|

市场调查报告书

商品编码

1716689

枪枝市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Firearms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

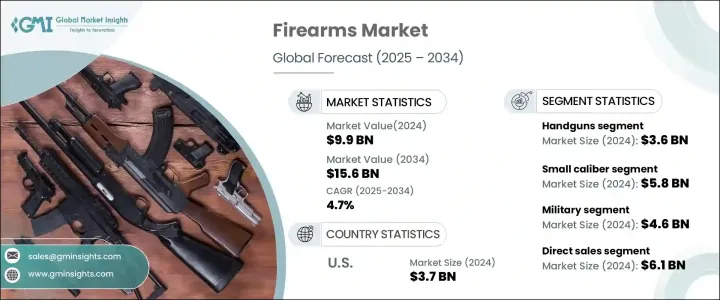

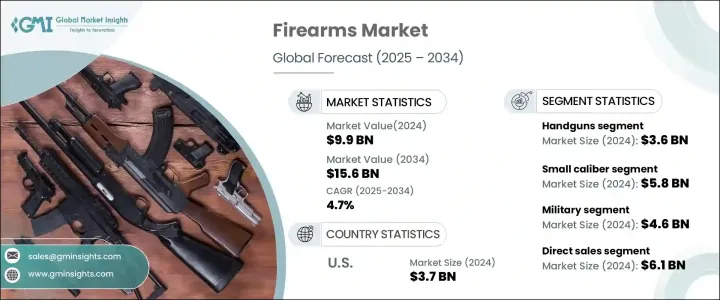

2024 年全球枪械市场价值为 99 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.7%。武器生产和出口的成长继续推动整个产业的需求。由于世界各国政府为国家安全而向先进武器分配了更多的预算,军事开支的增加对市场成长做出了重大贡献。这一趋势为製造商提供了丰厚的机会,使他们能够专注于生产符合现代防御要求的先进、高精度枪支。满足日益增长的民用需求并采用创新技术也可以加强市场,确保未来十年的稳定成长。

枪械是一种机械装置或便携式枪管武器,旨在利用燃烧推进剂产生的气体膨胀提供动力,以高速发射子弹。市场涵盖各种各样的武器,包括手枪、步枪、猎枪、机关枪和衝锋枪。 2024 年,手枪市场价值为 36 亿美元。人们对紧凑型、大容量和可隐藏的手枪的偏好日益增长,导致执法机构越来越多地采用这种手枪,他们不断升级现有枪支,采用改进的人体工学和更轻的材料,以提高作战效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 99亿美元 |

| 预测值 | 156亿美元 |

| 复合年增长率 | 4.7% |

枪枝市场按口径细分,包括小口径、中口径和大口径枪枝以及霰弹枪口径。 2024 年小口径枪占市场主导地位,估值达 58 亿美元。对于用于特定目的的紧凑型高速枪械的需求日益增长,推动了这一领域的需求。小口径武器因其轻量化设计和更高的精度而被广泛用于训练、休閒射击和军事应用。执法现代化和军事进步进一步刺激了这一领域的需求,使小口径枪支成为全球市场的主导类别。

按最终用户划分,枪支市场服务于军队、执法机构、平民、私人保全公司以及射击场和俱乐部。 2024 年,军事部分的价值为 46 亿美元。全球致力于透过下一代枪械增强军事实力,推动了该领域的大幅成长。各国防组织大量订购枪支显示了对武器库进行现代化改造的决心,从而进一步推动了市场扩张。执法机构也不断增加对升级枪枝的投资,以提高应对能力并确保公共安全。

市场也根据分销管道进行分类,包括直接销售和间接销售。直销,即製造商透过授权平台直接与客户互动,占据了市场主导地位,2024 年的估值为 61 亿美元。合法的 D2C 平台允许製造商绕过中间商,提供简化的采购流程。美国仍然是一个关键市场,受平民和安全机构对枪支的强劲需求推动,到 2024 年价值将达到 37 亿美元。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 军事和执法部门对现代化的需求

- 全球武器出口和製造不断增加

- 狩猎和射击运动的发展

- 智慧和人工智慧枪械的技术进步

- 地缘政治紧张局势导致军事预算增加

- 产业陷阱与挑战

- 严格的枪支法律和监管限制

- 非法武器贸易及走私

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 手枪

- 手枪

- 左轮手枪

- 步枪

- 半自动步枪

- 栓动步枪

- 突击步枪

- 狙击步枪

- 霰弹枪

- 泵动式霰弹枪

- 半自动霰弹枪

- 双管猎枪

- 单发霰弹枪

- 机关枪

- 衝锋枪

- 其他的

第六章:市场估计与预测:依口径,2021 年至 2034 年

- 主要趋势

- 小口径

- 中口径

- 大口径

- 猎枪口径

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 军队

- 执法机构

- 平民

- 私人保全公司

- 射击场和俱乐部

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销(製造商对消费者)

- 间接销售(经销商对消费者)

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Barrett Headquarters

- Colt CZ Group SE

- FN HERSTAL

- Glock Inc.

