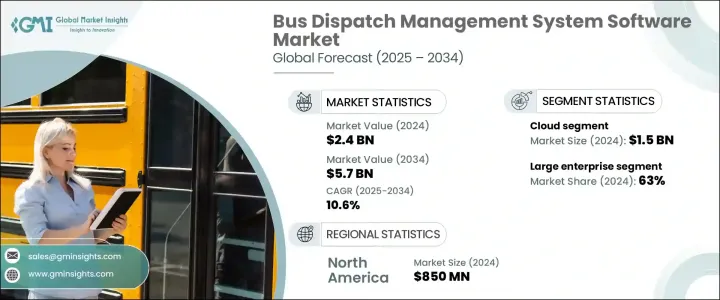

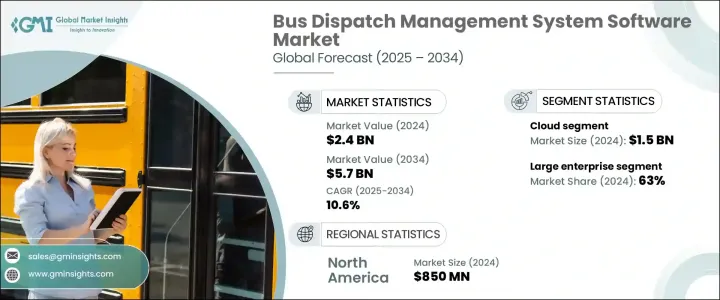

2024 年全球公车调度管理系统软体市场价值为 24 亿美元,预估 2025 年至 2034 年的复合年增长率为 10.6%。受公共交通技术投资增加和对高效车队管理解决方案的需求不断增长的推动,该市场正在快速扩张。随着城市人口的不断增长,交通运输机构和运输提供商正在转向先进的软体解决方案,以优化公车营运、提高调度准确性并简化整体车队监控。随着世界各地的城市优先考虑更智慧、更永续的行动解决方案,向数位化公共交通基础设施的转变进一步加速了需求。

随着城市化进程的加快,对结构良好、可靠的公共交通网络的需求变得至关重要。城市人口激增导致道路拥挤加剧、通勤量增加,需要采用智慧公车调度管理系统。这些先进的平台可实现即时监控、自动调度和人工智慧路线优化,确保车队平稳运作并提升通勤体验。政府和私人交通机构正在积极投资这些技术,以减少延误、提高燃油效率并降低营运成本。此外,对绿色环保交通解决方案的日益追求也导致对整合电动和混合动力汽车管理的公车调度软体的需求增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 57亿美元 |

| 复合年增长率 | 10.6% |

市场主要根据部署模型进行细分,其中基于云端的解决方案和内部部署的解决方案是两大类别。基于云端的解决方案占据了该领域的主导地位,2024 年创造了 15 亿美元的收入,预计 2025 年至 2034 年期间的复合年增长率将达到 11%。基于云端的调度管理软体提供了无与伦比的可扩展性,使运输机构能够无缝管理车队运营,无论车队规模大小。这些解决方案还支援远端访问,使车队经理和调度员能够从任何具有互联网连接的地方监控即时操作。基于云端的平台的灵活性和成本效益已被广泛采用,特别是在寻求强大且面向未来的解决方案的运输机构中。

依企业规模分析市场时,大型企业占据主导地位,2024年将占63%的市场。公共交通管理部门和拥有大量预算的跨国公车业者继续投资于复杂的公车调度管理软体。这些先进的系统为大型组织提供即时追踪、预测分析和人工智慧驱动的最佳化工具,从而提高车队性能并减少停机时间。随着企业寻求提高乘客安全、营运效率和成本管理,大规模交通运营对自动化的需求不断增长,进一步推动了市场扩张。

北美占据公车调度管理系统软体市场的 35% 份额,2024 年市场规模达 8.5 亿美元。该地区强大的市场影响力归功于智慧移动解决方案的日益普及以及人工智慧、物联网和云端运算在交通运营中的整合。随着交通运输机构不断更新其车队管理策略,对先进公车调度软体的需求预计将激增,从而进一步推动未来几年的市场成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 软体开发商/供应商

