|

市场调查报告书

商品编码

1716659

先进空中交通市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Advanced Air Mobility Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

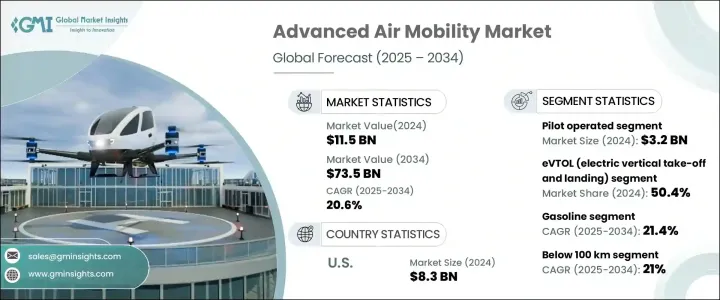

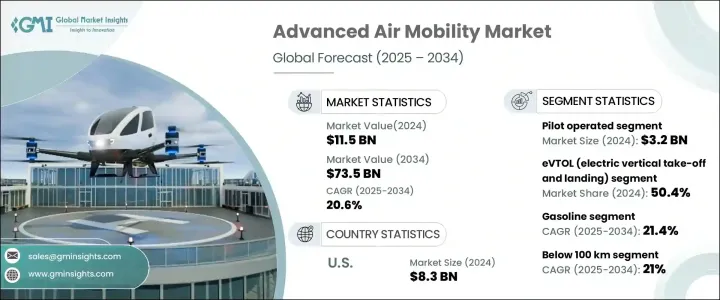

2024 年全球先进空中交通市场规模达 115 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 20.6%。随着世界各国加强减少碳排放和应对气候变迁的力度,交通运输业正经历向更清洁解决方案的转型。先进的空中交通正在改变游戏规则,提供可持续的航空运输选择,减少交通拥堵,提高运输效率,并最大限度地减少对环境的影响。电力推进系统、自动驾驶技术和创新车辆设计的日益融合正在加速 AAM 解决方案的采用。

全球各国政府和监管机构正在透过优惠政策和投资支持这些进步,从而实现 AAM 技术的快速认证和商业化。此外,城市规划者和交通管理部门对将 AAM 系统纳入智慧城市框架的兴趣日益浓厚,这推动了市场的成长。随着城市化进程的加快以及对更快、更有效率的出行解决方案的需求不断增长,AAM 有望透过提供无缝的点对点交通彻底改变区域和城市交通。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 115亿美元 |

| 预测值 | 735亿美元 |

| 复合年增长率 | 20.6% |

到 2024 年,无人驾驶先进空中交通领域价值将达到 32 亿美元,该领域将人类专业知识与技术创新相结合,提供安全可靠的城市空中交通,正在经历强劲增长。有人驾驶的 AAM 飞行器利用经验丰富的飞行员的技能,提供了额外的安全性,即使在复杂或人口稠密的环境中也能确保平稳运行。此外,现有航空基础设施的整合和有利监管框架的实施正在加快认证进程,为这些技术的更快部署和更广泛接受铺平了道路。随着业界向自动驾驶解决方案迈进,自动驾驶 AAM 车辆正在成为建立公众信任和改善营运流程的桥樑。

AAM 市场按飞行器类型分类,包括电动垂直起降 (eVTOL) 飞机、短距起降 (STOL) 飞机和传统固定翼飞机。 2024 年,eVTOL 领域将占据 50.4% 的市场份额,这得益于电动和混合动力推进系统的日益普及。 eVTOL 飞机因其能够满足乘客运输要求,同时遵守严格的安全和操作标准而越来越受到关注。 eVTOL 技术的发展有望在塑造先进空中交通的未来方面发挥关键作用,因为这些交通工具有可能提供可扩展、经济高效且环境永续的交通解决方案。

美国先进空中交通市场价值 2024 年将达到 83 亿美元,凭藉强大的技术创新生态系统和知名航太公司,美国将成为全球领导者。透过在研发方面投入大量资金以及建立完善的测试和部署新技术的基础设施,美国正在推动 AAM 解决方案的进步和采用。美国积极的监管环境,加上公共和私营部门利益相关者之间的持续合作,正在加速先进空中机动技术的商业化,并使美国成为全球空中机动领域的领导者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 都市化与交通拥堵

- 消费者偏好的改变

- 投资和政府支持

- 策略伙伴关係和合作

- 扩展用例和应用

- 产业陷阱与挑战

- 监管和安全挑战

- 大众接受度和认知

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按营运模式,2021 年至 2034 年

- 主要趋势

- 先导式

- 自主/遥控

第六章:市场估计与预测:按车型,2021 年至 2034 年

- 主要趋势

- eVTOL(电动垂直起降)飞机

- STOL(短距起降)飞机

- 常规固定翼飞机

第七章:市场估计与预测:依推进类型,2021 年至 2034 年

- 主要趋势

- 汽油

- 涡轮发动机(Turbo)

- 往復式(活塞)发动机

- 电力推进

- 混合动力推进

第八章:市场估计与预测:按范围,2021 年至 2034 年

- 主要趋势

- 100公里以下

- 100公里 – 250公里

- 250公里 – 500公里

- 超过500公里

第九章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 货物运输

- 客运

- 测绘与测量

- 特殊使命

- 监视和监控

- 其他的

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 商业的

- 政府和军队

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十二章:公司简介

- Airbus SAS

- Aurora Flight Sciences

- Bell Textron Inc.

