|

市场调查报告书

商品编码

1716700

生物农药市场机会、成长动力、产业趋势分析及2025-2034年预测Biopesticides Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

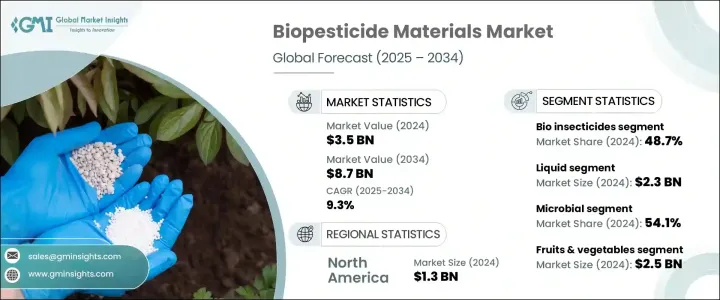

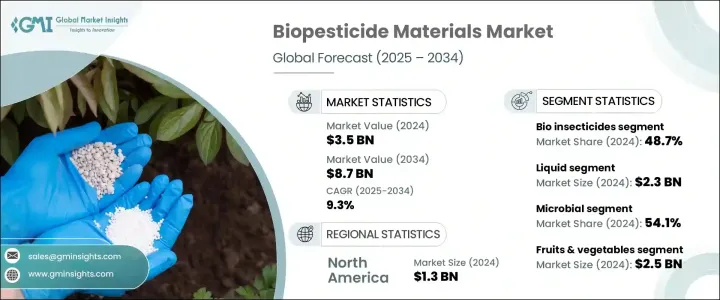

2024 年全球生物农药市场规模达到 35 亿美元,预计 2025 年至 2034 年期间将以 9.3% 的复合年增长率强劲增长,这得益于全球消费者对有机农产品的需求不断增长和健康意识不断增强。随着人们对合成农药不良影响的担忧不断增加,生物农药正迅速成为更安全、更永续的作物保护替代品。如今,消费者对传统种植的水果和蔬菜中的农药残留有了更多的认识,这极大地推动了有机农业实践的采用。

由于生物农药来自细菌、真菌、病毒和植物物质等天然来源,因此它们越来越受到综合虫害管理计划和永续农业的青睐。此外,全球对生态友善农业实践的关注,加上对化学农药使用的更严格的监管,正在加速向生物农药的转变。世界各国政府也透过优惠政策和补贴支持有机农业计画来推动生物农药的使用。此外,害虫对合成农药的抗药性日益普遍,迫使农民探索更有效、更环保的解决方案,这为生物农药市场的成长增添了进一步的动力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 9.3% |

生物农药市场分为生物杀虫剂、生物除草剂、生物杀菌剂和其他产品,其中生物杀虫剂在 2024 年将占据最大的市场份额,为 48.7%。预计到 2034 年,该细分市场将以 9.2% 的复合年增长率扩张,这得益于对在保持高作物产量的同时最大限度地减少环境危害的害虫防治解决方案的需求不断增长。生物杀虫剂由天然微生物或植物活性化合物组成,已成为现代农业的重要组成部分,尤其是在农民寻求减少对化学杀虫剂依赖的情况下。它们在综合虫害管理 (IPM) 系统中发挥的作用以及与有机农业标准的兼容性支持了它们日益广泛的应用,使其成为传统种植者和有机种植者的首选。

根据产品形态,市场分为干製剂和液体製剂,其中液体生物农药在 2024 年的市场规模为 23 亿美元,预计到 2034 年的复合年增长率为 9.4%。液体製剂因其使用方便、功效更高、货架稳定性优越等特点而越来越受到青睐。这些製剂有悬浮液、乳油和可溶性液体等形式,能够更好地黏附在植物表面,并且可以使用现有的喷洒设备轻鬆施用,从而在寻求有效害虫防治的农民中得到广泛使用。

从地区来看,北美地区 2024 年的生物农药销售额为 13 亿美元,预计在 2025 年至 2034 年期间的复合年增长率将达到 9%。由于美国和加拿大对农业生物技术的大量投资,该地区在全球市场中保持领先地位。向永续农业方法和有机农业的持续转变继续增强北美对生物农药的需求。此外,先进农业技术和综合虫害管理实践的广泛实施巩固了该地区在这个快速扩张的市场中的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对有机产品的偏好

