|

市场调查报告书

商品编码

1716677

电动舷外机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Outboard Engines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

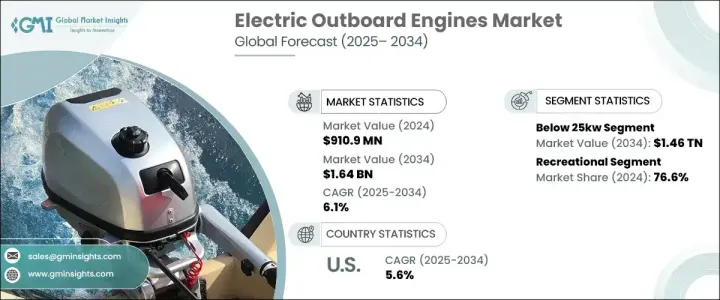

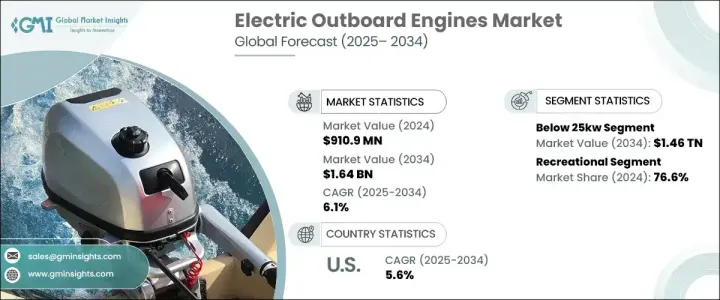

2024 年全球电动舷外机市场规模达 9.109 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.1%。受环保船舶解决方案的日益普及和可持续资源保护意识的不断增强的推动,该市场正在经历强劲增长。随着人们对环境问题的日益关注以及消费者对更环保替代品的需求,电动舷外机正成为比传统燃气引擎更受欢迎的选择。生态旅游和永续划船实践的兴起进一步推动了电动马达的普及。此外,政府推出了严格的法规来限制海洋部门的排放,迫使製造商和消费者都转向更清洁的技术。技术进步,尤其是电池技术的进步,大大提高了电动舷外机的运作效率和可靠性。锂电池提高了能量密度并延长了这些马达的使用寿命,使其更适合广泛使用。电池效率的创新不断减少充电时间并延长行驶距离,从而解决了对行驶里程和性能有限的担忧。

根据输出功率,市场可分为 25 kW 以下、25-50 kW 和 50-150 kW 的引擎。 2024 年,25 千瓦以下引擎市场的收入为 8.116 亿美元,这主要是因为它们在小型船舶、个人水上摩托车和皮划艇用户中很受欢迎。这些引擎非常适合休閒划船和钓鱼活动,具有紧凑的设计、易于安装和增强的机动性。与传统汽油和高功率电动引擎相比,这些引擎更具成本效益,对注重预算的消费者俱有吸引力。此外,它们需要的维护较少,排放量较少,具有显着的环境效益,因此对于有环保意识的消费者来说是一个有吸引力的选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.109亿美元 |

| 预测值 | 16.4亿美元 |

| 复合年增长率 | 6.1% |

电动舷外机市场根据应用进一步分为休閒、商业和军事领域。休閒娱乐领域占据市场主导地位,2024 年占有 76.6% 的份额,预计 2025-2034 年期间的复合年增长率为 6%。人们对环保船舶解决方案的日益青睐推动了这一增长,因为电动马达运行安静且零排放,完全符合人们对永续休閒活动日益增长的需求。寻求遵守不断发展的环境法规的消费者正在迅速采用电动舷外机,从而促进了该领域的强劲扩张。

2024 年,美国电动舷外机市场规模达到 4.183 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.6%。美国休閒船舶产业已发展成熟,每年有数百万美国人参与划船活动。美国消费者环保意识的不断增强继续推动人们向电动舷外发动机转变,电动舷外发动机为传统内燃机提供了更清洁、更永续的替代品。随着对安静、无排放的划船体验的需求不断增长,预计美国市场将在未来十年内持续成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 产业衝击力

- 成长动力

- 增加休閒划船活动

- 游艇生产和销售不断成长

- 不断发展的海洋旅游休閒产业

- 产业陷阱与挑战

- 初始投资成本高

- 成长动力

- 成长潜力分析

- 消费者购买行为分析

- 技术概述

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按功率

- 主要趋势

- 25千瓦以下

- 25 – 50 千瓦

- 50 – 150 千瓦

第六章:市场估计与预测:按速度(英哩/小时)

- 主要趋势

- 低于 5 英里/小时

- 5-10英里/小时

- 10-15英里/小时

- 时速 15 英里以上

第七章:市场估计与预测:按应用

- 主要趋势

- 商业的

- 休閒娱乐

- 军队

第八章:市场估计与预测:按配销通路

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Evoy

- Golden Motors

- Hitachi Ltd.

