|

市场调查报告书

商品编码

1716644

烘焙包装机市场机会、成长动力、产业趋势分析及2025-2034年预测Bakery Packaging Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

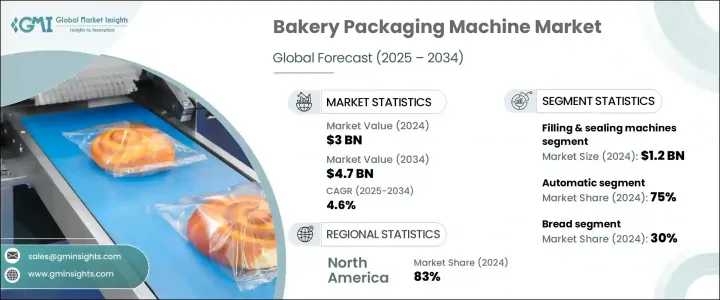

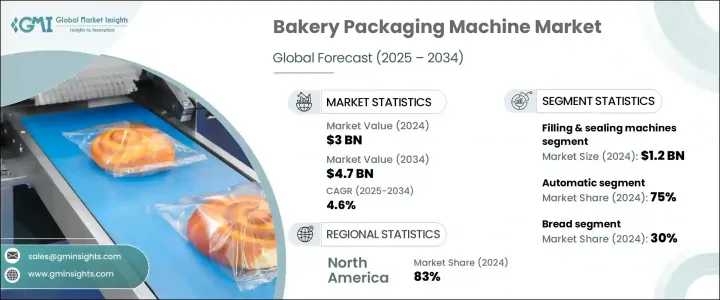

2024 年全球烘焙包装机市场价值为 30 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.6%。这一增长得益于全球对包装烘焙产品的需求不断增长以及零售店和烘焙连锁店的不断增加。随着消费者的生活方式变得越来越忙碌,他们越来越倾向于购买即食烘焙食品,例如麵包、蛋糕、饼干和糕点。这种转变对创新、高效、外观吸引人的包装解决方案产生了强烈的需求,这些解决方案不仅可以保护这些产品的质量,还可以延长其保质期。此外,随着电子商务和直接面向消费者的送货服务的兴起,烘焙品牌正在投资高品质的包装机械,以满足消费者不断变化的需求。随着越来越多的烘焙品牌寻求在竞争日益激烈的市场中脱颖而出,他们越来越重视能够增强品牌形象并确保产品在运输过程中完整性的包装解决方案。

烘焙包装机市场分为多种类型,包括填充和封口机、贴标机、捆扎机、胶带机等。其中,灌装封口机领域2024年创收12亿美元,预计将维持强劲成长轨迹。这种增长归因于对能够处理不同形状和尺寸的烘焙产品的机器的需求不断增长,以满足大量生产的需求。製造商正专注于能够适应独特形状、尺寸和定製品牌的灵活包装解决方案,确保他们的产品在拥挤的货架上脱颖而出。此外,能够处理多种包装形式的填充和封口机对于旨在有效满足不断变化的消费者偏好的麵包店来说已经变得至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 47亿美元 |

| 复合年增长率 | 4.6% |

就自动化程度而言,市场分为全自动机器和半自动机器。 2024 年,自动机器占据市场主导地位,占有 75% 的份额。自动化需求的不断增长是由于需要提高营运效率、降低劳动成本并确保包装的一致性。自动包装机对于大批量麵包店来说尤其重要,因为速度和一致性对于维持产品品质至关重要。这些系统简化了生产流程,使製造商能够扩大其营运规模,同时最大限度地减少错误和营运停机时间。随着烘焙业的不断发展,自动化机器对于维持高效率和高品质的标准变得越来越不可或缺。

北美烘焙包装机市场占全球市场的 83%,2024 年产值达 8.8 亿美元。该地区的主导地位源于人们对烘焙产品(尤其是麵包)的需求不断增长,以及美国和加拿大各地烘焙店数量的不断增加。随着消费者在选择食品时不断追求便利性,先进包装技术的需求激增。智慧包装创新和自动化在满足这些需求方面发挥关键作用,使麵包店能够改进其包装流程,同时保持产品的新鲜度和吸引力。随着烘焙业的不断扩张,采用尖端包装技术有望推动北美市场的持续成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 包装烘焙产品需求不断成长

- 扩大烘焙连锁店和零售店

- 产业陷阱与挑战

- 初期投资成本高

- 严格遵守食品安全规定

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 灌装和封口机

- 贴标机

- 捆扎机

- 磁带机

- 其他(漫画等)

