|

市场调查报告书

商品编码

1716674

工业帮浦市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

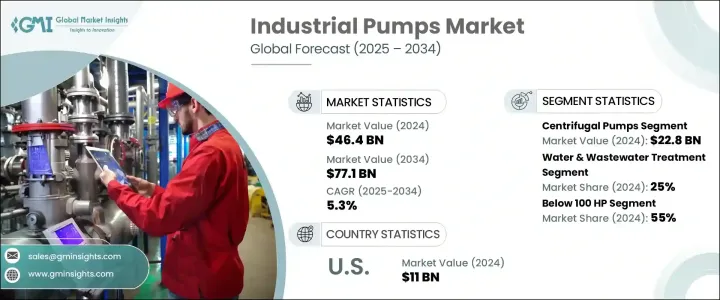

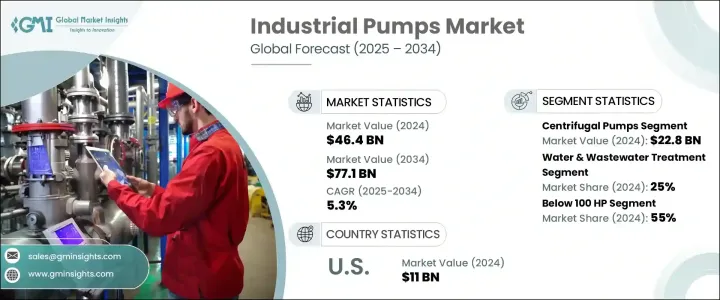

全球工业帮浦市场规模在 2024 年将达到 464 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.3%。这一增长主要得益于各行各业需求的不断增长、泵送系统的技术进步以及全球工业化的快速发展。随着经济扩张和製造业蓬勃发展,对高效、耐用、高性能工业泵的需求不断增加。石油和天然气、水和废水处理、采矿和化学品等领域的应用日益增多,推动着市场的成长。此外,向永续水管理实践的转变,加上日益严格的环境法规,进一步提升了对现代节能帮浦的需求。新兴市场,尤其是亚太和拉丁美洲的新兴市场,由于城市化进程加快和基础设施建设投资增加,对工业泵的需求激增。智慧泵技术和物联网系统的采用正在重塑产业格局,使各行各业能够提高营运效率并降低能源消耗。

市场按泵类型细分,包括离心泵、容积泵、隔膜泵、齿轮泵、螺桿泵等。 2024 年,离心泵浦市场创造了 228 亿美元的收入,这得益于其在石油和天然气、水管理和化学加工等行业的广泛应用。容积泵以其处理黏性流体的高效性而闻名,预计在水力压裂应用日益增多和老化基础设施更换的推动下,容积泵将实现稳步增长。这一趋势在大力投资能源领域的国家尤其明显,高性能泵浦对于优化开采、精炼和运输流程至关重要。随着各行各业都专注于提高生产力和减少停机时间,对可靠性和运作效率高的先进泵送系统的需求不断上升。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 464亿美元 |

| 预测值 | 771亿美元 |

| 复合年增长率 | 5.3% |

工业泵市场进一步按最终用途行业细分,包括水和废水处理、化学品、石化产品、采矿、食品和饮料、建筑、石油和天然气、製药、海洋、纸浆和造纸等。 2024 年,水和废水处理将占据 25% 的市场份额,反映出在快速城市化和工业成长的背景下,对清洁水管理的需求日益增长。随着人口的成长,特别是在发展中地区,对高效水处理和废水管理解决方案的需求不断增加。泵浦在采矿业中也发挥着至关重要的作用,其中排水泵可以排出矿井中多余的水,以确保安全和营运效率。此外,食品和饮料行业严重依赖专用泵进行卫生加工并保持产品完整性。

美国工业泵浦市场占 80% 的份额,2024 年产值达 110 亿美元。这种主导地位归因于技术进步、工业活动日益活跃以及对永续水管理的日益关注。美国石油和天然气行业,特别是页岩油生产,仍然是工业泵需求的重要驱动力,工业泵广泛用于开采、精炼和运输等过程。此外,采矿业对美国经济的贡献,加上其在为建筑、汽车和航太等行业供应必需材料方面发挥的关键作用,进一步支持了对工业泵的强劲需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 终端使用产业需求不断成长

- 全球工业化和製造业扩张

- 产业陷阱与挑战

- 高资本投入

- 能耗高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按泵类型,2021-2034

- 主要趋势

- 离心泵

- 容积泵

- 隔膜泵

- 齿轮泵浦

- 螺桿泵

- 其他(活塞泵、螺桿泵等)

第六章:市场估计与预测:按电源,2021-2034

- 主要趋势

- 电动和太阳能泵

- 柴油泵

- 其他(汽油、太阳能等)

第七章:市场估计与预测:按流量,2021-2034

- 主要趋势

- 低于100立方米/小时

- 100 - 500 立方米/小时

- 高于500立方米/小时

第八章:市场估计与预测:按功率,2021-2034

- 主要趋势

- 低于100 HP

- 100 - 500 马力

- 500 以上

第九章:市场估计与预测:依技术,2021-2034

- 主要趋势

- 传统的

- 聪明的

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 水和废水处理

- 化学品和石化产品

- 矿业

- 食品和饮料

- 建造

- 石油和天然气

- 製药

- 海洋

- 纸浆和造纸

- 其他(农业、纺织等)