- KONE

- MINN KOTA

- Mitsubishi Electric Corporation

- Parsun Power

- Pure Watercraft

- Schindler

- Torqeedo GmbH

The Global Electric Outboard Engines Market generated USD 910.9 million in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. The market is witnessing strong growth, driven by the increasing adoption of eco-friendly boating solutions and rising awareness of sustainable resource conservation. As environmental concerns escalate and consumers demand greener alternatives, electric outboard motors are becoming a preferred choice over traditional gas-powered engines. The surge in eco-tourism and sustainable boating practices further fuels the adoption of electric motors. Additionally, stringent government regulations to curb emissions from the marine sector are compelling manufacturers and consumers alike to transition toward cleaner technologies. Technological advancements, particularly in battery technology, have significantly enhanced the operational efficiency and reliability of electric outboard motors. Lithium-based batteries have improved energy density and extended the lifespan of these motors, making them more viable for widespread use. Innovations in battery efficiency continue to reduce charging times and extend travel distances, thereby addressing concerns about limited range and performance.

The market is segmented by power output into engines below 25 kW, 25-50 kW, and 50-150 kW. In 2024, the segment for engines below 25 kW generated USD 811.6 million, primarily due to their popularity among users of small boats, personal watercraft, and kayaks. These motors are highly suitable for recreational boating and fishing activities, offering compact designs, ease of installation, and enhanced maneuverability. Compared to traditional gasoline and higher-powered electric engines, these motors are more cost-effective, appealing to budget-conscious consumers. Additionally, they require lower maintenance and provide substantial environmental benefits with minimal emissions, making them an attractive option for environmentally conscious consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $910.9 Million |

| Forecast Value | $1.64 Billion |

| CAGR | 6.1% |

The electric outboard engines market is further categorized by application into recreational, commercial, and military sectors. The recreational segment dominated the market, holding a 76.6% share in 2024, and is expected to grow at a CAGR of 6% during 2025-2034. The rising preference for eco-friendly boating solutions drives this growth, as electric motors offer quiet operation and zero emissions, aligning perfectly with the increasing demand for sustainable leisure activities. Consumers seeking compliance with evolving environmental regulations are rapidly adopting electric outboard motors, contributing to the robust expansion of this segment.

The US electric outboard engines market reached USD 418.3 million in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. The US recreational boating industry is well-established, with millions of Americans engaging in boating activities annually. Growing environmental awareness among US consumers continues to drive the shift toward electric outboard motors, which offer a cleaner and more sustainable alternative to traditional combustion engines. As the demand for quiet, emission-free boating experiences rises, the US market is expected to witness consistent growth over the next decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing recreation boating activities

- 3.2.1.2 Rising production and sale of yachts

- 3.2.1.3 Growing marine tourism and leisure industry

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost of investments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Consumer buying behavior analysis

- 3.5 Technological overview

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Company market share analysis

- 4.2 Competitive positioning matrix

- 4.3 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Power (USD Billion)

- 5.1 Key trends

- 5.2 Below 25 kW

- 5.3 25 – 50 kW

- 5.4 50 – 150 kW

Chapter 6 Market Estimates & Forecast, By Speed (Mph) (USD Billion)

- 6.1 Key trends

- 6.2 Below 5 mph

- 6.3 5-10 mph

- 6.4 10-15 mph

- 6.5 Above 15 mph

Chapter 7 Market Estimates & Forecast, By Application (USD Billion)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Recreational

- 7.4 Military

Chapter 8 Market Estimates & Forecast, By Distribution Channel (USD Billion)

- 8.1 Key trends

- 8.2 Direct sale

- 8.3 Indirect sale

Chapter 9 Market Estimates & Forecast, By Region (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Evoy

- 10.2 Golden Motors

- 10.3 Hitachi Ltd.

- 10.4 KONE

- 10.5 MINN KOTA

- 10.6 Mitsubishi Electric Corporation

- 10.7 Parsun Power

- 10.8 Pure Watercraft

- 10.9 Schindler

- 10.10 Torqeedo GmbH