第六章:市场估计与预测:依自动化等级,2021 年至 2034 年

- 主要趋势

- 自动的

- 半自动

第七章:市场估计与预测:依产量,2021 - 2034

- 主要趋势

- 高达50/分钟

- 50至100次/分钟

- 100至200次/分钟

- 200次/分钟以上

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 麵包

- 蛋糕

- 饼干

- 糕点

- 贝果

- 其他(可颂等)

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Arpac

- Bosch Packaging Technology

- Buhler

- Filpack

- Hopak Machinery

- Ishida

- Joiepack Industrial

- Multivac

- PAC Machinery

- Rademaker

- Rianta

- SOMIC Packaging

- Syntegon Technology

- Middleby

- Viking Masek

The Global Bakery Packaging Machine Market was valued at USD 3 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2034. This growth is fueled by the increasing demand for packaged bakery products and the rising presence of retail outlets and bakery chains worldwide. As consumer lifestyles become more hectic, there is a growing inclination toward ready-to-eat bakery items such as bread, cakes, cookies, and pastries. This shift has created a strong demand for innovative, efficient, and visually appealing packaging solutions that not only protect the quality of these products but also extend their shelf life. Moreover, with the rise in e-commerce and direct-to-consumer delivery services, bakery brands are investing in high-quality packaging machinery to meet the changing needs of consumers. As more bakery brands look to differentiate themselves in an increasingly competitive market, there is a growing emphasis on packaging solutions that enhance brand identity and ensure product integrity during transit.

The market for bakery packaging machines is categorized into various types, including filling and sealing machines, labeling machines, strapping machines, tape machines, and others. Among these, the filling and sealing machines segment generated USD 1.2 billion in 2024 and is expected to maintain a strong growth trajectory. This growth is attributed to the increasing need for machines that can handle diverse bakery products in different forms and sizes, catering to bulk production requirements. Manufacturers are focusing on flexible packaging solutions that can accommodate unique shapes, sizes, and custom branding, ensuring that their products stand out on crowded shelves. Additionally, filling and sealing machines that can handle multiple packaging formats have become essential for bakeries aiming to meet changing consumer preferences efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.6% |

In terms of automation, the market is divided into automatic and semi-automatic machines. Automatic machines dominated the market in 2024, holding a 75% share. The rising demand for automation is driven by the need to improve operational efficiency, reduce labor costs, and ensure consistency in packaging. Automatic packaging machines are particularly crucial for high-volume bakeries, where speed and uniformity are essential for maintaining product quality. These systems streamline production processes, enabling manufacturers to scale their operations while minimizing errors and operational downtime. As the bakery industry continues to grow, automatic machines are becoming indispensable in maintaining high standards of efficiency and quality.

The North America bakery packaging machine market accounted for 83% of the global market and generated USD 880 million in 2024. The region's dominance is driven by a growing appetite for bakery products, especially bread, and an increasing number of bakery outlets across the United States and Canada. As consumers continue to seek convenience in their food choices, the demand for advanced packaging technologies has surged. Smart packaging innovations and automation play a pivotal role in meeting these demands, allowing bakeries to enhance their packaging processes while maintaining product freshness and appeal. With the continuous expansion of the bakery sector, the adoption of cutting-edge packaging technologies is expected to drive sustained growth in the North American market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for packaged bakery products

- 3.6.1.2 Expansion of bakery chains and retail outlets

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment costs

- 3.6.2.2 Strict food safety compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling & sealing machines

- 5.3 Labelling machines

- 5.4 Strapping machines

- 5.5 Tape machines

- 5.6 Others (cartooning etc.)

Chapter 6 Market Estimates & Forecast, By Automation Grade, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Output Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 50/min

- 7.3 50 to 100/min

- 7.4 100 to 200/min

- 7.5 Above 200/min

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Bread

- 8.3 Cakes

- 8.4 Cookies

- 8.5 Pastry

- 8.6 Bagels

- 8.7 Others (croissants etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Arpac

- 11.2 Bosch Packaging Technology

- 11.3 Buhler

- 11.4 Filpack

- 11.5 Hopak Machinery

- 11.6 Ishida

- 11.7 Joiepack Industrial

- 11.8 Multivac

- 11.9 PAC Machinery

- 11.10 Rademaker

- 11.11 Rianta

- 11.12 SOMIC Packaging

- 11.13 Syntegon Technology

- 11.14 Middleby

- 11.15 Viking Masek