- 硬体提供者

- 系统整合商

- 电信公司

- 交通运输机构/营运商

- 利润率分析

- 价格趋势

- 技术与创新格局

- 专利分析

- 案例研究

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对高效公共交通的需求不断增加

- 都市化和人口成长

- 增加对公共交通技术的投资

- 汽车感测器技术日益发展

- 产业陷阱与挑战

- 网路连线有限和基础设施限制

- 来自传统交通运输机构或利害关係人的抵制

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 云

第六章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 路线优化

- 即时追踪

- 车队管理

- 调度与通信

- 其他的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 大众运输机构

- 私营巴士营运商

- 教育机构

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- BusHive

- Cubic Transportation Systems

- Driver Schedule

- GIRO

- Goal Systems

- GPS Insight

- Hudson Software

- IBI Group

- INIT Innovations in Transportation

- Optibus

- Reveal Management Services

- Ride Systems

- Routematch Software

- Samsara Networks

- Syncromatics

- TransLoc

- Trapeze Group

- TripSpark Technologies

- Verizon Connect Reveal

- Zonar Systems

The Global Bus Dispatch Management System Software Market was valued at USD 2.4 billion in 2024 and is projected to grow at a CAGR of 10.6% from 2025 to 2034. The market is experiencing rapid expansion, driven by increasing investments in public transport technology and the rising need for efficient fleet management solutions. With urban populations continuing to grow, transit agencies and transportation providers are turning to advanced software solutions that optimize bus operations, enhance scheduling accuracy, and streamline overall fleet monitoring. The shift toward digitized public transportation infrastructure is further accelerating demand as cities worldwide prioritize smarter, more sustainable mobility solutions.

As urbanization intensifies, the need for well-structured and reliable public transportation networks becomes critical. The surge in urban population results in increased road congestion and higher commuter volumes, necessitating the adoption of intelligent bus dispatch management systems. These advanced platforms enable real-time monitoring, automated scheduling, and AI-powered route optimization, ensuring smooth fleet operations and enhanced commuter experience. Governments and private transit agencies are actively investing in these technologies to reduce delays, improve fuel efficiency, and minimize operational costs. Additionally, the growing push for green and eco-friendly transit solutions is leading to an increased demand for bus dispatch software that integrates electric and hybrid vehicle management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 10.6% |

The market is primarily segmented based on deployment models, with cloud-based and on-premises solutions being the two major categories. Cloud-based solutions dominated the segment, generating USD 1.5 billion in 2024, and are expected to grow at a CAGR of 11% between 2025 and 2034. Cloud-based dispatch management software offers unparalleled scalability, allowing transportation agencies to seamlessly manage fleet operations regardless of size. These solutions also enable remote access, giving fleet managers and dispatchers the ability to monitor real-time operations from any location with internet connectivity. The flexibility and cost-effectiveness of cloud-based platforms have led to widespread adoption, particularly among transit agencies looking for robust and future-ready solutions.

When analyzing the market by enterprise size, large enterprises held a dominant position, accounting for 63% of the market share in 2024. Public transportation authorities and multinational bus operators with substantial budgets continue to invest in sophisticated bus dispatch management software. These advanced systems empower large organizations with real-time tracking, predictive analytics, and AI-driven optimization tools that enhance fleet performance and reduce downtime. The rising need for automation in large-scale transit operations further fuels market expansion as enterprises seek to improve passenger safety, operational efficiency, and cost management.

North America led the bus dispatch management system software market with a 35% share, generating USD 850 million in 2024. The region's strong market presence is attributed to the growing adoption of smart mobility solutions and the integration of AI, IoT, and cloud computing in transit operations. As transportation agencies continue to modernize their fleet management strategies, demand for advanced bus dispatch software is expected to surge, further driving market growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Software developers/vendors

- 3.2.2 Hardware providers

- 3.2.3 System integrators

- 3.2.4 Telecommunications companies

- 3.2.5 Transit agencies/operators

- 3.3 Profit margin analysis

- 3.4 Price trends

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Case study

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for efficient public transportation

- 3.10.1.2 Growing urbanization and population growth

- 3.10.1.3 Increasing investments in public transport technology

- 3.10.1.4 Rising growth of automotive sensor technology

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Limited internet connectivity and infrastructure limitations

- 3.10.2.2 Resistance from traditional transit agencies or stakeholders

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 On-premises

- 5.3 Cloud

Chapter 6 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Large enterprises

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Route optimization

- 7.3 Real-time tracking

- 7.4 Fleet management

- 7.5 Dispatch and communication

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Public transit agencies

- 8.3 Private bus operators

- 8.4 Educational institutions

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 BusHive

- 10.2 Cubic Transportation Systems

- 10.3 Driver Schedule

- 10.4 GIRO

- 10.5 Goal Systems

- 10.6 GPS Insight

- 10.7 Hudson Software

- 10.8 IBI Group

- 10.9 INIT Innovations in Transportation

- 10.10 Optibus

- 10.11 Reveal Management Services

- 10.12 Ride Systems

- 10.13 Routematch Software

- 10.14 Samsara Networks

- 10.15 Syncromatics

- 10.16 TransLoc

- 10.17 Trapeze Group

- 10.18 TripSpark Technologies

- 10.19 Verizon Connect Reveal

- 10.20 Zonar Systems