- Heckler & Koch

- Kalashnikov Concern JSC

- MOSSBERG & SONS, INC.

- Pietro Beretta Arms Factory SpA

- PTR Industries Inc.

- RemArms LLC.

- Ruger & Co., Inc.

- SIG SAUER

- Smith & Wesson

- Taurus International Manufacturing, Inc.

The Global Firearms Market was valued at USD 9.9 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The rising production and export of weapons continue to drive demand across the industry. Increased military spending contributes significantly to market growth, as governments around the world allocate higher budgets toward advanced weapons for national security. This trend presents lucrative opportunities for manufacturers to focus on producing advanced and high-precision firearms that align with modern defense requirements. Catering to the growing civilian demand and adopting innovative technologies can also strengthen the market, ensuring steady growth over the next decade.

Firearms are mechanical devices or portable barreled weapons designed to launch bullets at high velocity, powered by the expansion of gases from burning propellants. The market encompasses a diverse range of weapons, including handguns, rifles, shotguns, machine guns, and submachine guns. In 2024, the handguns market was valued at USD 3.6 billion. The rising preference for compact, high-capacity, and concealable handguns has led to increasing adoption by law enforcement agencies, which continue to upgrade their existing firearms with improved ergonomics and lighter materials to enhance operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $15.6 Billion |

| CAGR | 4.7% |

The firearms market is segmented by caliber, with categories including small, medium, and large caliber firearms, along with shotgun gauges. Small caliber firearms led the market in 2024 with a valuation of USD 5.8 billion. The growing need for compact, high-velocity firearms for specific purposes is driving demand in this segment. Small caliber weapons are widely used for training, recreational shooting, and military applications due to their lightweight design and improved accuracy. Law enforcement modernization and military advancements have further fueled demand in this segment, making small caliber firearms a dominant category in the global market.

By end user, the firearms market serves military forces, law enforcement agencies, civilians, private security firms, and shooting ranges and clubs. In 2024, the military segment was valued at USD 4.6 billion. The global focus on enhancing military strength through next-generation firearms has contributed to substantial growth in this segment. Bulk orders of firearms by various defense organizations indicate a commitment to modernizing arsenals, further boosting market expansion. Law enforcement agencies are also increasingly investing in upgraded firearms to improve response capabilities and ensure public safety.

The market is also classified by distribution channels, including direct and indirect sales. Direct sales, where manufacturers directly engage with customers through authorized platforms, dominated the market with a valuation of USD 6.1 billion in 2024. Legal D2C platforms allow manufacturers to bypass intermediaries, offering a streamlined purchasing process. The U.S. remains a key market, valued at USD 3.7 billion in 2024, driven by strong demand for firearms among civilians and security agencies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Military and law enforcement demand for modernization

- 3.2.1.2 Increasing export and manufacturing of the weapons across the globe

- 3.2.1.3 Growth of hunting & shooting sports

- 3.2.1.4 Technological advancements in smart & ai-integrated firearms

- 3.2.1.5 Rising military budget amid geopolitical tensions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent gun laws & regulatory restrictions

- 3.2.2.2 Illegal arms trade & smuggling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Handguns

- 5.2.1 Pistols

- 5.2.2 Revolvers

- 5.3 Rifles

- 5.3.1 Semi-automatic rifles

- 5.3.2 Bolt-action rifles

- 5.3.3 Assault rifles

- 5.3.4 Sniper rifles

- 5.4 Shotguns

- 5.4.1 Pump-action shotguns

- 5.4.2 Semi-automatic shotguns

- 5.4.3 Double-barrel shotguns

- 5.4.4 Single-shot shotguns

- 5.5 Machine guns

- 5.6 Submachine guns

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Caliber, 2021 – 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Small caliber

- 6.3 Medium caliber

- 6.4 Large caliber

- 6.5 Shotgun gauges

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Military

- 7.3 Law enforcement agencies

- 7.4 Civilians

- 7.5 Private security firms

- 7.6 Shooting ranges and clubs

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 Direct sales (manufacturer to consumer)

- 8.3 Indirect sales (distributors to consumers)

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Barrett Headquarters

- 10.2 Colt CZ Group SE

- 10.3 FN HERSTAL

- 10.4 Glock Inc.

- 10.5 Heckler & Koch

- 10.6 Kalashnikov Concern JSC

- 10.7 MOSSBERG & SONS, INC.

- 10.8 Pietro Beretta Arms Factory SpA

- 10.9 PTR Industries Inc.

- 10.10 RemArms LLC.

- 10.11 Ruger & Co., Inc.

- 10.12 SIG SAUER

- 10.13 Smith & Wesson

- 10.14 Taurus International Manufacturing, Inc.