- Embraer SA

- Garmin Aviation

- GE Aviation

- GKN Aerospace

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Honywell

- Joby Aviation

- Lilium GmbH

- Opener, Inc.

- Safran

- Siemens

- Thales Group

- The Boeing Company

The Global Advanced Air Mobility Market generated USD 11.5 billion in 2024 and is projected to grow at a CAGR of 20.6% between 2025 and 2034. As the world intensifies its efforts to reduce carbon emissions and combat climate change, the transportation sector is undergoing a transformative shift toward cleaner solutions. Advanced air mobility is emerging as a game-changer, offering sustainable air transport options that reduce traffic congestion, enhance transportation efficiency, and minimize environmental impacts. The increasing integration of electric propulsion systems, autonomous technologies, and innovative vehicle designs is accelerating the adoption of AAM solutions.

Governments and regulatory authorities across the globe are supporting these advancements through favorable policies and investments, enabling rapid certification and commercialization of AAM technologies. Furthermore, the growing interest from urban planners and transportation authorities in incorporating AAM systems into smart city frameworks is driving market growth. With the rise of urbanization and increasing demand for faster and more efficient travel solutions, AAM is expected to revolutionize regional and urban mobility by offering seamless, point-to-point transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $73.5 Billion |

| CAGR | 20.6% |

The piloted advanced air mobility segment, valued at USD 3.2 billion in 2024, is witnessing robust growth as it blends human expertise with technological innovations to deliver safe and reliable urban air transportation. Piloted AAM vehicles offer an added layer of safety by leveraging the skills of experienced pilots, ensuring smooth operations even in complex or densely populated environments. Additionally, the integration of existing aviation infrastructure and the implementation of favorable regulatory frameworks are expediting the certification process, paving the way for faster deployment and wider acceptance of these technologies. As the industry moves toward autonomous solutions, piloted AAM vehicles are serving as a bridge to build public trust and refine operational processes.

The AAM market is categorized by vehicle types, including electric vertical take-off and landing (eVTOL) aircraft, short take-off and landing (STOL) aircraft, and conventional fixed-wing aircraft. In 2024, the eVTOL segment accounted for 50.4% of the market share, driven by the growing adoption of electric and hybrid propulsion systems. eVTOL aircraft are gaining traction due to their ability to meet passenger transportation requirements while adhering to stringent safety and operational standards. The development of eVTOL technology is expected to play a pivotal role in shaping the future of advanced air mobility, as these vehicles offer the potential for scalable, cost-effective, and environmentally sustainable transportation solutions.

The U.S. advanced air mobility market, valued at USD 8.3 billion in 2024, is positioned as a global leader fueled by a strong technological innovation ecosystem and the presence of prominent aerospace companies. With significant investments in research and development and a well-established infrastructure for testing and deploying new technologies, the U.S. is driving the advancement and adoption of AAM solutions. The country's proactive regulatory environment, combined with continuous collaboration between public and private sector stakeholders, is accelerating the commercialization of advanced air mobility technologies and positioning the U.S. as a frontrunner in the global AAM landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and traffic congestion

- 3.2.1.2 Changing consumer preferences

- 3.2.1.3 Investment and government support

- 3.2.1.4 Strategic partnerships and collaborations

- 3.2.1.5 Expansion of use cases and applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and safety challenges

- 3.2.2.2 Public acceptance and perception

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pilot operated

- 5.3 Autonomous/Remotely operated

Chapter 6 Market Estimates and Forecast, By Vehicle Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 eVTOL (Electric Vertical Takeoff and Landing) aircraft

- 6.3 STOL (Short Takeoff and Landing) aircraft

- 6.4 Conventional fixed-wing aircraft

Chapter 7 Market Estimates and Forecast, By Propulsion Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Gasoline

- 7.2.1 Turbine engines (Turbo)

- 7.2.2 Reciprocating (Piston) engines

- 7.3 Electric propulsion

- 7.4 Hybrid propulsion

Chapter 8 Market Estimates and Forecast, By Range, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 100 km

- 8.3 100 km – 250 km

- 8.4 250 km – 500 km

- 8.5 More than 500 km

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Cargo transport

- 9.3 Passenger transport

- 9.4 Mapping & surveying

- 9.5 Special mission

- 9.6 Surveillance & monitoring

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Commercial

- 10.3 Government & military

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Airbus S.A.S.

- 12.2 Aurora Flight Sciences

- 12.3 Bell Textron Inc.

- 12.4 Embraer S.A.

- 12.5 Garmin Aviation

- 12.6 GE Aviation

- 12.7 GKN Aerospace

- 12.8 Guangzhou EHang Intelligent Technology Co. Ltd.

- 12.9 Honywell

- 12.10 Joby Aviation

- 12.11 Lilium GmbH

- 12.12 Opener, Inc.

- 12.13 Safran

- 12.14 Siemens

- 12.15 Thales Group

- 12.16 The Boeing Company