- 监管支持和政府倡议

- 技术进步

- 产业陷阱与挑战

- 生产成本高

- 与化学农药相比作用较慢

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 生物除草剂

- 生物杀虫剂

- 生物杀菌剂

第六章:市场规模与预测:依形式,2021 年至 2034 年

- 主要趋势

- 干燥

- 液体

第七章:市场规模及预测:依来源,2021 年至 2034 年

- 主要趋势

- 微生物

- 生化

- 其他的

第八章:市场规模及预测:依作物,2021 年至 2034 年

- 主要趋势

- 谷物和油籽

- 水果和蔬菜

- 苹果

- 葡萄

- 马铃薯

- 其他的

- 其他的

第九章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 种子处理

- 叶面喷施

- 土壤喷洒

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- BASF SE

- Bayer AG

- Syngenta AG

- UPL Limited

- FMC Corporation

- Marrone Bio Innovations

- Novonesis

- Nufarm

- Isagro SpA

- Certis USA LLC

- Koppert Biological Systems

- Biobest Group NV

- Valent BioSciences

- STK Bio-Ag Technologies

The Global Biopesticides Market reached USD 3.5 billion in 2024 and is projected to witness robust growth at a CAGR of 9.3% from 2025 to 2034, fueled by the growing demand for organic produce and increasing health consciousness among consumers worldwide. As concerns over the adverse effects of synthetic pesticides continue to rise, biopesticides are rapidly emerging as a safer and more sustainable alternative for crop protection. Consumers today are more aware of pesticide residues found in conventionally grown fruits and vegetables, which is significantly pushing the adoption of organic farming practices.

Since biopesticides are derived from natural sources such as bacteria, fungi, viruses, and plant-based substances, they are increasingly preferred for integrated pest management programs and sustainable agriculture. Moreover, the global focus on eco-friendly agricultural practices, coupled with stricter regulations against chemical pesticide usage, is accelerating the shift toward biopesticides. Governments worldwide are also promoting biopesticide use through favorable policies and subsidy support for organic farming initiatives. Additionally, the rising prevalence of pest resistance to synthetic pesticides is compelling farmers to explore more effective and environmentally responsible solutions, adding further momentum to the biopesticides market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9.3% |

The biopesticides market is segmented into bio insecticides, bio herbicides, bio fungicides, and other products, with bio insecticides accounting for the largest market share of 48.7% in 2024. This segment is projected to expand at a CAGR of 9.2% through 2034, driven by the rising need for pest control solutions that minimize environmental harm while maintaining high crop yields. Bio insecticides, composed of natural microorganisms or plant-based active compounds, have become essential components in modern agriculture, especially as farmers seek to reduce dependency on chemical insecticides. Their growing adoption is supported by their role in integrated pest management (IPM) systems and their compatibility with organic farming standards, making them a favored choice for both conventional and organic growers.

Based on product form, the market is divided into dry and liquid formulations, with liquid biopesticides generating USD 2.3 billion in 2024 and anticipated to grow at a CAGR of 9.4% through 2034. Liquid formulations are gaining traction due to their user-friendly application, higher efficacy, and superior shelf stability. Available as suspension concentrates, emulsifiable concentrates, and soluble liquids, these formulations ensure better adherence to plant surfaces and are easily applied using existing spraying equipment, driving widespread usage among farmers seeking efficient pest control.

Regionally, North America generated USD 1.3 billion in biopesticides sales in 2024 and is poised to grow at a CAGR of 9% between 2025 and 2034. The region maintains a leading position in the global market, backed by significant investments in agricultural biotechnology across the United States and Canada. The ongoing shift toward sustainable farming methods and organic agriculture continues to bolster the demand for biopesticides in North America. Furthermore, the widespread implementation of advanced farming techniques and integrated pest management practices reinforces the region's stronghold in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Consumer preference for organic products

- 3.6.1.2 Regulatory support and government initiatives

- 3.6.1.3 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Production Costs

- 3.6.2.2 Slow action compared to chemical pesticides

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Bio herbicides

- 5.3 Bio insecticides

- 5.4 Bio fungicides

Chapter 6 Market Size and Forecast, By Form, 2021 – 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Liquid

Chapter 7 Market Size and Forecast, By Source, 2021 – 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Microbial

- 7.3 Biochemical

- 7.4 Others

Chapter 8 Market Size and Forecast, By Crop, 2021 – 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Grain & oil seeds

- 8.3 Fruit & vegetables

- 8.3.1 Apples

- 8.3.2 Grapes

- 8.3.3 Potatoes

- 8.3.4 Others

- 8.4 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Seed treatment

- 9.3 Foliar spray

- 9.4 Soil spray

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BASF SE

- 11.2 Bayer AG

- 11.3 Syngenta AG

- 11.4 UPL Limited

- 11.5 FMC Corporation

- 11.6 Marrone Bio Innovations

- 11.7 Novonesis

- 11.8 Nufarm

- 11.9 Isagro S.p.A

- 11.10 Certis USA L.L.C.

- 11.11 Koppert Biological Systems

- 11.12 Biobest Group NV

- 11.13 Valent BioSciences

- 11.14 STK Bio-Ag Technologies