第 11 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 间接销售

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十三章:公司简介

- Atlas Copco

- Ebara

- Flowserve

- Gardner Denver

- Gorman-Rupp

- Grundfos

- ITT

- Kirloskar

- KSB

- SPX Flow

- Sulzer

- Tsurumi

- Weir

- Wilo

- Xylem

The Global Industrial Pumps Market, valued at USD 46.4 billion in 2024, is projected to grow at a CAGR of 5.3% from 2025 to 2034. This growth is primarily driven by rising demand across various industries, technological advancements in pumping systems, and rapid industrialization worldwide. As economies expand and manufacturing sectors thrive, the need for efficient, durable, and high-performance industrial pumps continues to escalate. Increasing applications in sectors such as oil and gas, water and wastewater treatment, mining, and chemicals are fueling market growth. Moreover, the transition toward sustainable water management practices, coupled with rising environmental regulations, has further elevated the need for modern and energy-efficient pumps. Emerging markets, especially in Asia Pacific and Latin America, are witnessing surging demand for industrial pumps due to rapid urbanization and increasing investments in infrastructure development. The adoption of smart pump technologies and IoT-enabled systems is reshaping the landscape, allowing industries to improve operational efficiency and reduce energy consumption.

The market is segmented by pump type, including centrifugal pumps, positive displacement pumps, diaphragm pumps, gear pumps, screw pumps, and others. In 2024, the centrifugal pumps segment generated USD 22.8 billion, owing to its widespread application in industries such as oil and gas, water management, and chemical processing. Positive displacement pumps, known for their efficiency in handling viscous fluids, are expected to witness steady growth, driven by increasing use in hydraulic fracturing and the replacement of aging infrastructure. This trend is particularly noticeable in countries investing heavily in their energy sectors, where high-performance pumps are essential for optimizing extraction, refining, and transportation processes. As industries focus on enhancing productivity and minimizing downtime, the demand for advanced pumping systems that offer reliability and operational efficiency continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.4 Billion |

| Forecast Value | $77.1 Billion |

| CAGR | 5.3% |

The industrial pumps market is further segmented by end-use industries, including water and wastewater treatment, chemicals, petrochemicals, mining, food and beverages, construction, oil and gas, pharmaceuticals, marine, pulp and paper, and others. Water and wastewater treatment accounted for a 25% market share in 2024, reflecting the growing need for clean water management amid rapid urbanization and industrial growth. As population increases, especially in developing regions, the need for efficient water treatment and wastewater management solutions continues to intensify. Pumps also play a critical role in the mining industry, where dewatering pumps remove excess water from mines to ensure safety and operational efficiency. Additionally, the food and beverage sector relies heavily on specialized pumps for hygienic processing and maintaining product integrity.

The United States Industrial Pumps Market commanded an 80% share, generating USD 11 billion in 2024. This dominance is attributed to technological advancements, growing industrial activity, and an increasing focus on sustainable water management. The U.S. oil and gas industry, particularly shale oil production, remains a significant driver of demand for industrial pumps, which are used extensively in processes such as extraction, refining, and transportation. Additionally, the mining sector's contributions to the U.S. economy, coupled with its critical role in supplying essential materials to industries like construction, automotive, and aerospace, further support the robust demand for industrial pumps.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand from end use industries

- 3.6.1.2 Global industrialization and manufacturing expansion

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High capital investment

- 3.6.2.2 High energy consumption

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Centrifugal pumps

- 5.3 Positive displacement pumps

- 5.4 Diaphragm pumps

- 5.5 Gear pumps

- 5.6 Screw pumps

- 5.7 Others (piston pumps, progressive cavity pumps, etc.)

Chapter 6 Market Estimates & Forecast, By Power Source, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric & solar pumps

- 6.3 Diesel pumps

- 6.4 Others (gasoline solar etc.)

Chapter 7 Market Estimates & Forecast, By Flow Rate, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 100 m³/h

- 7.3 100 - 500 m³/h

- 7.4 Above 500 m³/h

Chapter 8 Market Estimates & Forecast, By Power, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 100 HP

- 8.3 100 - 500 HP

- 8.4 Above 500 HP

Chapter 9 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Conventional

- 9.3 Smart

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Water & wastewater treatment

- 10.3 Chemicals and petrochemicals

- 10.4 Mining

- 10.5 Food and beverages

- 10.6 Construction

- 10.7 Oil & gas

- 10.8 Pharmaceutical

- 10.9 Marine

- 10.10 Pulp & paper

- 10.11 Others (agricultural, textile etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Atlas Copco

- 13.2 Ebara

- 13.3 Flowserve

- 13.4 Gardner Denver

- 13.5 Gorman-Rupp

- 13.6 Grundfos

- 13.7 ITT

- 13.8 Kirloskar

- 13.9 KSB

- 13.10 SPX Flow

- 13.11 Sulzer

- 13.12 Tsurumi

- 13.13 Weir

- 13.14 Wilo

- 13.15 Xylem